JHVEPhoto

The AllianceBernstein Global High Income Fund (NYSE:AWF) is a closed-end-fund that provides high current income from a global fixed income portfolio. While AWF’s monthly distribution of $0.0655/share is attractive, there is a concern it is unsustainable, as the distribution yield is greater than the fund’s average annual returns. However, in terms of a global fixed income fund, I believe the AWF fund is superior to the Aberdeen Income Credit Strategies Fund (ACP) offered by abrdn, as it has higher historical returns on all timeframes and lower volatility.

Fund Overview

The AllianceBernstein Global High Income Fund is a closed-end fund (“CEF”) that seeks to provide high current income by investing in a portfolio of global fixed income securities. The fund has over $900 million in assets as of November 30, 2022.

Strategy

The AWF fund invests in a global portfolio of high-income securities by leveraging AllianceBernstein’s global research platform.

Bernstein is widely recognized as one of the best independent sell-side research firms on Wall Street, consistently ranking at or near the top of institutional research surveys (Figure 1).

Figure 1 – Bernstein is consistently top-ranked in institutional surveys (bernsteinresearch.com)

The fund manager takes a global multi-sector approach to managing the AWF fund, balancing risks and returns across multiple sectors and geographies. The portfolio’s risk level is adjusted constantly: during favorable market conditions, the portfolio will seek extra income; however, in times of caution, the portfolio will reduce portfolio risks.

Portfolio Holdings

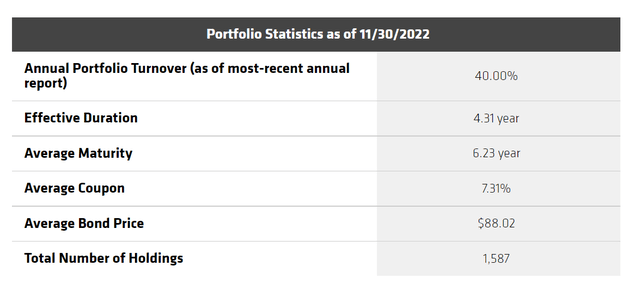

Figure 2 shows the portfolio’s characteristics as of November 30, 2022. The AWF fund has almost 1,600 holdings with effective duration of 4.3 years.

Figure 2 – AWF fund characteristics (alliancebernstein.com)

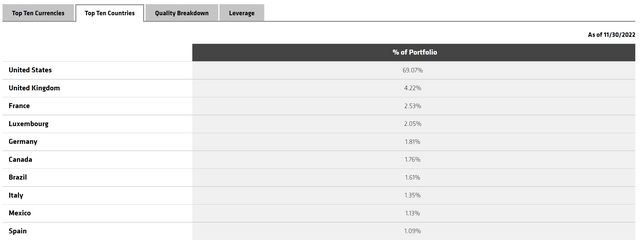

While the fund is marketed as a global fixed income fund, it is still predominantly invested domestically, with the U.S. accounting for 69.1% of the fund’s assets. Other top geographies are the UK at 4.2%, France at 2.5%, and Luxembourg at 2.1% (Figure 3).

Figure 3 – AWF geographical allocation (alliancebernstein.com)

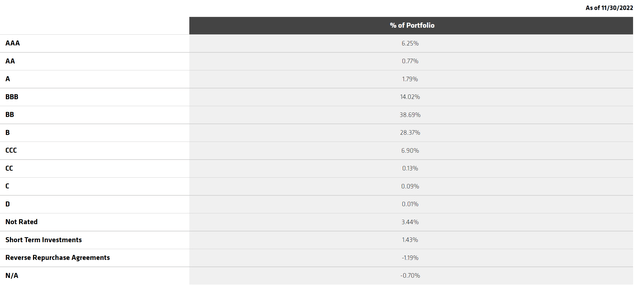

Figure 4 shows the AWF fund’s credit quality allocation. 22.8% of the fund is investment grade (BBB or better) while 38.7% of the fund is rated BB and 28.4% of the fund is rated B.

Figure 4 – AWF credit quality allocation (alliancebernstein.com)

Returns

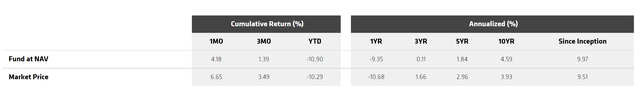

The AWF has generated modest historical returns, with 3/5/10Yr average annual total returns of 0.1%/1.8%/4.6% respectively, to November 30, 2022 (Figure 5).

Figure 5 – AWF historical returns (alliancebernstein.com)

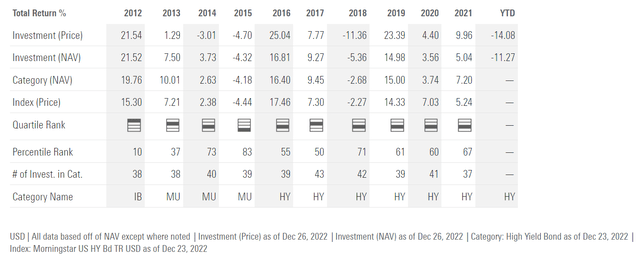

On an annual basis, we can see the AWF fund has generated positive NAV returns in 8 of the past 11 years (including YTD 2022). The negative return years were mostly macro driven: 2015 was the global growth slowdown, 2018 was President Trump’s trade war, and 2022 was inflation and interest rate increases (Figure 6).

