tirc83/iStock via Getty Images

Axon Enterprise (NASDAQ:AXON) is an American business founded in 1993 which develops hardware and software products for military, law enforcement, and civilians. Their core mission is to “protect life” and “make the bullet obsolete”. Axon is perhaps best known for their TASER handheld device which delivers a non-lethal electric shock designed to immobilise an offender. Indeed, Axon was formerly named ‘Taser International’ but changed their name in April 2017 to reflect their expanded business lines and reduced revenue concentration from TASER sales.

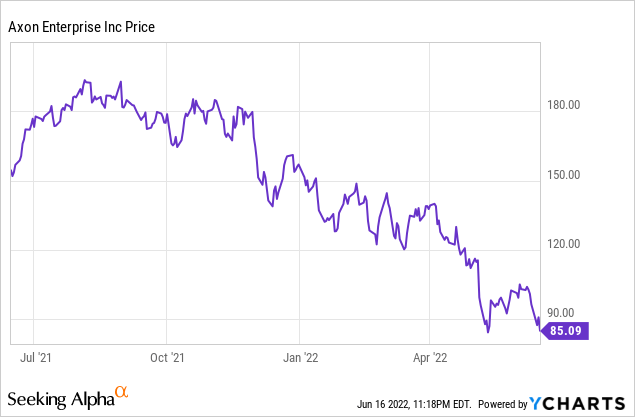

I’ve owned Axon since December 2018 and have added to the position several times (including in 2022), earning a respectable 23% internal rate of return (IRR) on the overall position, making it one of my largest holdings. While I was impressed by Axon during my initial research in 2018, my conviction on the company has grown substantially as they’ve continued to bolster their dominant competitive position, grow revenues at a 25%+ compound annual growth rate (CAGR), improve margins, and expand their product offering. With shares down 44% so far in 2022 despite a ‘beat-and-raise’ Q1 on both the top and bottom lines, I think now is an opportune time for investors to take a look at Axon.

In this article, I’ve assessed Axon using Hamilton Helmer’s ‘7 Powers’ framework, while also discussing their financial results and current valuation.

Axon’s Powers

In his seminal book ‘7 Powers: The Foundations of Business Strategy’, renowned business strategist and investor Hamilton Helmer argues that all businesses have seven forms of power at their disposal. A business lacking at least one of these sources of power is vulnerable to displacement from competitive threats and is unlikely to generate high returns for investors.

In his book, Helmer defines power as the “set of conditions which create the potential for persistent and differentiated returns”. The two key words in this sentence are “persistent” and “differentiated”. As investors, we want to generate market-beating returns (i.e., differentiated returns) by purchasing shares in a handful of companies that can compound their revenues and profits (and thus share price) for an extended period of time (i.e., persistent returns).

It is all well and good to find a business that has a dominant competitive position at a single point in time, but it’s unlikely that business will generate strong future returns unless they have a sustainable competitive advantage – otherwise known as a ‘moat’ – that protects them from the natural laws of capitalism (i.e., creative destruction). Consider investing in Yahoo at the height of their dominance in the search market or Blackberry (BB) during the early days of the smartphone revolution.

I believe Axon has several powers which will help them continue to thwart off competitive threats and generate market-beating returns for the next decade. I’ve outlined each applicable form of power below.

Power 1: Switching Costs (Large)

In my opinion, switching costs represent Axon’s strongest form of power. Switching costs refer to the costs (financial or otherwise) that arise when attempting to change between substitute products or service providers. A business with high switching costs is able to lock (note: metaphorically) customers into their ecosystem, enabling them to charge higher prices, whilst also benefiting from increased customer retention.

Apple (AAPL) is the classic example of high switching costs. Once a customer has purchased their first Apple product (e.g., an iPhone), they often go ahead and purchase other Apple products and accessories (e.g., Mac, iPad, AirPods) as the user interface is similar, all data syncs seamlessly on the iCloud network, and it reduces decision fatigue. Once a customer is ‘locked in’ to the Apple ecosystem, it’s very rare for them to leave.

