standret/iStock via Getty Images

Introduction

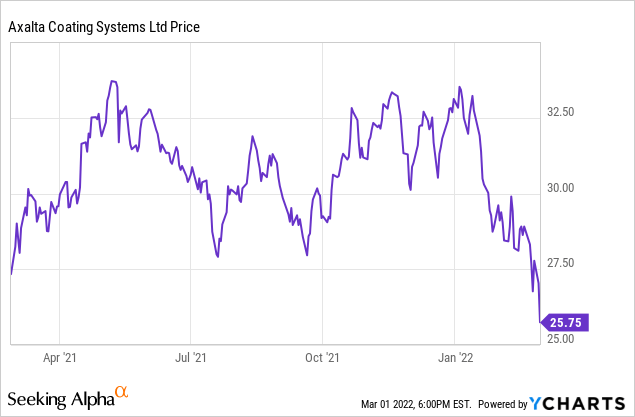

Back in October last year, I wasn’t too happy when Axalta Coating Systems (AXTA) pulled its full year guidance for 2021 as the inflation had a severe negative impact on the operating margins. In September, Axalta announced it expected a revenue decrease in Q3 of approximately $40M while the EBIT would drop by $130-140M. Despite pulling the guidance, Axalta’s share price increased by about 15% before it started to slide down to just under $27, where it’s currently trading at.

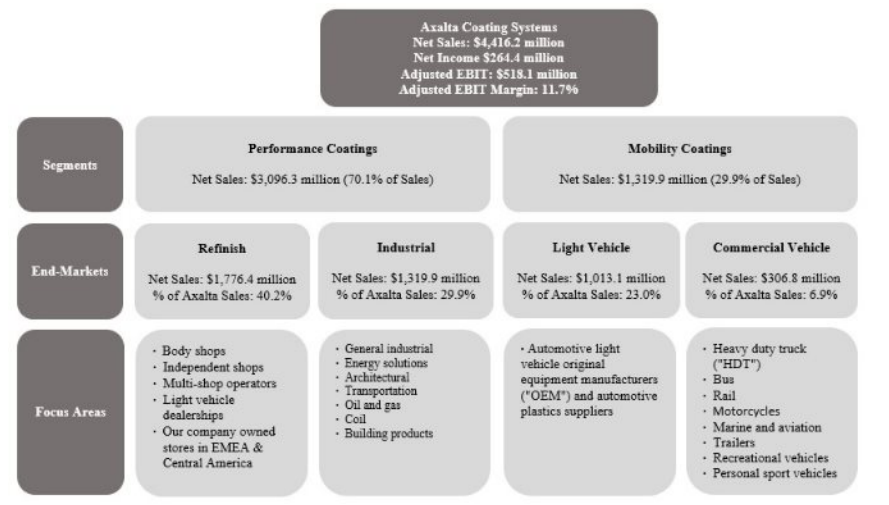

I won’t go into too much detail on Axalta’s business model as that has been discussed in previous articles, but the main takeaway is that Axalta is a leader in the coatings industry with several applications. While the automotive industry represents an important portion of the revenue, let’s not forget industrial coatings also represent close to 30% of the FY 2021 revenue, providing a useful diversification.

Axalta Investor Relations

The writing was on the wall when Axalta pulled its guidance for 2021 in October

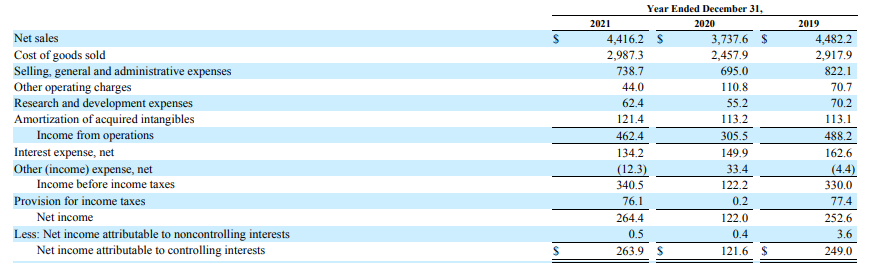

When a company pulls its full-year guidance, you kinda know you shouldn’t expect too much. That being said, I have the impression Axalta has done a good job in keeping the damage relatively limited. In fact, the operating income was just a few percent below the 2019 (pre-COVID) result while the reduction in interest expenses over the past few years actually resulted in a higher pre-tax income.

