ipopba/iStock via Getty Images

We like investments that have a low correlation to the overall market direction. That stems from our view that the market returns will be exceptionally poor over the next decade. Despite that view, we have chosen to dodge the bond bubble as well and refused to accept the insane “return-free-risk” yields as compensation. With yields now rising steadily, opportunities have started becoming more plentiful. We look at one great company today that works for both our above investing criteria.

AXIS Capital Holdings Limited (NYSE:AXS)

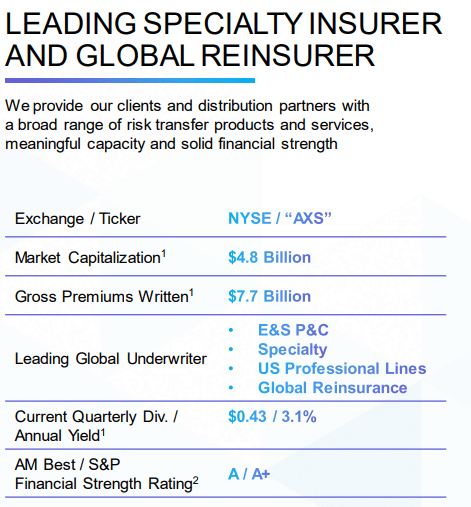

AXIS is a leading global specialty insurer and reinsurance provider that has been around for more than 18 years. The company has taken an increasing focus on reinsurance as it has developed more size and muscle over the years.

AXIS Q4-2021 Presentation

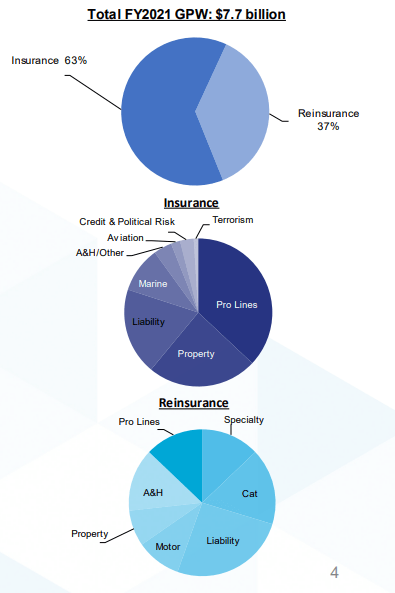

At present, reinsurance makes up 37% of gross premiums written. Both insurance and reinsurance lines are well diversified by product type and even geographically, thanks to the company’s global reach.

AXIS Q4-2021 Presentation

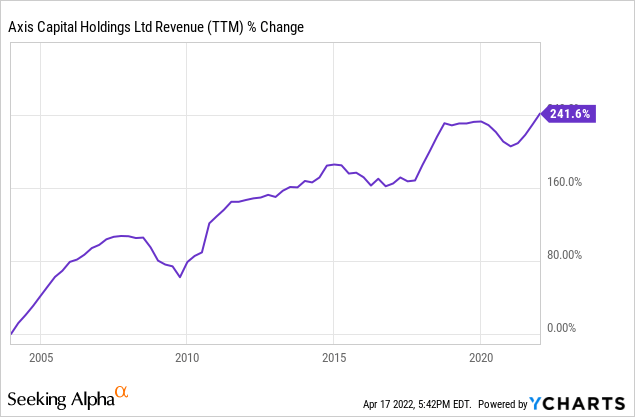

The company retains a fair bit of its profits and that has allowed it to steadily grow revenues over time.

Recent Results

2020 was incredibly challenging for most insurance companies as all kinds of unusual business interruption policies were paid out. 2020 was not light on catastrophes either and the reinsurance side was not able to help. 2021 did much better. AXIS reported net income available of $6.90 per diluted common share with the bulk ($5.12) coming from operating results. Improvements were seen in all lines of business and AXIS delivered 12.2% return on common equity. These results allowed repair of the small balance sheet hit after 2020.

Outlook & Valuation

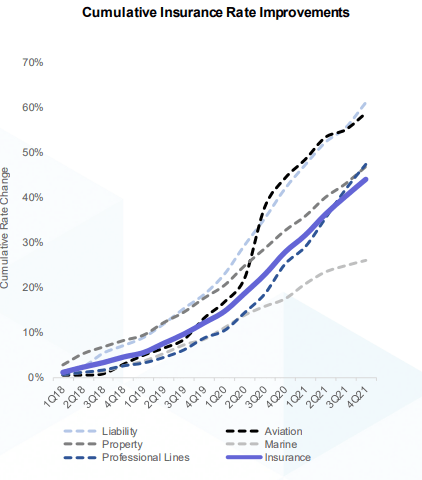

We are still early in the insurance and reinsurance premium cycle. Too much capital had entered this space after 2010 and most of it has been obliterated writing bad policies at bad prices. We have seen a turnaround and proper pricing momentum since 2018. That is beginning to heal the loss ratios we saw previously.

AXIS Q4-2021 Presentation

In addition to the chart above, you can see comments from the company after their Q4-2021 results.

Average rate increases of ~14%; 7th consecutive quarter of double-digit rate increases

Rate increases seen in almost every line of business.