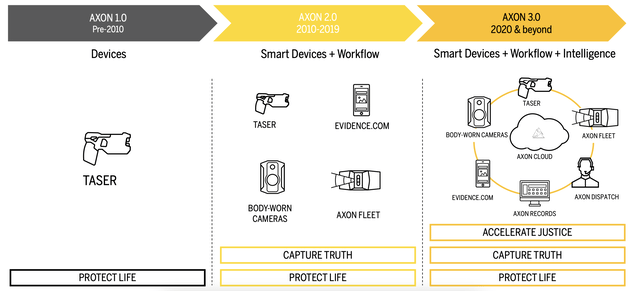

Over the past decade, Axon has focused relentlessly on expanding their suite of products and software solutions outside of their core TASER product. Indeed, research and development (R&D) costs as a percentage of revenue have expanded from 7% in FY13 to 22% in FY21 and are expected to exceed 20% for the foreseeable future. Axon now offers the following suite of products (non-exhaustive):

- TASERs – For both consumers and law enforcement agents.

- Evidence.com – Cloud management data storage platform for body-worn camera recordings, CCTV footage, photographs, audio, written documents, etc.

- Body-worn cameras – Enables high-resolution recordings of incidents (e.g., police shootings).

- Axon Fleet – Enables license plate recognition to detect speeding and/or unregistered vehicles.

- Axon Records – Reporting software which streamlines the administrative process for law enforcement personnel.

- Axon Dispatch – Computer-aided dispatch (CAD) software to help agencies more efficiently respond to emergencies.

Axon Product Offering (Axon May 2022 Investor Presentation)

Other notable products launched in the past 24 months which are not included in the above diagram include:

- VR training – To help law enforcement agencies train staff to appropriately respond to high-pressure situations.

- Attorney Premier – Digital evidence management system designed to streamline the legal process for prosecutors and public defenders.

All of these products and services are becoming increasingly ‘mission-critical’ for the military and particularly police agencies due to increased public scrutiny on police violence and shootings. Having a suite of products allows Axon to offer bundling discounts for customers who purchase multiple products, helping to build switching costs as customers become locked into Axon’s ecosystem.

This multi-product strategy also dramatically improves unit economics as Axon already has an established base of customers to whom new products can be cross-sold, reducing customer acquisition cost (CAC) compared to having to acquire a brand new customer. Moreover, as customers bundle multiple products together, it increases their customer lifetime value (LTV), providing a powerful effect on the LTV/CAC ratio.

We can see this increasing LTV materialize in Axon’s net revenue expansion rate which has been 119% for the past five quarters. This means that Axon’s existing customers are spending 19% more on Axon products with each successive 12-month period, resulting from both price rises and increased cross-selling of multiple products.

In addition to supporting customers to purchase multiple products, Axon also builds switching costs in two other ways:

- As more data is uploaded onto Evidence.com and it becomes a more central part of a law enforcement agency’s workflow, the switching costs involved with moving all that data to a completing platform become overly burdensome.

- As military and police officers become increasingly familiar with Axon’s products and evidence/reporting software, the default option for managers becomes sticking with Axon as it avoids the need to re-train staff to use different products/software and reduces the onboarding time for new hires who are familiar with Axon’s products/software from a previous job.

Power 2: Branding (Moderate)

Brand is another form of power, albeit a more subjective one than switching costs. Think of renowned brands like Apple, Ferrari (RACE), Starbucks (SBUX), and Disney (DIS) – what do they all have in common? Customers have learned through decades and decades of experience with these companies to expect a certain level of service, quality, and reliability. As a result, they all charge a premium price relative to competitors, affording them higher margins.

Thus, brand is a powerful force that allows a business to gain pricing power. But, a branding moat isn’t easy to achieve; far from it. It takes time (often decades) and consistent positive customer experiences.