Figure 6 – AWF annual returns (morningstar.com)

Distribution & Yield

The AWF fund pays a monthly $0.0655/share distribution, which annualizes to a current yield of 8.4%. On NAV, the monthly distribution annualizes to 7.5%. The AWF fund also announced a special distribution of $0.1632/share to shareholders as of December 15, 2022, payable on January 20, 2023.

AWF Is A Return Of Principal Fund

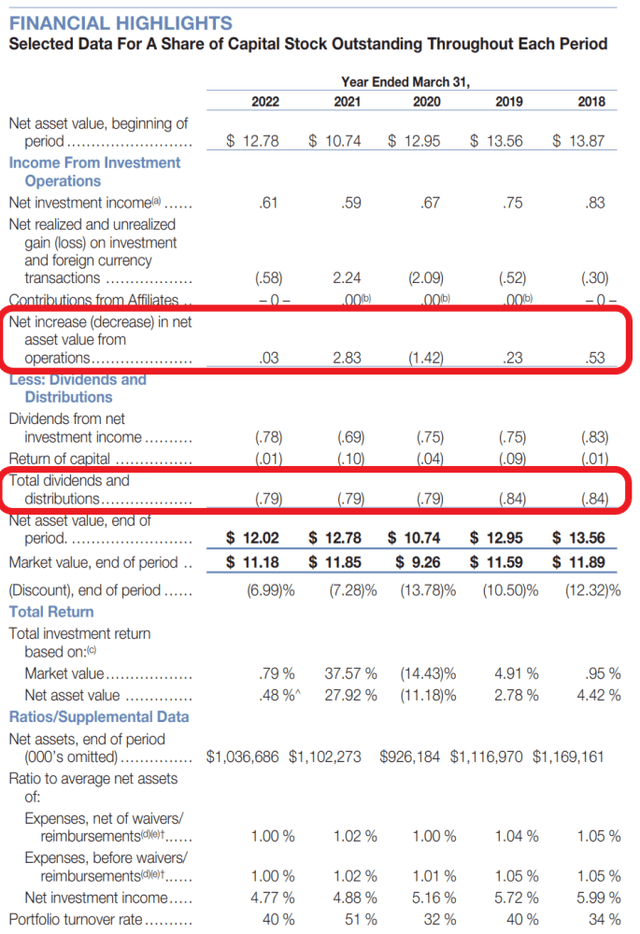

Looking at AWF’s returns history versus its distribution rate, there is a concern that AWF is paying more than it earns. For example, in the past 5 fiscal years, the fund has generated $2.20 in NAV returns ($3.45 in net investment income and -$1.25 in realized and unrealized losses) vs. distributions of $4.05 (Figure 7).

Figure 7 – AWF financial summary (AWF 2022 annual report)

Over the long run, funds that pay more than they earn face a shrinking NAV and declining distributions, as there are less income-earning assets to support future distributions.

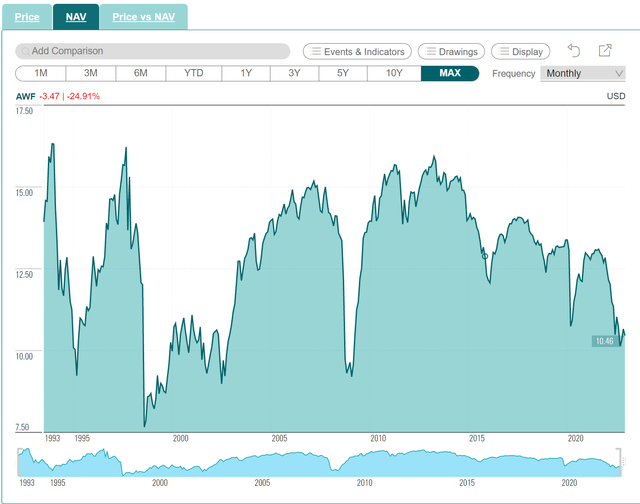

For AWF, we can see that the fund’s NAV has declined from a post Great Financial Crisis (“GFC”) peak NAV of $15.93 in 2013 to the current NAV of $10.46 (Figure 8).

