Ronald Martinez

AT&T (NYSE:T) submitted a much better than expected earnings sheet for the third quarter that included better revenue and earnings per-share than projected and strong net additions in the booming 5G and fiber businesses. For those reasons, shares of AT&T soared 8% yesterday. Additionally, the company generated $3.8B in free cash flow in the third quarter which is more than enough to cover the dividend which costs AT&T approximately $2.0B a quarter. Since AT&T did not cut its free cash flow guidance for FY 2022, I believe AT&T continues to represent deep value for dividend investors!

AT&T crushed expectations for its third quarter

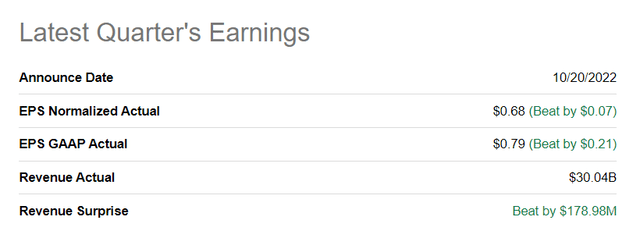

AT&T submitted a strong earnings report yesterday that saw the telecom beating Wall Street’s expectations both on the top and the bottom line. AT&T generated $30.0B in revenues in Q3’22 which was $179M better than the forecast. Earnings were reported at $0.68 per-share compared to a prediction of $0.61 per-share.

Seeking Alpha: AT&T’s Q3’22 Results

The earnings report sent shares of AT&T up to 10% higher before they ended the day about 8% in the green. The reason for the price surge was that AT&T managed to present a strong financial quarter that erases concerns about the telecom’s dividend sustainability. Key to the company’s strong performance is the fiber business which is where AT&T is growing extremely fast and acquiring a lot of new customers.

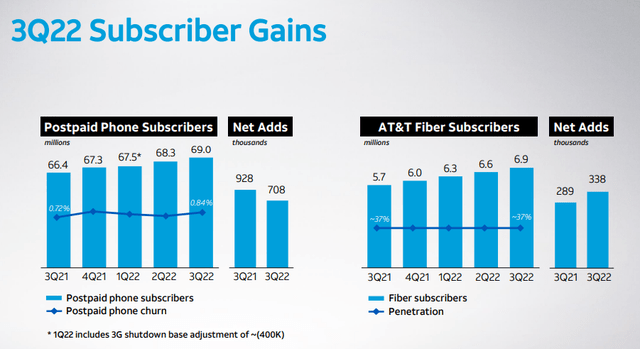

In the third quarter, AT&T had 338 thousand fiber net adds which showed an increase of 49 thousand acquired customers compared to the year-earlier period. According to AT&T, the third quarter was the second-best quarter ever for AT&T’s fiber business regarding customer acquisition and the eleventh straight quarter of net adds exceeding 200 thousand.

The third quarter brought AT&T’s fiber subscribers to a record 6.9M, showing an increase of 1.2M new subscribers compared to last year. At the same time, AT&T managed to sign up new subscribers in the postpaid phone business as well: 708 thousand new net adds were reported for Q3’22.

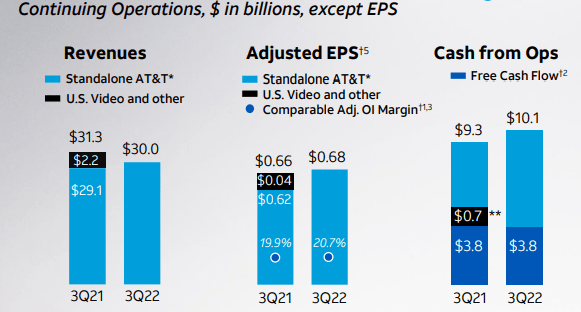

Business momentum in core segments translates to strong financial performance

Possibly the biggest take-away from the earnings report was that AT&T managed to cover its quarterly dividend payment of approximately $2.0B with free cash flow. AT&T reported $3.8B in free cash flow in Q3’22 on total operating cash flow of $10.1B. The dividend payout ratio, based off of free cash flow, was 53%, indicating that AT&T has no issues covering its dividend.

AT&T Q3’22 Results

FY 2022 free cash flow guidance confirmed, reducing uncertainty

AT&T confirmed that it is planning for $14.0B in free cash flow for the current fiscal year. January through September, AT&T’s business operations generated a total of $5.9B in free cash flow. To meet its guidance for FY 2022, AT&T is looking at $8.1B in free cash flow in Q4’22. Since AT&T did not cut its guidance, the company appears to believe that it will indeed achieve its free cash flow target which is reducing uncertainty for investors.

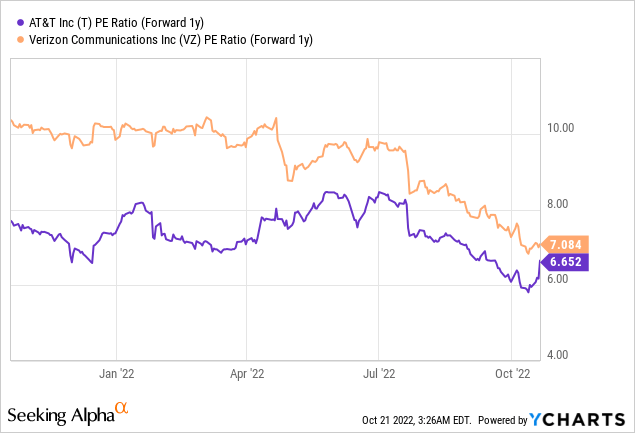

Valuation of AT&T

AT&T, based off of free cash flow, is still cheap, despite the stock surging almost 8% yesterday. Working with $14.0B in free cash flow this year and considering that the telecom has a market cap of $119B, the stock is trading at a P-FCF ratio of 8.5 X. Based off of earnings, AT&T is trading at 6.7 X FY 2023 earnings. Shares of AT&T and Verizon (VZ) are both cheap as investors widely expected both companies to see weaker free cash flow this year due inflation pressuring consumers with their bill payments.

Risks with AT&T

I believe that AT&T’s dividend risks are exaggerated. The telecom covered its dividend payment in the third quarter and business momentum in 5G and fiber strongly indicates that AT&T is on the right track. The company also didn’t cut its free cash flow outlook for FY 2022, meaning AT&T continues to plan with $14B in free cash flow this year. What would change my mind about AT&T is if the company failed to meet its free cash flow target badly in Q4’22.

Final thoughts

AT&T’s third quarter earnings report showed that the rebound is finally here. Key business momentum in postpaid and fiber indicates that AT&T’s stock price has fallen too far and that investors have turned too bearish on the stock. Since AT&T covered its dividend with free cash flow easily in the third quarter, I believe the stock has continual rebound potential. The yield of 6.6% remains highly attractive for defensive dividend investors and I don’t see AT&T cutting its dividend any time soon!

Be the first to comment