I believe Axon has significant branding power, which will enable them to continue to flex their pricing power over the next decade. In particular, two factors contribute most to their brand:

- Affective valence – This occurs when people feel a strong connection to a brand. Axon has been careful to cultivate their image as a mission-driven company striving to make the world a safer place, particularly for minority groups who have unfortunately too often been the victim of police brutality. Indeed, Axon’s CEO Rick Smith recently published a book titled, “The End of Killing: How Our Newest Technologies Can Solve Humanity’s Oldest Problem”, helping to raise public awareness of Axon’s mission.

- Uncertainty reduction – This occurs when a customer gains piece of mind through purchasing from a specific brand. Axon has been in business since 1993 and their brand is synonymous with TASERs, boasting a strong leadership position in the US market. Whenever the media publishes a recording of a police or military incident, there’s a very high chance you’ll see Axon’s logo in the top right-hand corner. Axon boasts 4+/5 reviews on almost all review websites on Google and has built a strong reputation for their reliable products. The default option as a military or law enforcement agency has become Axon, with secondary consideration of non-specialised competitors, such as Motorola Solutions (MSI).

Power 3: Cornered Resource (Small)

According to Helmer, a business has a cornered resource when they have preferential access at attractive terms to a coveted asset that can create business value. An example of a cornered resource might be: (1) a patent (e.g., a pharmaceutical company), (2) significant intellectual property (e.g., Disney’s character library), (3) a monopoly on a specific product or geographical location (e.g., railways or being the sole airline between two cities), or (4) a group of talented individuals.

I believe Axon’s cornered resource is their Co-Founder and CEO, Rick Smith, who has led the business since its founding in 1993. According to TIKR, he owns 3.1% of Axon, equating to a $188 million stake in the business. He has a unique incentive structure where he receives no salary but receives stock-based compensation (SBC) entirely based on shareholder-friendly outcomes, such as Axon’s market cap, revenue, and adjusted EBITDA targets. In short, Rick gets paid when shareholders do well. It’s that simple.

On a podcast appearance in 2021, Rick disclosed that Axon has been his only job as an adult and that he is committed to devoting his whole life to Axon. This is what I like to see. A mission-driven founder with skin in the game and a long-term mindset. Rick has become the face of Axon and a well-regarded proponent of improving public safety.

Helmer argues that specific leadership (i.e., one person rather than a team) is a weak form of cornered resource and, as such, I have categorized this as Axon’s weakest form of power. Nonetheless, I believe that Axon is a materially weaker company without Rick Smith at the helm and any change from his current role as CEO would force me to take a step back and reconsider my investment.

Axon’s Financials And Valuation

It would be remiss if I didn’t include a broader discussion of Axon’s financial performance and valuation in this article.

Consistent Revenue Growth

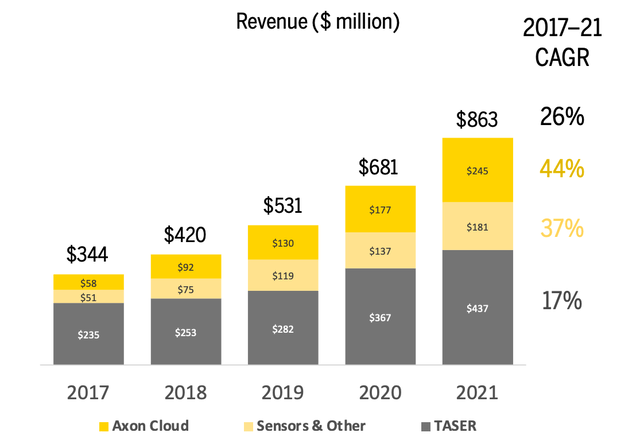

Axon has grown revenues at a 26% CAGR from 2017-2021, reporting $863 million in FY21 revenue. Overall revenue growth has been led by growth in Axon’s high-margin subscription revenue (Axon Cloud; 44% CAGR) and sensors and other revenue (37% CAGR). Management has guided for their long-term revenue growth rate to remain above 20%.

