PM Images

Written by Nick Ackerman. This article was originally published to Cash Builder Opportunity members on August 13th, 2022.

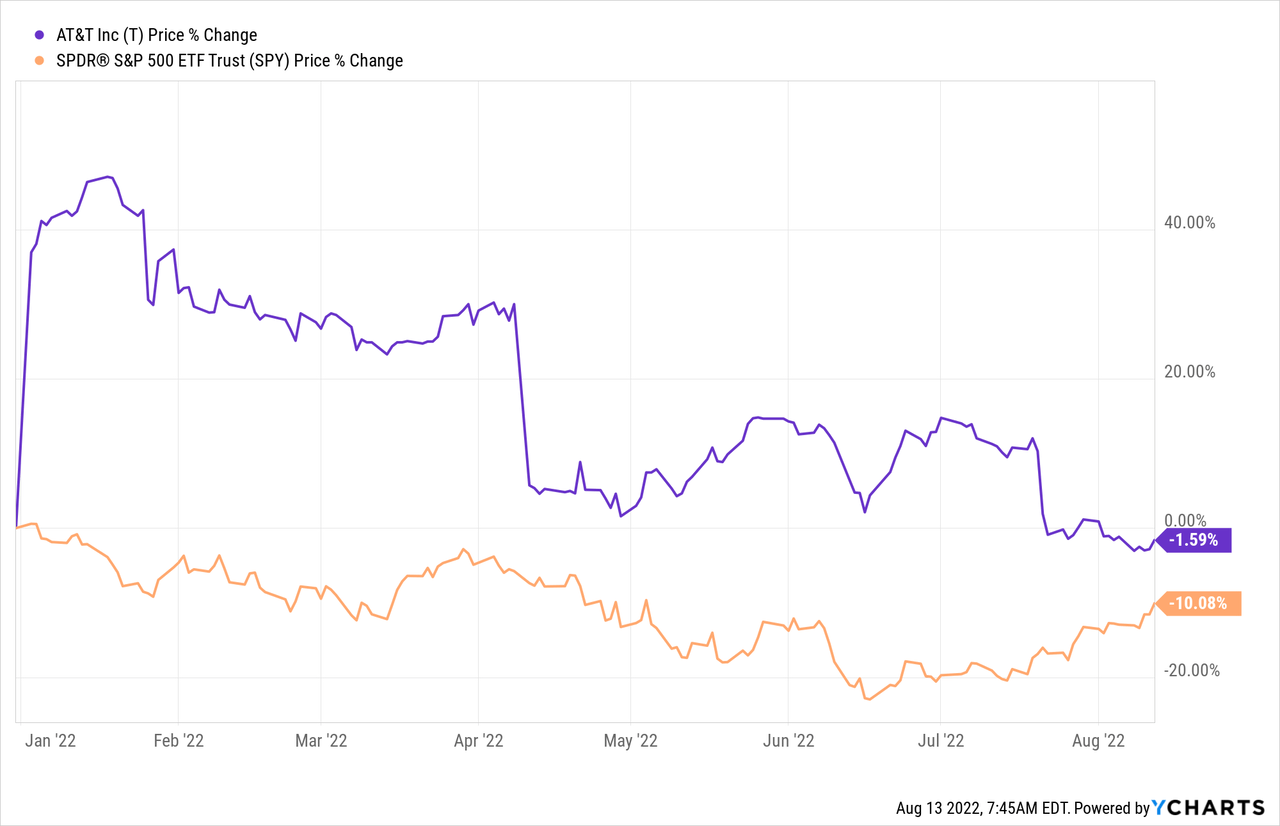

The overall market has been rallying from its June lows. However, one stock sitting out of that rally has been shares of AT&T (NYSE:T). After a good earnings report but a free cash flow guidance slash from an expectation of $16 to $14 billion, the stock nosedived. It has only recovered a bit from that earnings crash. That being said, shares of T are still outpacing the broader market on a YTD basis.

