Kar-Tr/iStock via Getty Images

It’s old news that AT&T (NYSE:T) stock took a pummeling following last week’s earnings results. The stock took an immediate tumble of over 7%. A downgrade by Barclays the following day, citing “execution risk,” sent the shares dropping another 3%.

Pundits noted Q2 FCF cannot cover this quarter’s dividend. Also, management’s response to a question regarding dividend policy was interpreted by some as meaning a dividend cut is possible.

Lost in the commotion that followed the results are the long term trends that are shaping AT&T.

The Good, The Bad And The Homely

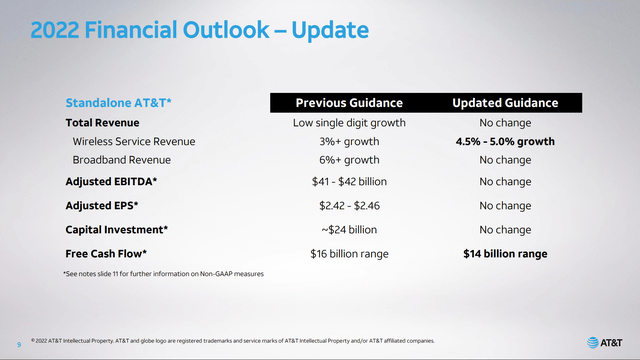

Much ado surrounded the announcement that management cut FCF guidance for the fiscal year from $16 billion to $14 billion. It behooves investors to understand fully the causes of the change in the forecast. After all, if this is a one-off event, then it is of little import over the long haul.

Two contributing factors in the reduction in FCF are macroeconomic in nature. I turn to management’s commentary during the earnings call for color:

…we’re seeing inflationary pressures. And we estimate those to be more than $1 billion above the elevated cost expectations embedded into our outlook. We’re clearly operating in different times, and the macroeconomic backdrop is evolving in a dynamic manner.

…on the consumer side of our business, we’re seeing an increase in bad debt to slightly higher than pre-pandemic levels as well as extended cash collection cycles.

…we’re seeing some longer collection cycles and inflationary costs that we’ve not been successful in fully offsetting. These cash flow impacts, along with expectations for a more tempered economic climate in the latter half of the year, have led us to adjust our cash flow expectations for the full year…

Although I admit the $1 billion in inflation related costs seems a bit hefty, I would argue that veteran investors expect to see macroeconomic headwinds affecting most companies at this juncture. The “longer collection cycles” are likewise a symptom of the current economic conditions.

Management added that consumers’ responses fit a typical pattern seen during times of economic malaise.

…it’s important to note that historical patterns in previous economic cycles suggest customers have managed their accounts similar to what we’re experiencing today. …We view this cycle no differently and still expect customers will pay their bills, albeit a little less timely.

As previously stated, there was some focus on the fact that Q2 FCF fell below the dividend payouts for the quarter. T devoted $2.09 billion to dividend payments in Q2. Since FCF for the quarter was $1.4 billion, that means the company has a payout ratio of approximately 150%.

However, FCF for Q2 is affected by AT&T spending much of the capex budget during the first half of the fiscal year.

While free cash did come in lower than we expected this quarter, there were several notable factors that drove this. The first is the timing of higher success-based investments on the back of our robust customer growth. Additionally, we front-end loaded our capital investment plans in order to kick-start our growth initiatives.

In perusing scores of AT&T articles over the last week, I’ve seen authors interpreting the response to a question regarding future dividend payments as casting doubt on management’s commitment to paying the dividend at the current level.

Can you comment a little bit on your dividend policy going forward? Is it a priority to grow the dividend by various amounts?

Frank, look, we’ve been pretty clear on the dividend policy as to what we’re doing. And the board ultimately makes this call and this decision. And as I’ve said before, we set this at what we think is an incredibly attractive return in the market right now. And I think we are still standing there relative to the yield on the stock. As I said, the Board will evaluate dividends, along with other choices in front of us to return to shareholders. As we’ve indicated, our priority right now is to get the balance sheet where we want it, which is a full rush and push to getting to 2.5x, and then we can evaluate what other options are at that point in time. And those other options will range from whether or not we want to do something on dividend policy or something we want to invest more back into the business or whether we want to push on some buybacks. And those decisions will be weighted at the time when we have those options in front of us and evaluate the market as to where it stands.

