Ronald Martinez/Getty Images News

Investment Thesis

As the Fed grapples with inflation, leading experts, such as the former Federal Reserve of New York president, predict a recession. These projections might be true, but personally, timing the market isn’t my virtue. For all I know, the duration, extent, and severity of a potential economic downturn are already priced in today’s frail market. For this reason, I continue building up my positions, gradually adding more shares as we go through these turbulent times, and sticking to a long-term investment strategy that matches my goal of building a retirement fund.

I have never been a fan of AT&T (NYSE:T). I started writing this piece a year ago. Still, I never published it because AT&T was so complex that the sheer attempt to graph subscriber numbers was a toil. Repeated organizational restructuring forced management to regroup and redefine various business segments, hindering the ability to study historical subscriber trends. These figures are critical, culminating in everything the company offers, from network quality to marketing campaigns, customer service, and market position, who are otherwise difficult to assess. Below are some notes from the unpublished draft.

AT&T changes the way it counts prepaid subscribers to exclude session-based tablets

Beginning with the first quarter of 2015, we have updated our definition of prepaid subscribers to exclude session-based tablets, which are now included with connected devices. Prepaid subscribers now consist primarily of phone users. On this revised basis, prepaid subscribers decreased 3.6% when compared to the first quarter of 2014. Q1 2015 report

AT&T restructures business segments after the acquisition of DirectTV

Due to recent organizational changes and our July 24, 2015 acquisition of DIRECTV, effective for the quarter ended September 30, 2015, we are revising our operating segments to align with our new management structure and organizational responsibilities Q3 2015 report

AT&T combines business and consumer segments

To most effectively implement our strategies for 2018, we have realigned certain responsibilities and operations within our reportable segments. The most significant of these changes is to report individual wireless accounts with employer discounts in our Consumer Mobility segment, instead of our Business Solutions segment Q1 2018 report

AT&T stops reporting many segments

Due to organizational changes and our June 14, 2018 acquisition of Time Warner, effective for the quarter ended September 30, 2018, we revised our operating segments to align with the new management structure and organizational responsibilities, and have accordingly recast our segment disclosures for all periods presented. As a result of the realignment to combine all domestic wireless products and services into the Mobility business unit, which is now one of our reporting units, $27,568 of goodwill from our former Business Solutions segment and $16,540 from our former Consumer Mobility segment was reallocated to the Mobility business unit. Q3 2018 report

For this reason, AT&T’s pitch of unlocking value by simplifying operations resonates well with me. I finally added AT&T shares to my portfolio, partly because of the benefits of the planned divestments and, more importantly, the expected dividend from the Warner Spin-off, appearing as stocks in the new venture Warner-Discovery, which I plan to sell, to reduce exposure to the difficult to follow video streaming market. The analysis below sheds light on the risks/rewards of AT&T Remain Co.

The Leg-pulling Oligopoly Facade

Telecom service is essentially a commodity. At a certain level of speed, consumers are indifferent to data providers. How many people you know are psyched about 5G? Consumers want consistent, standard, workday service, which I term “quality network,” at a reasonable price. These two channels are the primary ways a carrier can differentiate itself from competitors. The lack of avenues for differentiation forces telecom companies to focus their marketing efforts on price and consistency of standard service. Today, for wireless data, this standard is 4G. This is an important concept to remember to keep investors grounded against much-touted “growth” plans and “favorable industry trends” trumpeted by pundits. Given the commodity-like characteristics of communication services, the industry is marked by intense price wars and heavy capital expenditure, an unattractive combination for those looking for above-average returns. Thinking about my new investment, after the spin-off, I will be holding a business characterized by low ROA, which I am okay with, given the current price, but still mindful not to mistake appearances of oligopoly with pricing power.

5G

The 5G rollout is now more Public Relations than sales and marketing at this stage. The service is available at no extra cost on most wireless plans. AT&T, Verizon (VZ), and T-Mobile (TMUS) glorify the tech because of fear of being perceived as having an inferior network. There are no applications or software for 5G that can meaningfully drive demand. Historically apps and software followed hardware installations of wireless technologies (2G, 3G, LTE, and 4G), and in the few times this order switched, contention followed. Think, for example, when Apple rolled facetime. At that time, the AT&T network capacity couldn’t handle such an app, pushing management to block it. The benefits of 5G for AT&T are strategic, allowing it to lower data prices to match competitors installing the same tech in anticipation of the day it becomes the new wireless data standard. In previous articles, I pointed out that upstream tech companies in the 5G supply chain are better positioned to profit from the 5G rollout than wireless carriers.

