seanfboggs

Axon Enterprise (NASDAQ:AXON) is an innovative business offering a range of hardware (e.g., TASERs, body cameras) and software products (e.g., Axon Cloud, VR training) for the military, law enforcement officers, private security personnel, and civilians. In my last article published on the 17th June 2022, I argued that Axon had several attractive business characteristics that made it worthy of an investment, including:

- High switching costs once a customer is ‘locked in’ to their product ecosystem.

- Demonstrated track-record of 25%+ YoY revenue growth, with a 44% revenue CAGR in their high-margin Axon Cloud segment from 2017-2021.

- Significant gross margin and adjusted EBITDA margin expansion since 2017.

- Low penetration with Axon Cloud globally and across all products outside of the US and Commonwealth countries (e.g., Australia, Canada, UK).

- Strong balance sheet with no debt and consistent positive free cash flow.

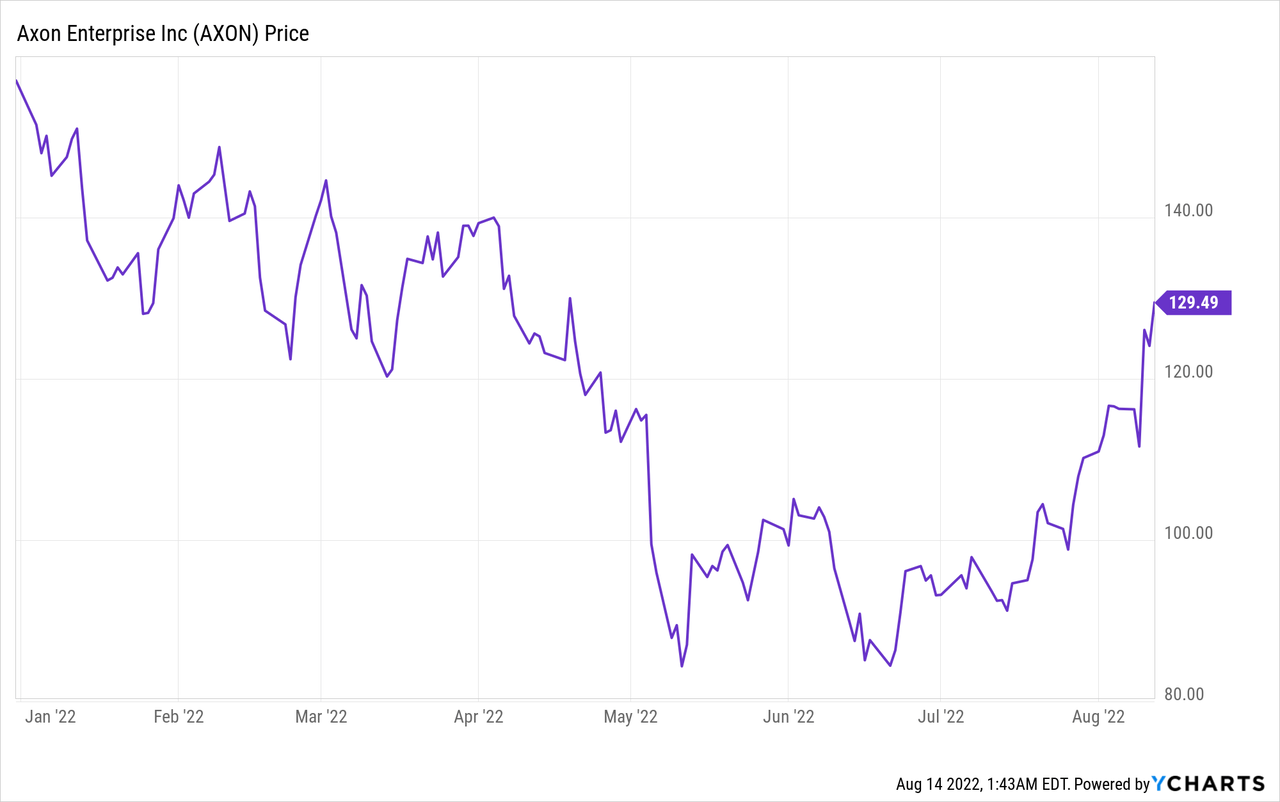

Despite these factors, Axon had been swept up in the broader market sell-off and traded at one of their lowest relative valuations since 2017. As such, I recommended that investors consider purchasing shares. It seems I picked the short-term bottom in Axon’s share price, which has rallied hard since that article was published, up 48% vs. 16% for the S&P 500. Much of this rally came following their Q2 results, which beat analyst expectations on both the top and bottom lines.