Ycharts

We noted some of these challenges when we looked at Verizon (VZ) previously. T had added the most postpaid subscribers in over a decade in that latest quarter. Certainly, a strength I didn’t see happening as they’ve been raising prices, while competitors such as T-Mobile (TMUS) aren’t. Though TMUS isn’t raising its monthly subscription prices, TMUS is raising some fees.

We should continue monitoring these changes as investors to see the impact. For now, consumers have shown a strong resilience across the board as inflation hikes up prices of nearly everything.

One of the main causes for concern is that the dividend comes into question with a reduced cash flow. That would be after they had just cut their dividend in half earlier this year after the WarnerMedia and then merging into Warner Bros. Discovery (WBD) spin-off.

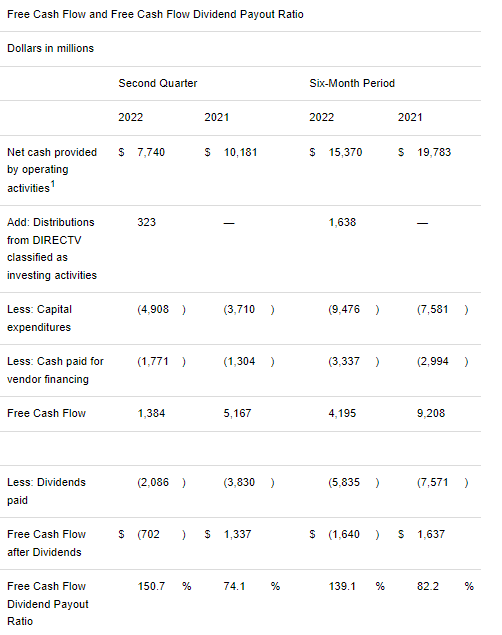

T Cash Flow Dividend Payout (T Earnings)

Of course, that is something that should be concerning. The free cash flow dividend payout ratio is 150.7% in the latest quarter. We see a free cash flow payout ratio of 139.1% for the first six months. That’s certainly the wrong direction to be heading in after making a significant adjustment to your dividend already.

T is an income play at the end of the day. They made their thoughts on the dividend quite clear in the latest call. They had previously called for being a “dividend competitor.”

I think we’re a dividend competitor moving forward, meaning I want the dividend to remain at a competitive level relative to others out in the market, which means I’ll pay attention to the yield of the dividend…

…we’ll pay attention to the yield, but I don’t necessarily intend to every quarter look at it and say my expectation is that I have to grow the dividend in any given quarter relative to not answering the question of how do we stand competitively in the market and whether or not we think we’ve got the right kind of mix of how we’re investing our capital and deploying it within the business.

With this latest conference call, John Stankey was pressed more to clarify what a sort of dividend policy would be.

Q. Frank Louthan

Can you comment a little bit on your dividend policy going forward? Is it a priority to grow the dividend by various amounts? That would be great. And then on part of the business side, I think you commented earlier this year about exiting some lines of business that were really low to no margin. How is that going? And to what extent is that impacting the declines that we’re seeing in the business line?

A. John Stankey

Frank, look, we’ve been pretty clear on the dividend policy as to what we’re doing. And the board ultimately makes this call and this decision. And as I’ve said before, we set this at what we think is an incredibly attractive return in the market right now. And I think we are still standing there relative to the yield on the stock. As I said, the Board will evaluate dividends, along with other choices in front of us to return to shareholders. As we’ve indicated, our priority right now is to get the balance sheet where we want it, which is a full rush and push to getting to 2.5x, and then we can evaluate what other options are at that point in time. And those other options will range from whether or not we want to do something on dividend policy or something we want to invest more back into the business or whether we want to push on some buybacks. And those decisions will be weighted at the time when we have those options in front of us and evaluate the market as to where it stands.

Our intent is to ensure that we’re returning a good and competitive dividend out to our shareholders, which we have today. And we’ll continue to be mindful of that as we go forward and we see the stock price adjust in what occurs in the value of the business.

