DuxX/iStock via Getty Images

Introduction

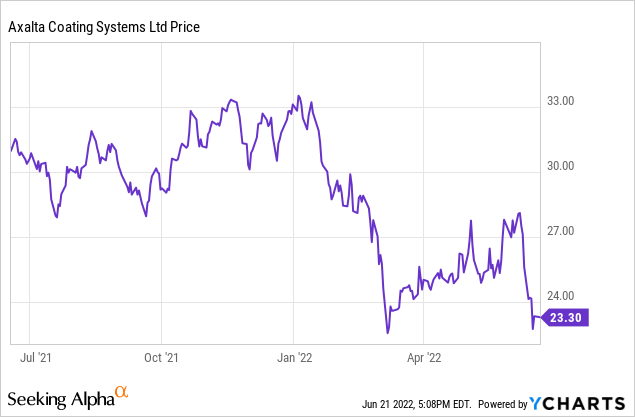

Back in March, I argued Axalta Coating Systems (NYSE:AXTA) was trading at attractive levels as the company’s free cash flow result remained very strong. One caveat was the relatively high net debt load and the increasing interest rates will cause the interest expenses to continue to increase so it will be important for Axalta to apply its incoming cash flows to reduce its gross debt. The Q1 results already showed Axalta is nicely on track for a good year but let’s see how the company performs in the second quarter as the entire economic system is coming under pressure.

The traditional build-up of the working capital makes the balance sheet look worse than it actually is

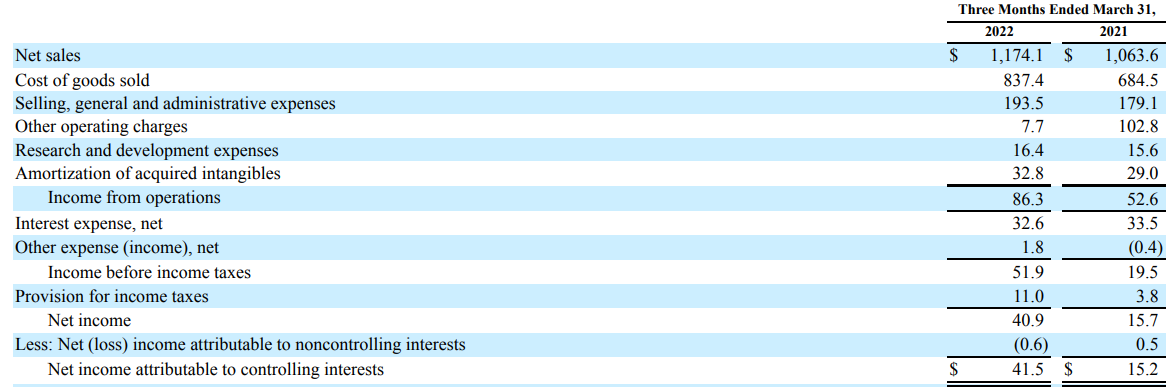

The income statement of Axalta looks pretty decent in the first quarter of the year, but investors should realize there were some non-recurring expenses in Q1 of last year which were a drag on the reported results. In Q1 of this year, the total revenue increased by about 10% to $1.17B. That’s great but as the COGS increased by about 20%, the margins were clearly under pressure.

Fortunately, Axalta was able to keep the increases in other expenses relatively stable: the SG&A expenses increased by just around 8% while the R&D expenses remained stable.

Axalta Investor Relations

This resulted in an operating income of $86.3M, compared to just $52.6M in Q1 of last year. This sounds phenomenal but keep in mind the $102.8M in ‘other operating charges’ weighed on last year’s result. If we would remove that factor, the operating income would have been just over $155M in Q1 2021 and about $94M in Q1 of this year. So excluding non-recurring items, Q1 2022 was clearly worse than in the same period last year. Fortunately, the interest expenses decreased a little bit as well (although this doesn’t make a massive difference and the bottom line shows a net income of $41.5M for an EPS of $0.18/share.

That’s not great, but in my previous articles, I always approached Axalta from a cash flow perspective, mainly because the company’s required capital expenditures are lower than the depreciation and amortization expenses. That remains a very valid approach.

