AWelshLad/iStock via Getty Images

Investment summary

Considering the systematic drivers of equity returns are well at play (namely, macroeconomic drivers, rates, industry factors, and growth factors) in markets right now, we argue to seek out exposure to idiosyncratic risk premia in order to derive risk-adjusted alpha.

With this front of mind, we rate Axonics, Inc. (NASDAQ:AXNX) a speculative buy following Q2 results and additional market factors discussed below. The company’s niche operating segment continues to offer a defensible growth play albeit with little correlation to equity markets, attractive features in the current investment landscape. In addition to these points, shares are trading at multiples above the peer median; however, this is balanced when factoring in a number of inputs into the valuation debate. With this, and recent momentum on the chart in mind, we rate AXNX a buy.

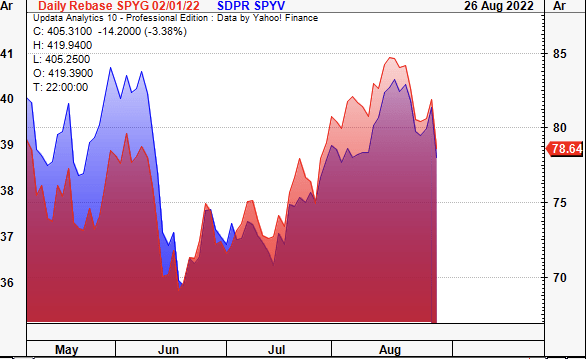

Exhibit 1. AXNX 6-month price action

How current market factors impact AXNX

The high-beta trade has unwound itself in FY22, and investors must now find selective opportunities with asymmetrical pricing within risk assets. Factor rotations have also been of high magnitude this year as well. Continuing its return to grace, value caught a strong bid from the June bounce, as seen in Exhibit 2. Investors have nibbled at compressed multiples in June-August as yields stabilized and a slight tightening of inflation. Value also continues to attract strategic positioning as managers seek to wind back equity duration and beta.

Meanwhile, growth as caught a bid since this time as well, particularly in late August. This has direct implications to the outlook of the AXNX share price. With cash flows priced out into the future, we need investors to be net buyers of growth – and pay a premium at that to capture market-derived alpha when looking ahead.

Exhibit 2. Both growth and value have caught a bid since the June bounce, highlighting some return in confidence to equities

Data: Updata

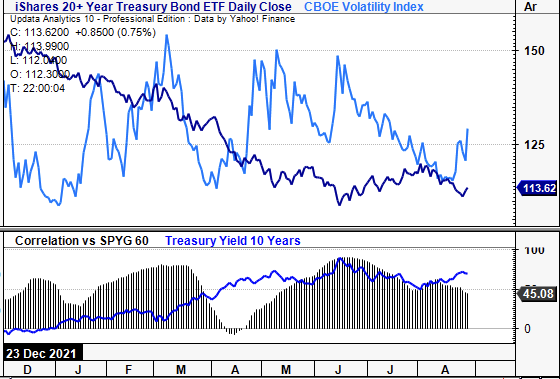

Meanwhile, whist yields have rolled over in recent months, alongside stock/bond correlations, a recent spike in the VIX and the long-end suggests stocks may not be out of the water, and raises questions on the validity of the relief rally outlined above.

Exhibit 3. Whilst stock/bond correlations and yields have rolled over in recent months, recent spikes in volatility in stocks and steepness at the long-end suggest we aren’t out of the woods at all

Data: Updata

Q2 earnings conducive of growth play

AXNX generated total revenue of $69 million (“mm”) last quarter, a 50% YoY growth schedule. Upside was driven by sacral neuromodulation (“SNM”) revenue of $55.8mm, a 39% YoY gain. Nearly 100% of turnover was generated in the US, mitigating FOREX headwinds (although, the company did recognize a $12mm non-cash forex adjustment in its comprehensive loss). Q2 SNM sales were propped by the launch of the recharge-free Axonics F15 system.

Meanwhile, Bulkamid sales came in at ~$13mm with ~$3mm in ex-US revenue, as the speed of new accounts and volume from existing accounts both saw upticks. We estimate the Bulkamid transaction (completed February FY21) to be accretive to ~$0.18 (18% margin) in EPS during the quarter. From the increase in revenue volume, gross margin increased by ~10 percentage points YoY to 72.8%.

Moving down the P&L, it bought this down to an operating loss of ~$21.4mm, as operating expense came in 60% higher YoY. Net loss narrowed to ~$21mm, with a $12mm expense for foreign currency translation adjustments, bringing the comprehensive loss to $34mm.

The strong quarter sees management lift FY22 guidance to 40% in revenue growth, calling for $253mm at the topline (previously $238mm). It anticipates SNM revenue of ~$205mm and Bulkamid to contribute $48mm, a 111% YoY gain. With respect to CMS outpatient facility rates, for 2023, the relevant sacral neuromodulation codes proposed an increase of 5-7%, whereas the Bulkamid code an increase of ~4%.

In terms of catalysts to move the needle, we estimate there is substantial premium yet to be priced in by the market with regards to the company’s 4th generation neurostimulator. AXNX submitted its PMA supplement to the FDA back in May on this. Key changes to the current model are around recharging, in that, the new model will only need recharging every 6 months for 1 hour, down from once a month. It expects this to be approved by year’s end.

AXNX valuation and conclusion

Shares are currently trading at 14x TTM sales, well ahead of the GICS Health Care sector peer median of 4.45x. In addition, AXNX looks to be richly priced at 7.3x book value, again far in front of the peer’s 2.16x multiple. However, the market has AXNX priced at ~13.3x forward sales, which, we believe, suggests the investors are pricing in an above-sector result for the company at the topline for the coming 12 months. We estimate FY23 sales of $317mm for the company, and at 13x this estimate sets a price target of $84, roughly 18% return potential from the current market price.

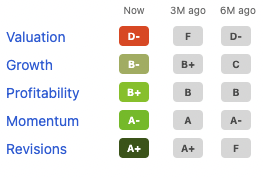

Despite its lofty multiples versus peers, Seeking Alpha’s quantitative factor grades rate AXNX highly across an entire valuation composite, as seen in Exhibit 4. Although, it is rated a ‘D’ for valuation. Nevertheless, this is an attractive feature in the investment debate, as the composite synthesizes a wide set of data into a quantifiable formate.

Exhibit 4. AXNX Quantitative Factor Grades suggest there is relative value when factoring in a suite of inputs into the valuation

Data: Seeking Alpha Quant Factor Grades, AXNX

Considering all of the upside and mitigating factors in AXNX’s investment debate, we rate it a buy. The company looks well positioned to deal with market and economic headwinds looking ahead, and valuations based on our forward-looking sales multiples appear to be attractive also. The key risk to our investment thesis is a weaker-than-expected Q3 FY22 earnings result, because this could see a de-rating to the valuation listed above. Nevertheless, we look forward to providing additional coverage.

Be the first to comment