I think that pretty much seals the discussion that they aren’t looking to raise their dividend any time soon until they get a healthier balance sheet. Quite frankly, we all probably knew that already. To get this extra color, without saying it specifically, I would say it confirms our suspicions.

At the end of the day, this is a healthy thing. I’d rather they focus on paying down their debt. Net debt was down to $131.9 billion at the end of the quarter from $168 billion last year. That brought net debt-to-adjusted EBITDA to 3.23x.

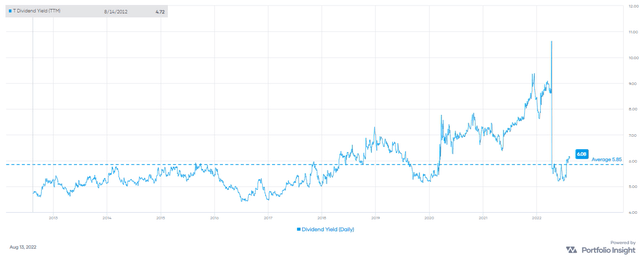

We are looking at a dividend yield of around 6% at the current price. That’s a pretty strong and “competitive” dividend if I ever saw one.

T Dividend Yield (Portfolio Insight)

I continue to believe that the dividend is quite safe. I don’t expect another cut, at least not soon after the latest one. The main reason is that they still expect most of their free cash flow to come up in the year’s second half.

The latest quarter saw them payout just over $2 billion, so we can extrapolate and assume around $8 billion for the full year. $14 billion is a considerable amount of cash flow that they are targeting, which is more than enough to cover the dividend plus pay off some debt. They are expected to hit $2.54 in earnings on an EPS basis. That would translate to a payout ratio of just 43.7%. Analysts believe that 2023 EPS will be similar, then slowly rise from there.

I think that is why it’s premature to start talking about cuts. Of course, they could continue to guide this down, which would be cause for concern and something to pay attention to.

