JHVEPhoto/iStock Editorial via Getty Images

There are many iconic software companies that have become synonymous with the product categories they created, and Autodesk (NASDAQ:ADSK) is one of them. The leader in CAD (computer-aided design) software and the gold standard for engineers across the globe, Autodesk has long been a formidable software company that recently successfully pulled off a transition to cloud-based subscriptions, putting the company in sync with modern tech consumption models and lowering barriers to entry for new users, while at the same time granting the company a much more reliable and larger revenue base over time.

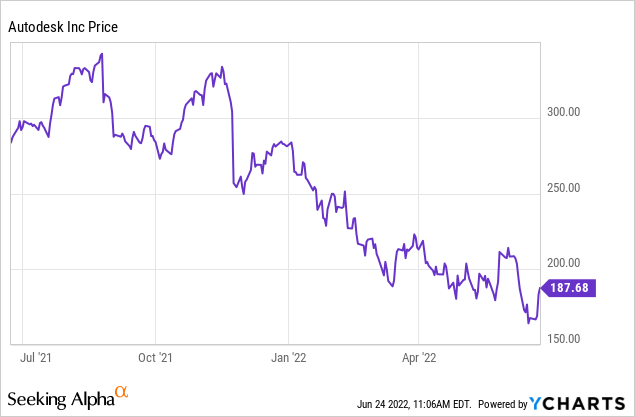

While Autodesk’s performance this year has largely held firm, sentiment has not. Falling alongside other tech names, shares of Autodesk have lost roughly a third of their value this year. The stock attempted to rally after a relatively strong Q1 earnings print in late May, but the June selloff took Autodesk to new 52-week lows.

The question for investors now is: is now the right time to buy Autodesk on the dip?

My stance on Autodesk remains neutral. There are a lot of things the company is doing right. Demand is holding up relatively strong, and outside of the pause of business in Russia, management notes that end-customer demand as well as usage of the company’s software continues to increase. The company is holding a firm line on expenses, improving its operating margins and free cash flow. And in addition, Autodesk has deployed its balance sheet to buy back a hefty chunk of stock as it has been falling (although it may have pulled the trigger too soon; in Q1 the company reported that it bought back $464 million worth of stock at an average price of $212).

At the same time, however, we have to ask: are there any meaningful catalysts that can take Autodesk beyond current levels? In my view, Autodesk’s YTD share price crunch is largely a function of its stock returning to normalized, pre-pandemic valuation levels. I’m not sure that the company’s fundamentals truly warrant much of a premium beyond where it’s trading today.

At Autodesk’s current share prices near $188, the company has a market cap of $40.62 billion. After we net off the $1.62 billion of cash and $2.63 billion of debt on Autodesk’s most recent balance sheet, the company’s resulting enterprise value is $41.63 billion.

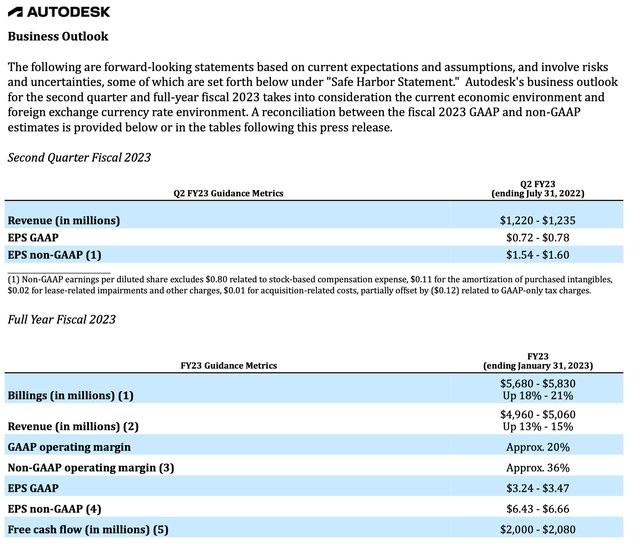

Meanwhile, for the current fiscal year, Autodesk has guided to $4.96-$5.06 billion in revenue, representing 13-15% y/y growth. We note as well that the company’s billings plan of 18-21% y/y growth appears robust, but the 16% y/y billings in Q1 is lagging behind this target. The company has also pointed to $2.0-$2.08 billion in free cash flow, or a 41% FCF margin; as well as $6.43-$6.66 in pro forma EPS.

Autodesk FY23 outlook (Autodesk Q1 earnings release)

Against the midpoints presented in this outlook, Autodesk trades at multiples of:

- 8.3x EV/FY23 revenue

- 20.4x EV/FY23 free cash flow

- 28.7x P/E

None of these multiples exactly screams cheap. I worry about investing too quickly in a company like Autodesk which is still trading at “normalized” valuation multiples when so many other software stocks are trading at deep bargain-basement discounts.

The bottom line here: I do believe Autodesk can rally back into the low $200s in a broader market rebound. At the same time, however, I’m directing the majority of my portfolio into small/mid-cap, truly beaten-down names that will be far more sensitive to upside momentum (favorite names at the moment include Coupa (COUP), Sumo Logic (SUMO), Twilio (TWLO), and Asana (ASAN)). I’m remaining on the sidelines here, unless Autodesk drops materially further or its fundamental improve dramatically without a corresponding jump in share prices.

Q1 download

On paper, Autodesk had a solid Q1 earnings print. However, I don’t see anything in particular that justifies Autodesk rallying significantly beyond its current share price.

Let’s now discuss the latest Q1 results in greater detail – take a look at the Q1 earnings summary in the table below:

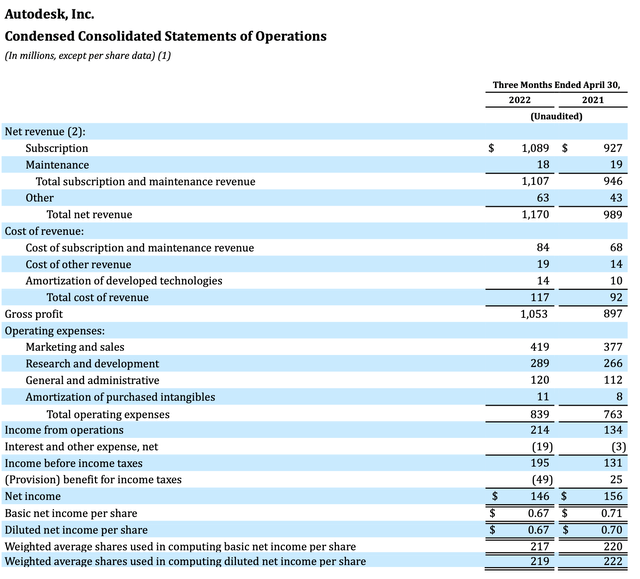

Autodesk Q1 results (Autodesk Q1 earnings release)

Total revenue grew 18% y/y to $1.17 billion in the quarter, slightly accelerating over Q4’s 17% y/y growth pace and marginally beating Wall Street’s expectations of $1.15 billion (+16% y/y) by a two-point margin.

Autodesk’s Architecture, Engineering, and Construction segment (‘AEC’), its largest at 44% of Q1 revenue, reported some key milestones in the quarter. It signed its second largest ever enterprise agreement with an infrastructure company. The Construction Cloud product also reported its best-ever quarter for new business, reporting both growing contract sizes and improved renewal rates. The company also launched a new product called Bridge, specifically aimed at helping subcontractors. In the design and manufacturing segments, meanwhile, Autodesk reported that legacy customers continue to accelerate their transition into the cloud.

Andrew Anagnost, Autodesk’s CEO, commented as follows on go-to-market performance and customer demand on the Q1 earnings call:

Beyond the immediate impact in Russia, other leading indicators trend positive. For example, usage remained steady in Europe during the quarter and grew in America and Asia-Pacific region; building connected bid activity again hit record levels; and our partner channel remains optimistic. The strong momentum sets us up well for the remainder of the year.”

One slight area of concern for me is billings, which grew only 16% y/y in the quarter to $1.13 billion. Now, billings as a metric is a double-edged sword, as many seasoned software investors are aware. On the one hand, it’s a great indicator of future growth because it captures deals signed in any given quarter that are not immediately recognized as revenue. But billings is also subject to deal timing, which makes it a lumpy metric that will be more volatile than revenue.

Autodesk’s Q1 billings was lower in terms of both growth percentage points and dollars versus revenue, which may be a leading indicator of growth deceleration. The company cited $115 million of direct billings impact from the decision to halt business in Russia. Now, Autodesk is still guiding to 18-21% y/y billings growth for FY23, so it’s possible that it is expecting more deal closings in the rest of the year. But until we see such results materialize, it’s hard to count on it.

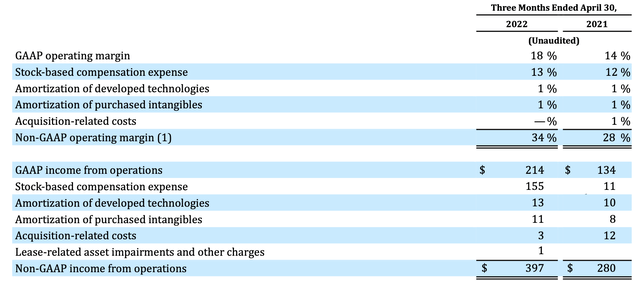

From a profitability standpoint, Autodesk excelled. The company’s pro forma operating margins expanded six points to 34%, driven by operating expense discipline. Pro forma operating income grew 42% y/y to $397 million, while Q1 free cash flow also grew 34% y/y to $422 million.

Autodesk operating margins (Autodesk Q1 earnings release)

Key takeaways

To me, there’s truthfully not much that is exciting about Autodesk. It may be tempting to buy this brand-name software stock when it’s ~30% down on the year, but I think the majority of this drop owes to a much-needed valuation reset. Be patient here and remain on the sidelines.

Be the first to comment