SBDIGIT/E+ via Getty Images

This is my second evaluation of Avadel Pharmaceuticals (NASDAQ:AVDL) following 09/2022’s inaugural Avadel article. It is my first article on Jazz Pharmaceuticals (NASDAQ:JAZZ). In this article, I review the hotly contested battle ongoing between these two companies over their respective sodium oxybate products.

LUMRYZ, in treatment of cataplexy, received tentative FDA approval in 07/2022

On 07/19/2022 Avadel Pharmaceuticals announced that the FDA had granted it tentative approval for its LUMRYZ (FT218, sodium oxybate) extended-release oral suspension. The approval was tentative for the treatment of excessive daytime sleepiness [EDS] or cataplexy in adults with narcolepsy. According to Avadel’s announcement:

Tentative approval indicates that LUMRYZ has met all required quality, safety, and efficacy standards necessary for approval in the U.S. Final approval is pending disposition of U.S. Patent No. 8,731,963 (the “REMS patent”) which is listed in FDA’s Orange Book.

While this substantially derisks future approval prospects, it does not authorize sales or create immediate revenues. For that, Avadel must wait for a full approval. During its Q3, 2022 earnings call (the “Avadel Call”), Avadel stated that this tentative approval establishes a target date of 06/17/2022 by which a final approval process will commence.

Unfortunately for Avadel’s investors sodium oxybate is a cornerstone therapy underlying Jazz’s revenues. There are ample tools in Jazz’s armamentarium to delay and harass Avadel as it works to bring its new improved sodium oxybate LUMRYZ to market. As discussed below, Jazz is trying out a variety of these tools.

Avadel’s LUMRYZ is its first shot at product revenue; Jazz’s XYREM/XYWAV duopoly is important in its product stable

Avadel

The Avadel story is a simple one. It is a small biotech with a one therapy pipeline, LUMRYZ. Its fortunes will rise or fall as does that therapy.

With its puny ~$0.54 billion market cap and its tightly constrained liquidity, Avadel can ill afford protracted litigation with a larger, more established company. Avadel is all about its lead therapy LUMRYZ.

As reported in its Q3, 2022 10-Q (p. 10 …in thousands, except per share data) as of the close of Q3, it had tenuous liquidity as follows:

…$60,715 of cash and cash equivalents and $45,760 of marketable securities available for use to fund its operations, debt service and capital requirements. The Company’s ability to generate revenue is expected to start following the launch of LUMRYZ, which is dependent, in part, on final approval of LUMRYZ by the FDA. As of September 30, 2022, the Company has $26,375 aggregate principal amount of its 4.50% exchangeable senior notes due February 2023 (the “February 2023 Notes”) and $117,375 aggregate principal amount of its 4.50% exchangeable senior notes due October 2023 (the “October 2023 Notes”) (together, the “2023 Notes”).

As is common for small biotechs, it has lots of levers to pull to increase its liquidity, including a combination of:

- royalty financing,

- secured or unsecured debt, convertible debt and equity,

- refinancing or negotiating new terms for the 2023 Notes,

- use of its at-the-market offering [ATM] which could provide the Company up to approximately $135,000 (as of September 30, 2022), net of commissions.

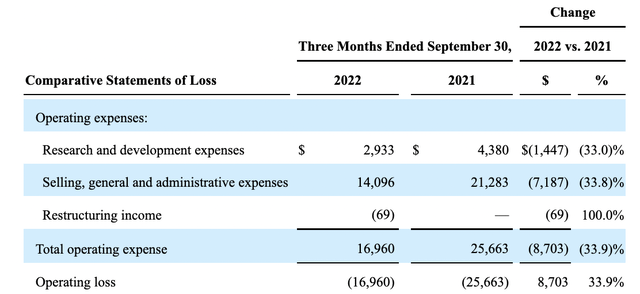

Avadel’s operations for Q3 showed a quarterly loss as follows:

seekingalpha.com

During the Avadel Call, it touted target operating expenses at a range of $12-$14 million. This is no doubt a laudable goal. Whether it is realistic seems questionable. The expenses associated with its LUMRYZ launch and legal fees as it jousts with Jazz lead me to question it.

Jazz

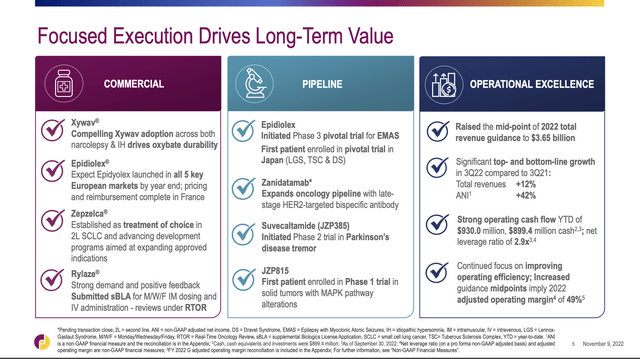

Unlike Avadel, Jazz is an established pharma with a PE ratio >8.5. It has a market cap approaching $10 billion. It has a track record of FDA approved products. It shows off its recent operations with its 2022 Third Quarter Financial Results & Business Update (the “Jazz Presentation”).

