Scharfsinn86

Note: I have covered Ballard Power Systems (NASDAQ:BLDP) previously, so investors should view this as an update to my earlier articles on the company.

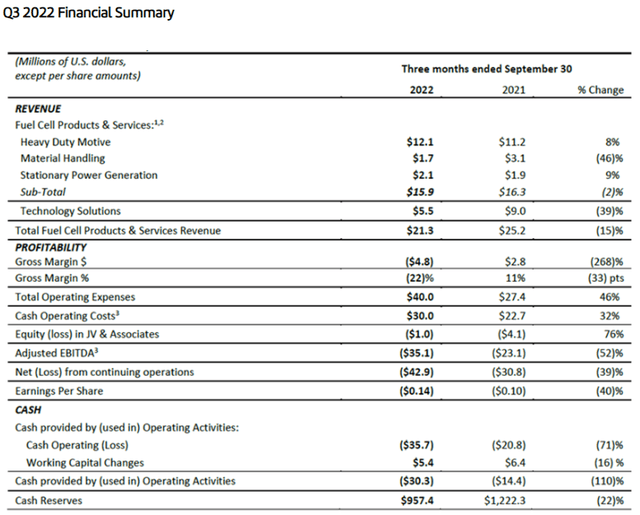

On Monday, leading Canadian fuel cell systems developer Ballard Power Systems (“Ballard” or “Ballard Power”) reported just another set of disappointing quarterly results:

Once again, the company missed consensus revenue expectations by a mile. In addition, consolidated gross margin of negative 22% represented a new multi-year low for Ballard Power with no near-term improvement in sight:

This quarter our revenue and gross margin were $21.3 million and (22)%, respectively. As previously communicated, we continue to see a challenging gross margin picture which we expect to persist through 2023 until our volume ramps and our product cost reduction initiatives move into production.

According to management on the conference call, the additional downward pressure was driven by a shift in revenue mix, impact of pricing strategies, higher fixed overhead costs, inventory adjustments and increased inflationary pressures.

Albeit down somewhat from Q2 levels, cash usage remained significant as the company recorded negative free cash flow of $45.8 million. That said, Ballard Power still commands almost $1 billion in cash and cash equivalents, sufficient to fund the business for up to five years at the current pace of cash burn.

New order intake was the sole bright spot in the Q3 report as the company secured $31.8 million in new purchase orders thus increasing total backlog by 11% sequentially to $102 million.

Please note that this number does not include a recently received purchase order from Siemens Mobility for 100 fuel cell engines with an estimated value of at least $30 million. Unfortunately, it will likely take a number of years until full delivery as Siemens Mobility’s new Mireo Plus H fuel cell train offering has experienced limited customer demand so far.

On the flipside, Ballard’s near-term order book decreased by almost 20% quarter-over-quarter to a paltry $51 million as previously anticipated technology transfer revenues from the Weichai Ballard JV will now be recognized at a later date as management was forced to admit in the Q&A session of the conference call:

On the 12-month order book decreasing to $51 million to a net decline of 10, what was also included in there was the largest contributor — one of the largest contributors to the drop was shifting out from the 12-month order book, the remaining portion of the tech transfer agreement we have with the joint venture. So, that was pushed out to the 12 plus month timeframe. We are in the process of renegotiating the scope of that remaining contract, but fully expect to earn this revenue — that revenue going forward. The timing could be adjusted over the next couple of years, so we expect some of that to come into ’23 — for ’23, ’24 most likely.

Suffice to say, with just $51 million in backlog for the next twelve months, Ballard Power’s 2023 revenues won’t be anywhere close to the prevailing $134.3 million analyst consensus.

Twelve months ago, the company’s short-term backlog was just shy of $80 million and according to my estimates, full-year 2022 revenues are likely to come in around $85 million.

Even using generous assumptions, Ballard Power’s revenues are unlikely to exceed $70 million next year, almost 50% below the current consensus.

