Dean Mitchell/E+ via Getty Images

We believe AXS-07 has a high chance of approval in April 2022

Axsome Therapeutics (NASDAQ:AXSM) has announced that the U.S. FDA accepted the New Drug Application (NDA) filing for AXS-07, targeting acute treatment of migraine, and has set a Prescription Drug User Fee Act (PDUFA) target date to April 30, 2022. As April 30 is on the weekend, we believe the decision may be published on Friday or Monday next week. We highlight that AXS-07 will be approved based on the two positive data from the pivotal phase 3 trials, the MOMENTUM and the INTERCEPT study (explained in detail in the next section). Also, we find comfort in the recent news that the FDA mentioned that they have the capacity to inspect Axsome’s manufacturing facility before the PDUFA decision date. We view CMC to be continuously important, especially with the new FDA commissioner Robert Califf with a high degree of focus on CMC and safety.

AXS-05

AXS-05 remains to be an overhang for the company, but looking at the current price level, we think the risk is priced in, and any good news flow regarding AXS-05 will offer a positive boost to the company’s share price.

On August 20, 2021, FDA notified Axsome that they would not complete the review of AXS-05 for MDD on August 22 PDUFA due to two deficiencies related to analytical methods in the CMC section of the NDA. In January 2022, the company has submitted its response, and with the acknowledgment by the FDA on the submission, no issues have been identified by the FDA. As such, AXSM has indicated that the company will provide updates to investors regarding the review (i.e., initiation of definitive labeling discussion). However, as of today, neither the FDA nor the company has provided a meaningful update on the PDUFA decision. However, considering its strong data and the high unmet need for major depressive disorder, we believe FDA will come up with a PDUFA date during the next couple of months, and that news will offer an attractive boost to the stock price. However, until the company announces its plans on AXS-055, we continue to await an update. We continue to believe the drug will be approved based on the highly promising phase 3 study available.

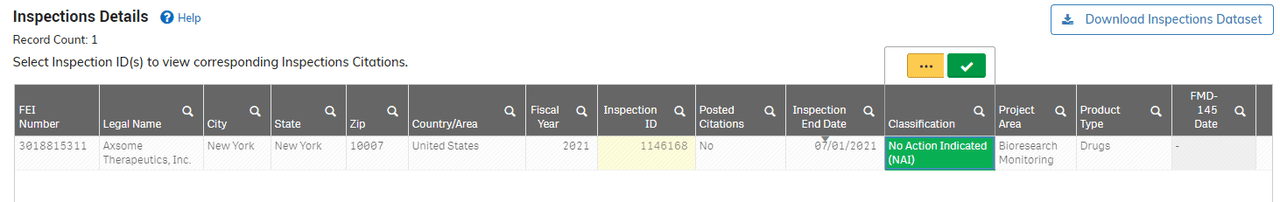

FDA database

The FDA’s database indicates that the inspection in 2021 received a no-action indication classification. We suspect that the NDA is ongoing.

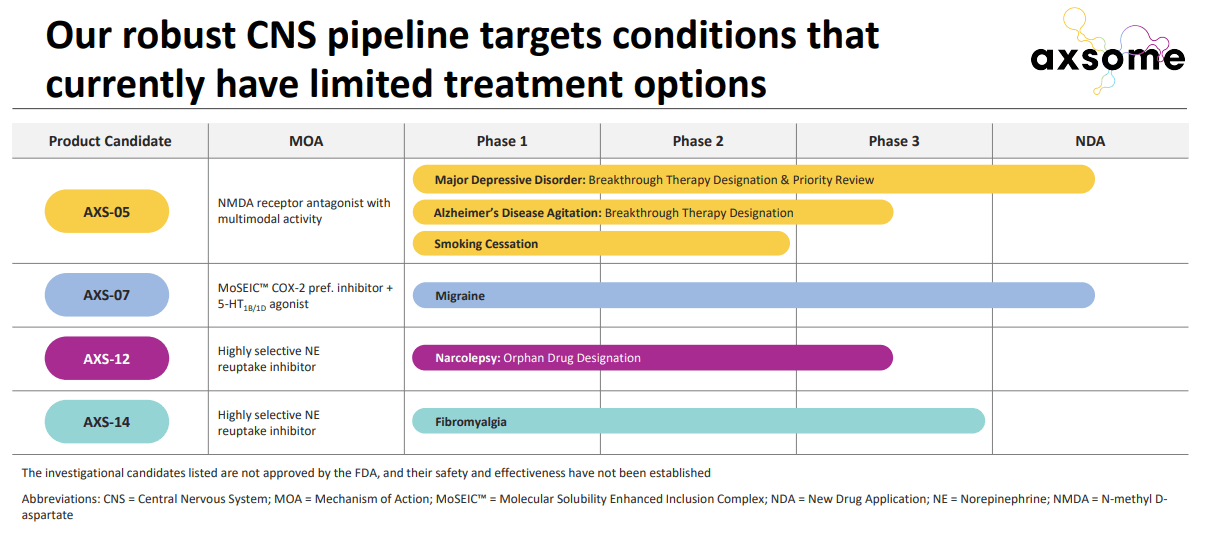

Other than the key assets, AXS-05 and AXS-07, there are multiple other early-stage and mid-stage candidates such as AXS-14, AXS-12, etc.

AXSM IR presentation

AXS-07 is our short-term focus

We are thinking of trading around the PDUFA on April 4th because of AXS-07.

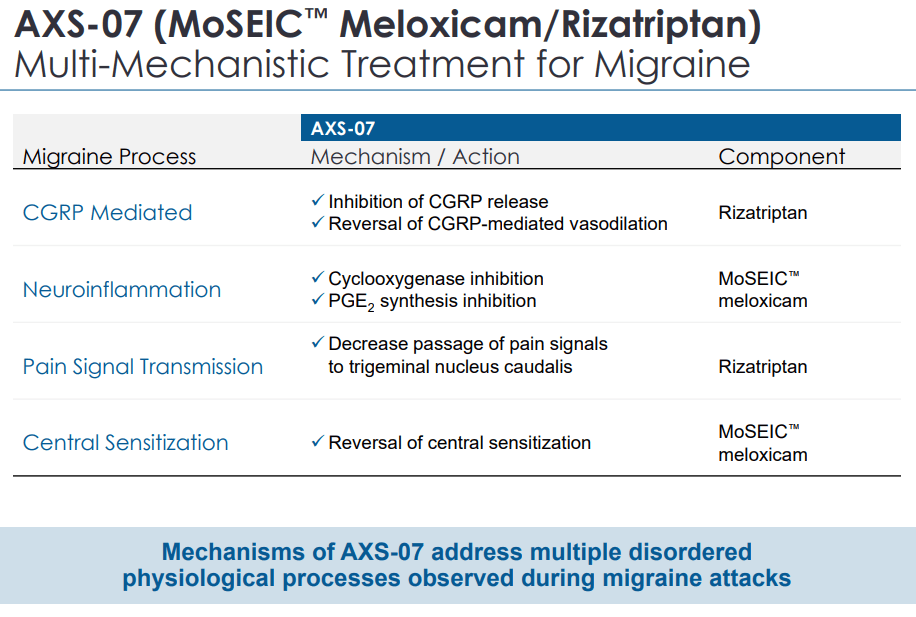

AXS-07 is a novel, oral, rapidly absorbed drug with a novel & multi-mechanism of action. The drug’s key ingredients are MoSEIC Meloxicam + Rizatriptan, which is a novel treatment for acute migraine.

AXSM IR presentation

Meloxicam is a long-acting nonsteroidal anti-inflammatory drug (NSAID), with COX-2 preferential inhibition and potent pain-relieving efficacy. The drug has not been approved for migraines due to its prolonged Tmax.

Tmax is the time it takes for a drug to reach the maximum concentration (CMAX) after administration of a drug that needs to be absorbed (e.g. an oral drug). Tmax is governed by the rate of drug absorption and the rate of drug elimination. Source

As such, in order to overcome this hurdle, Axsome developed a new technology Molecular Solubility Enhanced Inclusion Complex (MoSEIC) that enables Meloxicam to be delivered more rapidly and has an extended half-life. During phase I, we highlight that AXS-07 has shown a rapid absorption, and fast onset of action compared to Meloxicam mono-therapy.

We like the three positive clinical data that showed more rapid and sustained efficacy (migraine pain and bothersome symptoms) than the SOC triptans (Rizatriptan). We think efficacy is the key point of differentiation for AXS-07.

-

MOMENTUM, in patients with a history of inadequate response, vs. placebo and rizatriptan

-

INTERCEPT, in early treatment, vs. placebo

-

MOVEMENT, long-term open-label treatment, up to 12 months

|

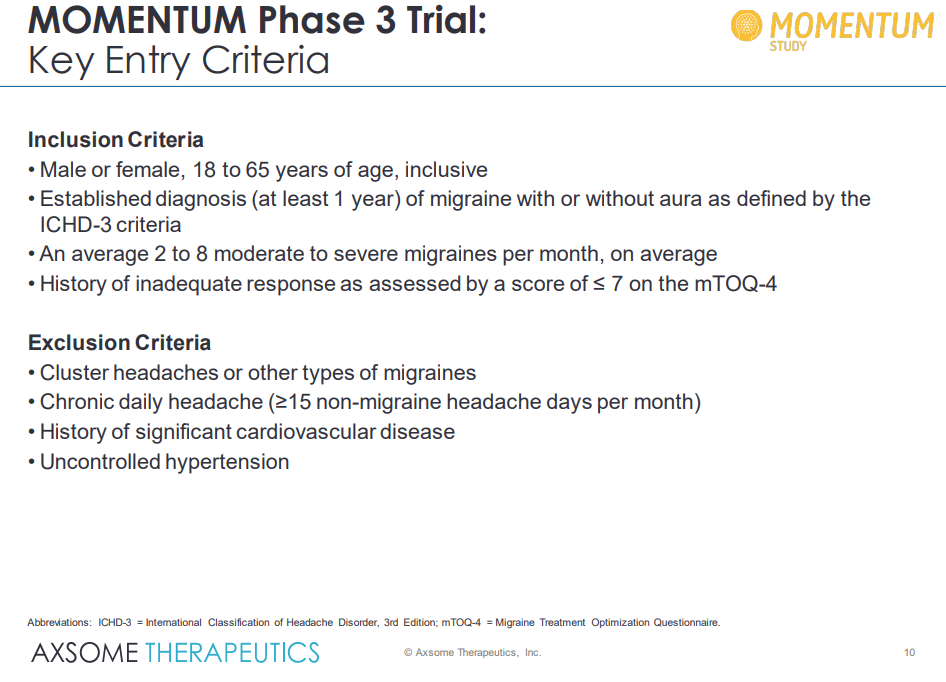

Inclusion criteria |

Primary and secondary endpoints |

|

|

Intercept |

Male or female, 18 to 65 years of age, inclusive Established diagnosis (at least 1 year) of migraine with or without aura as defined by the ICHD-3 criteria An average 2 to 8 migraines per month |

Primary endpoints Secondary Endpoints: |

|

Momentum |

Has an established diagnosis of migraine with or without aura. Has experienced an inadequate response to prior acute treatments. |

Primary endpoints:

Secondary Endpoints:

|

Source: Clinicaltrial.gov

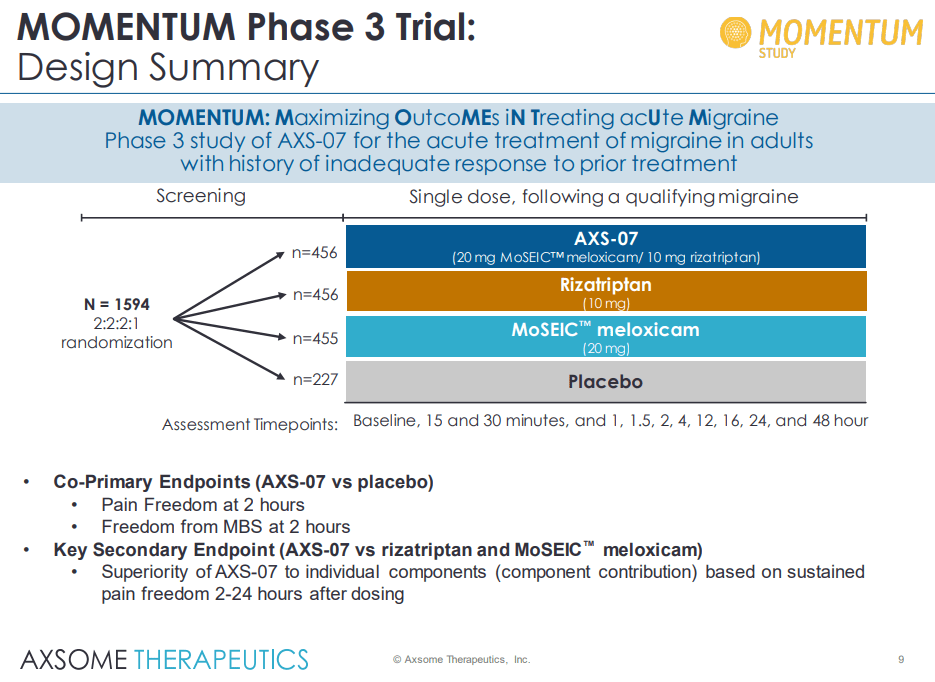

MOMENTUM Study: Phase III – ACUTE Migraine patients

AXSM IR presentation

During the large (n=1594) pivotal phase III Momentum study showed highly compelling study results in the acute treatment of migraine in a patient population with a history of inadequate response to prior acute treatments. We are impressed at the drug’s ability to demonstrate statistical efficacy, rapid onset of action, and durability on both primary and secondary endpoints in difficult-to-treat patient populations with a history of inadequate response to prior treatments for acute migraines.

AXSM IR presentation

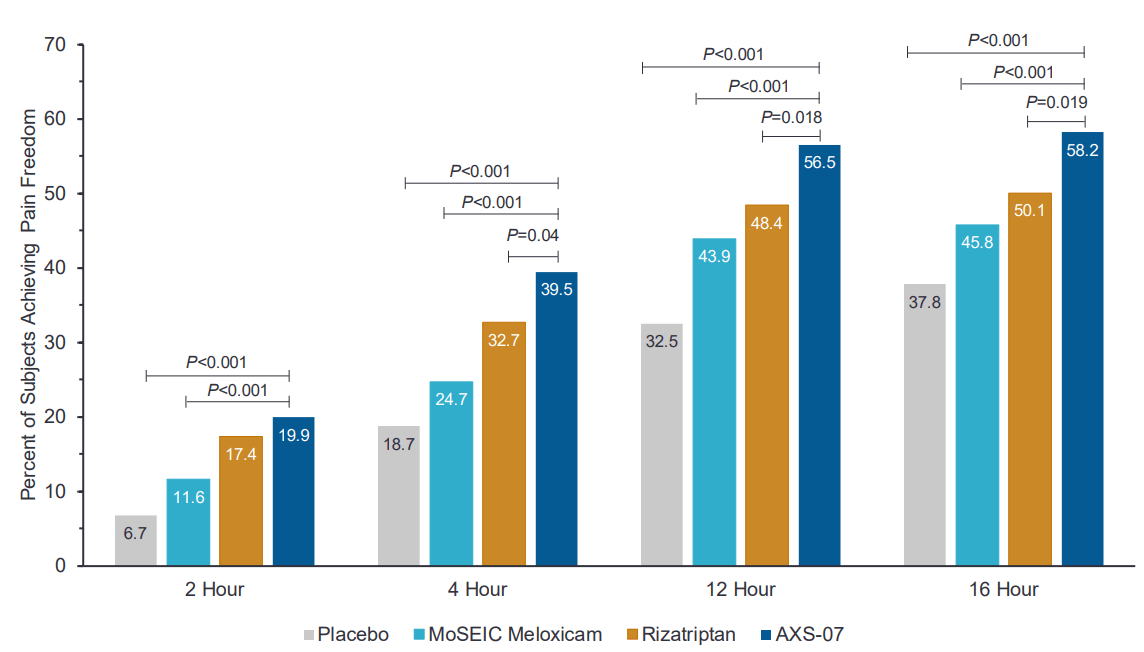

The momentum study highlights its differentiated efficacy to a standard of care acute treatments such as rizatriptan.

The top-line results demonstrate that AXS-07-treated patients met the co-primary endpoints and achieved a substantial improvement over placebo (13.2% and 12.5% improvement over placebo) in two metrics, pain freedom and absence of most bothersome symptoms 2 hours after drug administration.

In order to comply with the regulatory requirements, Axsome Therapeutics tested AXS-07 against only a placebo arm for understanding the co-primary endpoints. However, for the secondary endpoints, additional individual active comparator arms of additional drugs (rizatriptan and MoSEIC meloxicam) were included. There, the secondary endpoints were met with statistical significance. On the secondary arm, AXS-07 demonstrated clear superiority over rizatriptan: statistically significant results for 1 hr pain relief, 2-24 hr sustained pain relief, 2-48 hr pain relief, 2-24 hour sustained pain freedom, 2-48 hour sustained pain freedom, PGI-C, functional improvement at 24-hours and use of rescue medications. Further additional data presented showed that AXS-07 showed impressive onset of action, superior pain relief greater than rizatriptan within 30 min after dosing, and every point from then. This shows that AXS-07 is around 3 times faster than Rizatriptan, 4hs vs 1.5hrs median time to migraine pain relief. Furthermore, data showed that AXS-07 reduced the relapse of migraine pain more than Rizatriptan, 45.2% vs 21.2% of patients experienced relapses over 48 hrs after dosing.

AXSM IR presentation

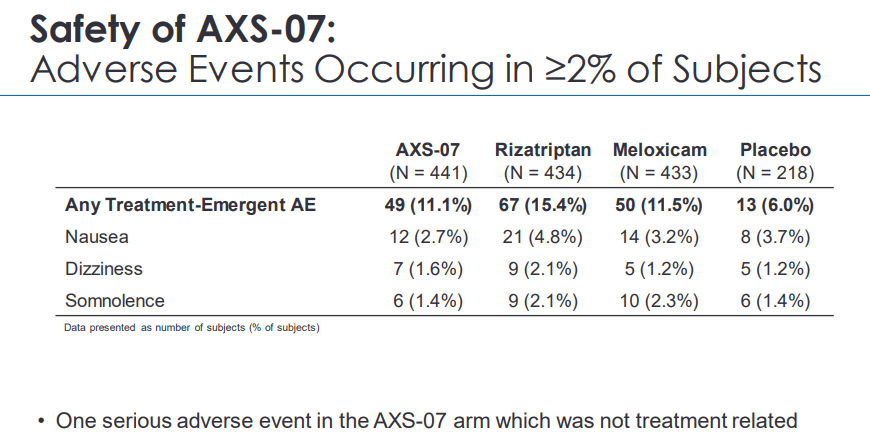

On the safety front, AXS-07 was safe and well-tolerated. According to the company, the most common adverse events were nausea, dizziness, and somnolence; however, we note that none of which occurred at a rate greater than placebo or higher than 3%. One serious adverse event took place, but the investigator concluded that it not to be related to the study drug. On the Momentum 12 months OLE (Open Label Extension), only 1.6% of patients discontinued due to adverse events.

AXSM IR presentation

We think this data is highly compelling and showed superior/comparable efficacy to other oral anti-CGRP therapies. We believe it is only fair to compare AXS-07 to oral anti-CGRP agents considering the drug’s convenient oral mechanism of action. For example, while it is hard to extrapolate across clinical trials due to different patient sizes and populations, Biohaven’s (BHVN), oral anti-CGRP drug, rimegepant, demonstrated a 10.3% and 8.3% improvement vs placebo-treated patients in pain freedom and freedom from most bothersome symptoms, within 2 hours of dose administration.

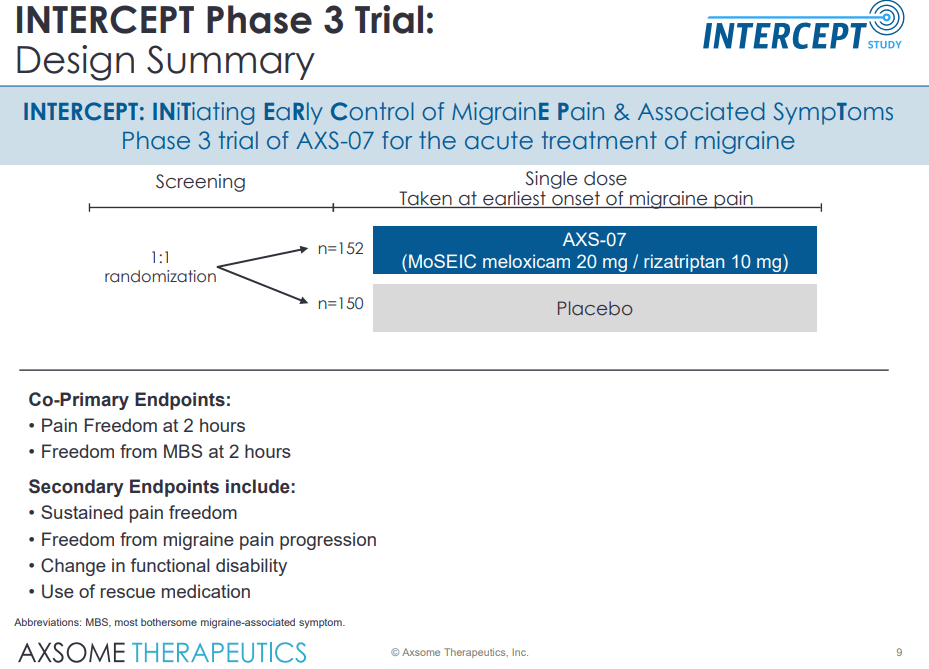

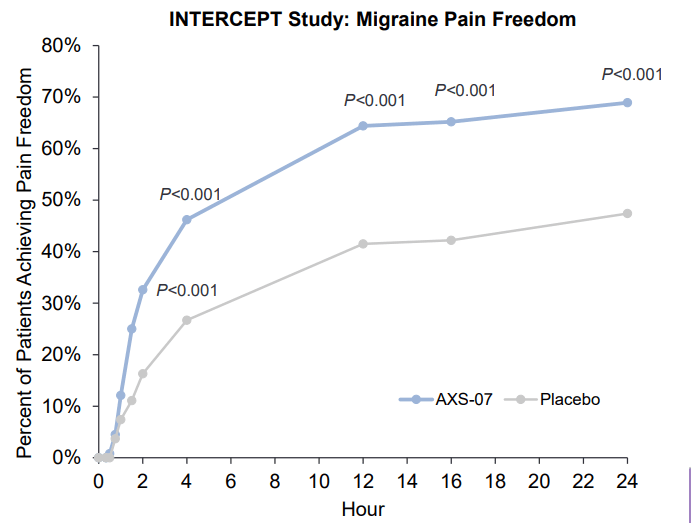

INTERCEPT study: Phase III – Early Migraine patient population

AXSM IR presentation

During INTERCEPT, the company evaluated the drug in the more general migraine population (all-comer patient population), and dosing for this study is initiated on the first sign of any pain, contrary to the MOMENTUM trial where patients were directed to wait until migraine severity was moderate to severe.

AXSM IR presentation

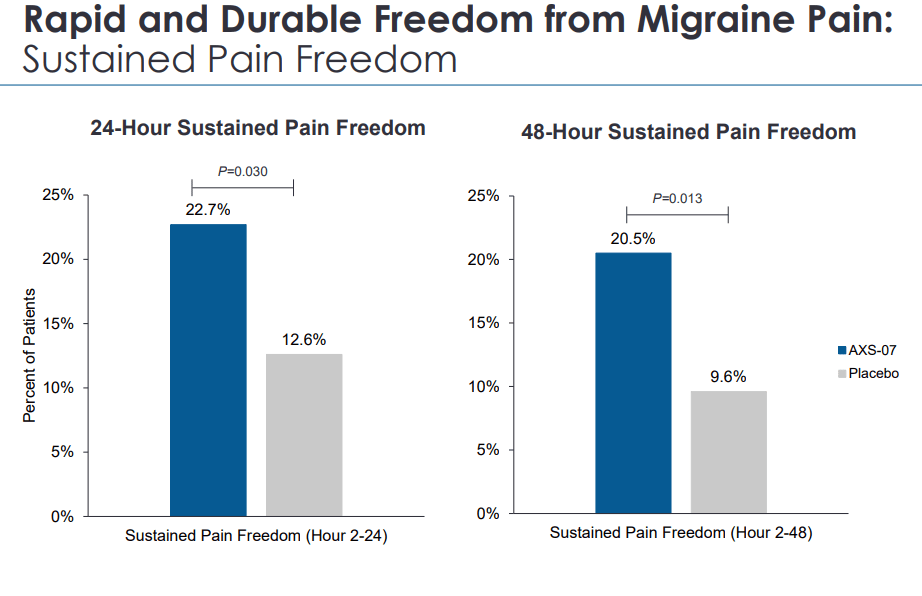

The results were highly encouraging; AXS-07 treated patients have met the two co-primary endpoints, proving the drug’s efficacy in reducing rates of migraine pain freedom and most bothersome symptom within 2 hours of administration vs. placebo.

AXSM IR deck

Furthermore, in this population as well, AXS-07 has significantly prevented the progression of migraine pain beyond mild in the majority of patients between 2 and 24 hours of treatment.

On the safety front, AXS-07 was generally safe and well-tolerated. The most commonly reported AEs with AXS-07 were: somnolence, dizziness, and paresthesia which occurred at a rate of <5% occurrence rate. Unlike the Momentum trial, there were no serious adverse events during the trial. Based on the promising efficacy and safety data, we believe AXS-007 has the potential to move up to the first-line treatment setting with a broader label, with a significantly greater market opportunity.

Valuation

We believe Migraine is a highly attractive indication with the huge patient size and the chronic nature of the disease. However, we concede the space is packed with many big pharma competitors and recent entrants, such as Reyvow from Eli Lilly (LLY) and Aimovig from Amgen (AMGN). As such, we do not believe AXS-07 will generate multi-billion dollar revenue for the company. Especially, we see commercialization to be a hurdle considering it is hard to go up against big biotech competitors with significantly greater financial resources and commercial capacities (i.e., cross-selling).

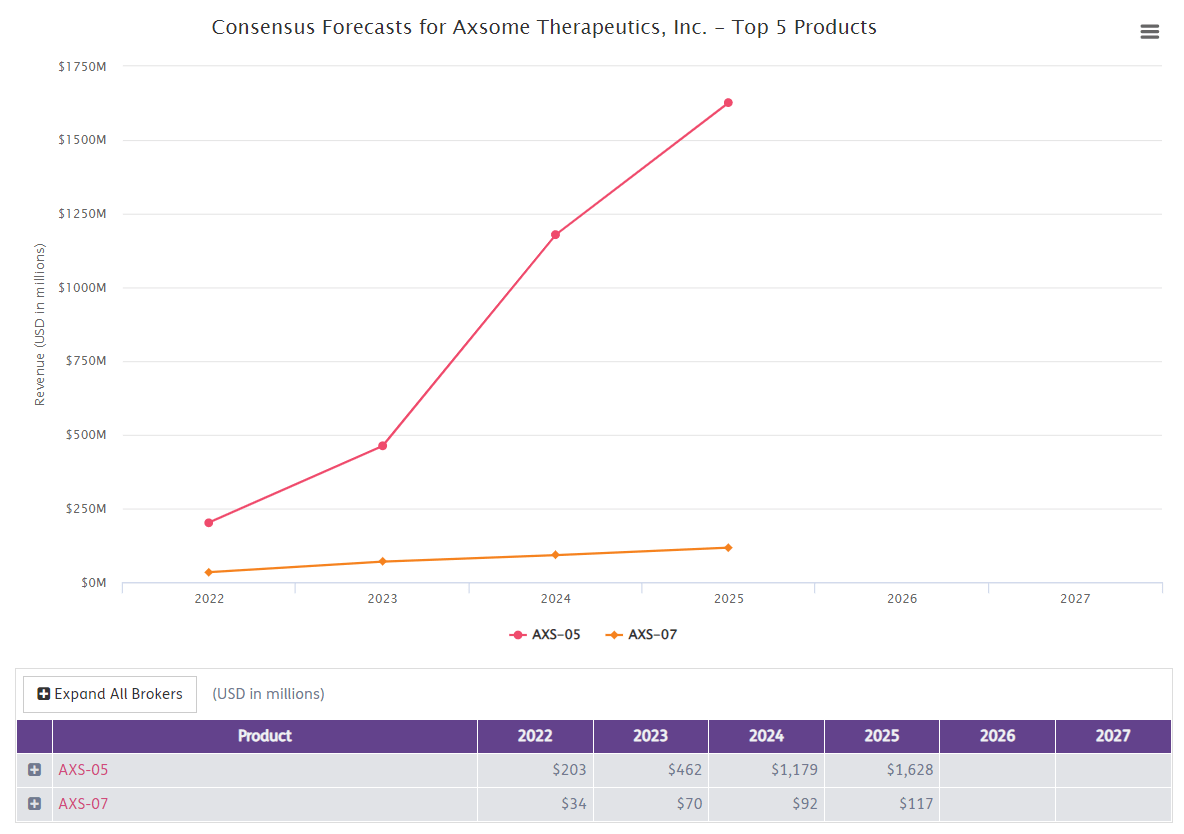

Using Informa Business intelligence’s broker consensus estimate (Below), the peak sales of AXS-07 would be around 117M and AXS-05’s peak sales to be around USD 1.6 Bn.

Using a probability of success of 86.7% for a neurological indication in the NDA/BLA stage and peak sales of 1.7Bn, we get around USD 1.46Bn of risk-adjusted peak sales. Using a conservative peak sales multiple of 3, we get around USD 4.38Bn of EV for just two candidates, AXS-07 and AXS-05. As such, there is a close 280% upside from the current EV of 1.56 Bn (As of April 1st, 2022). Based on this, our target price is USD 120 per share.

Biomedtracker – Consensus

Robust balance sheet, we are not worried about Dilution risk

The company has approximately USD 100M in cash and access to USD 120M from term loans ($100 million on AXS-05 MDD approval and $20 million for AXS-07 migraine approval), and in the earnings call, the company mentioned that it will be enough to last until 2024.

Risks

-

Clinical risk: if the company’s lead candidate gets rejected, we see a potential 50% downside considering the company’s pre-commercial status.

-

Macro risk: geopolitical tensions and macro forces (rising interest rates) may plague the biotech market like what we have observed during 2021-2022.

Conclusion

We have initiated a small option-sized position on Axsome Therapeutics and plan to slowly accumulate until the PDUFA date that is scheduled on April 29th, 2022 for AXS-07. Based on the BTVI’s risk-adjusted peak-sales valuation, we see a potential 290% upside long-term with the potential approval of AXS-05 and 20-30% of upside with the approval of AXS-07. We believe investors are more focused on AXS-05, which is currently in limbo without a PDUFA target date, and AXS-07 has fallen through the crack. From this point, we expect positive news flows for the company until the end of the year. We are bullish on both AXS-05 and AXS-07, and we expect positive results from the upcoming (April 29th) PDUFA for AXS-07 and for AXS-05. We expect FDA to come up with a definitive target date (as inspection seems to be a non-issue as described in detail above). Furthermore, looking at the current valuation and general biotech market (XBI), (IBB) starting to bottom out, we view the bottom is in and the biotech sector will start trading to the upside from here. Furthermore, on the AXS-07 front, we view the downside to be limited unless AXS-05 completely fails, as a majority of the value is driven by AXS-05.

Be the first to comment