Charday Penn/E+ via Getty Images

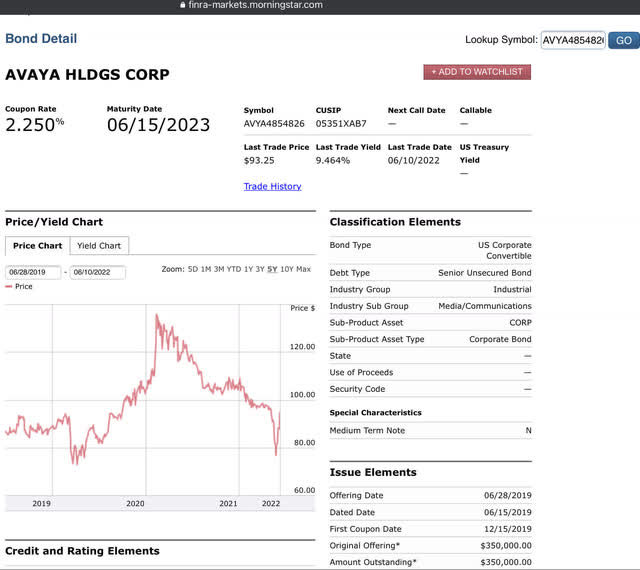

Avaya Holdings (NYSE:AVYA) shares are currently trading like an equity stub as a result of bankruptcy fears surrounding a $350 million convertible note coming due in June 2023, and within the larger context of its overall $2.8 billion debt load, the remainder of which doesn’t come due till 2027 and 2028.

At AVYA’s $4.52 closing price on June 10, investors valued Avaya’s market cap at just under $400 million, or a total enterprise value of $2.9 billion after adding Avaya’s $2.5 billion in net debt ($2.8 billion debt less $300 million cash). Technically speaking, AVYA shares spiked on June 1 and 2 on greater than 10-12x average daily trading volumes, and significant out of the money call options were purchased for June 4 and 5c and September 8c expiries and strikes. This was very odd behavior on “no news” and I believe market participants understood that a debt refinancing was in the offing (and confirmed by a June 8 8-K filing officially announced the launch of a $500 million senior secured loan offering to pre-fund the June 2023 note).

Avaya stock chart (StockCharts)

In addition, Avaya June 2023 notes traded down to $75.50 on May 31 as a result of the liquidity panic, but rebounded and now trade around $94, indicating that credit investors believe a refinancing is a high likelihood event.

Morningstar

In my view, the liquidity fears for Avaya are overblown, and overshadow a very positive development at Avaya, which is an accelerating transition to its OneCloud Unified Communications and Contact Center-as-a-Service (UCaaS and CCaaS) offerings and resultant increase in Annual Recurring Revenue (“ARR”). This transition is accelerating faster than management anticipated, and the company is on track to deliver at least $1 billion ARR by calendar year-end.

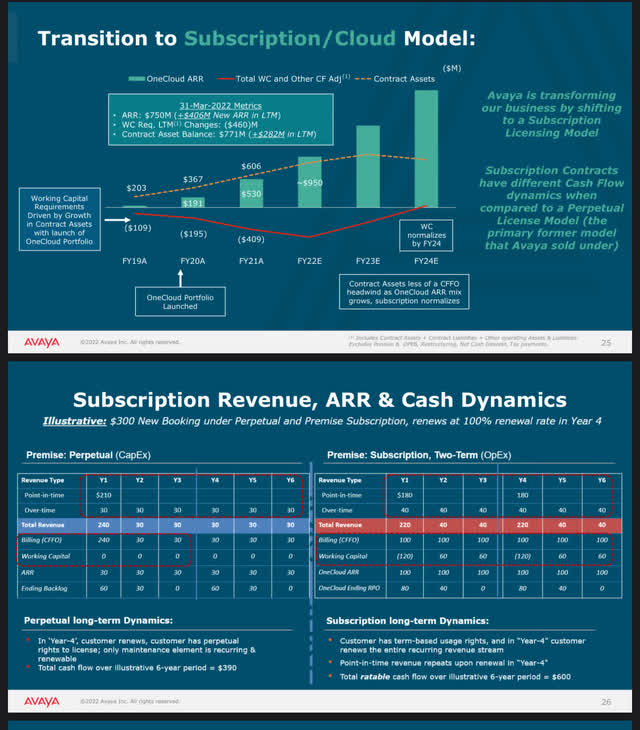

Optically, however, this ramp of OneCloud bookings created pressure on near-term revenue and cash flow as the dynamics of SaaS bookings results in less upfront revenue and cash, but stickier revenue and more reliable cash flow over the total contract life. To that end, I believe OneCloud revenues/bookings should actually be valued higher than legacy one-time sales plus ongoing maintenance which is historically how Avaya managed its business.

Here is an illustrative example of Avaya’s new OneCloud economics:

Avaya June 2022 Investor Deck

As you can see, point-in-time GAAP revenue (upfront) is lower under the OneCloud offering, but results in higher revenue in the out years along with stable cash flows over the term of the deal. In other words, investments in upfront working capital are reversed over time as cash is ratable collected and forms the basis for how Avaya will deleverage over time.

Given this business model shift, and the fears it caused relative to the June 2023 convertible note maturity, I believe this confluence of factors created a unique asymmetric situation for AVYA shares from current levels. But that said, I recognize that credit markets are tightening, in particular in the high yield bond market, as a result of recent policy shifts at the Federal Reserve and because of persistent and elevated inflation. Therefore, Avaya’s recent launch of a $500 million secured bond offering needs to go well in order for this idea to work.

Underlying Avaya’s valuation is a highly diversified customer base (over 90,000 global customers) delivering $2.8 billion in FY2022 revenue and $590 million adjusted EBITDA, although a slight increase in working capital as a result of the OneCloud model which should dramatically reverse in FY2024 when management expects $2 billion+ ARR and for the business to spin off 12 to 15% free cash flow margins which will be used to deleverage Avaya to its target 2.5x net debt levels.

The current Avaya balance sheet situation reminds me of Maxar Technologies (MAXR) in the summer and fall of 2019 when there was considerable fear over its financial viability. Maxar ultimately refinanced a large portion of its near-term debt and conducted asset sales, and the stock rose from $6 to $20 before the COVID-19 pandemic cratered the stock only to regain strength later in the pandemic topping out at $58.

In a show of strength in the high yield market, Maxar announced a $500 million secured bond offering on June 1 to replace a $500 million 2023 maturity, and priced it on June 10 at 7.75% (down from the 9.75% bond it replaced).

I believe Avaya will also be able to draw lender interest for its $500 million bond offering as a result of its market leading ARR growth KPI in UCaaS and CCaaS and a business model that only requires 2-3% maintenance capex.

In terms of comparison, Maxar reported $84 million adjusted EBITDA last quarter with a $2 billion market cap and $2 billion in debt, while Avaya reported nearly double the adjusted EBITDA at $145 million with a $400 million market cap and $2.8 billion debt, while also sporting a more diversified customer base, stickier SaaS revenue stream and a far less capital-intensive business compared to Maxar which requires heavy capex to build its satellite constellations.

Conclusion

Avaya appears like an asymmetric bet on a near-term balance sheet catalyst which should dramatically remove bankruptcy fears for the company. My expectation is that the new Avaya bond offer should price by the end of this week, or June 17 at the latest (which would be 9 days from the announcement to pricing of the bond, similar to Maxar).

Should the company successfully refinance its debt, any re-rating to the company will be magnified in the equity of the company. Each 1x turn higher in EBITDA multiple is good for about $6.50 in stock price ($590 million divided by 90 million shares outstanding).

At current levels based on FY22 $590 million adjusted EBITDA guidance, Avaya trades at 4.9x EV/EBITDA and I’d argue the company should get at least a 6x multiple ($3.5 billion EV), suggesting a $1B market cap, or $11.50 per share.

Longer term, if OneCloud continues to prove out, I’d argue that Avaya would deserve a higher EV/EBITDA multiple (8-10x) to account for ARR growth coupled with the paydown of debt, even more of Avaya’s value would inure to equity holders suggesting significant upside should management fix its balance sheet and continue to drive profitable growth.

Further illustrating Avaya’s value is rumored private equity buyout offer in 2019 in the $5 billion enterprise value neighborhood, which doesn’t seem all that outrageous absent a balance sheet panic (and would be 9x FY adjusted EBITDA), given Avaya has large, stable high-margin cash flows, a global customer footprint and is being integrated into Microsoft (MSFT), Alcatel-Lucent (ALU) and RingCentral (RNG) service offerings. In my view, Avaya also has significant strategic value to each of these players, as evidenced by the strategic tie-ins and investments such as RingCentral’s $500 million investment in Avaya ($125M AVYA preferred shares convertible at $16) and a $375 million payment in the form of RNG shares for future licensing rights of Avaya IP in 2019.

Moreover, private competitor to Avaya — Genesys — raised $580 million at a $21 billion valuation in December 2021 (led by Salesforce.com (CRM) and Zoom Video Communications (ZM)) on the back of $1.9 billion FY22 revenue, of which $825 million was ARR cloud revenue (growing 60% YoY). Given Salesforce and Zoom led the Genesys financing round in December 2021, I think it also highlights the importance of UCaaS and CCaaS for the consumer experience for employees and customers.

All told, Avaya is a larger player than Genesys at $2.8 billion FY22 revenue and is expecting faster growth and to generate $950 million in its OneCloud business, and includes major competitive wins such as a $400 million OneCloud ARR deal with a large financial services customer over 7 years which displaced several large incumbent competitors. Given Avaya is winning competitive deals, the disparity between the Genesys and Avaya valuation appears even more stark.

Given all these factors, Avaya shares appear like they can provide magnified upside in the short (12.5% of the float is held short as well) and over the longer term should the balance sheet situation be resolved, coupled with multiple other shots on goal such as a low $400 million equity valuation, a business model transformation to SaaS and continuing to grow in a good sector for the post CV-19 world with more hybrid work spaces and ways to manage customer service in remote contact center environments.

Be the first to comment