da-kuk/iStock via Getty Images

This article first appeared in Trend Investing on March 11, 2022, but has been updated for this article.

As chaos reigns in Europe with the Russia-Ukraine war, Australia offers investors a safe haven that is set to benefit from rising commodity prices. International borders and state borders have recently reopened and COVID-19 restrictions are now mostly removed, allowing the services based economy to thrive once again.

The Australian stock market is currently well valued, has a good yield, and the country is now getting back on its feet after COVID-19.

Today I look at the iShares Core S&P/ASX 200 ETF [ASX:IOZ] (“IOZ”), an index fund that tracks the top 200 Australian stocks.

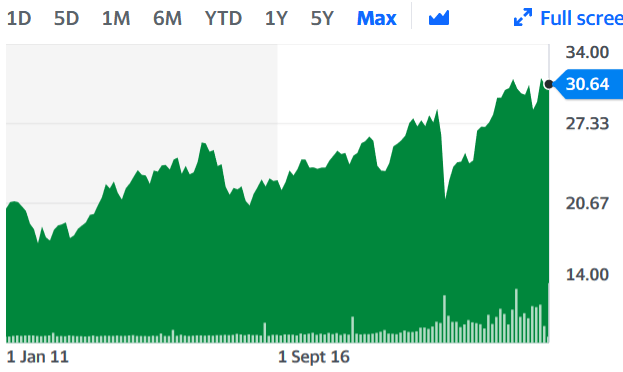

iShares Core S&P/ASX 200 ETF [ASX:IOZ] – Price = AUD 30.64

The iShares Australia ASX200 Fund [ASX:IOZ] (“IOZ”) is up 2.6% in 2022.

IOZ long term price chart

Yahoo Finance

Russia and Ukraine’s loss is Australia’s gain

The West is stepping up sanctions on Russia. On March 8, 2022 it was announced that “Biden bans US imports of Russian oil, gas and coal“. The UK decided to follow with a ban of Russian oil by the end of 2022, and Europe will try to wean itself of Russian energy this decade. Europe has recently agreed to ban Russian coal and is still considering a ban on Russian oil and gas. Then on April 12, 2022 Reuters reported: “Russian oil embargo could be part of next EU sanctions package, ministers say.”

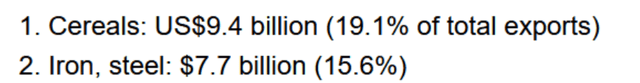

Below is a summary of some key commodities that may see supply problems and higher prices due to the current war. Quoted from my recent article “A Look At Some Winners And Losers If We Get A Russia-Ukraine War“:

Russian exports (with gas possibly excluded) may also be sanctioned, which could lead to spikes in prices of key commodities (oil, gas & coal) and metals (precious metals, iron ore/steel, nickel, aluminum, or uranium) and agricultural products (grains such as wheat, corn, sunflower).

Ukraine is well known for its agricultural, mining, and manufacturing industries. Key agricultural products include corn, wheat, sunflower oil, timber, sugar, dairy, meats, honey, and nuts. Mining products include natural gas, oil, coal, iron ore, chalk, limestone, and manganese.

Russia’s top exports

Ukraine’s top exports

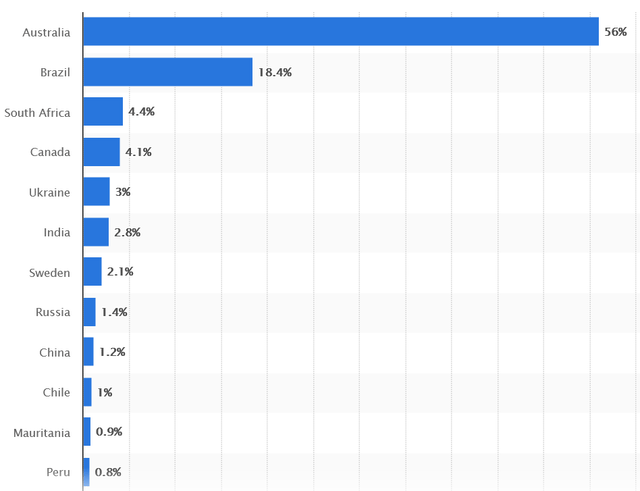

Note: Cereals is mostly wheat and corn, and iron is iron ore. Iron ore is a key export of Australia.

