XXLPhoto/iStock via Getty Images

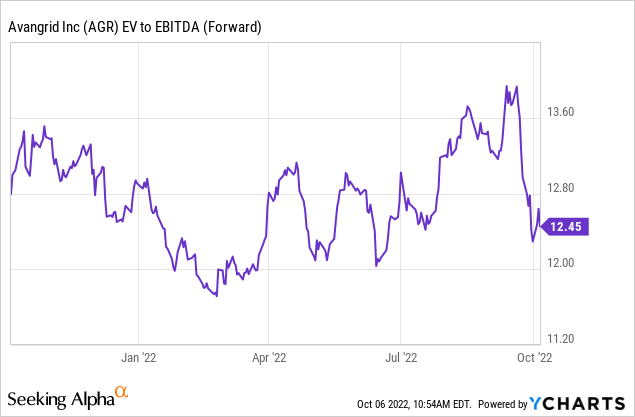

New CEO Pedro Azagra kicked off his tenure at Avangrid (NYSE:AGR) with an aggressive growth message, although operating challenges still led to the mid-term EPS target range being lowered to 6-7% CAGR through 2025. To be clear, AGR’s growth and dividend potential as a regulated utility are compelling over the long run – through increased investments and the partial sale of its onshore renewable ownership stakes, AGR is on track to build out a more stable earnings stream. Yet, execution remains the key overhang to the outlook over the next twelve months. In particular, the outcome of the pending New York/Connecticut/Maine rate cases could drive significant upward (or downward) revisions to the guidance, along with the pending PNM acquisition. At ~12x EBITDA, the valuation is also rich given the rate case risk and execution challenges ahead.

Offshore Wind as the Key Renewables Driver

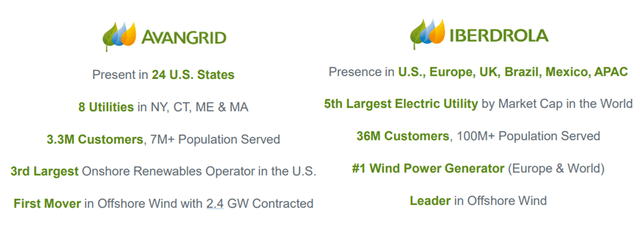

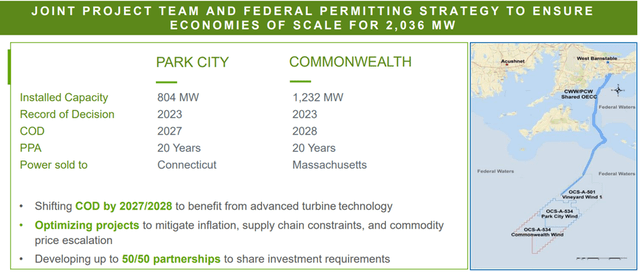

The primary renewables focus for AGR remains wind (offshore and onshore). For onshore wind, the company is adopting a more risk-adjusted approach via a partnership model. In line with this shift, AGR will sell down ~60% of its 2024-2025 onshore projects, with total onshore megawatts growth down to ~650MW through 2025 (vs the prior plan for ~2.3GW of onshore additions). Given the recent Inflation Reduction Act singled out the importance of renewables as a long-term focus, the lower onshore development targets came as a surprise. Expect the earnings growth potential to move lower as a result, although the move does free up equity financing for other projects or transactions. In the meantime, AGR’s offshore scale at 2.4GW (under power purchase agreements) remains intact and should support the overall outlook for the renewables segment.

For now, execution is the key concern – AGR is guiding for further delays to the commercial operation date for Park City/Commonwealth due to the current supply chain challenges and interest rate headwinds. To mitigate the risk, AGR is increasingly de-risking its cash flow by expanding its regulated utility exposure to offset the risk (mainly via investments and sell downs of its onshore/offshore renewable ownership stakes). Still, I would remain cautious on the project risk associated with building out offshore wind farms, particularly given the limited visibility into project returns at this early stage of the industry cycle.