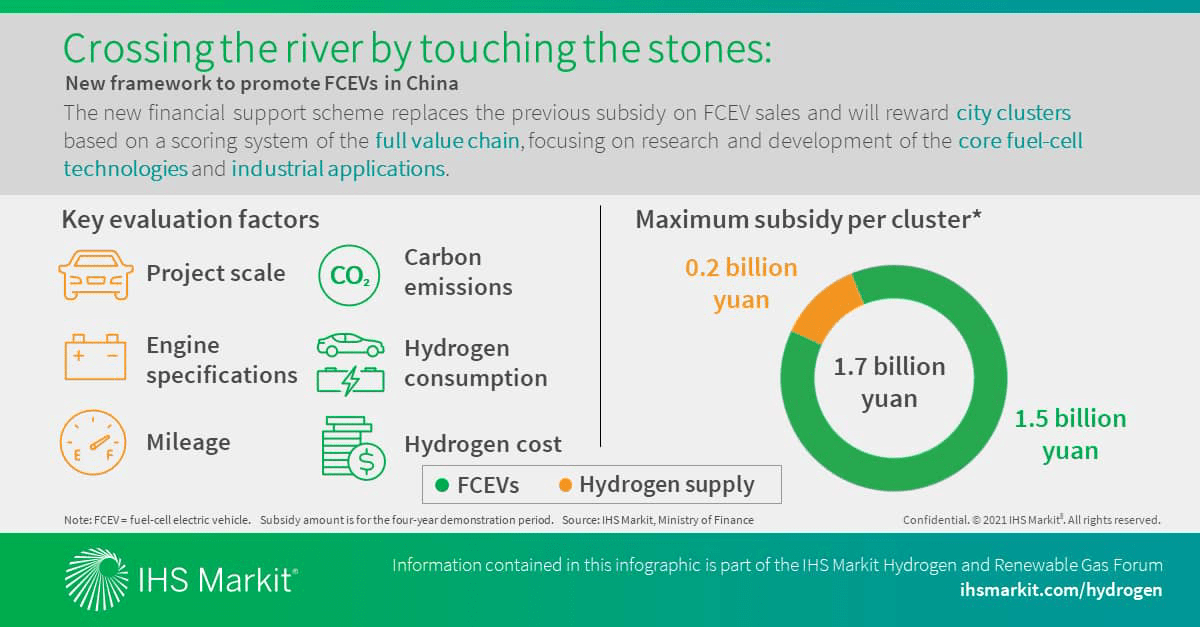

On the conference call, many questions centered around the recently announced $130 million investment in a new, large-scale MEA manufacturing facility in Shanghai. As already discussed by me last month, Ballard was more or less forced to establish domestic operations in a hydrogen cluster eligible for government subsidies to avoid competitive disadvantages and circumvent anticipated import tax increases.

Not surprisingly, management danced around the single analyst question related to potential protection of the company’s intellectual property with the core MEA product being manufactured in China soon.

That said, the Chinese market is unlikely to pick up anytime soon as the central government’s latest subsidy approach remains directed towards establishing a complete domestic fuel cell technology and hydrogen supply chain over time thus resulting in limited impact on near-term FCEV adoption.

IHS Markit

But even with the start of Chinese manufacturing operations not scheduled before 2025, management still expects utilization of the new facility to be “relatively low” initially.

Bottom Line

Ballard Power reported another weak quarter with revenues well below consensus expectations, sizeable cash burn and abysmal gross margins.

With near-term backlog at multi-year lows, the company is likely to miss both Q4 and full-year 2023 consensus expectations by a very wide margin.

In addition, Ballard has been caught between a rock and a hard place in China with the government’s latest subsidy framework more or less forcing the company to establish domestic manufacturing operations for its core MEA product with the apparent risk of being crowded out of the Chinese market over the long term by domestic competitors after successfully accessing the company’s IP.

Moreover, there won’t be any short- and medium-term benefits to Ballard’s top- and bottom line. In fact, the required $130 million investment will consume approximately 15% of the company’s cash balance and increase operating expenses quite meaningfully.

But even when assuming the project to increase the company’s annual cash burn rate to approximately $250 million, Ballard Power’s liquidity of close to $1 billion should still carry the company well into 2026.

Despite the stock price being near multi-year lows and considering the company’s large cash balance of approximately $3.20 per share, the painfully weak near- and medium-term prospects have caused me to reduce my rating from “Hold” to “Sell“.

Be the first to comment