A look at what drives the Australian economy

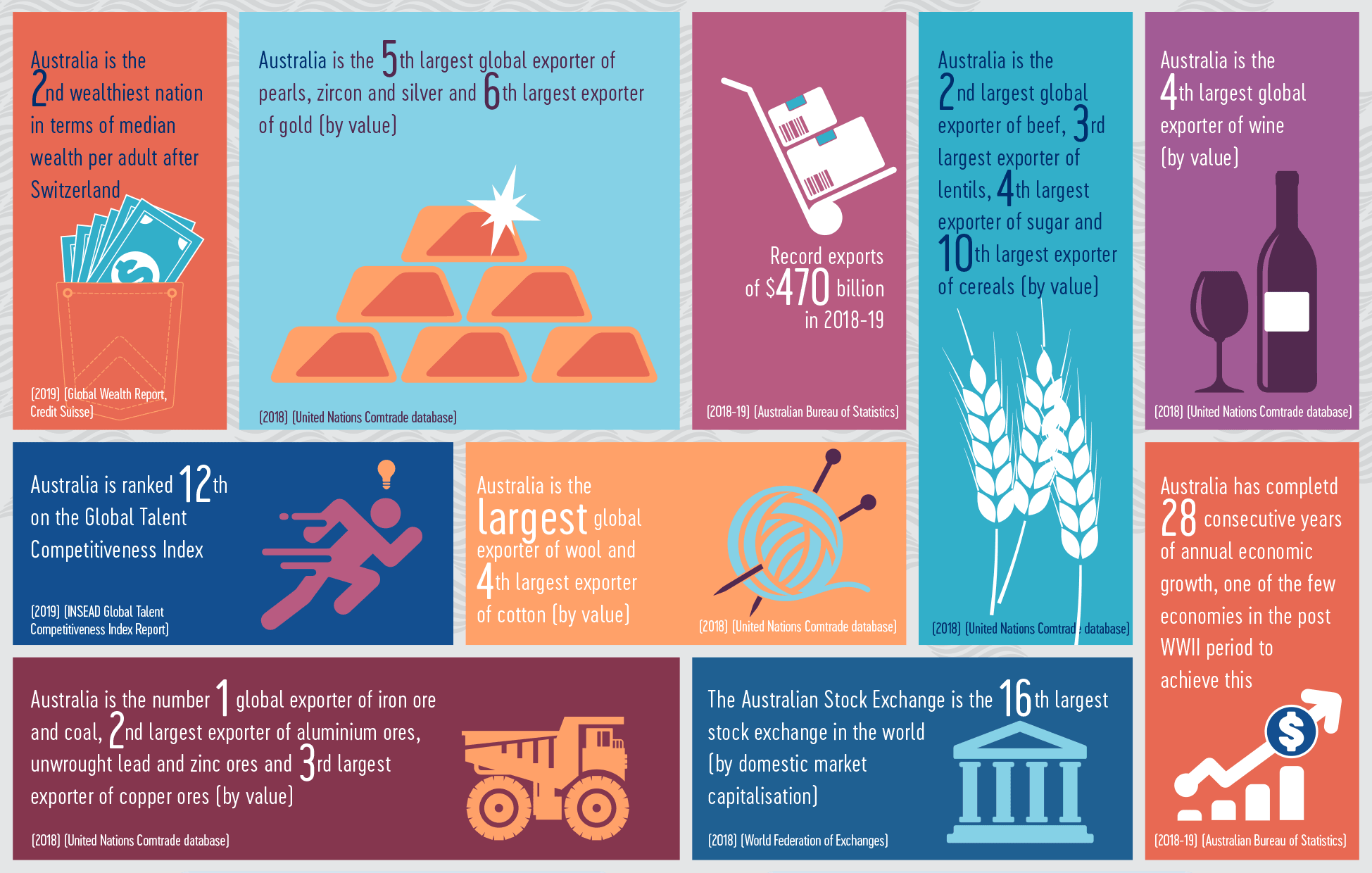

Australia has a population of ~26 million with an IMF GDP forecast of 4.1% pa growth in 2022.