A Challenging Mid-Term Financial Outlook

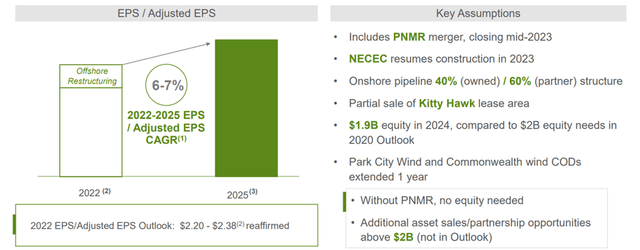

AGR’s EPS CAGR over the 2022-2025 period now stands at 6-7% (down from the prior 6-8%), inclusive of contribution from PNM and New England Clean Energy Connect (NECEC), as well as new onshore renewables partnerships. The outlook also incorporates a $1.9bn equity raise in FY24 (although asset monetization could reduce the final amount) and proceeds from a partial sale of the Kitty Hawk lease. Of these, AGR’s pending PNM acquisition is the top growth driver of the base case – even though an outcome is far from certain given AGR is still litigating in the New Mexico courts. At this stage, I don’t take a view on the likelihood of a transaction closing, but would note the significant implications of a deal break to the earnings outlook (negative), as well as the balance sheet (positive, as it negates any future equity financing).

Beyond the PNM deal, following through on the planned renewable asset sales also represents a crucial step to achieving the mid-term target, particularly given the contribution has already been included in adj EPS. The bar is high for AGR’s 2022 EPS guidance as well – at the $2.29/share mid-point, AGR is penciling in a sizeable ~$0.46/share of benefit from one-time offshore wind lease area gains. The current 2023 EPS expectations of around $2.20-$2.40/share also incorporates ~$100m of pre-tax contribution from the partial sale of its Kitty Hawk offshore wind lease area (equivalent to (~$0.20 of EPS). In sum, the execution bar is high and any challenges could result in more earnings downgrades ahead.

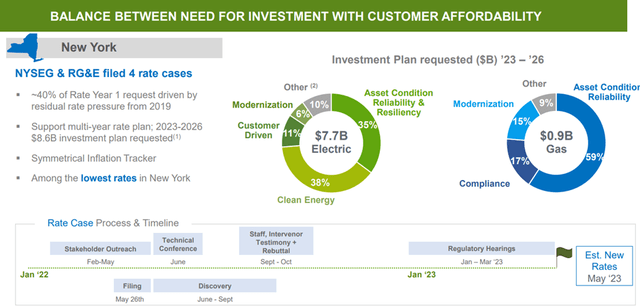

Pending Rate Cases are the Key Near-Term Swing Factor

AGR’s active New York/Connecticut/Maine rate cases present material upside/downside to estimates, given these multi-year plans (through 2026) entail capital investments and ROEs well in excess of AGR’s revised outlook. AGR has also not incorporated the requested capital/rate base increases in its current ~7% rate base growth outlook, so favorable (or unfavorable) outcomes will be worth keeping an eye on. For context, the NY rate case, the most material of the three, calls for a massive multi-year rate plan requiring $8.6bn of investments over the next three years. The capital outlay will need to be weighed against the ongoing impact of elevated commodity prices on customer bills, though, with the challenging backdrop likely weighing on rate activity going forward. In sum, securing multi-year plans without lofty efficiency targets will be a delicate balancing act for AGR’s networks segment and thus, increases the execution risk.

Risks Outweigh the Reward

All things considered, Avangrid had a solid investor day event, making a clear case for its long-term regulated utility growth potential under new CEO Pedro Azagra. The near-to-mid-term case is less clear, though, as EPS growth projections through 2025 were moderated and remain subject to the completion of major projects such as NECEC and the (previously rejected) PNM Resources acquisition. The post-event stock price decline indicates the market agrees with this view, although AGR still commands a premium valuation (for a regulated utility) at ~12x EV/EBITDA. Given AGR also faces risks from its pending NY, CT, and ME rate cases and the execution/construction of key projects like the Vineyard Wind offshore wind project, the stock remains a ‘show me’ story for now.

Be the first to comment