Its operations overview slide tells the tale:

seekingalpha.com

It has four lead commercial products, the foremost of which is its Xywav oxybate. In its Q3, 2022 10-Q (p. 9) Jazz describes it as:

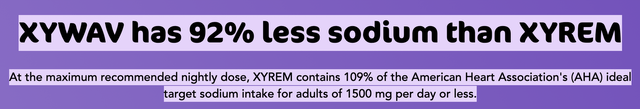

XYWAV® (calcium, magnesium, potassium, and sodium oxybates) oral solution, a product approved by the U.S. Food and Drug Administration, or FDA, in July 2020 and launched in the U.S. in November 2020 for the treatment of cataplexy or excessive daytime sleepiness, or EDS, in patients with narcolepsy aged seven years of age and older, and also approved by FDA in August 2021 for the treatment of idiopathic hypersomnia, or IH, in adults and launched in the U.S. in November 2021. XYWAV contains 92% less sodium than Xyrem®;

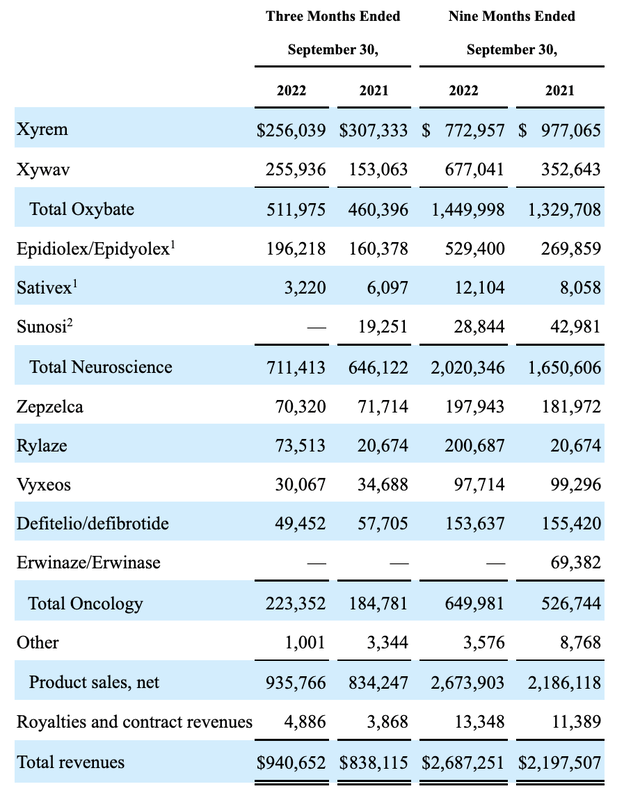

In its 10-Q, Jazz reports the following as its product revenues for Q3, 2022:

seekingalpha.com

Jazz’s oxybates made up over well half of its ~$2.2 billion in revenues for the quarter. According to the Jazz Presentation slide 6 its goal is to generate $25 billion in 2025 revenue. Obviously, it will not be surrendering ground to Avadel easily.

Jazz is fighting tooth and nail to block Avadel’s application

While Avadel hypothesizes that it will be able to move forward no later than 06/17/2023, it is impatient to expedite the situation. In the meantime, it is at work in the courts trying to invalidate the REMS patent that is holding up the works. Subsequent to the Avadel Call, the FDA filed an amicus brief before the FTC supporting Avadel’s delisting efforts.

This brief provides a nice explanation of the issues at play between the parties, along with their legal underpinnings. For example, it explains:

- The rationale behind requiring a Risk Evaluation and Mitigation Strategy [REMS] for controlled substances such as sodium oxybate because of its potential for misuse and abuse, including as a dangerous “date rape” drug;

- the single pharmacy system which Jazz uses for its XYREM, a sodium oxybate which has been in use since the 1960s as a treatment for narcolepsy;

- Jazz has no formulation patents on XYREM rather it has built its blockbuster XYREM business on its use and distribution patents;

- use and distribution patents do not qualify as Orange Book listed patents;

- accordingly, Jazz’s patent should be delisted from the Orange Book in accordance with settled law.