John Stankey, CEO

I emphasized some of the above sentences because there are pundits who have focused solely on those portions of Stankey’s response. When taken in that context, it can appear as if the CEO is prevaricating in regards to future dividend payments.

I would argue that this ignores a number of rather strong statements management has made in the past few quarters.

We also expect to remain a top dividend-paying company after deal close, with a dividend payout in the $8 billion to $9 billion range where anywhere in that range should rank us among the best dividend yields in corporate America.

John Stankey, CEO, Q4 2021

I could provide additional testimony related to the firm’s dividend policy. Suffice it to say that the current payout ratio is at the lower end of AT&T’s targeted dividend payout range, and that the decreased annual FCF projections are well above the company’s current annual dividend payments.

I contend that a one-time shortfall in FCF that leads to a high payout ratio for a quarter is of little consequence over the long haul.

While investors were set aback by the cut in projected annual FCF, there were a number of positives to be found in the quarterly report. Adjusted for the Warner spinoff, DirecTV transaction, and Latin American asset sale, total revenue increased 2.2% year-over-year.

Seeking Alpha

Aside from the downgrade in FCF, management is standing by its previous guidance, with one notable exception. By front loading capex, AT&T is experiencing a surge in wireless service revenue. The company reported that over the last 8 quarters, it led the industry with 6 million postpaid phone net additions.

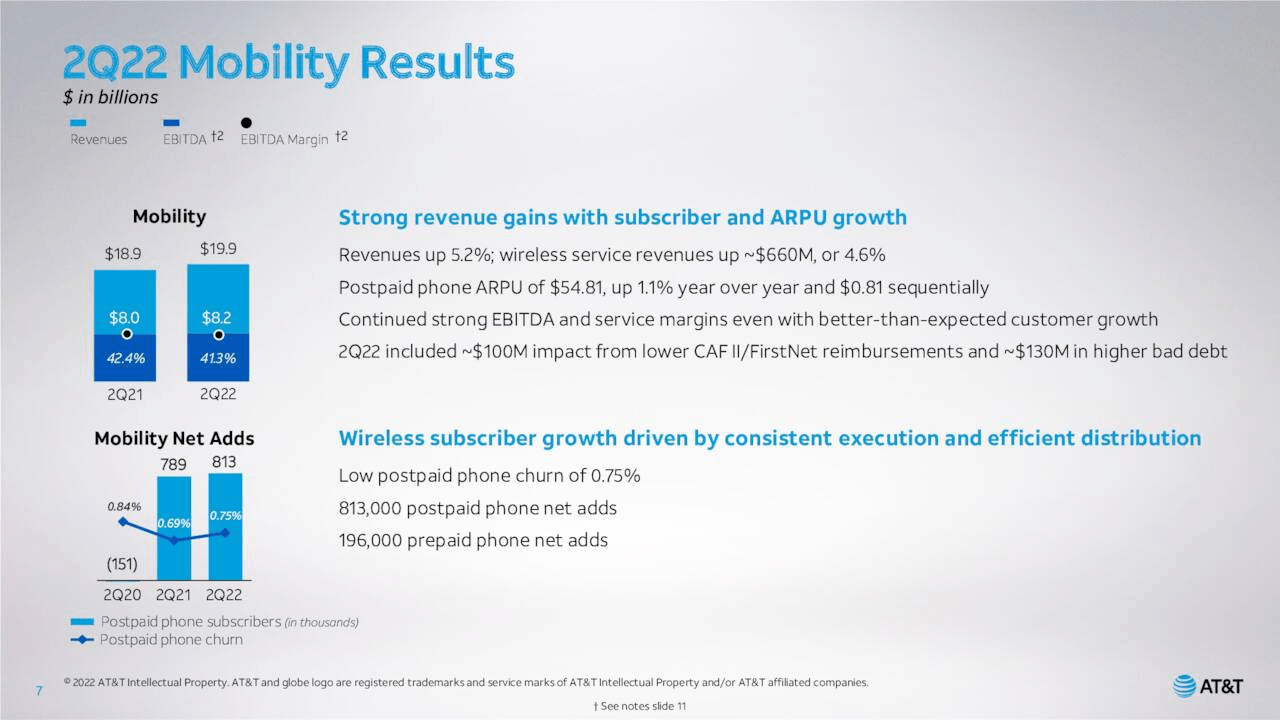

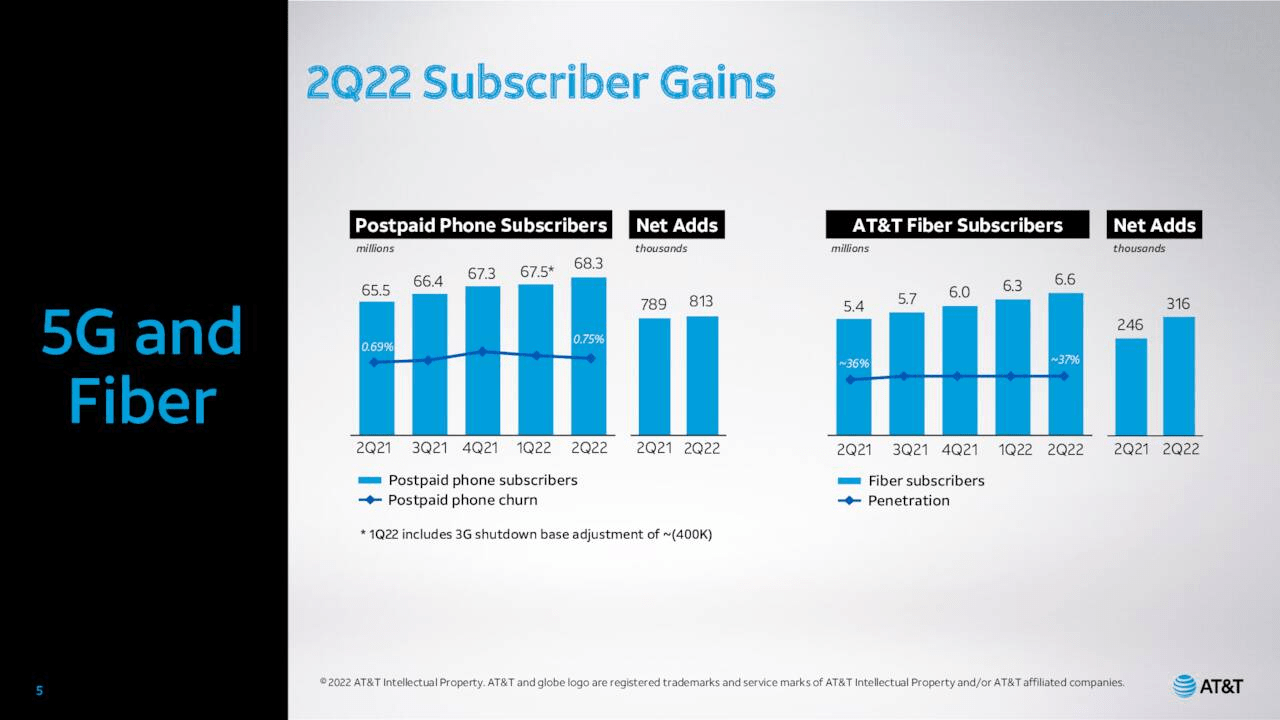

T added 813,000 postpaid phone customers during Q2 alone. That’s a year-over-year increase from 798,000, and marks the strongest second quarter in a decade. Average revenue per postpaid phone customer also increased by 1.1%.

In June, AT&T initiated a price hike on older wireless plans. Individual plans were increased by $6 per month while family plan rates increased by $12 additional monthly. There was a bit of angst expressed by observers from this move. The fear was that there would be a marked increase in churn related to the price increases. However, management credits the price increases as a contributing factor in ARPU growth, and expects increased momentum in that metric in the latter half of this year.

It is important to take note of the strength in AT&T’s wireless Mobility results, as that business generates nearly 70% of post-spinoff revenue.

Seeking Alpha

Mobility EBITDA increased by 2.5% year over year, and management projects improved Mobility-adjusted EBITDA in the second half of the year.