The problem is that 5G installation is pretty expensive and requires new hardware on tens of thousands of sites. The monetary rewards are not as big as many think. The entire debate around net neutrality stems from carriers’ desire (led by AT&T) to charge content providers, i.e., Netflix (NFLX), for accessing its “pipes” because the industry leaders feel they are not being rewarded monetarily for their investment, a frustration shared by shareholders.

5G threatens to cannibalize AT&T’s fiber-optic business and broadband. I have a 4G phone, which I use as a hotspot for my laptop and sometimes the kids’ iPads, Xbox and SmartTV. I have never tested the network’s maximum capacity. Still, I did connect four devices at once, with at least two screens streaming videos without interruptions. When I get a 5G mobile, I will test my 5G coverage, and if it is good, I will most likely unsubscribe from broadband and use it as a hotspot, which is a faster and cheaper alternative.

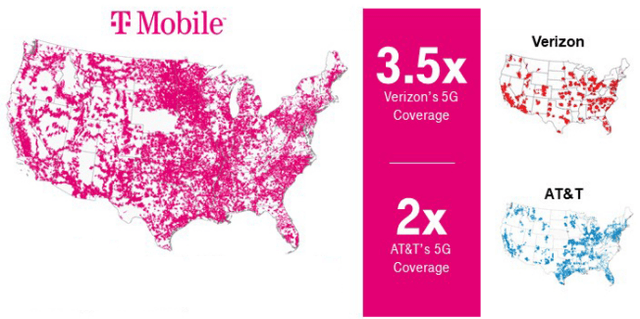

Currently, 5G is more about the market image, with T-Mobile leading the race. But financially, I don’t see the tech creating a jump in carriers’ revenue.

Expected Returns

Before the restructuring, AT&T was a dividend aristocrat, growing dividends for more than three decades. Last month’s dividend decrease was the first for a long time, alienating many of its fixed-income-hungry shareholder base, suppressing shares. However, when AT&T grew dividends, it demonstrated the viability of its core operations as a lucrative, cash-flow, and relatively stable business. Currently, the forward dividend stands at 0.28$ per quarter, translating to a 4.6% annual yield, in line with peers.

I am happy with these figures, but what prompted me to make the purchase is the Warner dividend. On April 5, will receive 0.24 shares for every AT&T share I own. Last week, AT&T released more details on the planned spin-off. From this new data, and based on AT&T’s number of shares, spin-off conversion rate, and the 71% control of current AT&T shareholders of the new venture, I estimate that the total number of shares of the new entity is 7.2 billion/0.71 = 2,448,991,795 shares

The average Price/Sales ratio of five leading video streaming companies is 3.2x. However, this includes outliers such as Netflix and Roku (ROKU), two popular video streaming tickers with above-average multiples. In my opinion, Disney (DIS), Comcast (CMCSA), and Discovery (DISCA) are closer comparables.

Using the average Price/Sales multiples of these three yields a 2.1x ratio. Using 2021 Warner and Discovery Sales ($12 billion + $35 billion = 47 billion), the estimated price per share of Warner Discovery is $38. Thus, the stock dividend I will receive is around $9 for every stake in AT&T, translating to a 37% yield in one day! Nonetheless, one should heed that these are rough estimates, and how the market values the new Warner Discovery is yet to be seen. Also, shares in AT&T remain co might depreciate at the April 5 record date.

| Company | Price/Sales |

| Netflix (NFLX) | 5.34x |

| Roku (ROKU) | 4.10x |

| Disney (DIS) | 3.41x |

| Discovery (DISCA) | 1.2 |

| Comcast (CMCSA) | 1.88x |

| Average | 3.2x |

Data from Seeking Alpha

Final Thoughts

Some investors buy the three major carriers, thinking that competition is a zero-sum game, where a loss of one carrier is the win of another. That’s not entirely accurate. The market is more like a Prisoner’s Dilemma, where, unless all carriers collaborate on pricing (which is illegal), all wireless providers lose.

The industry is characterized by intense competition and high capital costs. Rapid technology changes only exacerbate these dynamics, counterbalancing the utility-like demand for communications. Nonetheless, AT&T demonstrated the ability to joggle these contradicting elements to deliver on a dividend growth strategy. If it wasn’t for the Warner spin-off, AT&T might have maintained dividends.

The spin-off offers a lucrative one-time dividend. Shares are trading at record lows, suppressed by management’s decision to divest and cut the dividend, alienating a broad segment of its fixed-income oriented shareholder base. Although historically, I have never been a fan of the telecom industry, this situation is too attractive to ignore. For this reason, I am buying AT&T.

Be the first to comment