Unfortunately, there are a welter of disputes pending between the parties. In its Q3, 2022 10-Q at pp. 23-24 under the heading “Avadel Patent Litigation” Jazz describes:

- 3 patent infringement suits filed by Jazz against Avadel in Delaware District Court on 05/13, 08/04 and 11/30, all in 2021;

- Avadel filed answers and counterclaims in each of the suits;

- on 04/14/2022 Avadel filed suit against Jazz for, inter alia, misappropriation of trade secrets related to Avadel’s once-nightly sodium oxybate development program and breach of certain contracts;

- on 06/07/2022 Avadel gave Jazz notice of its proceeding to invalidate Jazz’s Orange Book patent giving rise to yet more claims and counterclaims;

- on 07/21/2022 Avadel sued the FDA in district court for the District of Columbia seeking a declaration that requiring a patent certification was unlawful and other relief; on 07/27/2022, Jazz intervened in that case, on 11/03/2022 the Court granted Jazz and FDA’s motions for summary judgment and denied Avadel’s motion.

Avadel’s Q3, 2022 10-Q (pps 19-21) gives a rundown and description of these and other proceedings it is pursuing in its effort to achieve FDA approval for LUMRYZ as soon as possible.

Additionally, CEO Divis discusses late developments in Avadel’s 12/01/2022 appearance at the Evercore ISI HealthCONx Conference. In his discussion, he is clear that he intends for Avadel to begin its launch at the very first time it can do so. Unless Jazz actually succeeds in enjoining it from proceeding, Avadel will go to market with LUMRYZ as soon as the FDA approves it.

Avadel will file for full approval as soon as it resolves the REMS patent block, which should be no later than June 17, 2023.

If it can get FDA approval, LUMRYZ is highly competitive with XYREM/XYWAV

My initial Avadel article, “Avadel’s LUMRYZ: A Good Night’s Sleep For Narcolepsy Patients” (“Sleep”), sets out the respective labels for XYREM and XYWAV and compares them to LUMRYZ. The major competitive advantage of LUMRYZ is its dosing. In Sleep, I describe the following:

Each requires patients to take two doses, one at bedtime and a second dose 2.5-4 hours later. Hunh…how does that work? You take your first dose right before you get in bed, then you set an alarm to wake up 2.5-4 hours later.

That guarantees a disrupted night’s sleep, for sleep disorder patients mind you. LUMRYZ on the other hand features an extended release formulation such that it only requires a single dose. It is little wonder that Jazz is doing everything possible to derail FDA approval of LUMRYZ.

From a first blush, data-free perspective, the one dose seems like a compelling advantage. The idea of setting an alarm to take a second dose of a sleep medicine simply doesn’t compute by my reckoning. It seems like enough of an advantage to propel a second to market therapy over an entrenched, better capitalized competitor. But as the old saying goes, different strokes for different folks.

Maybe some people like their alarms and don’t mind them interrupting their sleep. I was gratified to read in the Avadel Call that Avadel has rounded up some data which confirms my intuitive belief. CEO Divis reported:

Very recent comprehensive market research …continues to confirm the significant interest in LUMRYZ across all patient and physician segments, all of which is supported further by what we see in the real-world data coming from our RESTORE study, where 94% of twice-nightly switch patients prefer the once-at-bedtime dosing of LUMRYZ.

So if this data and the intuitive appeal of a single dose hold true, it’s game over for XYREM/XYWAV — right? Not necessarily; several hurdles lie ahead for LUMRYZ, including:

- It will have to develop its own REMS to address a distribution plan for LUMRYZ to protect it from potential abuse; during the Avadel Call it assured that it was well on its way to;

- it will have to secure final FDA approval for LUMRYZ and block possible Jazz claims of orphan exclusivity for XYWAV;

- it will have to develop an effective marketing plan and launch for LUMRYZ.

One point I have not touched on that will impede Avadel as it goes forward is reflected by the Jazz Presentation slide excerpt below:

seekingalpha.com

Avadel did not discuss this during the Avadel Call. It is unclear to me how much of an issue this might be for LUMRYZ.

Conclusion

I have rated both Jazz and Avadel as “Hold”. The oxybate wars present significant risks for each of them. Over the longer term, I expect Avadel to fare better from the situation than Jazz.

Admittedly, the dispute could be existential for Avadel if somehow Jazz were able to close it off from ever getting approval. However, such an outcome appears unlikely after LUMRYZ’s tentative approval. The more likely outcome is that Jazz continue to cause delay and expense for Avadel but that Avadel likely is able to file for full FDA approval after 06/2023 as it plans.

Within some months thereafter, the FDA should give its full approval. Gradually, following the LUMRYZ approval, Jazz’s XYREM/XYWAV pair will lose revenues, likely faster than Jazz expects, but slower than Avadel bulls would prefer. For the time being, I’m steering clear.

Be the first to comment