kynny

Investment Thesis

Axcelis Technologies (NASDAQ:ACLS) is a manufacturer of ion implantation and other processing tools. The company has opened a new manufacturing and engineering facility in Korea to target customers in Korea and expand its footprints all over Asia. This operational facility can also increase efficiency in the coming quarters.

About Axcelis Technologies

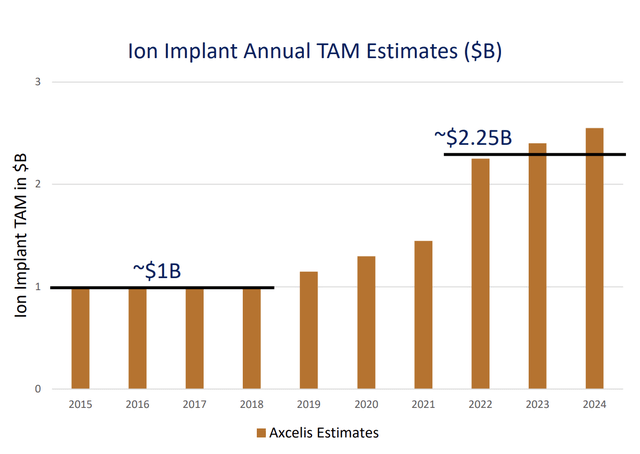

The business develops and produces ion implants and other processing equipment used in the USA, Europe, and Asia to create semiconductor chips. The corporation provides high energy, high current, and medium current implanters for a wide range of application needs. The ion implantation segment accounted for 97.4% of the company’s revenue, and the rest, 2.6%, came from aftermarket sales connected to other legacy processing equipment. The ion implant market is continuously growing, and the overall industry is experiencing robust demand in all segments. The ion implant’s total addressable market (TAM) has more than doubled in the last three years.

Ion implant’s total addressable market (ACLS’ Investor Presentation)

The rise in TAM was driven by the rise in wafer starts across all market segments, accelerated growth of implant capital-intensive mature nodes and specialty devices, and Purion product extensions needed for specialty market products. The mature market segment comprises more than 60% of the implant TAM. The mature process technology segment of the ACLS experienced robust growth in 2021 and has generated 82% of its revenues. The company expects the mature process technology segment to maintain the same levels as 2021. The memory segment generated 17%, while the advanced logic segment comprised 1% of the revenue. Currently, the company is focusing the growth by targeting new customers and opportunities in the power device market, geographic expansion, new implant applications, and expanding the Purion product portfolio for existing customers. To increase efficiency, target the expansion all over Asia and meet the rising demand, the company has recently ramped up a new manufacturing facility in Korea.

New Operation Centre in Korea

The company has recently announced a major increase in production capacity and employee level with Korea’s new manufacturing and engineering facility. A fully working cleanroom was included in this operations center, which is over 44,000 square feet in size and was built using the same lean and quality concepts that guide the company’s US manufacturing facility. The new facility has also received certification from the ISO 45001 Occupational Health and Safety Management System. The company plans to target the Korean market and expand to other Asian markets. The company is also trying to increase production and supply chain efficiency with this new facility. I think this new facility can pave the path for expansion all over Asia. Therefore, I believe this new facility might act as a primary growth factor for the company in the coming years. I also think the opening of the new facility indicates the company is experiencing a rising demand which can positively impact the revenue, and the anticipated increase in efficiency can increase the profitability in coming quarterly results.

What is the main risk faced by ACLS?

Majority of sales to China

ACLS has a high dependency on China as a majority of its revenue is earned from component sales to Chinese companies operating in China. Approximately 84% of the total revenue earned by ACLS was from Asian countries, the majority of it being from China. The reason why it is a risk for the company is the recent developments between Vietnam and China and the uncertainty that looms around the outcome of these developments. US and China had trade tensions even before the current military exercises by the Chinese near Vietnam, and after this, we could witness trade sanctions being imposed by both the United States and China. This could have a negative impact on ACLS. Although this risk is based on speculation, it cannot be ignored.

Technical Analysis and Fundamental Valuation

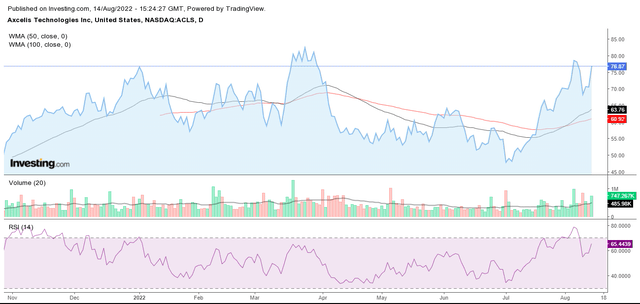

Technical Analysis (Investing.com)

ACLS has very positive technical indicators. The stock price is currently trading above its 50-day, and 100-day weighted moving average (WMA). This reflects that the company has strong momentum on its side. The stock is successfully sustaining above its 50-day and 100-day moving average, which reflects strength in the stock. The company has a strong support zone at $64 price levels which reflects that the stock has limited downside risk from current price levels. The RSI indicator suggests a strong buy from current price levels as the stock is actively testing the 70 RSI band level. Once the stock crosses the 70 RSI band level, we can witness even stronger momentum in the stock. Overall, the technical indicator suggests a buy from current price levels.

The expansion of the Korean manufacturing center and expected Asia pacific operations expansion is expected to drive considerable growth for the company. The company has seen a 76% increase in the share price in the past one year and is currently trading at a price of $76.87. The company is trading at a very attractive valuation both on the P/E and PEG parameters. ACLS is trading a forward P/E multiple of 16.05x against the sectorial median of 19.41x, a 17% discount. I believe for the growth companies like ACLS, the PEG ratio is a more suitable valuation parameter, and ACLS is trading at a PEG multiple of 0.12x compared to the sectorial median of 0.44x, a 73% discount. ACLS is on a solid growth trajectory, and I believe the company can trade at a higher PEG ratio of 0.17x in the near future, giving us a target price of $108, a 41% upside from current price levels.

Conclusion

The expansion of the Korean manufacturing facility is expected to increase the company’s manufacturing capacity and drive significant growth for ACLS. This new facility can help expand all over Asia, reducing the dependency on the Chinese market. It is a growth company with strong momentum in its favor. ACLS is trading at a very attractive valuation, and I believe it is a great investment opportunity for investors. I assign a buy recommendation for ACLS considering all these factors.

Be the first to comment