In this article, I discuss my key takeaways from Axon’s impressive Q2 results.

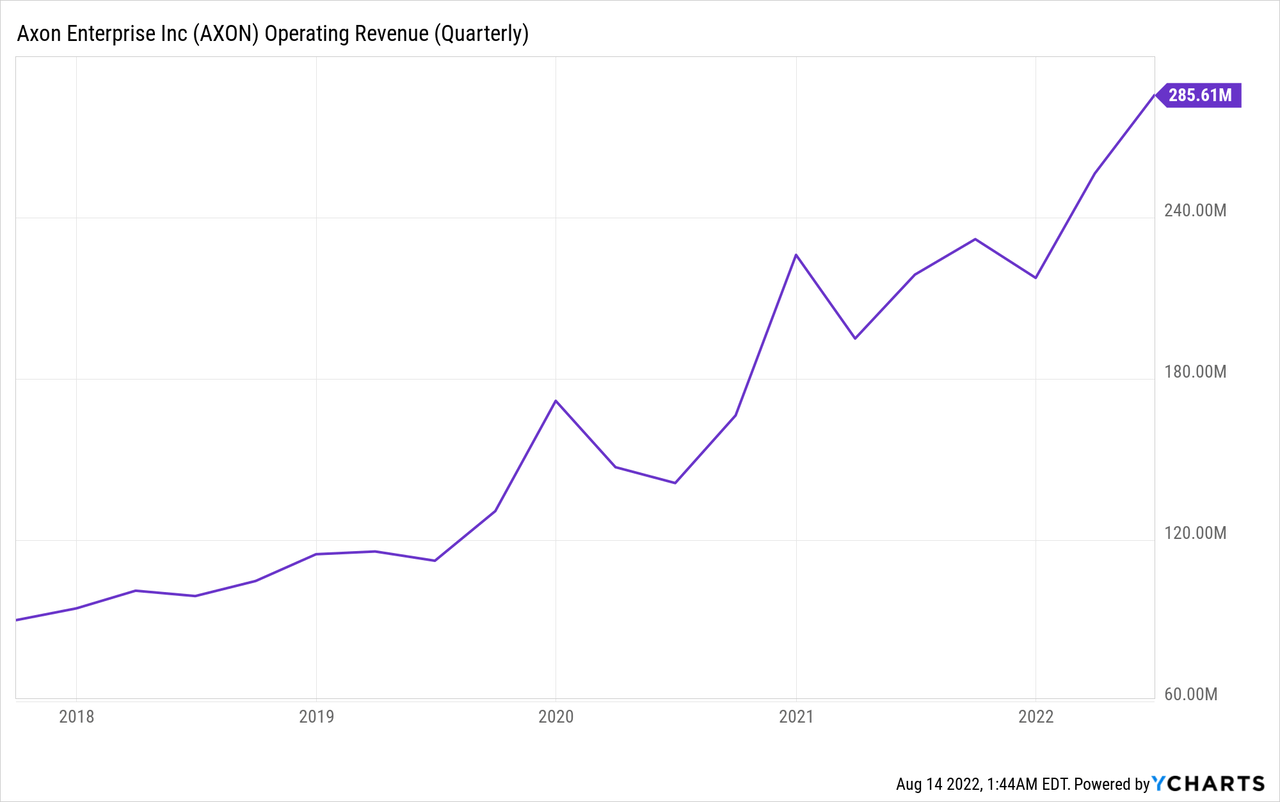

Continued 30%+ revenue growth

Axon’s Q2 revenue numbers smashed it out of the park. In spite of a global macroeconomic slowdown, Axon reported $286m in Q2 revenue (+12% QoQ; +31% YoY), following on from the 32% YoY growth reported in Q1 2022.

Breaking down each product segment, we see the following trends:

| Segment | QoQ Growth (%) | YoY Growth (%) | % of Total Revenue |

| TASER | 19% | 21% | 47% |

| Sensors & Other | 5% | 49% | 24% |

| Axon Cloud | 6% | 35% | 29% |

QoQ growth in TASER revenue of 19% was very strong as Axon continues to fulfil their backlog of TASER orders, which were substantially disrupted by supply chain difficulties in the past few quarters.

YoY growth in their sensors and other segment was also very strong at 49%, driven by a 150% YoY increase in the number of installed Axon Fleet units.

Axon Cloud YoY revenue growth of 35% was a notable deceleration from the 47% growth reported in the prior quarter and was below their 5-year CAGR of 44% from 2017-2021. However, given Axon’s increasing scale and penetration within their core market of law enforcement agencies, it makes sense to see a slowdown in Axon Cloud revenue growth to a more reasonable 30-40% CAGR. Pleasingly, revenue from Axon’s newest SaaS products (e.g., VR training, Axon Air) grew more than 200% YoY.

We are seeing broad-based strength across our product lines. And we are really energized by the growing number of agencies that are buying nearly everything we offer and signing up for 10-year contracts, and sometimes even 12 years (CEO Rick Smith, Q2 Earnings Call).

These impressive Q2 results gave Axon management the confidence to once again upgrade their FY22 revenue guidance from $1.05-1.10b (25% growth at the midpoint) to $1.07-1.12b (27% growth at the midpoint). When Axon released their Q4 2021 results, FY22 revenue guidance was only $1.04b, representing 20% YoY growth.

Axon is a business which continues to execute on their core strategic priorities and, when combined with a management team that understands the ‘beat-and-raise’ game of Wall Street, continues to surprise to the upside.