AXIS is growing a number of these lines such as Excess Casualty, Renewable Energy, A&H and Marine

Cyber rate increases remain in the high-double digits with further firming expected

Source: AXIS Q4-2021 Presentation

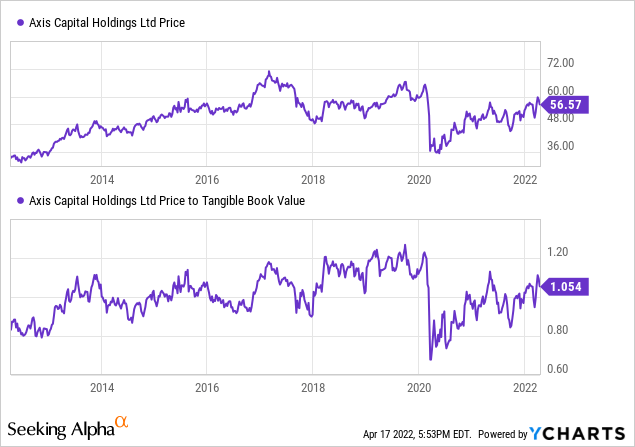

While the business of course remains unpredictable in any single quarter or even a year, we are entering the sweet spot for AXIS where it should be able to deliver 15% returns on tangible equity.

Its valuation remains good for that and AXIS is currently priced just a shade above tangible book value.

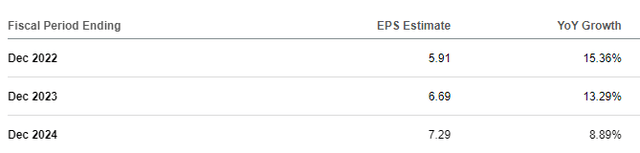

While perhaps not an exciting valuation, it offers a good entry point considering the premium cycle. We also think that AXIS will likely exceed these estimates as analysts often tend to underestimate these turns.

AXS Earnings Estimates (Seeking Alpha)

One area of concern might be the strong inflationary trends we have seen. Some smaller players like Universal Insurance Holdings Inc. (UVE) have certainly taken a decent sized hit from this problem as replacement costs trend higher than expected (but within policy limits). Our take is that for the big players with such pricing trends, this is not an issue. Rising interest rates are also boosting non-operating income on the portfolio and this should act as an offset. We have generally only tried to pick up AXIS at a deep discount to book value. Last time we sold a cash secured put that would have got us the entry at 0.8X tangible book value. We remain on the lookout for opportunities on this and other insurance names.

Preferred Shares

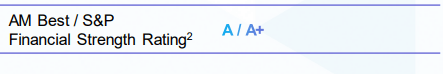

AXIS like most other insurance companies, runs low leverage and that earns it high marks from the rating agencies.

AXIS Q4-2021 Presentation

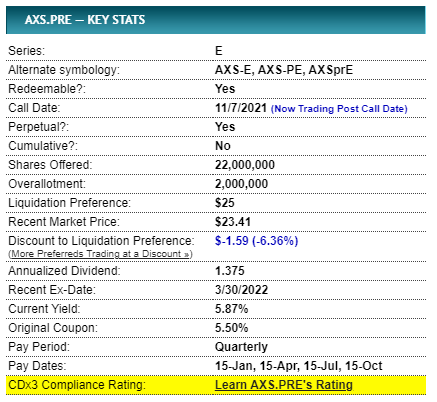

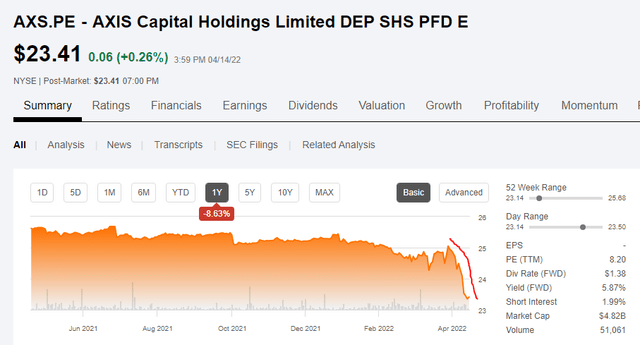

AXIS Capital Holdings Limited DEP SHS PFD E (NYSE:AXS.PE) are an interesting play off that strong credit rating. We have not even bothered to mention these in the past as their yield was too low and they most traded at a premium to par value. The recent selloff has changed that.

Moody’s rates these shares at Baa3.

The current yield is now 5.87% and these are worth keeping on your watchlist in case Treasury yields blow out further. These are past their call date so if interest rates collapse again, these will likely be called.

preferredstockchannel-axs.pre/

Of course, if you are buying at a 6.36% discount to par, you have nothing to fear about an early call. On a relative valuation front, RenaissanceRe Holdings Ltd. 4.20% DEP PFD G (RNR.PG), the preferred shares of RenaissanceRe Holdings Ltd. (RNR), yield 5.3% and they are rated one-notch higher by MCO. The current pricing for AXS.PE appears fair on a relative basis. Compared to Treasury bonds, we think a 300-basis point spread is a good buy point and with the 10-year yield at 2.80%, this again looks fairly priced. Having dodged the hurricane in bonds, preferred shares and closed end funds, we are now selectively adding fixed income (currently at 4% of total) as opportunities arise. We have this on our watch list as well and if we get a widening of spreads (which the Fed wants) vs. the 10-year Treasury Bonds, we might add to our fixed income portfolio.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment