FatCamera

Shares of Axsome Therapeutics (NASDAQ:AXSM) have doubled over the past three years, yet have posted a 30% gain so far in 2022.

With multiple news developments of note occurring in the past few months, from August FDA approval of Auvelity in major depressive disorder to acquisition of Sunosi from Jazz Pharmaceuticals, not to mention initiation of phase 3 studies in acute migraine treatment and Alzheimer’s disease agitation, it’s clear there’s a lot going on under the hood for $2.1B enterprise value.

My objective for today is to revisit and evaluate this name as it relates to its potential for being included in our Core Biotech portfolio, which focuses on companies with approved drugs and potential for accelerating commercial (and clinical) momentum.

Chart

FinViz

Figure 1: AXSM weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares steadily decline from highs above $100 level. The August 2021 gap down to $20 was caused by regulatory setback (FDA identified deficiencies in labeling discussions for AXS-05 in major depressive disorder). From there, shares bounced around in the $20 to $40 range until the recent post approval spike when Auvelity finally got the regulatory green light. In the near term, I would not be surprised to see shares rangebound around the $50 level until Wall Street sees concrete proof of a successful launch out of the gate (a “show me” story). Thus, my initial suggestion for readers is to acquire a small pilot position in the stock and from there to only accumulate dips IF confirmation of the thesis is reflected in accelerating sales growth (and scripts).

Overview

Founded in 2012 with headquarters in New York (108 employees), Axsome Therapeutics currently sports an enterprise value of ~$2.1B and Q2 cash position of $243M providing them operational runway into 2024.

Corporate Slides

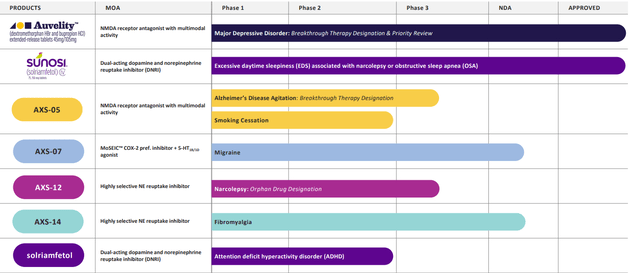

Figure 2: Pipeline (Source: corporate presentation)

In September’s presentation at Ladenburg Thalmann, management notes that they are on track to launch Auvelity in the early fourth quarter. The team is ready and the infrastructure is in place, and the major focus at this point is on commercial execution. Currently they have a salesforce on board for Sunosi as well as for Auvelity (165 reps). DCC platform (digital centric commercialization) is a suite of technology and tools allowing them to use data and analytics along with machine learning to more accurately target who the prescribers are for their products as well as figure out their specific preferences (how they prefer to receive information). Another aspect of it is using virtual detailing with the hybrid salesforce is the team was trained on in-person as well as virtually to increase efficiency. Management is confident there will be broad access to the drug based on product profile and clinical lead in marketplace (also due to payer discussions over the past year). Keep in mind when a product is launched there is no commercial coverage for the first six months or so (doctors write prescriptions and go to payers to get reimbursed). This “lag time” to get onto formulary (where decisions are made) is what I expect could cause a correction in the stock or at least cause performance to be stagnant until coverage ramps up.

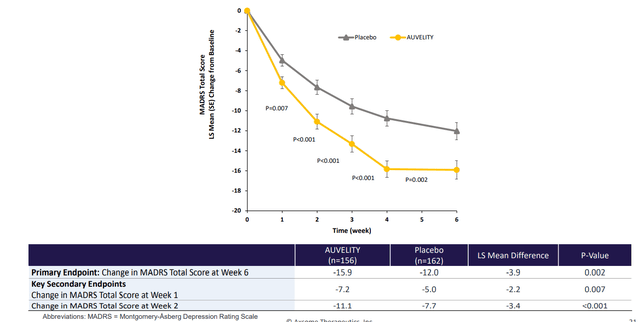

As to where Auvelity could fit in the MDD treatment landscape, two registrational studies included patients who were naive to treatment as well as those who had been on one prior treatment. Auvelity showed rapid, substantial and durable in depressive symptoms in these trials.