AT&T’s Fiber also gained 316,000 net subscribers during the quarter. This marked the tenth consecutive quarter in which the company recorded more than 200,000 fiber net adds. Over the last 8 quarters, T increased the number of fiber subscribers by 50%.

T also leads the industry over the last 8 quarters with 6 million net postpaid phone additions.

Seeking Alpha

AT&T’s Debt, Dividend And Valuation

AT&T’s total debt at the end of Q2 was $136 billion. That is down from $209 billion at the end of the previous quarter. The company’s credit ratings are at the lower range of investment grade.

The net debt/EBITDA ratio was 3.23x at the end of 2Q22. The company’s goal is to lower that ratio to 2.5x by the end of 2023.

The current yield is 6%. With the revised FCF numbers, the payout ratio should be roughly 60%. However, management has repeatedly stated that a range of $8 billion to $9 billion is the amount of FCF that will be devoted to dividend payments. The current annual payout falls in the middle of that range.

I view the likelihood of a dividend cut as very low. However, I also believe management will opt to either freeze the dividend or provide a token increase while the macroeconomic environment remains challenging.

As we’ve indicated, our priority right now is to get the balance sheet where we want it, which is a full rush and push to getting to 2.5x.

John Stankey, CEO

AT&T currently trades for $18.35 per share. The average one year price target of the 19 analysts that cover the stock is $23.43. The price target of the 6 analysts that treated the stock following the last quarterly report is $22.16.

T’s forward P/E is 7.88x, well below the stock’s 5 year average P/E of 12.71x.

This also compares well to that of Verizon (VZ), which has a forward P/E of 9.26x.

Summation

I will admit that I was somewhat surprised by the market’s reaction following management’s lowered FCF guidance. Perhaps investors viewed AT&T as an inflation-proof stock. I think this comment by John Stankey during the earnings call not only sums up the problems T faces, but also stands as a cautionary tale for a wide variety of companies.

And when you see 9% inflation, it tends to hit those in the low end of the market really, really hard. And it’s difficult when you walk up to the gas pump and have to fill the car, and you get the electric bill coming in and you see the kind of step-ups that people are seeing. And I think there’s an adjustment period that goes on.

John Stankey

Assuming management’s forecasts are accurate, we can take Q2 as a one-off event, or at worst as a headwind that will subside in time, but not as a crippling blow.

Furthermore, there is substantial reason to lend credence to AT&T’s projections. The company plans for significantly lower capex in the latter part of the year Furthermore, late paying customers are a normal phenomenon in this environment. Assuming past trends are repeated, customers will delay payments rather than opting out of service.

Investors should note that T will have no 3G shutdown costs in 2023, and the lower cash interest expense from retiring $73 billion in debt will increase cash flow. Management also expects that cost cuts in the Business Wireline division will produce more than $300 million in savings in 2023. The company forecasts FCF to bounce back to $20 billion in 2023.

The lowered debt load is just one mark of the progress the company has made. As I previously noted, approximately 70% of the firm’s revenue is generated by wireless services, and that segment is growing stronger.

In Q1 of 2017, T held less than a third of US wireless subscriptions. By Q1 2018, the company had garnered 37.7% of the wireless market. That increased to 39% in Q1 2019, 41.8% in Q1 2020, 44.8% in Q1 2021, and stood at 43.3% in Q1 of this year.

Management is doing exactly what investors have clamored for: AT&T is returning to its roots.

I view the sell-off as overblown, and I consider the stock to be trading at valuation that provides a margin of safety.

Consequently, I rate AT&T as a BUY.

I will note that investors are unlikely to witness significant growth in AT&T for the foreseeable future.

AT&T guides for low single-digit revenue growth in 2023.

In terms of its current yield, AT&T ranks among the top ten companies in the S&P 500. AT&T is for inventors that seek a large, safe yield, with the understanding that the stock’s total return is likely to underperform the markets over the long haul.

With rare exceptions, I am a dividend growth investor. My preference is for companies that provide a well funded, rapidly growing dividend. However, I devote a fraction of my portfolio to companies with outsized, safe yields. AT&T qualifies as such, and I added to my position in the stock following the Q2 results, after the share price dropped by roughly 10%.

Be the first to comment