Axon Revenue Chart (Axon May 2022 Investor Presentation)

Given Axon’s demonstrated track record of product innovation, expansion into new international markets, and their recent entrance into new horizontal markets (e.g., consumer and the legal system), I expect Axon to continue to grow revenues at a mid-20% CAGR for the foreseeable future.

Increasing Recurring SaaS Revenue

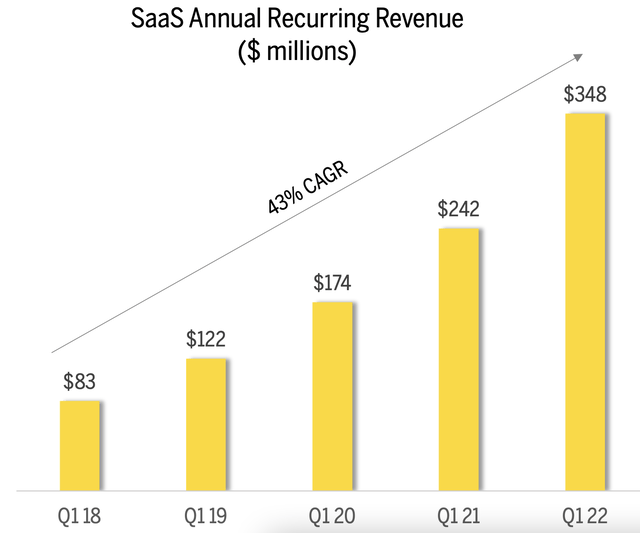

While Axon has increased revenues at a 26% CAGR since 2017, SaaS annual recurring revenue (ARR) has grown at an even faster 43% CAGR since 2018.

AXON SaaS ARR (May 2022 Investor Presentation)

As such, Axon’s revenue concentration from TASERs has decreased sharply from 63% of revenue (Q1 2018) to 45% of revenue (Q1 2022). Revenue from either capital or subscription sales of TASERs still represents Axon’s largest revenue source, but will likely be overtaken by their Axon Cloud or Sensors & Other segment in the coming years at current growth rates.

| Revenue Source | Revenue (Q1 2018) | % of Revenue | Revenue (Q1 2022) | % of Revenue |

| TASER | $63.5m | 63% | $114.4m | 45% |

| Axon Cloud | $20.2m | 20% | $77.0m | 30% |

| Sensors & Other | $17.5m | 17% | $65.1m | 25% |

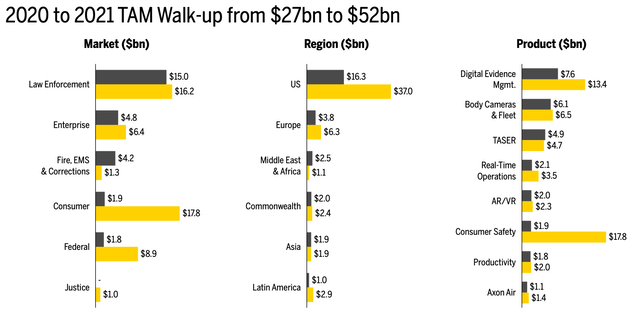

Significant TAM Expansion

One of the earlier criticisms of Axon’s business was that their end market was confined to law enforcement agencies, reducing their TAM. However, over the past few years, Axon has been able to leverage their strong brand to expand into new horizontal markets, notably private security officers (e.g., bouncers or guards at major sporting events), consumers, and the legal system.

While most of Axon’s existing products are applicable to private security officers, Axon is only currently offering a self-defence TASER product for consumers. Management noted in their Q3 results that their current market penetration of TASERs in the consumer segment was “virtually nil”. Axon’s expansion into the legal system comes through their Attorney Premier digital evidence management system, which is designed to streamline the discovery process for both prosecutors and public defenders.

As such, Axon recently expanded their TAM in November 2021 to $52 billion (up from prior estimates of $27 billion), providing a powerful tailwind for continued revenue growth.