Corporate Slides

Figure 3: Change from baseline in MADRS total score by week (Source: corporate presentation)

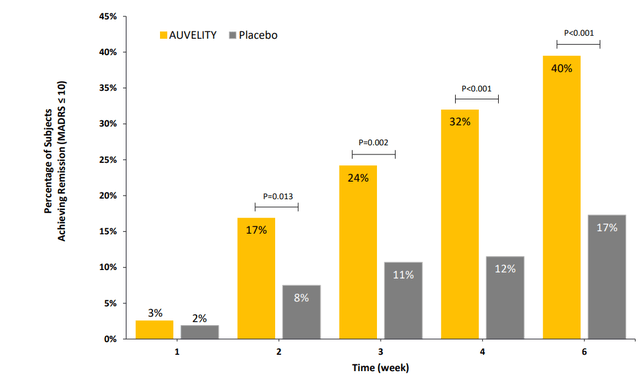

Auvelity also showed rapid induction of remission, which could be an important point of differentiation.

Corporate Slides

Figure 4: Achievement of remission by week, defined as MADRS reduction of 10 or less (Source: corporate presentation)

In the long-term open label study (numbering close to a thousand patients), they enrolled patients who had received various lines of treatment with the goal of generating data that would be useful to clinicians. Thus, they pre-specified sub-studies in patients who had been on one antidepressant and were unresponsive, patients treated with two or more antidepressants, those with suicidal ideation and those with TRD (treatment resistant depression). They observed that Auvelity performed equally well in each of these populations in terms of rapidity of onset and quantity of response. Essentially, this means that physicians should be able to use the drug as they see fit and are not hampered by certain subpopulations where the drug would not have utility or less effect. The undefined point here is how physicians will initially use the drug and later on in their practice as they become more familiar with it (thus the risk and reward in investing at this early stage where there are significant unknowns).

The major depressive market is unique in that there is a high percentage of patients who are already receiving treatment- the majority of these patients have an inadequate response to first line treatment (implies a large need for treatment with alternate mechanism of action that also works quickly). It’s well known that not only are we coming off the Covid-19 pandemic but are also in the middle of a mental health pandemic (MDD market opportunity has never been greater). One such opinion is that something related to the Covid-19 biology is causing higher incidence or occurrence of depression (more evidence needed for obvious reasons). Management quotes one paper that states levels of patients with depressive symptoms has tripled to quadrupled from prior to the pandemic (could be this one).

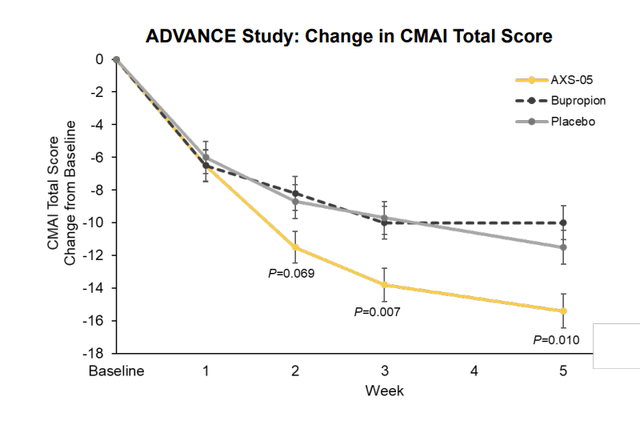

Moving on to other indications, Auvelity is also being evaluated in a phase 3 program for Alzheimer’s disease (agitation). Prior phase 3 ADVANCE-1 trial yielded positive results and another phase 3 (ACCORD) has been initiated. ADVANCE-1 study showed rapid and robust improvement in agitation symptoms, an area of high unmet need with no currently approved drugs.

Corporate Slides

Figure 5: Primary endpoint met in ADVANCE with clear separation from both placebo and bupropion (Source: corporate presentation)

Drugs currently used off label are highly problematic in terms of efficacy not outweighing risks associated with these treatments (antipsychotics, sedatives, anxiolytics, acetylcholinesterase inhibitors, antidepressants, etc). Breakthrough Therapy Designation was granted on the heels of ADVANCE-1 results, and ACCORD trial utilizes a randomized withdrawal design while ADVANCE-2 is a parallel study. Management made the decision to amend the relapse criteria for the randomized withdrawal study and to conclude it early so they can ensure the new parallel phase 3 trial enrolls at a good rate (difficult patient population and hard to have competing studies). Initially they saw lower rate of relapses than they expected in the ACCORD trial, and now as the study is truncated they know the powering will be less than it was originally (perhaps more risk) but it will have more utility (gain a sense of how long it takes for patients to relapse). If (big if) there is separation, this would confirm evidence observed in the prior ADVANCE-1 trial. As for how long it will take to enroll, management is unwilling to provide guidance at this point but ADVANCE-1 took over two years to enroll. The plan is to file an NDA for AXS-05 in this indication assuming the ADVANCE-2 trial has a positive readout.

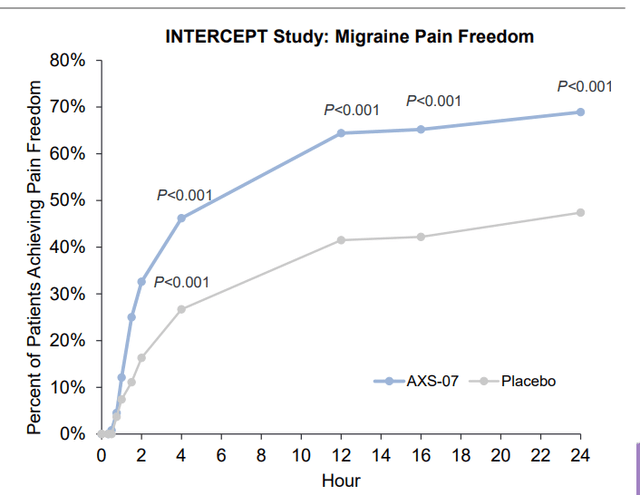

In terms of ex-US strategy, the drug portfolio is one for which the company generally has worldwide rights and the chosen approach is to use out-license candidates outside the US. The Sunosi acquisition included the European Sunosi business and gives Axsome a broader global footprint which could impact business development in a positive manner outside the US. Shifting toward the rest of the pipeline, for AXS-07 in migraine they concluded a Type A meeting with the FDA and plan to resubmit an NDA by Q3 2023. Resubmission will address issues raised in the Complete Response Letter (principally around CMC or chemistry, manufacturing & control).

Corporate Slides

Figure 6: Positive results demonstrated in migraine across 3 phase 3 programs including INTERCEPT for early treatment (Source: corporate presentation)

As for clinical profile of this treatment, it focuses on efficacy as patient and physician surveys show the highest unmet need is for more efficacious drugs.

Moving on to AXS-12 for narcolepsy and AXS-14 for fibromyalgia, the former has a phase 3 SYMPHONY study ongoing with guidance for data 1H 23 (sounds like they are generally on track but management tone could indicate a slight delay is possible as pace of enrollment is “bumpy”). Results from that trial along with results from long term safety study would put them in a position to file for approval. As for AXS-14, CMC work is ongoing as they already have positive phase 2 and phase 3 data in hand (when CMC is done, they can file NDA toward the end of 2023). As for Sunosi in ADHD, a phase 2/3 pivotal trial will be launched in Q4 with potential readouts next year and there is evidence that this dual-acting dopamine and norepinephrine reuptake inhibitor could prove to be a valuable non-stimulant option in this space given its low potential for approval. Additionally, the company plans to run a study evaluating whether Sunosi can improve cognitive outcome measures in patients with excessive daytime sleepiness associated with obstructive sleep apnea (OSA).

Corporate Slides

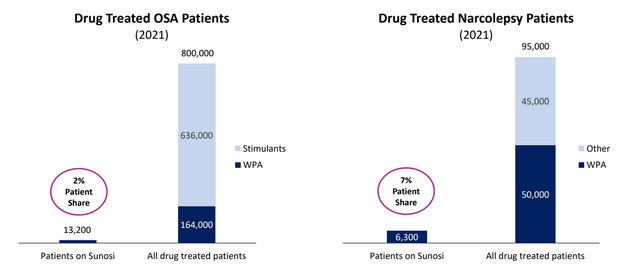

Figure 7: Growth potential for Sunosi in EDS in OSA and in narcolepsy (Source: corporate presentation)

More Thoughts On Sunosi Acquisition

When companies acquire new drug candidates externally, I view this as a great opportunity to assess the management team’s acumen in terms of business development, asking questions such as whether they overpaid and what value they could potentially have seen that others overlooked. In March of 2022, Axsome acquired rights to Sunosi from Jazz Pharmaceuticals for a $53M upfront payment along with being on the hook for high single-digit royalty on US net sales in current indication and mid single-digit royalty on US net sales in future indications. Axsome also assumed commitments to Asian partners SK Biopharmaceuticals and Aerial Biopharma (include single-digit tiered royalties and up to $165M in revenue milestones). Axsome funded this deal via its $300M loan facility with Hercules Capital.

The current snapshot is that the drug is the first and only DNRI approved to treat EDS in adults living with narcolepsy or OSA, with 2021 net sales of $57.9M representing 104% year-over-year growth. To further exploit this asset, Axsome intends to pursue new high-value indications in psychiatry and neurology. It’s worth noting that patent expiries last out to 2040 (before potential extensions), suggesting long runway to potentially allow for further revenue growth. Axsome thinks the drug candidate could do over $1 billion in peak sales when considering new indications should clinical trials yield positive data.

