MCCAIG

Pair Trade Review

Seeking Alpha challenged contributors in June 2022 to come up with articles featuring two stocks that share a commonality; one to buy and the other to sell or short.

The thesis I submitted suggested that AutoZone (NYSE:AZO) stock would outperform Tesla (NASDAQ:TSLA) stock for several reasons. Both companies are automotive-related, and acutely affected by economic downturns, consumer spending, interest rates, and inflation, just in vastly different ways. I’ll address both stocks in detail below.

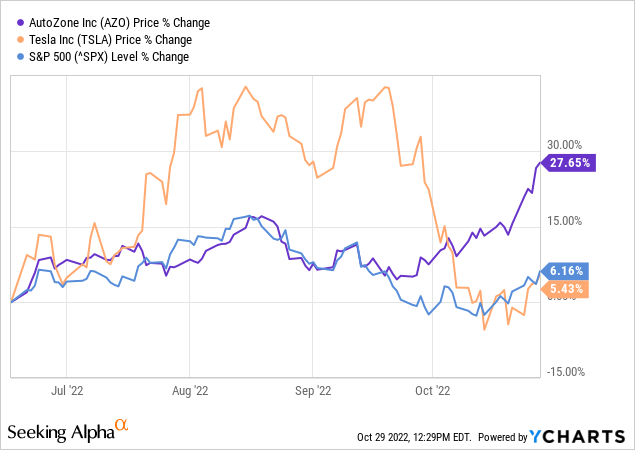

After more than four months, AutoZone stock has outperformed Tesla stock by 22%, as shown below. AutoZone has also crushed the S&P 500, while Tesla has pulled about even.

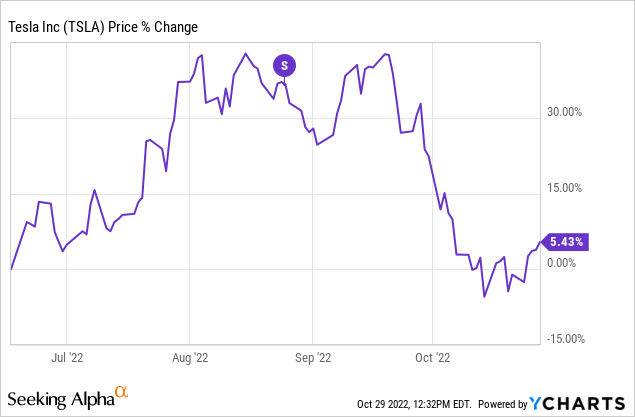

One of the reasons that Tesla stock rose through August and September before crashing back to Earth was almost certainly due to its anticipated stock split, as shown below with the split date noted.

Upcoming stock splits tend to buoy stocks with a high level of individual investor interest, but the hype dissipates pretty quickly. This is what I wrote in the June article:

The upcoming 3-for-1 stock split may provide a small spark, but the effects of stock splits aren’t typically lasting. The stock quickly retreated toward its announcement date price after the 2020 stock split, and then the stock took off afterward with the company’s success.

Several things have changed since June. The Federal Reserve has hiked interest rates twice, both companies have reported earnings, inflation has remained stubborn, and Musk has finalized the Twitter purchase, among others.

The valuation of AutoZone has also risen significantly. Is it time to change the thesis?

Why has AutoZone stock gone on a tear?

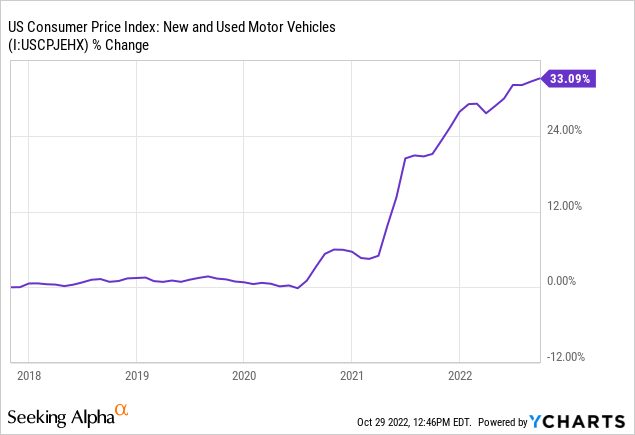

In April 2022, I wrote that AutoZone could be a beneficiary of inflation. The stock has outperformed the S&P 500 by 26% since then. AutoZone benefits because the drastic increases in new and used car prices encourage people to keep their current vehicles longer. This means more parts and more repairs.