Axon TAM (Axon May 2022 Investor Presentation)

Margin Expansion From Axon Cloud And New Products

As mentioned earlier, Axon’s revenue base has become increasingly diversified since 2018 as growth in software and sensor products has outpaced growth in TASER revenue. If we break down Axon’s gross margin profile for each revenue source (note: simple average over the past three quarters), it’s clear that Axon Cloud revenue has a material impact on consolidated gross margins:

- TASER gross margins = 65.0%

- Axon Cloud gross margins = 73.9%

- Sensors & Other gross margins = 40.3%

Thus, as growth in subscription revenue continues to outpace growth in other business divisions, it should result in continued expansion of consolidated gross margins, which sat at 60.7% as of Q1 2022. Several of Axon’s recent product launches (e.g., Attorney Premier) are subscription software products, providing a strong tailwind for continued growth in Axon Cloud revenue.

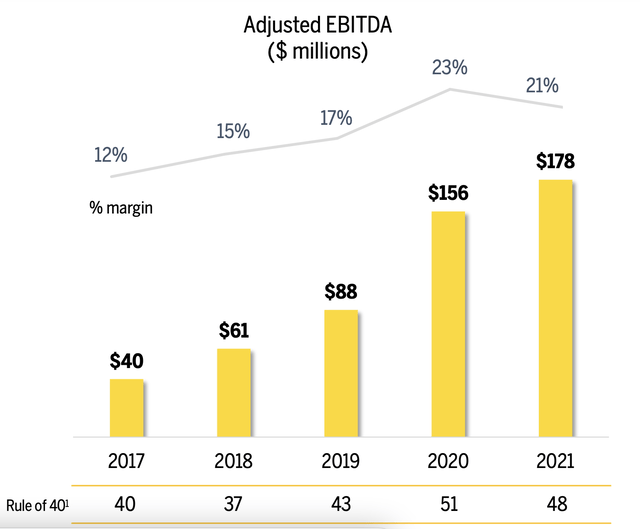

As Axon Cloud has become a larger part of Axon’s revenue base, we’ve also seen adjusted EBITDA margins (excludes SBC and other one-off expenses) increase from 12% (2017) to 21% (2021). Management have guided in several conference calls towards a long-term adjusted EBITDA margin of 30%, making them a ‘Rule of 50’ company if they are able to simultaneously maintain a revenue growth rate above 20%.

Axon Adjusted EBITDA (Axon May 2022 Investor Presentation)

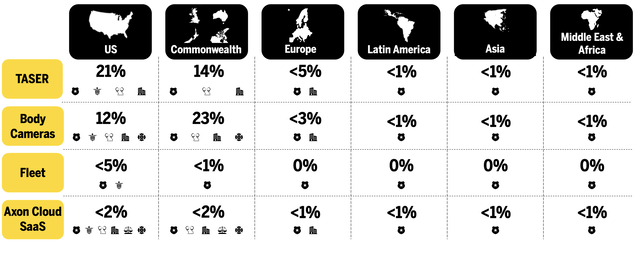

Significant Remaining Global Penetration

While Axon has a dominant market position for TASERs and body cameras in the US and Commonwealth (e.g., Australia, UK, Canada), Axon Cloud has less than 2% penetration in these markets, providing a significant runway for future growth.

Axon also has minimal penetration with their TASER, Axon Cloud, or other hardware revenue in Europe, Latin America, Asia, and the Middle East and Africa. On aggregate, these geographical regions have higher crime rates than the US and Commonwealth, so it could be argued there is an even greater need for Axon’s product in such areas.

Although Axon has been in business since 1993 and intuition would suggest that revenue growth should slow over the coming decade due to the law of large numbers, it’s worth remembering how much untapped potential there is with Axon Cloud in developed markets and across all products in developing markets.