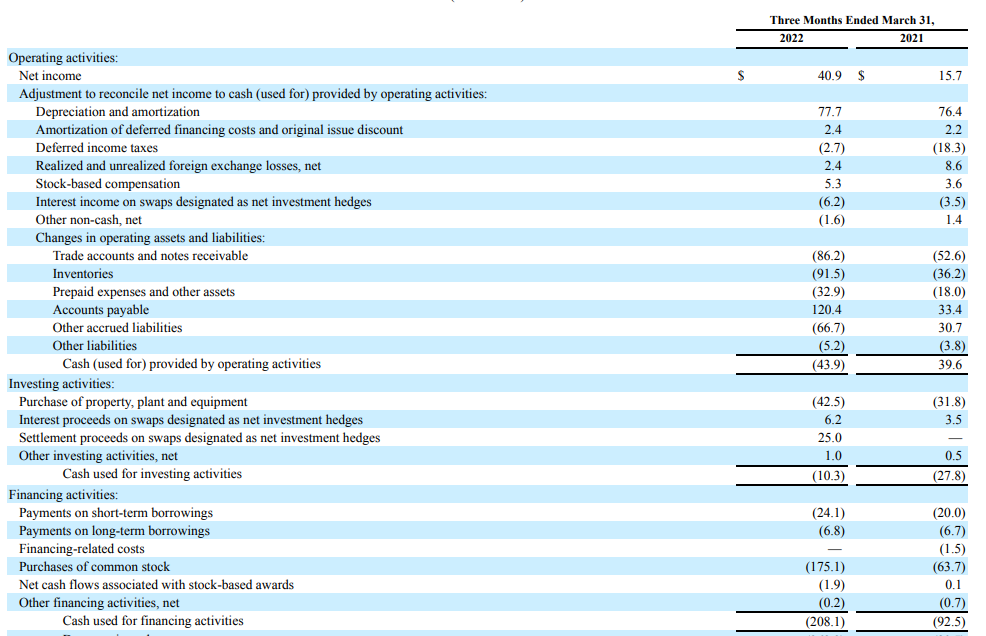

As you can see in the image below, the reported operating cash flow was a negative $43.9M due to the (seasonal) changes in the working capital position. Excluding these WC changes, the adjusted operating cash flow was $118.2M (up from the $86M generated in Q1 last year).

Axalta Investor Relations

The total capex was just $42.5M. That’s higher than in the first quarter of last year but still substantially lower than the $77.7M in depreciation and amortization expenses. The underlying free cash flow, adjusted for changes in the working capital position, was $75.7M.

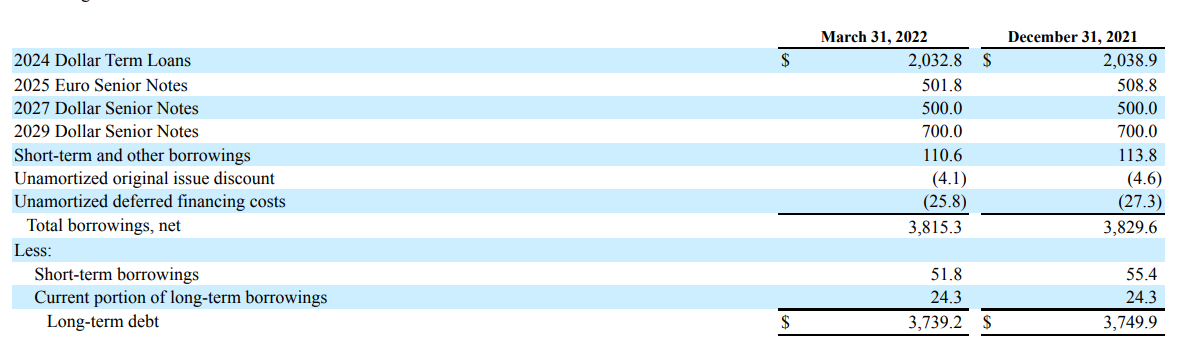

Due to these investments in the working capital position, the net debt remained relatively high at $3.24B, but I still expect Axalta to reduce its net debt to less than $3B by the end of this year.

Axalta Investor Relations

The majority of the long-term debt consists of term loans and Axalta will be on the hook for higher interest expenses. Fortunately, AXTA also has about $1.7B in notes maturing in 2025, 2027, and 2029 with a fixed interest rate. The 2027 notes have an interest rate of 4.75%, while the 2025 euro notes have a 3.75% coupon. Both issues are currently trading way below the par value at respectively 91% and 91.7% of the par value. This means the yield to maturity for the 5-year debt in Dollars is now closer to 7% while the Euro-denominated debt maturing in 2025 has roughly the same YTM. That’s surprising as generally speaking debt in Euro is still cheaper than USD-denominated debt these days but that is likely caused by the lower liquidity levels of the Euro-debt.

One thing is for sure. If things stay like they are now, Axalta will have to pay substantially more to borrow money from the financial markets, so I can only hope the company’s management team will prioritize hoarding cash to reduce the gross debt in an attempt to keep the interest expenses under control. A 300 bp increase in the cost of debt would cost the company about $90M per year in free cash flow. That’s 40 cents per share.

Investment thesis

I always looked at Axalta from a capital gains perspective. Perhaps I should revise that perspective given the current interest rate environment. I think there’s a lot to be said for the 2027 bonds with a yield to maturity of 6.91% right now, and from a risk/reward perspective, it sounds better to be a creditor rather than becoming a shareholder of a company with a negative tangible book value (the value of the goodwill on the asset side is higher than the total equity value). Unfortunately, the minimum size of the 2025 USD bonds is $150,000 in principal value while the Euro-bonds have a minimum of 100,000 EUR in principal amount. So I need to consider whether or not it is wise to lock up that amount of cash for an extended period of time. But for larger investors, the debt is certainly something to have a look at.

Of course, if a buyout by PPG Industries (PPG) materializes, shareholders will be better off than creditors. That’s why I will likely continue to write put options (that are out of the money) to pocket the option premiums. Perhaps a mixed approach works best here by buying both the debt as well as a more speculative position in its equity.

Be the first to comment