Pgiam/iStock via Getty Images

Avadel Pharmaceuticals plc (NASDAQ:AVDL) is facing yet another hurdle to getting its once-nightly, admittedly superior daytime sleepiness drug approved. First, there was a delay from October 15, 2021, the original PDUFA date, because of what now appear to be FDA staffing issues. Then, more than 6 months later, the FDA has now once again delayed approval, citing a patent issue. Here’s Avadel’s related 8-K:

On May 24, 2022, Avadel Pharmaceuticals plc (the “Company”) received a proposed, final label and medication guide for FT218 from the U.S. Food & Drug Administration (“FDA”). In addition, the Company was notified by FDA that the FT218 New Drug Application (“NDA”) patent statement pertaining to US Patent No. 8,731,963 (the “REMS patent”) was deemed inappropriate by FDA. As such, FDA has requested the Company add a certification to the REMS patent to its NDA. FDA further confirmed, based on the final proposed label, that no additional patent certifications will be required.

Based upon the above, the Company anticipates tentative approval of the FT218 NDA with potential full approval on or before the expiration of the REMS patent on June 17, 2023. Full approval could occur sooner if the REMS patent is delisted from FDA’s Orange Book, a court determines the patent is invalid, not infringed or otherwise unenforceable, or a court determines that FDA erred in requesting a certification.

This is complicated and needs some explaining.

Jazz’s (JAZZ) drug Xyrem consists of sodium oxybate, which is liable to be misused as a so-called “date rape” drug. There are also other safety issues. Therefore, the FDA had asked Jazz to add a Risk Evaluation and Mitigation Strategy (REMS) to the drug label. A REMS is a safety program that the FDA:

“can require for certain medications with serious safety concerns to help ensure the benefits of the medication outweigh its risks. REMS are designed to reinforce medication use behaviors and actions that support the safe use of that medication.”

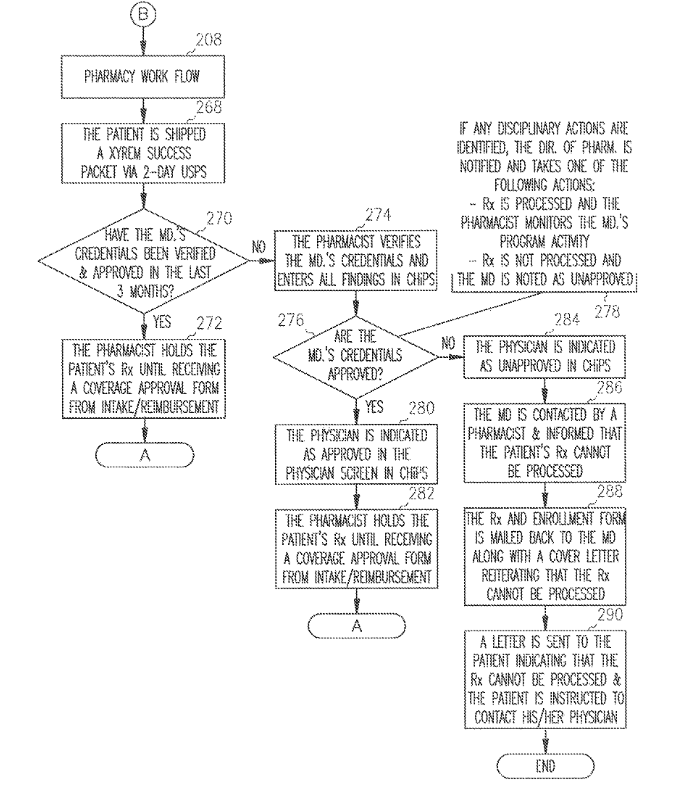

Now, a REMS could be complicated. In fact, it could be complicated enough that the strategy – the method of implementing the REMS program – can be patented. This is what Jazz did with Xyrem; it went ahead and patented the entire REMS program, and the FDA even added it to the Orange Book – the big list of FDA approved drugs. Just one quick chart from the specific patent – U.S. Patent No. 8,731,963 – will give you an idea:

Xyrem REMS (Google Patents)

When a generic version of Xyrem was approved in 2017, it also needed to go through the same REMS process. Among the generic makers, at least two went to the Patent Review Board to complain that a set of six patents including the REMS patent discussed here were obvious. The Board agreed; Jazz appealed; and the Appellate Court sided with the Board – and the generic makers – against Jazz. Here’s the case:

Jazz Pharmaceuticals, Inc. (“Jazz”) appeals from six inter partes review (“IPR”) decisions of the United States Patent and Trademark Office Patent Trial and Appeal Board (the “Board”).1 Collectively, the decisions held certain claims of Jazz’s U.S. Patents 7,668,730 (“‘730 patent”), 7,765,106, 7,765,107, 7,895,059, 8,589,182, 8,457,988 (“‘988 patent”), and 8,731,963 (“‘963 patent”) (together, the “patents in suit”) invalid as obvious. Because the Board did not err in its conclusions of obviousness, we affirm.

