tiero/iStock via Getty Images

These are volatile times right now. That makes it especially risky, but also potentially very lucrative, to invest in companies that themselves have fundamental volatility. One example of this that did pay off for investors so far can be seen by looking at Babcock & Wilcox Enterprises (NYSE:BW). This firm, which focuses on the renewable energy space through its work on waste-to-energy plants, construction and installation, biomass energy, and thermal technologies, has seen quite a bit of volatility on both its top and bottom lines recently. Having said that, the company continues to land contracts and shares have reacted positively to that. While I have no doubt that the long-term outlook for the company is likely favorable, and current conditions have been positive, I do also think that much of the easy money in buying into the company has probably already been made. Yes, it is entirely possible that further upside might be in store for investors. But given the other opportunities that are out there today, it may make sense to look elsewhere for attractive returns. Because of this, I’ve decided to decrease my rating on the company from a ‘buy’ to a ‘hold’.

Mixed results have been the norm lately

Back in May of this year, I wrote an article that took a bullish stance on Babcock & Wilcox. In that article, I acknowledged that the company had struggled a great deal over the prior few years. However, I also recognized that the picture was looking better than it had in quite a while. Of course, this was not to say that the company came without risks. Risks, I asserted, were plentiful. But at the end of the day, it looked to me as though a complete turnaround was in progress. This conclusion led me to rate the company a ‘buy’, reflecting my belief at that moment that the company would likely generate returns that would exceed what the broader market would for the foreseeable future. So far, that call has proven to be fantastic. While the S&P 500 is down by 1.4%, shares of Babcock & Wilcox have increased in value by 32.1%. That far exceeds anything I would have anticipated over such a short window of time.

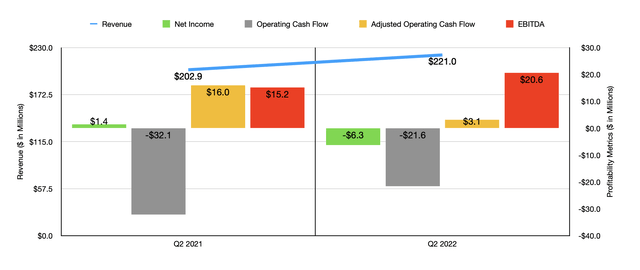

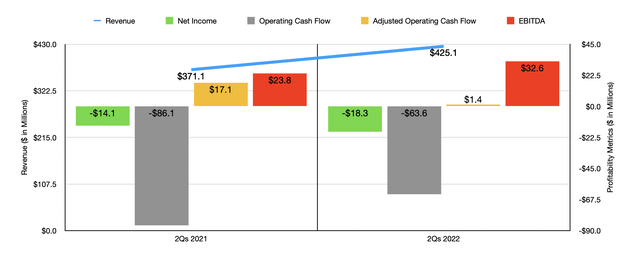

To understand why this upside occurred, we should first discuss the company’s mixed financial performance lately. When I last wrote about the company, we had data covering through the first quarter of the 2022 fiscal year. Today, that data now extends through the second quarter as well. During that time, revenue came in at $221 million. That translates to an increase of 8.9% compared to the $202.9 million generated the same quarter one year earlier. Although this was weaker than what the company achieved in the first quarter, it still was helpful in pushing financial results for the first half of the year as a whole up by 14.6%, taking sales from $371.1 million to $425.1 million.

Bottom line performance for the company, however, has been a bit more complicated. Consider net income. In the second quarter of the year, the company generated a loss of $6.3 million. That stacks up against the $1.4 million profit generated in the second quarter of last year. Thanks to this, net income for the full first half of the 2022 fiscal year came in negative to the tune of $18.3 million. That compares to the $14.1 million loss achieved the same time one year earlier. Operating cash flow also suffered, coming in at negative $21.6 million. However, that actually represented an improvement over the $32.1 million outflow the company saw in the second quarter of 2021. If we adjust for changes in working capital, the situation does flip, however. Instead of the metric improving, it actually worsened, going from $16 million to $3.1 million. The only profitability metric other than operating cash flow that did better year over year was EBITDA. It rose from $15.2 million last year to $20.6 million this year. Similarly mixed results can be seen for the first half of the year as a whole as well.

Although the financial situation for the company was definitely mixed, the firm was aided by some major contract wins following the end of its second quarter. On July 25th, for instance, the company announced that it was awarded contracts totaling $12 million for two utility-scale solar panel installation projects totaling 144 megawatts in the Midwestern portion of the US. This was followed up on August 1st by news that the company will team up with Newpoint Gas to provide construction services and supply hydrogen generation and decarbonization technology for the redevelopment of the former US Department of Energy Portsmouth Gaseous Diffusion Plant site near Piketon, Ohio. Specific financial terms for this contract were not released. But the overall project itself will cost about $1.51 billion. Also in early August, the company won an $18 million contract to provide environmental equipment in order to reduce emissions for a power plant in Africa. Just one day after that, the company announced a $20 million contract to provide engineering, procurement, and construction services for seven community solar projects in Illinois. And finally, on August 18th, the company landed a $42 million contract to provide construction and installation services for an environmental upgrade project at a US power plant. Add on top of this that the company ended the second quarter of this year with backlog of $731 million, which was $10 million above what it ended the first quarter at and compared favorably to the 500 million with the company had in the second quarter of last year, and it’s clear that momentum is building for the enterprise.

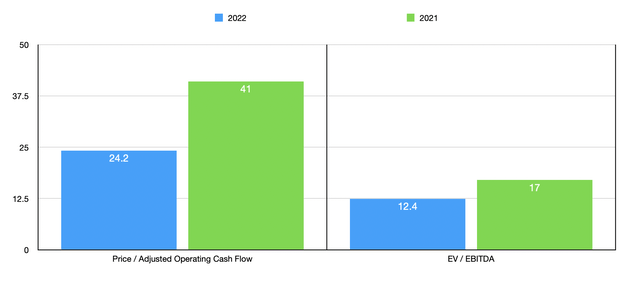

Given the historical volatility of the company, it’s really impossible to provide any good estimates of what the rest of the fiscal year will look like. And management has not provided any details on the matter either. If we were to just project out what financial performance would look like using the performance of EBITDA for the company for the first half of the year, then we should anticipate adjusted operating cash flow of $44 million and EBITDA of $96.7 million. Naturally, I always make sure to strip out the $14.86 million of preferred distributions from the operating cash flow figure. Although not typically something that you would strip out from that, I view it as necessary since it is a required cash outflow item that the company must normally pay. Doing this, we end up with a forward price to adjusted operating cash flow multiple of 24.2. That’s down from the 41 reading that we get using data from last year. Meanwhile, using the EV to EBITDA approach, the multiple is considerably lower at 12.4. Using the data from last year, the multiple would come in a bit higher at 17. As part of my analysis, I also compared the company to four similar firms. On a price to operating cash flow basis, these companies ranged from a low of 10.2 to a high of 46.5. Three of the four firms are cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range is between 5.1 and 68.6. In this case, only one of the companies is cheaper.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Babcock & Wilcox Enterprises | 24.2 | 12.4 |

| TPI Composites (TPIC) | 20.0 | 20.4 |

| Broadwind (BWEN) | 12.1 | 5.1 |

| AZZ Inc. (AZZ) | 10.2 | 14.9 |

| Vestas Wind Systems A/S (OTCPK:VWDRY) | 46.5 | 68.6 |

Takeaway

Although financial performance recorded by Babcock & Wilcox has been somewhat mixed lately, the significant award of contracts and the continued climb in sales is definitely promising. On a forward basis, the company is looking fairly affordable, especially when you look at the EV to EBITDA multiple. But when you use data from 2021, shares do look a bit pricier than when I last wrote about the company. Add on to this how much upside shares have already experienced and the uncertain market conditions that we are experiencing, and I have become a bit more cautious. While I do believe the company is continuing to turn around nicely, I do also think that much of the easy money has been made for now. Because of this, I’ve decided to change my rating on the company from a ‘buy’ to a ‘hold’.

Be the first to comment