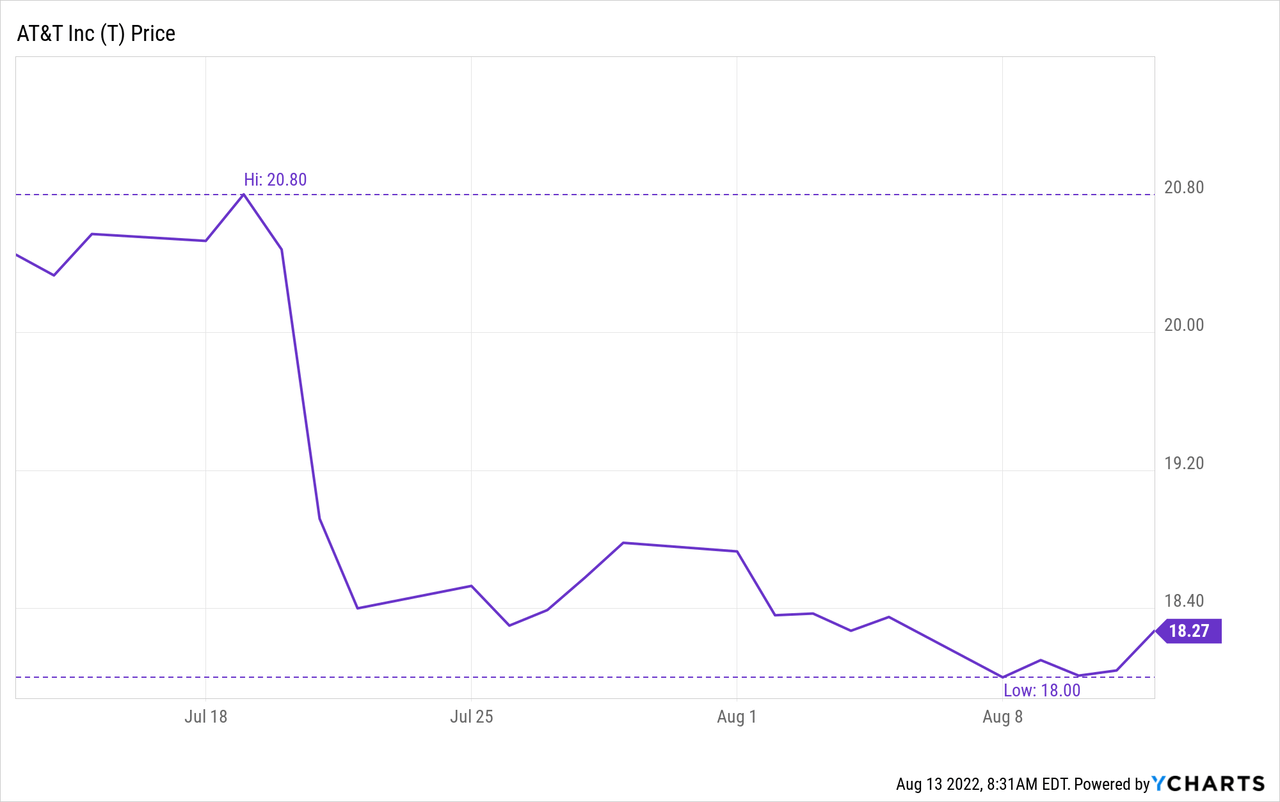

AT&T Stock Trade

That all leads to why the discussion on T is coming up today. That’s because, with the latest options expiration date, I’m taking the assignment of shares of T. The trade was entered in on July 13th, knowing that we were getting some extra premium due to the earnings report that would be coming up.

Shares were at $20.32, and we went with the $19 strike price, which allowed for around a 6.5% decline before the strike price would be breached. We collected $0.24 per share or $24 per contract. That brought the breakeven of the trade down to $18.76. The potential annualized return [PAR] came to an attractive 15.37% if we could do this similar trade every 30 days.

Once the earnings hit, that pushed the stock below our $19 strike. The stock has never recovered from this level yet – despite the strong market we’ve experienced overall.

Ycharts

While that could be discouraging, I’m happy to hold a high-yielding dividend payer. This isn’t our first trade on T; we have several in the books. We’ve been assigned before and ultimately had those shares called away to complete our option wheel strategy. This is actually our 11th trade on the shares between writing puts and covered calls. Here are all of the trades that are documented and easily found in our “Option Writing Tracker” spreadsheet.

What’s Next?

T’s next ex-dividend date should be coming up in early October if history repeats itself. Therefore, if we want to capture that dividend, we should look at potential expiration dates after that. One potential option here could be the October 21st, 22 expiration.

- $19 strike price with the latest bid at $0.36 would put the PAR at an attractive ~10%

However, it isn’t absolutely necessary that we necessarily wait for that dividend anyway. It would put us out after the ~30 days I generally target. The October 21st, 22 expiration is 69 days away from the time of writing. We could write nearer-dated calls, leaving us with several more potential outcomes.

One outcome would be that the trade simply expires worthless, and then we write more calls after that.

Shares could also rise, and we could take the opportunity to roll the position or close it out before having shares called away.

Another outcome could be that we simply allow the shares to be called away if the price rises above our strike. We could then turn around and write more puts to start the whole process over again.

Going with nearer-dated options will collect a small amount of premium, but the turnover of the trades will be quicker. T is a low-priced stock, so the premiums reflect that. However, it’s easy to do 5, 10 or even more contracts. At the end of the day, I think it can still translate into some attractive PAR percentages.

- September 16th expiration at the $19 strike could collect $0.14 for a PAR of 7.9% over 34 days.

- September 30th expiration at the $19 strike could collect $0.24 for a PAR of 9.6% over 48 days.

Those are just some of the potential trades that we could look at going forward that I believe present a fairly attractive PAR. My loose target is to collect a higher yield than the stock pays itself when writing covered calls.

Be the first to comment