According to Wikipedia:

Australia is the world’s 13th largest economy and has the tenth highest per capita GDP (nominal) at US$55,692……An emphasis on exporting commodities rather than manufactured goods has underpinned a significant increase in Australia’s terms of trade since the start of the 21st century, due to rising commodity prices.

Or put another way, Australia is a huge mining country that relies heavily on commodity exports, particularly iron, coal, and natural gas, but also other commodities and agricultural products (wheat etc.)

Trading Economics states:

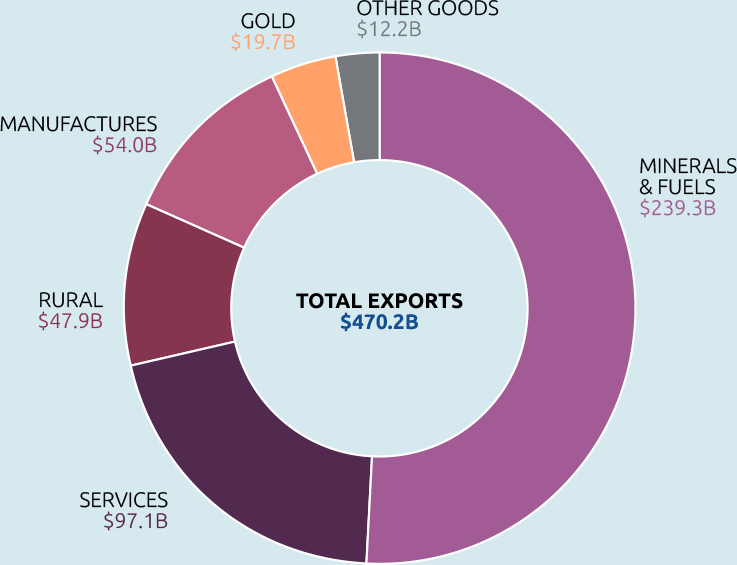

Rich in natural resources, Australia is a major exporter of commodities. Metalliferous ores and metal scrap account for 29 percent of total exports; coal, coke and briquettes for 15 percent; and gas for 7 percent. The country also exports: food and live animals (14 percent), mainly meat (5 percent) and cereals (4 percent); manufactured goods (6 percent), mainly non-ferrous metals (4 percent); and machinery and transport equipment (6 percent).

Australia’s largest export markets are China (32 percent of total exports), Japan (16 percent), South Korea (7 percent), the US (5 percent), India (4 percent), New Zealand, Singapore and Taiwan (3 percent each).

Note: Metalliferous ores refers to iron ore. Bold emphasis by the author.

Australia is also the world’s largest exporter of lithium, a surging new industry where the China spot lithium carbonate price is up 11x in the past 15 months, trading at a near record CNY 482,500/t (~USD 77,788/t).

Key summary points

- Australia is a global leader in mining and agriculture. Iron ore dominates, but coal, natural gas and other commodities are also significant.

- The Russia-Ukraine war is helping Australia by pushing up commodity prices.

- Australia exports almost nothing to Russia, so Russian sanctions have negligible impact on Australia.

- Export services are also important to Australia and include international student education and tourism.