As you can see below, the revenue of $4.4B resulted in an operating income of $462M and a pre-tax income of $341M. After deducting the taxes, the net income attributable to the shareholders of Axalta was just under $264M or $1.14/share. This means the H2 result was not as bad as feared as Axalta generated an income of $122M in the second half of the year. And that’s higher than the net income in H2 2020.

Axalta Investor Relations

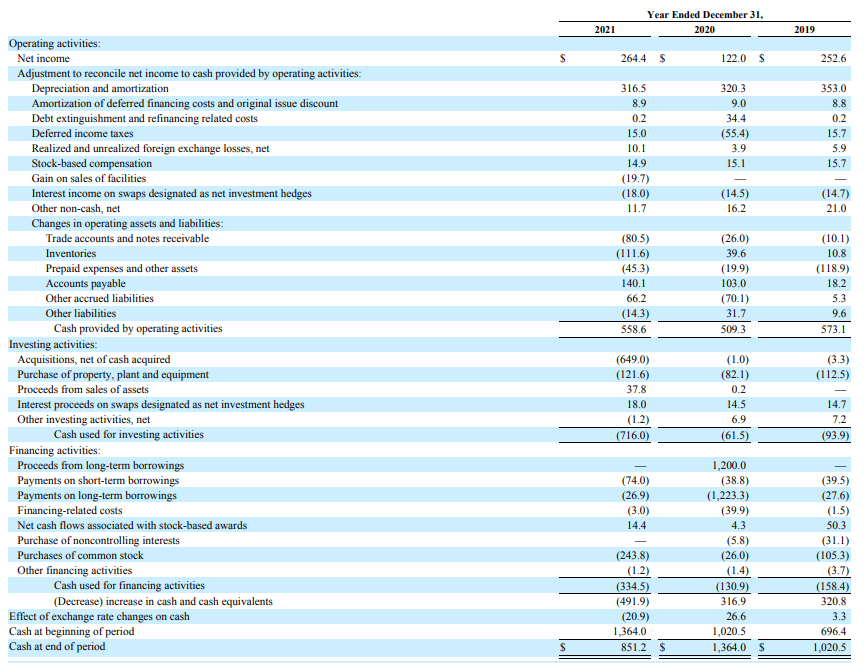

While I wholeheartedly agree it sounds rather expensive to buy a stock at 20 times the earnings, but as I have explained in all my previous articles, the focus for an investor in Axalta should be on the cash flow.

The reported operating cash flow in 2021 was just under $559M and that includes a net investment in the working capital position of approximately $45M. On an adjusted basis, the operating cash flow was $603M (compared to $450M in FY 2020 and $659M in FY 2019). The total capex in 2021 was just under $122M resulting in a free cash flow of approximately $481M.

Axalta Investor Relations

Divided over the current share count of 227 million shares, the free cash flow per share was just over $2.11. That’s indeed almost twice as high compared to the EPS and the easiest explanation is to refer to the difference between depreciation and amortization expenses of in excess of $325M while the total capital expenditures are just under $122M. The difference between both elements explains the large discrepancy between the net income and the free cash flow result.

A large portion of the free cash flow (excluding the $649M spent on acquisitions) was spent on a substantial share buyback program to the tune of almost $244M. This allowed Axalta to repurchase 8.2 million shares, or in excess of 3% of the share count. The net decrease in the amount of shares outstanding was 7.4 million shares as an additional 0.8M shares were issued as part of stock-based compensation.

What are the implications for this year?

