eyegelb

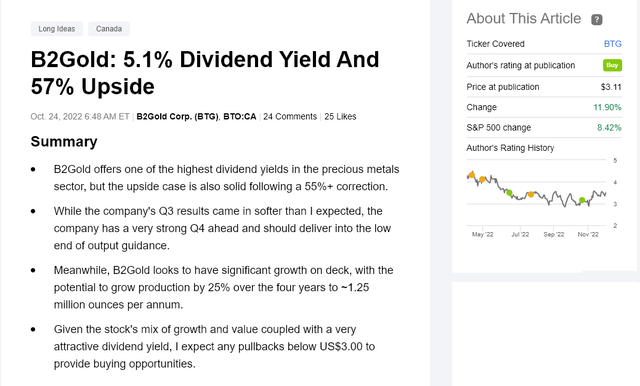

It’s been a volatile year for investors in the Gold Miners Index (GDX) and an even more frustrating two years, with the index shedding nearly 50% of its value despite a mere 21% correction in the gold price. While a few names have stood out as consistently over-delivering on promises despite sector-wide headwinds, like B2Gold (NYSE:BTG), which put up incredible results in H2-2021 while the sector was sagging, the company posted a rare miss in Q3 2022. This miss left the company tracking at just 66.7% of the low end of FY2022 guidance, prompting some to be skeptical of its ability to deliver on guidance, which would be a disappointment for a company with an excellent track record that makes it stand out among some of its peers.

However, as noted in my previous update, B2Gold’s production may be down, but it’s not out, and it’s in the unique position of having two very high-grade quarters ahead for two of its assets. This includes average grades of 3.0+ grams per tonne of gold at Fekola in Q4, with it now mining Phase 6 of the pit (3.4 – 3.5 grams per tonne of gold). In addition, Wolfshag Underground (Otjikoto) is expected to contribute with grades of ~6.0 grams per tonne of gold coupled with a higher-grade zone in the Otjikoto Pit. Hence, the difference between Q3 and Q4 will be night and day, and B2Gold is set to prove the naysayers wrong with a phenomenal finish to the year. Let’s take a closer look below:

Mali Exploration (Company Presentation)

Q3 Production & Sales

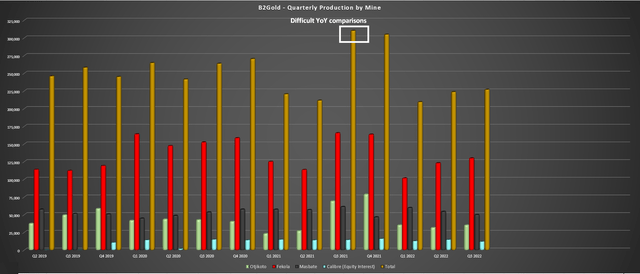

B2Gold released its Q3 results last month, reporting quarterly gold production of ~227,000 ounces (~214,000 ounces from its operations excluding Calibre), which left year-to-date consolidated production sitting at just ~660,000 ounces. When compared to annual guidance of 990,000 ounces to 1,050,000 ounces, it’s no surprise that some investors were disappointed, especially with sentiment in the gutter at the time that the production results were reported in early October. In terms of individual operations, all operations saw significant declines in production year-over-year. Still, it’s important to note that the company was lapping a massive quarter with huge production numbers from all three operations (~310,300 ounces produced).

B2Gold – Quarterly Production by Mine (Company Filings, Author’s Chart)

At the company’s flagship Fekola Mine, production came in at a mere ~129,900 ounces which was a very soft production figure compared to the past seven quarters following the mill expansion (trailing quarterly average: 135,800 ounces). However, the company noted that this was due to delayed access to higher grades in Phase 6 of the pit related to elevated rainfall in the period. That said, the company maintained its guidance of 570,000 to 600,000 ounces at Fekola for the year and reiterated its full-year guidance of 990,000 to 1,050,000 ounces on a consolidated basis. I believe annual results to be much more important than any single quarter, and with annual production on track and its Malian future looking better than ever, I don’t see any reason to lose sleep over a single quarterly miss.