Australia’s exports 2020 at a glance

DFAT.gov.au

Summary of the Australian economy (2018 data)

DFAT.gov.au

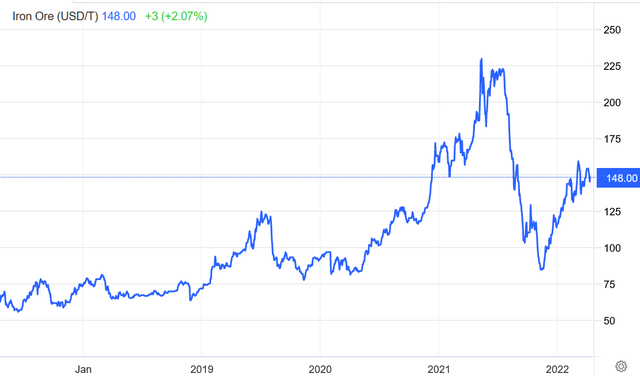

War is good for iron ore

It is well known that war creates an increased demand for iron ore to build the weapons and then later rebuild the damaged buildings and infrastructure. You also need to factor in the increased demand for iron ore as countries ramp up their military spending and weapons production increases.

If Ukraine and Russia’s iron ore production is reduced/stopped/sanctioned, that potentially reduces global supply by about 4.4%.

So the Russia-Ukraine war may lead to an increased demand and reduced supply of iron ore.

Distribution of global iron ore exports in 2020, by major country

The major driver of global iron ore demand is global construction and auto manufacturing. China is by far the largest user of iron ore, and hence the China housing and infrastructure market are key factors.

Iron ore price chart shows iron ore prices rising since the war started on Feb. 24, 2022

The iShares Core S&P/ASX 200 ETF [ASX:IOZ] Details

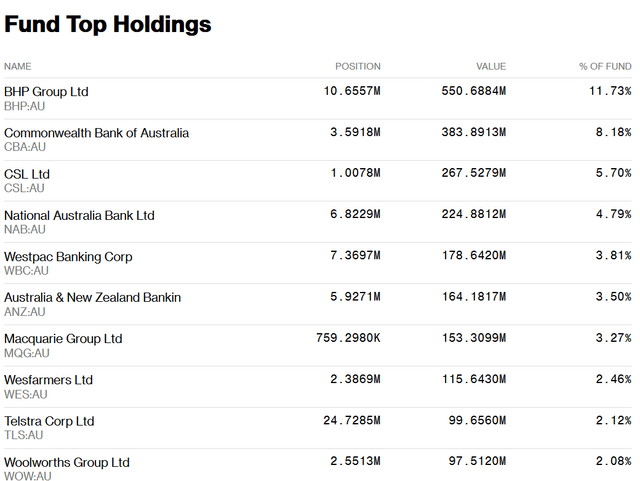

The iShares Core S&P/ASX 200 ETF [ASX:IOZ] (“IOZ”) aims to provide investors with the performance of the S&P/ASX 200 ‘Accumulation Index’ (growth + dividends), before fees and expenses. The index is designed to measure the performance of the 200 largest Australian securities listed on the Australian Stock Exchange (“ASX”).

The IOZ fund has 200 holdings, A$4.67 trillion in assets, is denominated in Australian dollars, has a management fee of 0.09%, is re-balanced quarterly, and pays quarterly distributions.

The ten-year average return is 9.89% pa.

As of March 9, 2022, the current PE ratio is 17.45 and last year’s distribution yield was 3.92%.

As shown below, mining giant BHP Group (BHP) is the largest holding. Next are the various big five Australian banks (CBA, NAB, WBC, ANZ, Macquarie). The rest of the top ten is made up of biotech giant Commonwealth Serum Laboratories [ASX:CSL] (OTCPK:CSLLY), food and retail group Wesfarmers [ASX:WES] (OTCPK:WFAFF) (OTCPK:WFAFY), national phone company Telstra [ASX:TLS] (OTCPK:TLSYY) (OTCPK:TTRAF), and food retail giant Woolworths [ASX:WOW] (OTCPK:WOLWF). Another large miner, Rio Tinto (RIO), sits just outside the top ten.