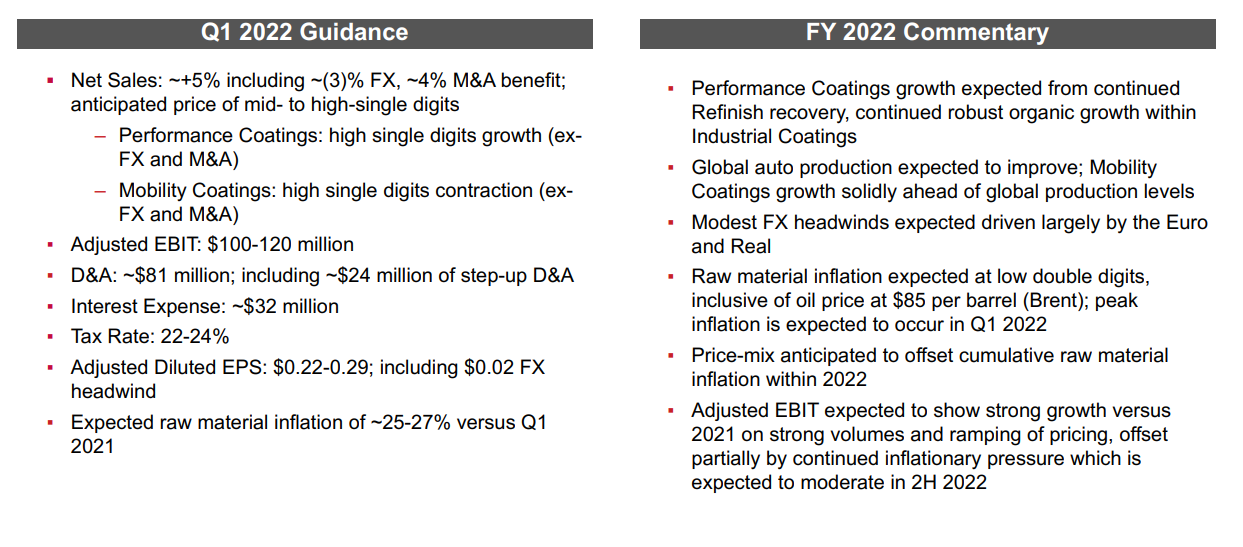

Axalta didn’t provide a detailed full-year guidance for 2022. While that’s disappointing, it likely is the right course of action given the inflationary environment it is currently operating in. During the Q4 conference call, Axalta’s management did confirm it anticipates to offset the anticipated inflation ‘within the year’ but it obviously takes a little bit of time to complete price hikes.

Axalta Investor Relations

The guidance for the first quarter is encouraging though as Axalta is guiding for an adjusted EBIT of $100-120M. We also know the interest expenses ($32M) which means the midpoint of the guidance implies a pre-tax income of around $80M. Applying a 24% tax rate, the net income for Q1 will likely be around $60M.

While that’s not great, keep in mind that the free cash flow tends to be much higher as the capex is much lower than the D&A expenses. For FY 2022, we can assume a quarterly capex of $35-40M which is less than half the anticipated D&A expenses in Q1. That means that while Axalta is implying a net income of $60M, it will likely show a normalized free cash flow of $100M or higher. And that’s why the net debt of just under $3B doesn’t worry me too much. The free cash flow remains strong and should get stronger throughout the year as Axalta is able to pass on an increasing part of the inflation impact to the end users.

Investment thesis

Investors who are solely looking at the EPS will immediately discard Axalta as a valid investment idea. After all, why would anyone pay in excess of 20 times the net income for a coating and paint company? The answer can be found in the cash flow statement. Whereas the income statement is impacted by non-cash expenses, the cash flows remain robust and despite 2022 shaping up to be another tough year, Axalta will still generate a strong free cash flow result. If it doesn’t complete any acquisitions and if it wouldn’t buy back stock, the net debt will fall to just around $2.5B by the end of this year which would make the debt ratio drop below 3.

I remain confident in Axalta’s longer-term outlook and as I’m an investor focusing on free cash flow, I like the current opportunity to go long Axalta again. I haven’t made a decision yet, but I may write some out of the money put options to at least take advantage of the volatility (and high option premiums).

Be the first to comment