The good news is that B2Gold put up incredible numbers in October, producing roughly 77,000 ounces of gold at Fekola, with the operation benefiting from 3.50+ grams per tonne from Fekola open-pit Phase 6. While I’m not sure that the company can keep up this pace for the entire quarter, using assumptions of ~2.35 million tonnes processed, an average grade of 3.02 grams per tonne of gold, and a 94.5% recovery rate, B2Gold could produce ~215,600 ounces of gold in Q4 from Fekola alone. To put this figure in perspective, it would crush the previous quarterly record (~165,600 ounces). It would also represent more production than all of B2Gold’s assets combined in Q3 from its three operations (~214,900 ounces).

Meanwhile, as noted earlier, Otjikoto will benefit from higher-grade stope ore from Wolfshag Underground and mining in a higher-grade portion of the Otjikoto Pit, setting this asset up for a nearly 65,000-ounce quarter. I have assumed 62,000 ounces to be conservative due to the brief illegal work stoppage at the mine in mid-October. This was resolved immediately but couldn’t have come at a worse time, with B2Gold needing a massive quarter to deliver into guidance. According to the news, 160 workers were suspended compared to a total of 870 permanent employees and 51 temporary workers.

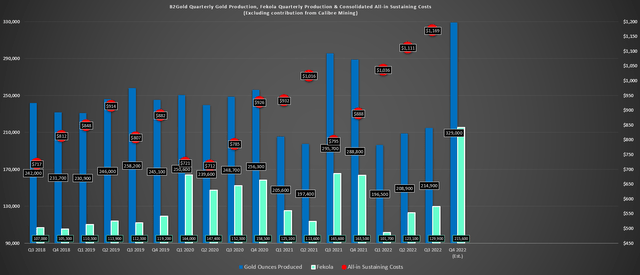

B2Gold – Quarterly Production (excluding Calibre) & Fekola Production (Company Filings, Author’s Chart)

Still, even if we assume a combined 113,000 ounces in Q4 from Otjikoto and Masbate, B2Gold will report production from its operations of ~329,000 ounces in Q4, an ~11% beat on its previous record in Q3 2021. On a consolidated basis (including Calibre equity investment), this would translate to the production of nearly 345,000 ounces, placing the company’s full-year production above ~1.01 million ounces and just shy of the guidance mid-point of 1,025,000 ounces for FY2022. In summary, B2Gold looks well positioned to deliver on guidance this year despite certainly being in a tricky spot and behind the eight ball heading into the final quarter of the year due to things out of its control (lower recoveries in Q2 due to low availability of lime, elevated rainfall delaying access to better grades in Q3).

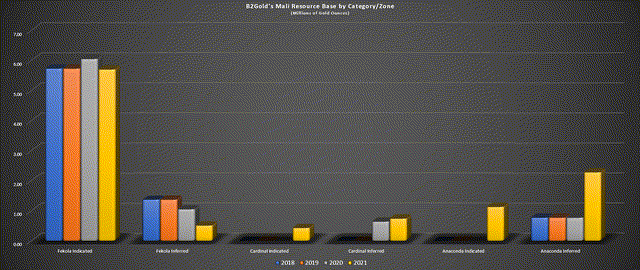

Malian Deposits Resource Growth (Company Filings, Author’s Chart)

From a bigger-picture standpoint, the B2Gold story could not be more exciting, with the company having a massive land package in Mali and continuing to report outstanding results from tenements north of Fekola. Given the continued resource growth and exploration success, B2Gold is looking into potentially constructing a stand-alone oxide plant at Anaconda, which could push annual production to 800,000+ ounces per annum by 2026. This is a massive upgrade from the previous outlook of ~500,000 ounces with the best years from a grade standpoint behind Fekola. Early indications suggest a processing rate of 4.0+ million tonnes per annum, with the possibility of adding sulphide processing capability down the road and possible mine life extensions if mining eventually heads underground at Fekola.

Fekola Operations (Company Presentation)

To summarize, while Fekola is set up for a blockbuster quarter in Q4 with up to 220,000 ounces of quarterly production, this is a record that looks like it could be broken by a wide margin post-2025, with the possibility of regular 190,000-ounce quarters going forward, with peak production quarters potentially north of 240,000 ounces (assuming a stand-alone plant is built). On a consolidated basis, B2Gold’s total production could be closer to ~1.20 million ounces post-2026, or ~1.26 million ounces, when accounting for its equity investment in Calibre (OTCQX:CXBMF), which is also looking to grow production as it benefits from higher grades from its Eastern Borosi Project and excess capacity at its Libertad Mill.

Costs & Margins

Moving over to costs, B2Gold had a tougher quarter in this department, which isn’t surprising at all, given the lower sales volumes in the period and the impact of a lower average realized gold price. Based on ~229,000 ounces at $1,711/oz vs. ~286,700 ounces sold at $1,782/oz, revenue slid by over 20% to $392.6 million (Q3 2021: $510.9 million), and operating cash flow dipped to ~$93 million vs. ~$320 million in Q3 2021. This was related to higher operating costs (cash costs: $824/oz), higher working capital outflows due to higher cash taxes paid, and higher production costs. Still, the company finished with a pristine balance sheet, sitting on ~$550 million in cash and having ~$1.1 billion in liquidity.

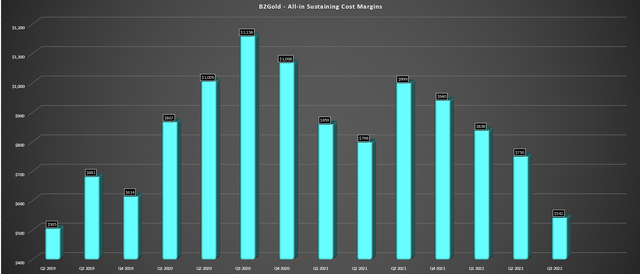

B2Gold – All-in Sustaining Cost Margins (Company Filings, Author’s Chart)

From a margin standpoint, all-in-sustaining cost [AISC] margins fell to their lowest levels since Q2 2019 ($542/oz) due to the impact of inflationary pressures (higher fuel, explosives, maintenance costs), a weaker gold price, plus the much lower production in the period. That said, B2Gold’s all-in-sustaining costs of $1,169/oz were still well below the industry average (~$1,300/oz), and it’s still on track to report all-in-sustaining costs more than 15% below the industry average on a full-year basis ($1,050/oz or lower based on guidance being reiterated). So, while the cost increases and margin pressure are a little disappointing, the Q3 results were an anomaly, and this is still a producer with industry-leading costs.

Valuation

Based on ~1.07 billion shares outstanding and a share price of $3.50, B2Gold trades at a market cap of $3.74 billion. This leaves B2Gold trading at a forward cash flow multiple of ~5.6 based on what I believe to be conservative FY2023 cash flow estimates of $0.61. The current multiple compares very favorably to its historical cash flow multiple of ~7.7 (10-year average) and ~10.2 since 2008. Given what I believe to be a conservative multiple for the company of 8.25x cash flow based on its organic growth potential in Mali and strong track record of disciplined growth and delivering on promises, I see a fair value for the stock of US$5.05.

It’s also worth noting that with over $500 million in cash and ~$1.1 billion in liquidity ($600 million RCF), B2Gold could use this period of depressed valuations to add a fourth mine or future mine, potentially giving it a ~1.50 million-ounce production profile by 2029 when combined with its vision for a Malian Mining Complex (two plants and multiple deposits). In my view, this would be an upgrade to the investment thesis and place B2Gold near the head of the pack among peers from a growth standpoint. Some investors might be less excited about the prospect of M&A, which is understandable given that we’ve seen some examples of overpaying since 2021 (GBR, ROXG, PVG). However, if B2Gold is one thing, it’s disciplined, and I would expect shareholders to be pleased with any deal if it does decide to go this route.

B2Gold – October Update (Seeking Alpha Premium)

Based on my requirement for a minimum 35% discount to fair value to justify buying mid-cap producers, B2Gold is just outside of a low-risk buy zone currently vs. my last article, where I highlighted it as being near a buy zone at US$3.00. However, if the stock were to dip below US$3.30 before year-end, I would view this as a relatively low-risk entry point.

Summary

B2Gold reported a rare miss in Q3 for a company that has done an exceptional job delivering on its promises over the past several years. However, the company is now on the eve of reporting record production in Q4 with a substantial margin increase sequentially. Plus, if gold price strength persists, the company is now up against much easier comps in H2-2023 as it laps an average realized gold price near ~$1,750/oz (H2-2022 estimates) and potentially slightly higher production next year if we see contribution from Anaconda to top up the Fekola mill.

So, with an attractive valuation, a very generous dividend yield (~4.60%), and an exciting year ahead as investors get a better idea of the true potential of its Malian assets, I would view pullbacks below US$3.30 before year-end as buying opportunities.

Be the first to comment