Ronald Martinez

AT&T (NYSE:T) is an American multinational company that has gone up 20% over the past few weeks. The company is still yielding more than 6%, despite this recent strength, and we do expect additional weakness to appear. As we’ll see throughout this article, despite this recent weakness, we expect the company to continue outperforming.

AT&T Business Priorities

AT&T’s business priorities are to deliver substantial shareholder returns while focusing on its growth.

AT&T has focused on growing customer relationships with 2.2 million new postpaid phone additions YTD. The company managed to also add nearly 1 million fiber subscribers. The company is focused on improving efficiency across its businesses while increasing its ARPU which will enable the company to both grow and generate increased returns.

The company is focused on deliberate capital allocation for both 5G and fiber while strengthening its balance sheet. The company reduced its balance sheet by more than $25 billion YTD and is continuing to provide strong returns. The company expects $14 billion in FCF to support its dividend yield of more than 6% while leaving $6 billion leftover.

AT&T 3Q 2022 Performance

AT&T has a strong quarter, on the back of several stronger than expected quarters for the company.

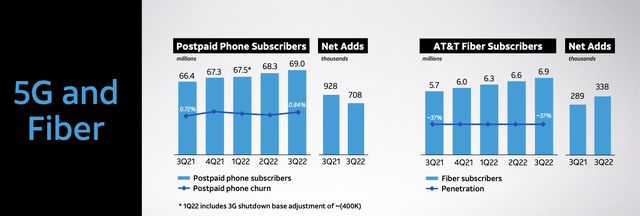

AT&T has managed to consistently increase its postpaid phone subscribers, by more than 1% quarterly, showing the continued strength of its business. That’s despite the loss of 400 thousand subscribers from the company’s shutdown of its 3G business. The company’s continued growth here of its postpaid phone subscribers is impressive to see.

The more impressive aspect of the company’s business is its AT&T fiber business a rapidly up and coming business as the company works to build the next generation of internet. The company managed to add more than 300 thousand subscribers in the quarter, but more importantly, it maintained a 37% penetration despite rapidly increasing the available customers.

The company’s ability to maintain penetration in that scenario implies that if it stopped expanding available locations so fast, it would be able to increase penetration. The company currently has almost 19 million customer locations and we expect that to continue increasing substantially. That continued growth will add billions in additional revenue.

AT&T 3Q 2022 Financial Results

AT&T has continued to perform incredibly well financially, showing its exceptional strength.

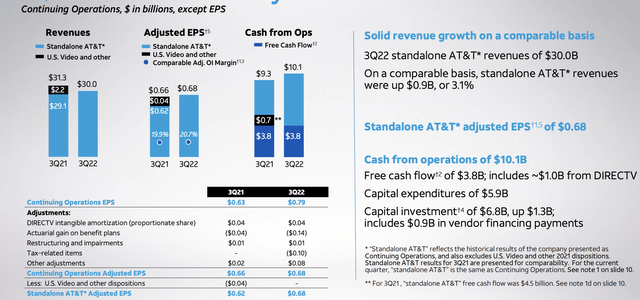

AT&T has the ability to continue generating strong financial results. The company earned $3.8 billion in FCF for the quarter supported by $1 billion from the DirecTV stake and it is continuing to maintain its guidance for $14 billion in annual FCF. That FCF will support the company’s dividends and continued shareholders returns.

The company’s revenues have increased some YoY along with its EPS. The flat FCF with growing cash from operations and substantial capital investments shows the company’s improving operations. After a messy 2Q for the company, we expect it to be able to continue improving its operations and proving its ability to generate FCF.

Our View

AT&T’s struggle continues to be three-fold.

The first is that the company is focused on two capital intensive projects. 5G rollout and the expansion of the company’s fiber business are both projects that cost billions. As long as the company continues to focus on expansion, we expect that it’ll spend billions if not tens of billions on these projects, hurting cash flow.

The second is that the company is working through a complex transition. It recently spun-off Warner Bros. Discovery and it’s now working on consolidating its operations through complicated procedures. Included in this is substantial synergies and various targets the company has for consolidating its operations. How that pans out will define the company’s ability to continue.

Lastly, the company still has a massive debt load, one as large as the company’s market capitalization. That debt load continues to cost the company more than $6 billion annualized, placing a substantial drag on both its FCF and its ability to drive its future shareholder returns. Until it cleans that up the company’s returns will struggle.

Thesis Risk

The largest risk to our thesis is that AT&T has previously struggled with execution. The company’s prior struggles have hurt the company’s ability to drive shareholder returns and we expect that could continue. The company once talked about massive share buybacks and keeping its integrated portfolio of assets together. That was before the Warner Bros spin-off. What happens remains to be seen but management tends to rapidly change direction.

Conclusion

AT&T is one of the largest companies in the world, and despite the company’s substantial debt load, it maintains a unique ability to generate FCF. The company’s annualized FCF is $14 billion and that’s after the massive $6 billion the company continues to spend on interest for its debt. The company’s $130 billion debt load maintains a substantial risk.

Going forward, we expect AT&T to continue to pay its dividend yield of 6% which is more than manageable as a holdover. The company also has $6 billion in leftover FCF after that dividend. As long as it continues to pay down its debt and improve operations, we expect the company to be able to generate substantial long-term shareholder returns.

Be the first to comment