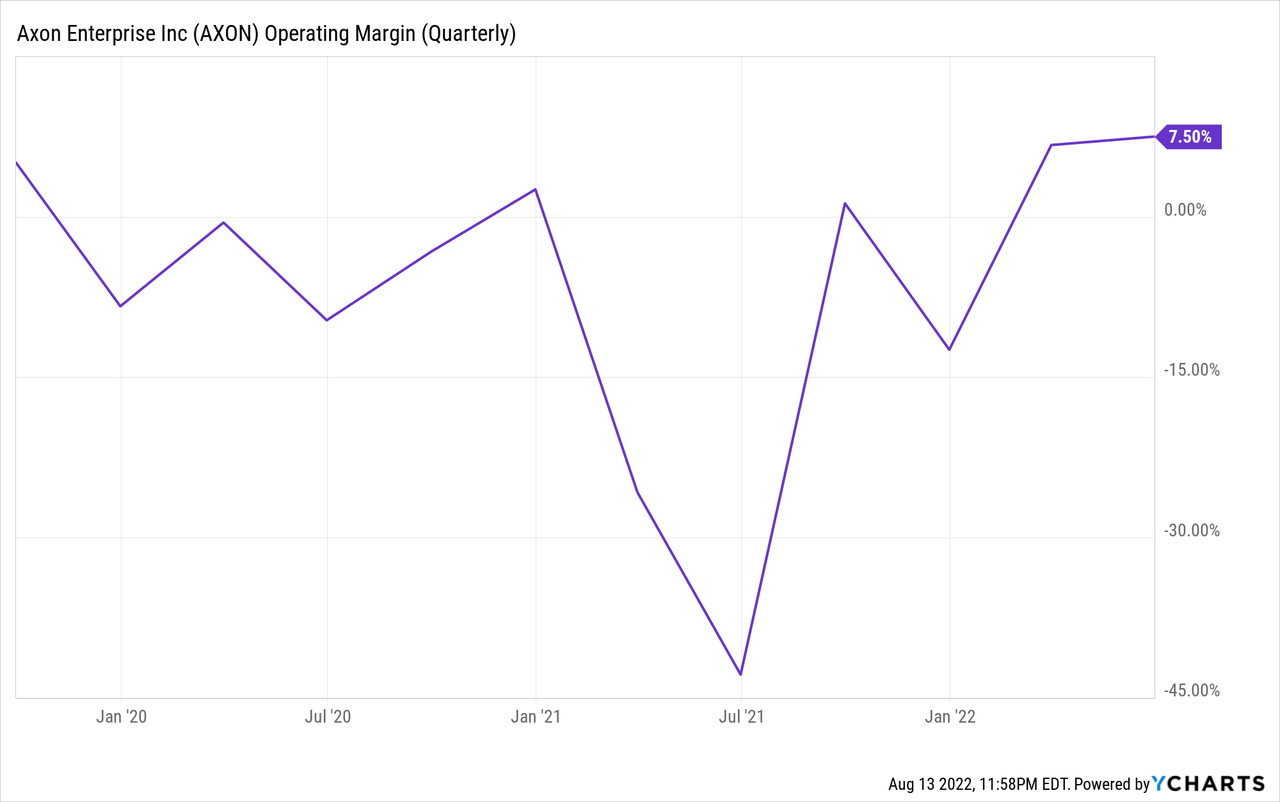

Record operating margins

In Q2, Axon reported $21m in operating profit, representing a 7% operating margin. While not high in absolute terms compared to tech behemoths dominating the market indices, such as Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), this 7% operating margin was the highest reported by Axon since 2018 and occurred despite $3m in non-recurring bonuses paid to staff and $1m of annual costs related to their ‘Axon Accelerate’ conference.

In Q2, Axon also reported $50m of adjusted EBITDA (17% margin) and $51m of net income (18% margin), which was boosted by $60m in net unrealised gains in strategic investments made off their balance sheet. Despite Axon’s adjusted EBITDA margin falling notably both QoQ (from 19.1%) and YoY (from 23.4%), Axon expects their 2022 adjusted EBITDA to be at the higher end of their guidance of $190-200m (17-19% margins), due to some cost-cutting measures outlined below.

Enforcing a stricter focus on profitability

Although Axon is still seeing strong demand for their products, there was a clear realisation on the earnings call that the macroeconomic environment had changed from 2021 to 2022 and that companies are now being judged on their profit margins and cash burn, rather than revenue growth rates. In response, Axon will be enforcing a greater focus on profitability and cash flow margins throughout the back half of 2022, which is pleasing to see:

Our commitment to generating strong cash flow and operational discipline is shared among the entire leadership team. You’ll see in our shareholder letter that we have revised our expected capital expenditures this year to reflect slower pacing on our net campus investments. We are adjusting our pacing to reflect a world that is still in flux as we determine the best and highest use for the campus, optimizing for the new world of hybrid work, as well as the best and highest uses for our capital. (CEO Rick Smith, Q2 Earnings Call)

In the earnings call, CEO Rick Smith also talked about the need to cut down on wasteful spending occurring on business travel and merchandise:

Also, we recently launched an internal campaign, called “spend it like it’s yours” – to clamp down on some low-hanging fruit, such as travel expenses and swag. In fact, we created a new position appointing a swag czar who must approve all purchases. Being scrappy is not new to Axon – we’re just taking it to another level of rigor. (Q2 Earnings Call)

Moreover, based on comments from Axon’s CFO and COO, investors should expect to see notable expansion in both adjusted EBITDA and free cash flow margins over the coming quarters:

With that context on the quarter, we are already focusing on moderating expense growth going forward to help drive Adjusted EBITDA margin expansion. (CFO Jim Zito, Q2 Earnings Call)

And finally, the entire management team is looking forward to turning on the free cash flow spigot over the next several quarters, which opens up a lot of options for us as a company. This is totally within our control, and we are implementing a plan to optimize the level of execution in this area. We can do a lot better here. (COO Joshua Isner, Q2 Earnings Call)

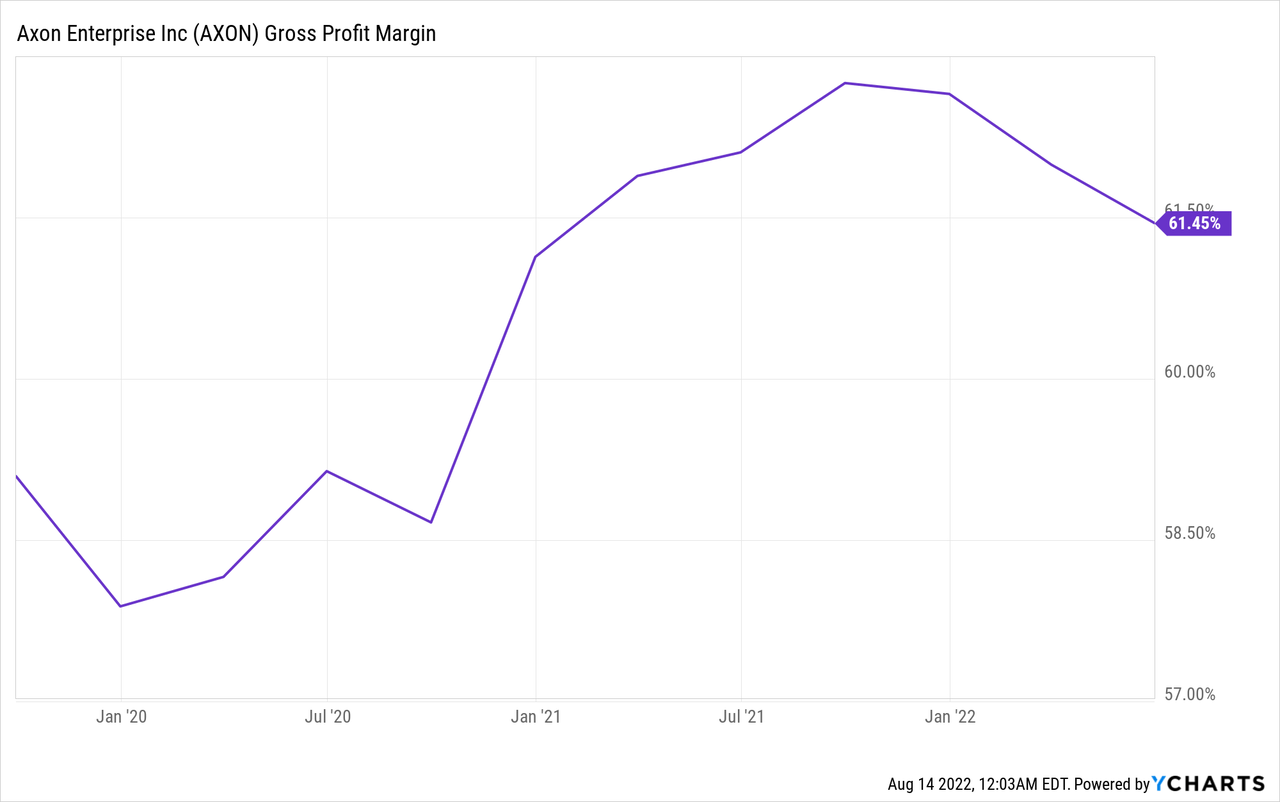

Temporary decline in gross margins is not a cause for concern

Axon’s Q2 gross margins were 60.9%, up from 60.7% in the prior quarter but down from 63.0% in Q2 2021. On the surface, this might seem like a cause for concern, but trailing 12 months (TTM) gross margins, which smooth out the lumpiness from one quarter to the next, demonstrate Axon’s consistent expansion in consolidated gross margins since 2020, albeit with a slight drop over the past few quarters.

So, what accounts for this recent drop in gross margins? Two main factors.

First, TASER gross margins declined 210 basis points YoY from 66.4% to 64.3% due to continued supply chain disruption (e.g., elevated raw material and freight costs).

Second, Axon Cloud gross margins decreased 410 basis points YoY from 74.5% to 70.4% due to expected professional services costs needed to install their Axon Fleet product. As mentioned earlier, installations of Axon Fleet increased 150% YoY. Axon’s pure software gross margin (excludes professional services costs) remained above 80% in Q2.

I’m not concerned about this short-term drop in gross margins. The enormous increase in Axon Fleet installations YoY was a one-off and should return to more normalised patterns in the coming quarters. Moreover, Axon has been investing significant amounts to build out their manufacturing and fulfilment capabilities, and they expect these investments to result in significant gross margin improvement for their TASER product in the back half of FY22 and FY23.

Indeed, COO Joshua Isner came out with some bullish guidance in the earnings call stating that he expects the TASER business to be a major driver of profitability in the back half of 2022:

And I’d say the big driver of profitability is the TASER business. And we expect exciting results there, but really across the board, we do see a lot of up-side in the back half of the year. (Q2 Earnings Call)

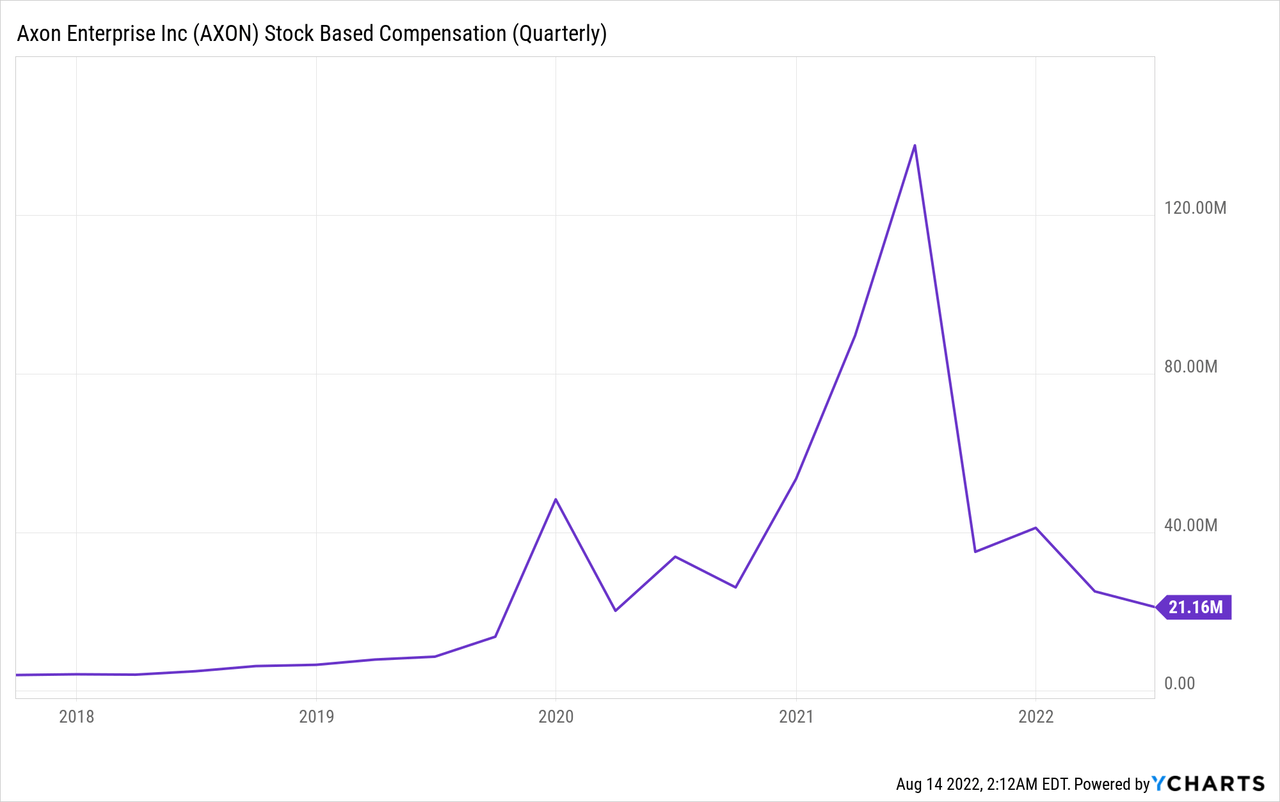

Continued reduction in stock-based compensation (SBC)

Axon reported $21m of SBC in Q2, representing 7% of their revenue. This continued reduction in SBC from 10% of revenue (Q1 2022) and 19% of revenue (Q4 2021) was pleasing to see as I noted in my previous article that high levels of SBC was one of my sole concerns about Axon.

Most of this historical SBC is attributable to CEO Rick Smith’s unique compensation package where he receives no annual salary but is rewarded with Axon shares for meeting pre-determined revenue, adjusted EBITDA, and market cap targets. To date, Axon has paid out 94% of this CEO performance award since the scheme was introduced in 2018, so I would expect to see SBC remain under 10% of revenue for the next few quarters.

Making moves to maintain their fortress balance sheet

In Q2, Axon generated $7m of free cash flow (2% margin), which means they have generated positive free cash flow in six of their last seven quarters. While their Q2 free cash flow margin was a significant decrease from the 10% reported in Q1, this number often bounces around from quarter-to-quarter due to changes in accounts receivable, inventory, deferred revenue, and unrealised gains or losses in marketable securities and strategic investments.

Axon’s net cash position decreased from $424m in Q1 to $356m in Q2, primarily due to $108m of investments to build out their new campus. However, to preserve cash, CEO Rick Smith noted that Axon will be slowing down their pace of CapEx investments to build out the campus going forward:

So earlier this year we had projected an accelerating spend on the new campus. Now we’re basically telling you we’re going to slow that down. We’re pacing it out a bit. There have been a number of things, I’d say one of them is just the inflationary environment, what we’ve seen as we were getting ready to really move forward with more of the significant buildout on the campus, construction costs are just up pretty dramatically. And when we couple that with seeing COVID resurging, I think even more than people had expected, and we looked at the whole return to work dynamic, we’ve come to accept that the future is going to be hybrid work … And then in this environment as well, like there’s a lot going on and we just wanted to preserve some optionality of our cash. (Q2 Earnings Call)

This seems a sensible move to me. Having a strong cash balance affords Axon significant optionality in the current climate to make strategic tuck-in acquisitions and reduces their dependence on capital markets if a severe macroeconomic slowdown were to ensue. With so many people able to work remotely via videoconferencing solutions like Zoom Video Communications (ZM), it makes sense to slow down investments in their campus until there is more clarity on the macroeconomic picture.

Growing support from (some of) the US federal government

Axon is a business where the risk of major disruption from changes in government legislation is low because greater transparency of police behaviour is a net positive for society and something which has good political ‘optics’. How can you argue against Axon’s mission to “protect life”?

Consistent with this idea, the US government issued an executive order in May 2022 mandating body cameras for federal law enforcement agents. They also proposed body camera funding for the Justice Department in their FY23 budget. Based on my assessment, this executive order is not overly material for Axon because: (1) Axon has a dominant position in the US market and likely already supplies most federal law enforcement agents and (2) this executive order only applies to federal agents, not state or local agents. Nonetheless, this move shows the growing tailwinds and support from the US federal government.

On the other hand, Axon is also currently in the midst of a legal dispute with the Federal Trade Commission (FTC) regarding their acquisition of a major competitor (Vievu) in 2018. Axon wrote the following about this legal dispute in their shareholder letter:

Parallel to these matters Axon is evaluating strategic alternatives to litigation, which Axon might pursue if determined to be in the best interests of shareholders and customers. This could include a divestiture of the Vievu entity and/or related assets. While Axon continues to believe the acquisition was lawful and a benefit to Vievu’s customers, the cost, risk and distraction of protracted litigation merit consideration of settlement if achievable on terms agreeable to the FTC and Axon. (Axon Q2 Shareholder Letter)

The above paragraph suggests that Axon is actively considering a settlement or divesture of Vievu’s assets to end their legal dispute, which I imagine is draining a non-trivial amount of resources from their core business operations. I wouldn’t expect this settlement fee or divesture to be highly material to Axon’s business, but it is worth keeping an eye out for in the coming quarters.

An update on valuation

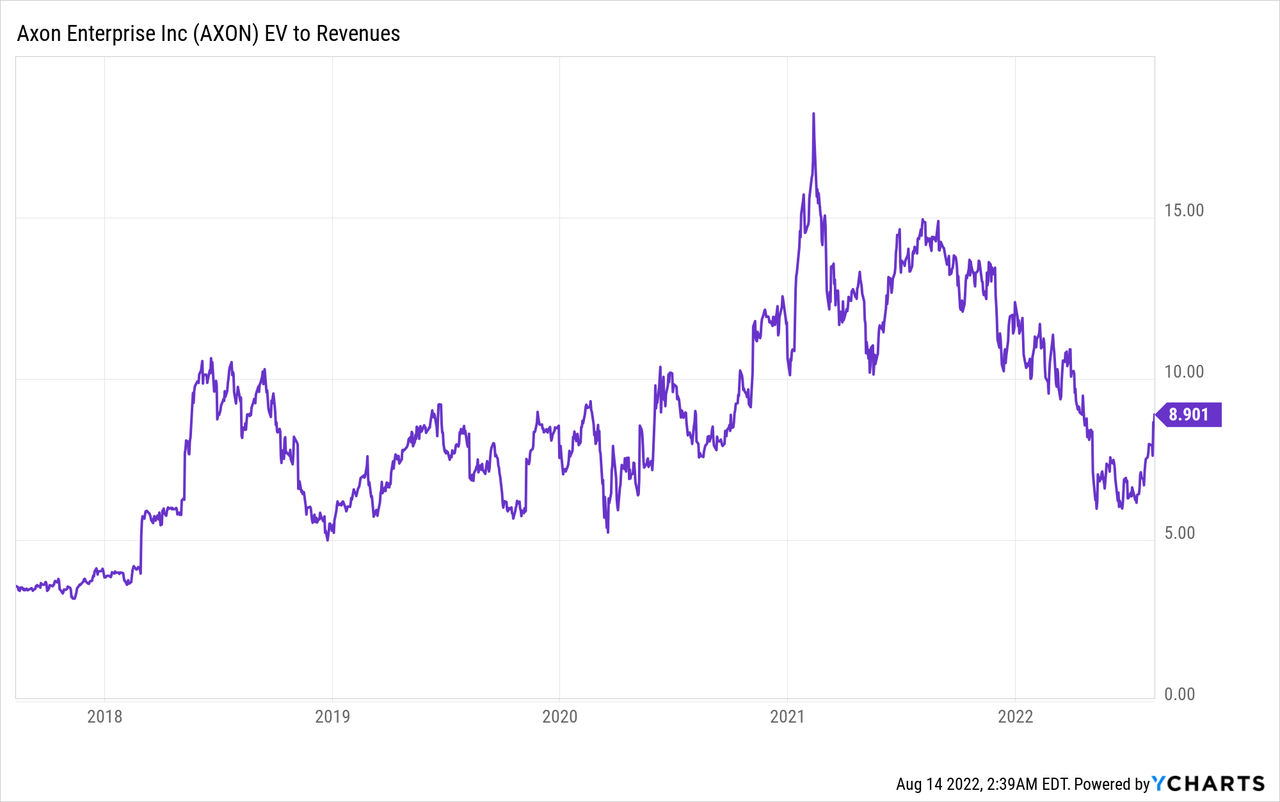

According to YCharts, Axon trades on an EV/TTM (trailing 12 months) revenue multiple of 8.9x. If we assume Axon is able to grow their revenues 25% over the next 12 months, shares are currently valued at around 7.1x forward revenue, roughly in line with the broader market multiples for public SaaS stocks.

While Axon’s valuation is not cheap in an absolute sense, it is broadly in line with their 5-year average EV/TTM revenue valuation range. As Axon pulls back on CapEx spending over the next few quarters to preserve cash and begin to optimise for profitability, it makes sense to also consider more traditional valuation measures, such as a P/E ratio, EV/EBITDA, or free cash flow yield.

Conclusion

These Q2 results represented much of the same for Axon. Strong 30%+ revenue growth, upgraded FY22 revenue guidance, rising operating margins, and reduced SBC. With each passing quarter, Axon continues to strengthen their dominant market position and execute against their strategic priorities. It will be interesting to follow how Axon’s margin profile changes in Q3 and Q4 as their supply chain issues are resolved and they begin to pull back on CapEx to optimise for profitability and free cash flow.

While shares have rallied hard in the past month, they still remain down 15% YTD in spite of two ‘beat-and-raise quarters’. It surprises me how little coverage Axon receives in the investor community given their track record of rewarding shareholders, but I’m doing my part to raise awareness of this great company one article at a time.

Be the first to comment