However, the case also does say the following:

Amneal Pharmaceuticals, LLC (“Amneal”) petitioned for IPR of the seven patents in suit.3 The Board instituted review of all petitioned claims for each patent except for the ‘963 patent, where the Board partially instituted review of a subset of the petitioned claims, see Amneal Pharm., LLC v. Jazz Pharm., Inc., IPR2015-01903, slip op. at 2 (P.T.A.B. Mar. 25, 2016), Paper No. 10. Also, in several of its institution decisions, the Board instituted review on fewer than all grounds raised in the petition. E.g., Amneal Pharm., LLC v. Jazz Pharm., Inc., IPR2015- 00551, IPR2015-00554, slip op. at 42 (P.T.A.B. July 28, 2015), Paper No. 20.

This is probably where the problem now arises for Avadel – that the entire ‘963 patent was not reviewed and held to be obvious.

When the FDA approved generic Xyrem, they gave it a separate REMS, which had the same elements to assure safe use (ETASU) as the Xyrem REMS and was designed to achieve the same level of safety. However, the generic version was not required to use a single, shared system for the REMS with ETASU. While there are elements of similarity in the outcome measures, the functional REMS differed in that while the Xyrem REMS used a single pharmacy and a single database for verifications, generic Xyrem used multiple certified pharmacies and multiple databases. These were:

“connected via an electronic telecommunication verification mechanism known as a ”witch system,” which verifies in real-time the same safe use conditions as the Xyrem REMS prior to dispensing the drug.”

According to a research report:

Two principles collide in the pharmaceutical industry. On the one hand, the U.S. Food and Drug Administration (“FDA”) approves potentially dangerous drugs under Risk Evaluation and Mitigation Strategies (“REMS”) programs when a drug’s benefits outweigh its risks. But on the other hand, brand firms can prevent generic competition by patenting these programs. REMS patents, which claim compliance with FDA-imposed REMS programs, pose two problems-one procedural, the other substantive. First, current practice is to list REMS patents in the Orange Book even though such listings may be invalid, with this conduct allowing the brand to obtain an automatic 30- month stay of generic approval. Second, because a REMS program appears on a product’s label and generics must copy that label, REMS patents threaten generics with claims of induced infringement.

Now, the generic drugs also got approved, and they also went through the same REMS problem. How they resolved that will be important for Avadel to understand to resolve its own problem. Did they make a deal with Jazz? Did they go to Court and win? If the former, Avadel either has to make a deal; or it has to wait until this patent expires, in June 2023, as they said in their 8-K.

In the research cited above, the authors suggest 5 ways to get around the problem of REMS certification for generic drugs, and this applies to FT218 as well, since it has the same ingredient as Xyrem. One of these methods is to seek to delist the patent from the Orange Book. Avadel tried this strategy already and failed. However, the failure was due more to the logic it used than to obviousness claims. So, further steps remain for Avadel. There are widespread concerns in the industry of branded drugmakers using this REMS patent angle to block generic drugs, so there’s a lot of opinion favoring Avadel, especially because, unlike generics, it offers a distinct functional advantage to Xyrem.

Financials

AVDL has a market cap of $132mn and a cash reserve of $123mn as of March. Both R&D and SG&A expenses increased vastly this quarter, with the former being $7.0 million and the latter being $21.6 million, up from $3.9 million and $11mn from the same period in 2021, respectively. These increases are in anticipation of launch and commercialization plans and so on. However, they still need to wait for 4 more quarters before they can be sure of approval – although the FDA can decide to approve earlier. Thus they simply do not have cash to continue to approval, and beyond. So expect some major dilution before approval unless they can get non-dilutive financing from somewhere.

Recently, a Director, the CEO & CFO all bought shares at the current low prices. The company also reported more positive data:

“interim results from ongoing RESTORE open-label extension / switch study of FT218 highlighting overwhelming patient preference for the once-at-bedtime dosing regimen and characterizing the burden associated with the second dose currently required for twice-nightly oxybates.”

Bottom Line

AVDL continues to be a very interesting stock. FT218 is highly differentiated from the blockbuster Xyrem drug. Not only Xyrem, but its low sodium version, Xywav, too, does not have a once-nightly version. So FT218 has a good chance of making it to the market, if more than 18 months delayed.

Given that, AVDL is not a complete zero-value stock for investors. It is just that the FDA has not played too nicely with it, and they don’t have a lot of cash. So a small pilot now and further follow on buys later looks like a sound approach. I must confess that I am tempted, having given up my position a few months ago after persistent losses, and when the FDA had not provided any clarity regarding the PDUFA.

Be the first to comment