Axon Product Penetration Across Geographies (Axon May 2022 Investor Presentation)

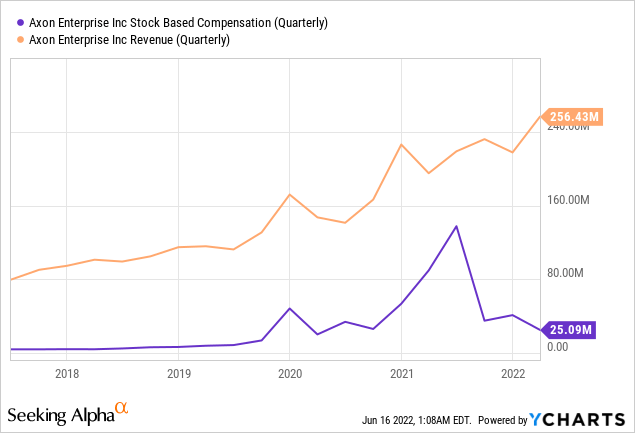

Reducing Stock-Based Compensation

Another major criticism of Axon has been their high SBC, which has expanded from 3% of revenue (2012) to 35% of revenue (2021). The lion’s share of this SBC is attributable to Rick Smith’s compensation package which rewarded him with significant amounts of SBC throughout 2021 for meeting pre-determined revenue and adjusted EBITDA targets, along with growing Axon’s market cap. Over the past few quarters, SBC as a percentage of revenue has reduced to 10% as the portion of outstanding SBC has decreased. Axon’s 2022 guidance calls for at least $104 million of SBC, which represents around 9% of 2022 revenue guidance. This remains high in absolute terms, but is coming down relative to 2020 and 2021.

Fortress Balance Sheet With Positive Free Cash Flow

Of heightened importance for companies in the current volatile market is having a strong balance sheet and being free cash flow positive. Axon passes both tests.

At the end of Q1 2022, Axon had $424 million in cash, cash equivalents, and investments with no debt. This represents around 7% of their current market cap (as of 16th June 2022).

Axon has also been free cash flow positive for five of the past six quarters and should therefore not be dependent on the capital markets to survive through this downturn. While free cash flow margins have bounced around due to investments to build out their supply chain infrastructure and in R&D, I expect free cash flow margins to become more stable in the mid-teen percentage range over the coming 18-24 months.

| Quarter | Free Cash Flow | % of Revenue |

| Q1 2022 | $26.8 million | 10% |

| Q4 2021 | $(0.7) million | 0% |

| Q3 2021 | $4.0 million | 2% |

| Q2 2021 | $20.6 million | 9% |

| Q1 2021 | $50.4 million | 26% |

| Q4 2020 | $27.6 million | 12% |

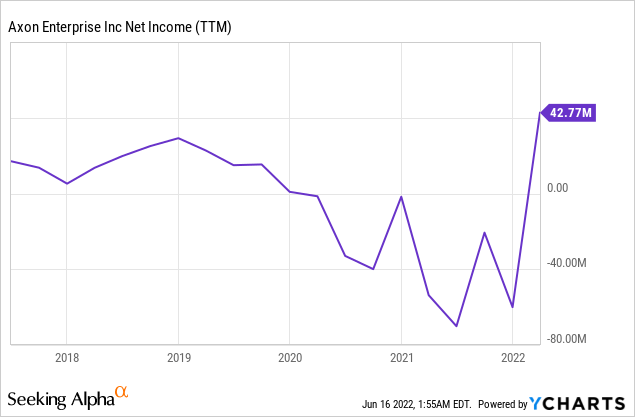

Profitability: The Missing Piece Of The Puzzle

While Axon has largely been free cash flow positive over the past 18 months, this has not translated into consistent profitability on a GAAP basis. The main drivers of Axon’s losses have been their high SBC (discussed earlier) and strategic R&D investments to build out their product pipeline. Rather than sitting back and milking profits from their core business, Axon has consistently invested between 15-25% of their revenue back into R&D since 2017, helping to cement their market leadership. One of the core areas of investment over the next 12 months will be their VR training:

We’ll be investing some of our expected revenue outperformance this year into new initiatives that will start driving revenue in 2023. One area where we’re adding investment this year is international VR training. There’s a broad global market for VR training, and it’s our fastest-growing new category in the U.S.” (Rick Smith, Q1 2022 Conference Call).