The chart below shows the extreme rise in vehicle prices.

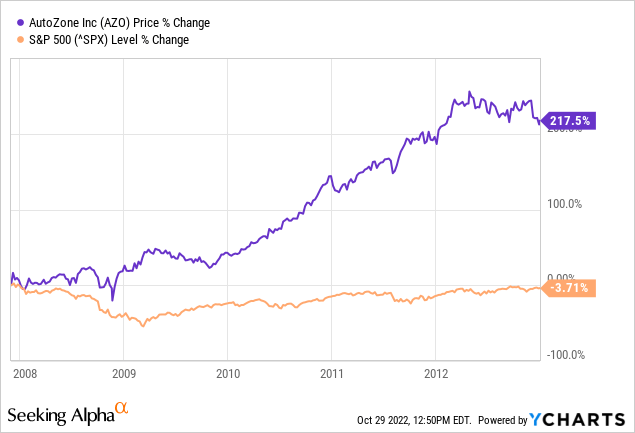

AutoZone crushed market returns coming out of the Great Recession for this reason, as shown below.

AutoZone CEO Bill Rhodes tells it like this:

…over the last 30 years, there have been four significant shocks to the economy. In all four of those shocks, our performance and our industry’s performance have made a meaningful step up. During those shocks – recessions and pandemics…our business has gone up, and it’s never stepped back down.

–Bill Rhodes, Chairman, President, and CEO, on fiscal Q3 2022 earnings call.

Stellar earnings

AutoZone’s fiscal Q4 2022 earnings were spectacular. Sales rose 9% year-over-year (YOY), and same-store sales were up 6.2%.

Management managed rising costs exceptionally well. The gross profit margin only fell nominally from 52.8% in fiscal 2021 to 52.1% in fiscal 2022, and the operating margin was even. Diluted earnings-per-share (EPS) rose 23% from $95.19 to $117.19.

AutoZone spent $4.4 billion on stock buybacks in fiscal 2022, reducing the share count by 2.2 million – a reduction of over 9%. This is outstanding. The average purchase price of the shares was $1,964 – far below Friday’s closing price of $2,543. The effect of future buybacks will be less with this high stock price.

Is the stock overpriced now?

I still believe in the long-term investment opportunity of AutoZone stock; however, as of Friday, I no longer own shares. The valuation is not attractive at this level for three main reasons:

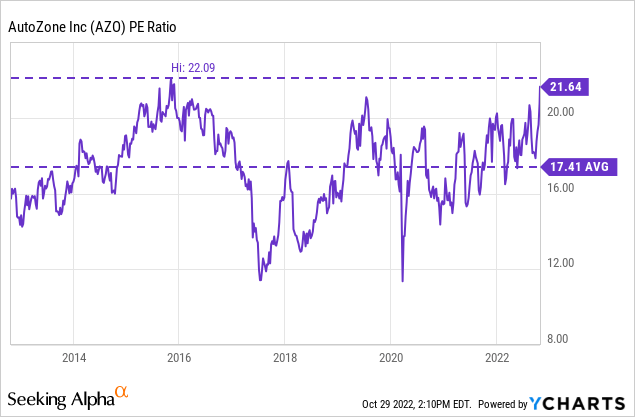

- Last week’s rally has put the stock near its highest price-to-earnings (P/E) ratio in ten years, as shown below.

AutoZone is not a growth stock. Therefore it is easier to value using traditional metrics. The big question is, “would I buy shares at this level?”. The answer is no.

- Stock buybacks will be weakened. AutoZone relies heavily on reducing the share count to increase earnings-per-share and the value of the investment. I love buybacks. But fewer shares will be repurchased at this level, and this could hinder EPS growth in 2023.

- Management did a tremendous job controlling costs last year. Margins remained impressive despite increased fuel, labor, and other costs economy-wide. Something has to give. I expect at least moderate margin pressures in the coming fiscal year.

I firmly believe in letting your winners run; however, this does not mean being stubborn when a stock gets ahead of itself.

The stock’s momentum could continue, but I expect to be able to get back in at a lower price in 2023.

What about Tesla?

Tesla is a revolutionary company. Its rise has been astounding, and the company will be highly successful for a long time.

But that doesn’t make the stock a buy for me right now. It’s critical to separate the company from the stock. Just as it is above with AutoZone. I love AutoZone’s results, but not the stock price.

The macroeconomic picture for Tesla couldn’t be much worse. Onrushing competition, a slowing economy, inflation leading to rising interest rates, and demand destruction weigh heavily.

We haven’t seen a meaningful retreat in inflation since June, and the Fed appears committed to its current track. There is talk of a “Fed pivot” away from raising rates, but many professionals aren’t seeing this until the end of 2023.

Elon Musk has been a vocal critic of Fed policy for a good reason. Rate hikes and demand destruction are bad for Tesla’s business. Musk also expressed concern that the Fed was risking deflation by continuing its current policy and contends that the Fed is looking back rather than forward:

“The Fed’s decisions make sense if you’re looking in the rear-view mirror, not if you’re looking out the windshield,” Musk said.

He has a point. There are solid arguments that the inflation battle should be fought more on the supply side (investing to increase supply, thereby lowering prices) than by tamping down demand. There is a legitimate risk that the Fed overshoots. But don’t expect it to budge.

Interest rates and inflation negatively affect Tesla stock in several ways, including declining consumer demand, margin pressures, and the stock’s valuation model.

Consumer demand

Tesla makes a great product, and the stock is priced for massive growth. However, consumers have already stared down nearly two years of rapidly-rising prices. Budgets will continue to tighten, and Tesla has raised its financing rate.

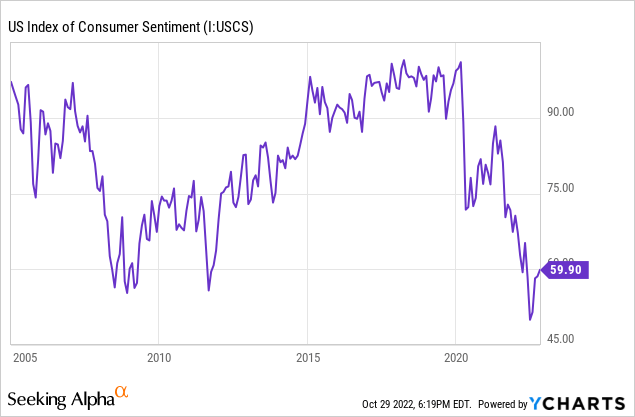

Consumer sentiment is the strongest indicator of future consumer spending and is still below its pandemic and Great Recession lows.

Again, something has to give.

Margin pressures

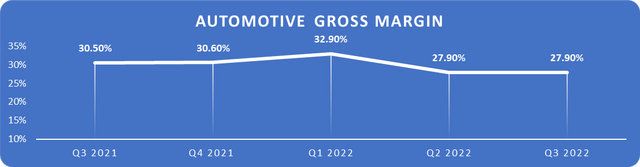

Tesla has margins that most other auto manufacturers can only dream of. But they are under pressure. Sales in Q3 grew 55% YOY. Growth this massive should lead to scaling efficiencies. Tesla has done an admirable job of controlling costs, including by raising prices, just like AutoZone; however, the trend is down. The automotive gross margin peaked in Q1 and has lagged since, as shown below.

Data source: Tesla. Chart by author.

Unlike AutoZone, Tesla is still a high-growth stock and tougher to value. Rising interest rates lower Wall Street’s valuation of growth stocks because the future cash flows are less valuable. This could put more downward pressure on the stock.

The bottom line

Tesla and AutoZone are quality companies with bright futures. Electric vehicles will soon be the norm rather than the exception. The market will balloon, but serious competition is coming from all sides, along with the macroeconomic headwinds.

AutoZone could be a net beneficiary of inflation and has historically outperformed during economic weakness. But the stock’s recent rise has it near its highest P/E ratio in a decade.

Although each company has a bright future, neither stock is an attractive investment given current conditions and prices.

Be the first to comment