peepo

Technology stocks remain heavily beaten down from their highs, with many investors having capitulated on this sector. While riskier and unproven small cap names probably deserved this market drubbing, some of the bigger and moat-worthy names may deserve a second look. I don’t believe the bear market on tech stocks will last forever, and this may be the time to look at quality names at a discount.

This brings me to Autodesk (NASDAQ:ADSK), which is a large cap company that specializes in design software with broad market applications. In this article, I highlight why now may be a good time to pick up the shares for potentially strong long-term returns, so let’s get started.

Why ADSK?

Autodesk is a software company whose products are recognized as the global industry standard for computer-aided design. Industry professionals utilize ADSK’s software to design and model buildings, transportation systems, manufactured products, animations, and video games. ADSK operates in all geographies worldwide, and in the trailing 12 months, generated $4.4 billion in total revenue.

Autodesk’s key competitive advantage stems from the ‘network effect’ that its products have enjoyed, with over 100 million people who use its flagship product AutoCAD, as well as Revit, Maya, 3ds Max, and more. This high number of industry professionals who have dedicated their career and resources to becoming proficient in the software results in sticky customer loyalty, making them unlikely to switch and restart a steep learning curve on another product. This is further reinforced by Autodesk building a healthy ecosystem around courseware and certifications.

As shown below, ADSK has enjoyed nearly unfettered growth since inception, with revenue more than doubling over the past 5 years.

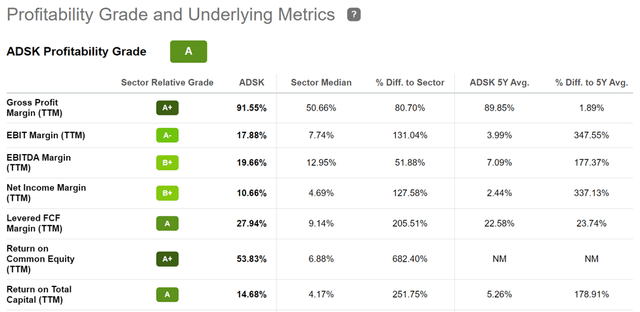

It also sports strong profitability given the durable proprietary nature of its software products. As shown below, ADSK scores an A grade with sector leading EBITDA and Net Income Margins of 20% and 11%, respectively.

ADSK Profitability (Seeking Alpha)

Meanwhile, it continues to demonstrate strong growth, with revenue rising by 18% YoY to $1.17 billion in Q1 FY23 (ended in April). Also encouraging, profitability increased as adjusted operating margin improved by 6 percentage points to 34%. These results were driven by broad strengths across ADSK’s portfolio and regions.

ADSK is also benefitting from switching the vast majority of its installed base to subscription licenses, which comes with the benefit of recurring revenues that now represent 95% of total revenue. This results in better revenue predictability due to a more stable revenue stream compared to perpetual licenses, with have more bump refresh cycles.

Looking forward, ADSK stands to benefit from increased infrastructure spend among worldwide governments. Management expressed their ability to deliver on the software tools to enable planning for these projects, as noted during the recent conference call:

The combination of Revit, Civil 3D, Navisworks, Autodesk BIM Collaborate Pro, InfraWorks, and more recently Autodesk Construction Cloud and Innovyze delivers industry-leading end-to-end capabilities in transportation and water from planning and design to construction and operations. And our customers can extend those capabilities through our partnerships with Aurigo in capital planning and ESRI in geospatial mapping.

This is important because governments and asset owners across the globe are investing growing amounts in next-generation infrastructure to meet the societal and environmental needs of the next century and are retooling now to do it. That equals opportunity for Autodesk. For example, in the first quarter, we signed our second largest EBA ever with a large global infrastructure company in a deal that included Innovyze and Autodesk Build for the first time.

Risks to Autodesk include an economic downturn, new entrants into the space, and the full impact of its pulling out of Russia due to the war in Ukraine.

It appears, however, that many of these concerns have already been factored in, with the share price falling by 25% since the start of the year. While ADSK doesn’t appear to be a value stock at the current price of $212 and forward PE of 32, I see the valuation as being justified considering the 19 – 29% EPS growth rate than analysts expect over the next 4 quarters.

Morningstar has a $230 fair value estimate, and sell side analysts have a consensus Buy rating with an average price target of $243.52, implying a potential one-year 15% return.

Investor Takeaway

Autodesk is a leading provider of design and engineering software and is benefitting from strong end market tailwinds. It also has a mostly subscription business model with sticky customer loyalty and high switching costs, which results in durable growth and profitability.

While the shares don’t appear to be cheap at current levels, I believe the valuation is justified given the moat-worthy nature of the company’s products and its long-term growth prospects. As such, I find ADSK to be a Buy at present for long-term growth investors.

Be the first to comment