Top ten holdings

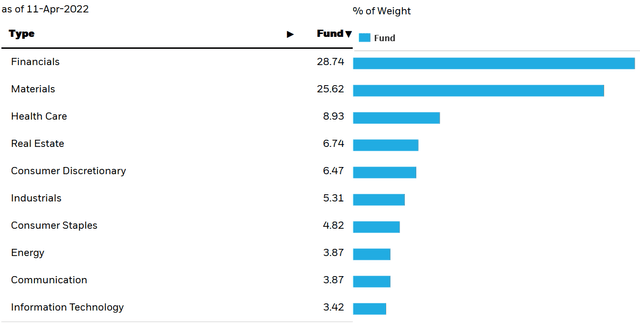

Breakdown by sector of the IOZ fund

As shown below, financials (28.74%) and materials (25.62%) are the top 2 sectors by far. The financial sector (mostly the Australian retail banks) is in good shape and have been doing well thanks to Australia’s obsession with property and borrowing huge sums of money. As mentioned earlier, the materials sector is doing well due to strong commodity prices (particularly iron ore, coal, gas).

Consumer spending is a key factor of the Australian economy and this looks set to pick up with the reopening of borders and removal of COVID-19 restrictions. Higher gasoline prices, some food inflation, and high household debt are negatives.

Risks

- Macroeconomic risks. COVID-19, Russia-Ukraine war or any events that slow the global economy.

- Australia is an export backed economy, so a global slowdown will impact their economy. Australia and China have had poor recent relations with China banning some of Australia’s exports. To date, this has not applied to iron ore, as China is currently dependent upon it. This may change in future years; however, Australia can also export to other countries.

- Debt – Australia’s government debt (~40% debt/GDP by in Q2 2022) has ballooned as a result of COVID-19. This may potentially place downward pressure on the Aussie dollar currency. Private debt to GDP is high at 211% at the end of 2020. This means Australian consumers are vulnerable to interest rate rises, especially if they rise fast.

- Currency risk. The stocks and IOZ fund are priced in Australian dollars. The AUD tends to be a risk-on currency and can do poorly compared to the USD during risk-off times. A key risk for investors would be if the AUD falls relative to their currency.

- Fund risks – The IOZ fund is very large and liquid and typically trades very near to NTA value, so fund risks are minimal. It is managed by Blackrock, a global leader.

- Market sentiment.

Alternative Australian ETF option

- iShares MSCI Australia ETF (NYSEARCA:EWA) – EWA is the USA investor version of IOZ listed on the NYSE. IOZ is listed on the ASX. The main difference is that EWA is priced in USD and has a higher (0.5%pa) expense ratio.

Further Reading

- March 2022 – The Guardian – Fuel and food prices set to rise as Russian invasion affects Australia’s economy. Reliance on commodity exports may assist country as world scrambles to find non-Russian sources of energy, metals and food.

- Australia announces fresh sanctions against Russian ‘propagandists’

-

How a Russian invasion of Ukraine will affect Australia – AFR “…..a surge in the oil price would result in a rise in coal and liquified natural gas [LNG] prices as buyers searched for energy substitutes. As a major exporter of both, Australia would benefit from that rise.”

- Feb. 2022 – ‘Welcome back world!’: Australia fully reopens borders after two years

- April 9, 2022 – Ukraine Corn, Wheat Exports Will Plummet Further, U.S. Says

Conclusion

Australia continues to be the ‘lucky country’. This time the Russia-Ukraine war has benefited Australia by pushing up prices for commodities. This ultimately helps the Aussie dollar and the Aussie stock market.

The end of COVID-19 restrictions is also a huge boost to the Australian ‘services industry’ as it welcomes back international tourists, students, and immigrants. The retail economy is also set to benefit as businesses get back to normal.

As a result of the war sell-off, the iShares Core S&P/ASX 200 ETF (IOZ) trades on a PE ratio of 17.45 and 3.92%pa yield. This makes the Australian share market well suited for investors chasing a relatively safe yield with a reasonably low valuation.

Risk relates mostly to any global/China growth slowdown or China trade disputes, especially those that reduce Australia’s exports or key export commodity prices. Please read the risks section.

I rate the IOZ (or EWA) ETF as a solid buy. IOZ is best suited for a 5-year plus time frame.

As usual, all comments are welcome.

Be the first to comment