Figure 8 – AWF’s NAV has declined from almost $16 in 2013 to $10.46 in November (cefconnect.com)

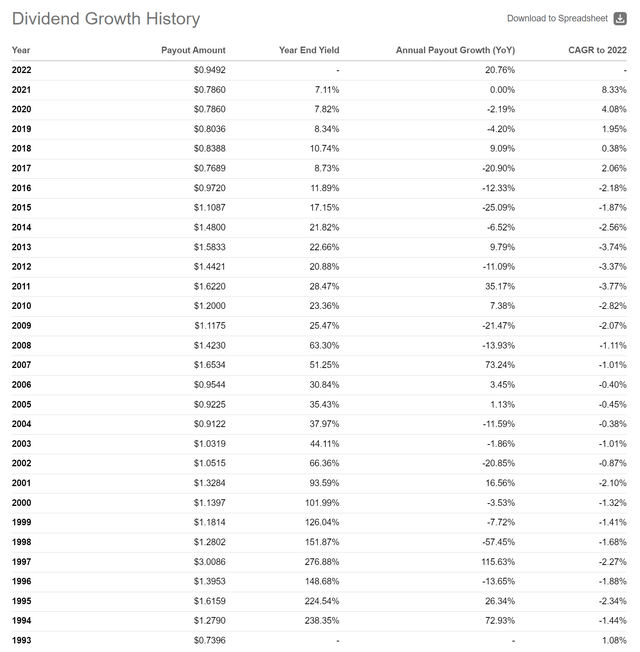

AWF’s distribution has likewise declined from $1.5833/share in calendar 2013 to $0.9492 in calendar 2022 (Figure 9).

Figure 9 – AWF annual distributions has been trending down as well (Seeking Alpha)

Fees

The AWF fund charges a modest 1.00% expense ratio. This is low in comparison to peer fixed income CEFs that typically charge over 2.00%.

AWF vs. ACP

I believe a good peer comparable for the AWF fund is the Aberdeen Income Credit Strategies Fund (“ACP”). Both funds are catered towards investors seeking current income from global fixed income opportunities. I wrote about the ACP fund in a recent article.

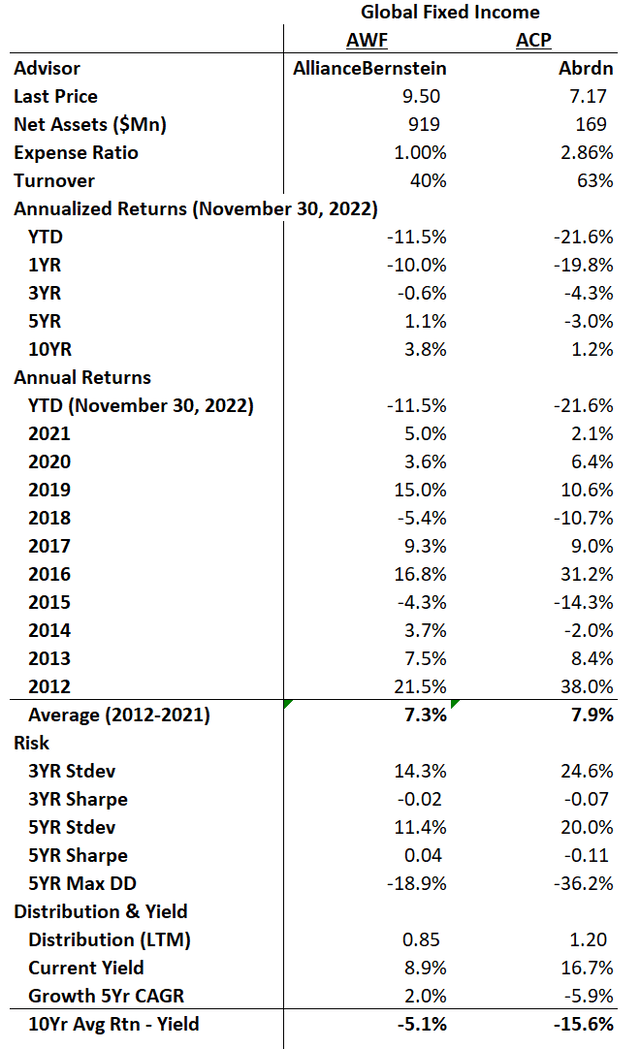

Figure 10 compares some key metrics between the two funds. First, we can see that the AWF fund is far larger ($919 million in AUM vs. $169 million) with much lower expenses (1.00% vs. 2.86%). A larger fund is important for investors concerned about liquidity, as the AWF trades an average of 195k shares/day or $1.8 million while the ACP only trades 133k shares/day or $0.9 million.

Figure 10 – AWF vs. ACP (Author created with returns and risk from Morningstar and fund details and distribution from Seeking Alpha)

Next, in terms of returns, we can see AWF has superior annualized returns on all time frames. Interestingly, ACP has a higher average annual return from 2012-2021. However, ACP’s annual returns are much more volatile, with higher highs (38.0% in 2012 for ACP vs. 21.5% for AWF) and lower lows (-14.3% in 2015 for ACP vs. -4.3% for AWF).

Overall, this leads to higher volatility measures for the ACP fund. AWF is superior to ACP in terms of risk metrics such as Sharpe Ratios and maximum drawdowns.

In my opinion, the only area where ACP is superior is its higher current yield of 16.7%, almost twice AWF’s yield. However, we should note that ACP’s earnings-distribution shortfall is also much more acute as a result.

Conclusion

The AWF fund seeks to provide current income by investing in a global portfolio of fixed income securities. Like many income-oriented CEFs I have reviewed recently, the AWF has an earnings-distribution shortfall, as it pays out more than it earns. However, compared to the ACP fund offered by abrdn, AllianceBernstein’s AWF fund has superior returns and lower volatility within the global fixed income asset class.

Be the first to comment