honglouwawa

LIFE isn’t about waiting for the storm to pass, it’s about learning to DANCE in the rain. – Vivian Greene

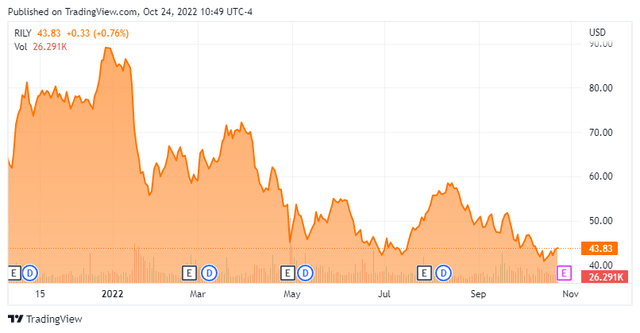

Today, we put B. Riley Financial (NASDAQ:RILY) in the spotlight. Like most investment banks, its stock has fallen on hard times as interest rates have risen substantially in 2022 and IPO as well as M&A volume has dried up. However, the stock now sports a dividend yield north of nine percent and the shares have attracted considerable insider buying of late. Signs the equity is now in the ‘buy zone‘? An analysis follows below.

Company Overview:

B. Riley Financial is based in Los Angeles. The Company provides investment banking and financial services to corporate, institutional, and high net worth clients in North America, Australia, and Europe. It has six business lines which breakdown into the following segments: Capital Markets, Wealth Management, Auction and Liquidation, Financial Consulting, Principal Investments, Communications, and Brands. The stock currently trades around $44.00 a share and sports an approximate market capitalization of $1.2 billion.

Second Quarter Results:

The company posted second quarter numbers in late July. As throughout the industry, B. Riley Financial has been significantly impacted by the sell-off throughout the markets in 2022 as well as a steep reduction in investment banking and institutional brokerage activities that were consistent with the industry-wide reduction in deal activity. B. Riley Financial had a GAAP net loss of $142.2 million during the quarter which driven entirely by a $223.9 million decline in the value of its investment portfolio.

July Company Presentation

The challenging environment saw significant year-over-year sales decline from the company’s two biggest business divisions (Capital Markets and Wealth Management) while Riley’s non-cyclical divisions like Communications saw revenues increases.

July Company Presentation

The company has been busy here in the fourth quarter. Earlier this month, this financial firm purchased a second portfolio of approximately $198 million performing receivables for $168 million in aggregate from the home-furnishing retailer W.S. Badcock, a subsidiary of Franchise Group (FRG). Then last week, Riley acquired Targus in a transaction valued at approximately $250 million. Targus makes and distributes laptop and tablet cases, backpacks, universal docking stations, and computer accessories and has an annual sales run rate north of $400 million. Targus was acquired for 5.2x Adjusted EBITDA for the trailing twelve-month period ending June 2022.

Analyst Commentary & Balance Sheet:

Since October, several insiders including the CEO have bought approximately $9 million worth of shares in aggregate in RILY. Just over 15% of the outstanding float is currently held short. The composition of the company’s balance sheet as of the end of the second quarter is shown below.

July Company Presentation

Cash and investments totaled approximately $2.2 billion including cash and cash equivalents of $216.1 million. Total cash and investments, net of debt, was $61.5 million as the end of the second quarter.

July Company Presentation

Verdict:

I think the CEO on the second quarter press release made the best case for an investment in RILY at current trading levels by the summary he provided:

Despite the markdown on our investments and declines in our underwriting business, our dynamic platform has demonstrated continued resiliency. We have earned over $17.00 per share for our shareholders since 2019, and despite a GAAP net loss of ($43.4 million) over the trailing twelve-month period, we delivered operating EBITDA of $366 million in the same period, representing a meaningful increase compared to $114 million in 2019. Increasing contributions from less cyclical and less episodic businesses have exceeded the capital needed to support our dividend while providing us flexibility to continue to invest across our business.

The business of B. Riley Financial is cyclical in nature, earnings tend to be quite ‘lumpy’ and the company is currently facing some strong headwinds. However, the shares trade for approximately two and a half times the EPS the company has generated over the past three years. In addition, an investor is getting paid an over nine percent yield supported by a balance sheet that looks positioned to continue to support these dividend payouts.

My guess is the market environment for this niche of the market will improve after the Federal Reserve ‘pivots‘ off its current aggressive course of monetary tightening. My view is that happens sometime in the first half of 2023, most likely in the first quarter as it becomes clear the country is in a recession.

Earlier this summer, Toronto-Dominion Bank (TD) purchased competitor Cowen (COWN) for $1.3 billion which included a nice buyout premium. We will see if this leads to further consolidation across the industry. Insiders seem to be signaling confidence in the company’s longer term future via their substantial purchases of the stock so far this month.

Therefore, I am slowly accumulating a position in RILY via covered call orders as I am probably early in this call and it might be a few quarters before Riley’s business notably improves.

To achieve the impossible, you must attempt the absurd – Jon R. Michaelsen

Be the first to comment