A devil’s advocate or skeptical point of view would be that if Jazz Pharmaceuticals did not do much with this agent, how will Axsome’s team do any better?

Per June’s Sunosi Investor Event, there are 12 investigator-sponsored trials ongoing for solriamfetol (generic name) across a variety of conditions. Seven of these are interventional studies in indications such as binge eating disorder, ADHD, shift work disorder, chronic fatigue syndrome, fatigue associated with MS and others. The opportunity in ADHD appears to be front and center, as dopamine and norepinephrine are implicated in the pathology of this condition. Aspects of the product profile that could be attractive here despite the crowded marketplace include low potential for abuse, non-stimulant, once-daily dosing and well-established safety & tolerability profile. I remain skeptical here in that Core Biotech holding Supernus Pharmaceuticals (SUPN) appears to be filling this niche with Qelbree.

In the ensuing Q&A session, management notes that Sunosi originally launched in the US in July 2019 and an initial growth trajectory was negatively impacted by pandemic restrictions enforced within the months of launch. Despite this headwind, script growth continues to trend upward. Currently, Sunosi only has a 2% patient share for drug-treated OSA patients and a 7% patient share for drug-treated narcolepsy patients. With broad payer coverage, management believes there is significant room to grow adoption and revenue. The majority of patients with EDS and OSA experience major depression, and thus a significant portion of OSA patients are seen by psychiatrists (potential overlap with Auvelity targets). Field force is focused on high potential subscribers (HCPs with a large pool of diagnosed patients, have high script volume and are familiar with weight promoting agents). Sunosi script and sales growth (or lack thereof) will be a good test of the much-touted DCC platform and its ability to align with and exploit prescriber preferences more efficiently. Gross margin on Sunosi net sales is expected to be in the mid-upper 70%’s (royalties to Jazz and other partners are included in COGS or cost of goods sold). As for the impact on operations, a small loss is expected in 2022, this includes further development for ADHD indication and additional investments in commercialization.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $73.4M (does not include ATM financing proceeds). Along with $100M term loan facility, they guided for operational runway into 2024. A word of caution is that they clearly state that operating expenses will grow year over year as they build out commercial function and advance the pipeline including late-stage studies in indications such as Alzheimer’s disease agitation.

Net loss for the quarter rose by about a third to $41.4M, as SG&A nearly doubled to $31.2M. Research and development expenses were up only slightly at $15.8M. I think accumulated deficit of $409.2M is actually quite reasonable considering the late-stage studies the company has completed (or underway) and that they’ve gotten Auvelity approved in an indication (MDD) that requires phase 3 studies with a high number of patients.

While it’s encouraging to see multiple clinical trial initiations coming up, I don’t count those as meaningful catalysts. However, near term we can look forward to phase 3 ACCORD readout in Alzheimer’s disease agitation and in 1H 23 phase 3 SYMPHONY readout of AXS-12 in narcolepsy is expected.

As for institutional investors of note, generalist funds Vanguard and Blackrock own ~7% and ~5% stakes, respectively. On the other hand, Baker Brothers sold out of its position as of August. Adage Capital Partners owns around 783,000 shares and RTW Investments disclosed ownership of 1.6M shares. Fairmount Funds Management recently disclosed a 5.4% stake and PFM Health Sciences similarly with a 5.4% stake.

As for insiders, there was a bit of buying activity in Q4 of last year. Mark Coleman on the board of directors owns over 422,000 shares, while Mark Saad bought over $100K worth of shares last November and Roger Jeffs bought $147K worth.

Fintel

Figure 8: Insider buying activity (Source: corporate presentation)

As for relevant leadership experience, it looks a bit light at the top although Chief Financial Officer Nick Pizzie served prior as VP and CFO of Pierre Fabre USA. Chief Operating Officer Mark Jacobson served prior as the Director Corporate Development at Stemline Therapeutics. EVP, Commercial and Business Development Lori Englebert served prior at Amgen in related positions in business development and on the commercial operations side.

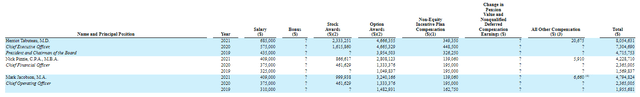

Moving on to executive compensation, $685k base salary for the CEO in 2021 seems on the high side (as smaller companies typically want to conserve cash for launch and commercialization activities). His level of option and stock awards is rather on the high side as well at over $4.6M and $2.3M, respectively.