Axon did report positive operating and net income in Q1 2022, but we’ll need to wait another few quarters to see if this becomes a trend or was a one-off resulting from reduced SBC.

While the lack of GAAP profitability remains a concern, all other financial metrics point to strong unit economics, gross and net revenue retention, and consistent free cash flow. Moreover, Axon has a clear path to profitability and has several levers to dial back if we are indeed entering a prolonged market downturn or recession. My assumptions for their path to profitability are as follows:

- Continued 20%+ revenue growth rate. I am confident that Axon can sustain this growth rate even in a recession as their products are ‘mission critical’ for law enforcement agencies, who still need to function as normal in a recession.

- Increased growth in Axon Cloud should result in continued expansion of consolidated gross margins toward the 65-70% range (as per management’s long-term targets).

- Pull back slightly on R&D costs to reach 10-15% of revenue.

- Pull back on sales and marketing costs to focus on cross-selling to existing customers.

- SBC should reduce in a market downturn as Rick’s Smith compensation targets based on market cap will be more difficult to meet.

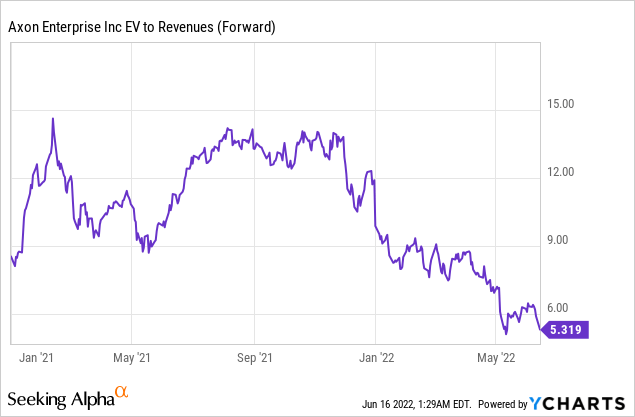

An Attractive Valuation

Like all other unprofitable tech companies, Axon has seen its valuation multiple contract sharply in the past 12 months. With the recent sell-off, Axon trades at a forward EV/sales multiple of 5.3x and has continued to slide in recent months, despite upgrading both their 2022 revenue and adjusted EBITDA guidance in their latest Q1 results.

Using the midpoint of their 2022 adjusted EBITDA guidance of $190-200 million, Axon currently trades at around 29x 2022 adjusted EBITDA. This is down from a high of more than 100x in February 2021. While not cheap on an absolute basis, Axon has not begun to optimise for profitability and is still continuing to invest significantly in R&D; thus, I prefer to use EV/sales multiples as a more appropriate valuation metric.

Conclusion

Axon Enterprise has a dominant leadership position in developed markets and benefits from three primary sources of power: high switching costs, a brand moat, and a cornered resource in CEO Rick Smith. Axon has a demonstrated track-record of growing revenues in the mid-20% range, expanding gross and adjusted EBITDA margins, while also producing consistent free cash flow in recent quarters. Given their $52 billion TAM, constantly evolving product pipeline, and significant untapped potential with Axon Cloud in both developed and developing countries, I believe Axon has the potential to continue to compound revenues at 20%+ over the coming decade, while also reaching profitability.

It’s not fun to be recommending stocks in the midst of one of the worst market downturns of the 21st century, but this is often the time where fortunes are made. In Q1 2022, Axon upgraded both their annual revenue and adjusted EBITDA guidance and is continuing to cement their leadership position with each passing quarter. It’s impossible to predict short-term market movements, but I believe now represents a compelling valuation for long-term investors. I’m certainly putting my money where my mouth is and have been aggressively adding to my position in Axon so far throughout 2022.

Be the first to comment