Fintel

Figure 9: Compensation table y (Source: corporate presentation)

Moving onto useful nuggets from members of the ROTY community, BioInvestingForAlpha notes the following:

Auvelity is a combination oral of two generics (bupropion & dextromethorphan). The trials have shown that these two chemicals interact in what appears to be a beneficial way by changing the pk/pd. Is there any potential for a doctor to simply prescribe the two individual generics instead of Auvelity? Note that dextromethorphan is the active agreement in many cough syrups. I am leaning towards that the quickness to see a benefit at one week could provide good differentiation and potential for the drug. But with bupropion generic readily available, doctors and payors need to believe dextromethorphan with bupropion is worth the price tag (key concern).

DSJ.2018 provides the following counterpoint and associated thoughts:

That’s long been THE criticism BUT evidently the two drugs mentioned are formulated in such a way that the FDA recognized as unique. They complement each other in a powerful way. I don’t believe it’s likely that one could mimic the effect just by giving the two drugs together or I have never heard anyone suggest such a thing. The typical anti-depressant is without much differentiation but Auvelity’s MOA is highly differentiated and should be well received by the payor community. Truist expects US peak sales in excess of $1.3 billion by 2036. In terms of pipeline, there are a lot to look forward to including Alzheimer’s disease agitation for AXS-05 which is a focus item given high commercial attractiveness.

As for IP, I see patent claims extending to 2034 and 2040 for Auvelity, to 2036 for AXS-07 and to 2039 for AXS-12. As mentioned prior, Sunosi has claims extending up to 2040 as well.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), it’s worth noting that drug substance and drug product for the company’s clinical candidates are done by third parties (they do not own or operate manufacturing facilities, it always means bottlenecks or other setbacks can be a risk given lack of internal control). For the MDD indication, they cite quite a few players on the market including Prozac from Eli Lilly, Zoloft from Pfizer, Tringellix marketed by Takeda, Effexor from Pfizer and Wellbutrin by GlaxoSmithKline, to name a few. Recent failure of Relmada Therapeutics’ (RLMD) REL-1017 was a net positive for Axsome in terms of losing a near-term competitor. Searching on clinical trials gov website, I found 30+ phase 3 studies actively recruiting patients. Core Biotech holding Supernus Pharmaceuticals (SUPN) has an interesting drug candidate (mTORC1 activator) for treatment resistant depression in phase 2 studies, as does Compass Pathways with psilocybin therapy COMP360 (meaningful increase in positive affect in just three weeks). In the high value indication of Alzheimer disease agitation, Axsome cites Otsuka’s combination of deuterated dextromethorphan and quinidine for this indication

As for the bear case and looking at the story from a different angle, my key cause for concern would be slow uptake for Auvelity out of the gate. While some commentary on Wall Street is grounded, it still seems like expectations are higher than warranted and it could be a few quarters or more before Auvelity sees real traction in terms of scripts and accelerating sales growth. Trials such as Alzheimer disease agitation will take some time to run as well (primary completion date June 2025 for that indication).

Final Thoughts

To conclude, I will be the first to state that I like the story here as the Auvelity launch gets underway in the lucrative MDD indication with a novel mechanism of action and key differentiators such as rapid onset of effect. Stories that combine accelerating commercial and clinical momentum are a sweet spot for me, and here we can look forward to progress in other high value indications such as Alzheimer disease agitation in addition to the company’s psychiatry-focused sales force exploiting synergies with Sunosi and Auvelity. In regards to valuation, keep in mind that back in 2014 Otsuka bought out Avanir for $3.5 billion to get its hands on Neudexta (combination of dextromethorphan and quinidine) for pseudelbar effect (also showed utility in Alzheimer’s agitation in mid-stage trial at the time, had plenty of critics as well). Key concerns include how the balance sheet holds up with increasing cash burn in coming quarters and how long it will take for Auvelity sales to gain traction in the MDD marketplace.

For readers who are interested in the story and have done their due diligence, AXSM is a Buy and suitable only for long-term investors with a multi-year timeframe. One potential plan of action could be to establish a small pilot position in the near term, then wait for subsequent quarterly updates to derisk and accumulate more exposure on any dips.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I’m not one to chase the stock back above the $50 level. I will keep a prewritten thesis on hand, monitor Auvelity launch metrics in coming quarters and from there decide whether to enter a position (also a function of whether cash is freed up in our portfolio, be it via M&A, taking profits or cutting a losing position).

As for risk rating (1=low, 5= high), I will put this one at a 3 as the balance sheet seems to be in good shape (though not overly strong), they have an approved drug in high value indication with differentiated MOA and multiple late-stage shots on goal that could expand the total addressable market opportunity for the portfolio. I would not be surprised to see another financing by mid to 2H 2023, and again it’s important to keep an eye on potential competitors including in the Alzheimer’s disease agitation indication.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment