Justin Sullivan

Those who follow my work know by now that I run a very concentrated portfolio. At this time, I only have shares of six different companies. And one of those firms happens to be telecommunications conglomerate AT&T (NYSE:T). Recently, the company has taken a beating, plunging in price in response to general market pessimism. However, the stock can only get so cheap and the data available today suggests that, in the long run, upside potential is significant. But of course, this picture can change over time, and the most vital periods to look at when evaluating the attractiveness of any opportunity is when the firm in question reports financial results. Lucky for investors, the management team at AT&T is due to report financial results covering the third quarter of the company’s 2022 fiscal year in just a few days. Heading into that release, investors would be wise to keep an eye out on a few key items. These, in aggregate, will go a long way to determining whether or not the picture for the company has changed for the better, the worse, or stayed more or less the same.

Watch AT&T’s debt and cash flows

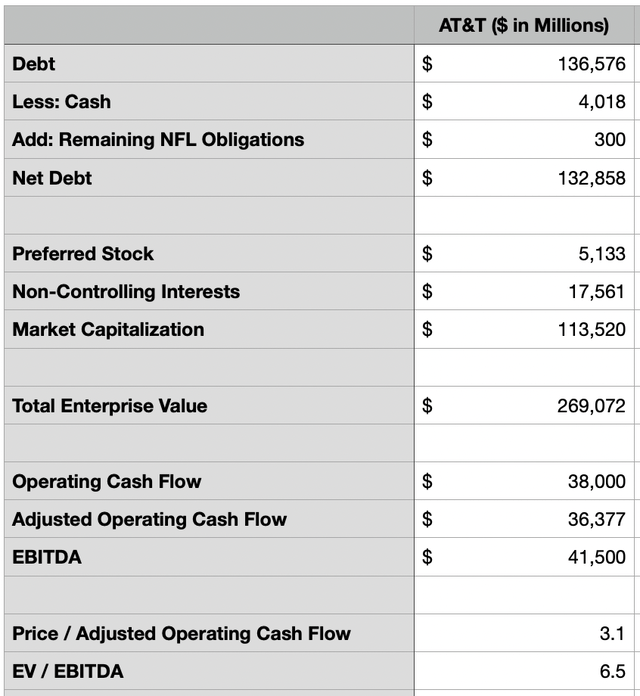

Before the market opens on October 20th, the management team at AT&T is expected to report financial results covering the third quarter of the company’s 2022 fiscal year. Why all the market will initially be focused on headline items like revenue and earnings per share, I do believe that there are other metrics that are more important for investors to pay attention to. One of the most significant would be the amount of leverage the company has on its books. You see, at the end of its 2021 fiscal year, the business had net debt of $157.65 billion. By the end of the second quarter, that number had been reduced to $132.56 billion.

Management’s goal has long been to get the net leverage ratio of the company down to 2.5 or lower by the end of the 2023 fiscal year. This was one of the driving factors behind the company’s decision to spin off WarnerMedia and merge it with Discovery to create Warner Bros. Discovery (WBD). At present, management is forecasting EBITDA, at the midpoint, of $41.5 billion for the current fiscal year. That would imply a net leverage ratio of about 3.19. If we assume that EBITDA will rise to the $44 billion that management had previously forecasted for the 2023 fiscal year, keeping net debt unchanged would bring this down to 3.01. To get to the 2.5 target, the company would need to pay down debt in the amount of $22.56 billion between now and the end of next year.

This is a massive task. But it brings me to another item that investors would be wise to pay attention to. Namely, this is the amount of cash the company generates. Prior to the second quarter earnings release, management was forecasting operating cash flow this year of $40 billion. Free cash flow had then been forecasted at $16 billion, with half of that going to dividends and the remainder being used for debt reduction. But in the second quarter earnings release, free cash flow was forecasted to come in at about $14 billion instead as capital expenditures remained unchanged. This means lower operating cash flow as well.

For the purpose of my own analysis, I do believe that a more appropriate measure of operating cash flow that belongs to common shareholders would be $36.38 billion. This factors in payments associated with preferred distributions and non-controlling interests. But irrespective of what that number is, investors would be wise to pay close attention to what management reports. Because how much cash flow is generated in this quarterly timeframe will go a long way to determining how the rest of the year looks. For context, in the second quarter this year, the firm generated operating cash flow of $15.37 billion and adjusted operating cash flow (cash flow without working capital adjustments) of $18.84 billion.

Growth is vital

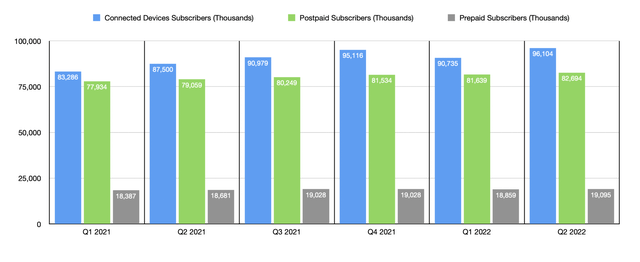

Many investors likely view AT&T as an old-school company without much growth potential. However, there are some aspects of the company that are growing nicely. My most important part in recent years has been the Connected Devices category of the firm, which I have written about multiple times in the past. In the second quarter of this year, the company reported 96.10 million subscribers under this category. This was up from the 90.74 million that the company had just one quarter earlier. It also compares favorably to the 87.50 million that the company had in the second quarter of 2021. What’s really fascinating is that this year-over-year growth completely glosses over the fact that in the first quarter of this year, the company lost 8.8 million subscribers because of its decision to end support for 3G devices. Otherwise, year-over-year growth would have been even greater. How well the company does in this category will help to determine whether or not this is still a growth story.

Investors should also pay close attention to the company’s other growth initiatives. For instance, during the second quarter, management said that the company’s goal is to target 100 million people by the end of the year in terms of exposure to its 5G network. This came after the company hit the 70 million limit during the quarter, ultimately encouraging them to increase their expected target that was previously between 70 million and 75 million. Ultimately, the company is aiming for 200 million by the end of its 2023 fiscal year. Meanwhile, the company is continuing to push on with its fiber growth. As of the end of the second quarter this year, the company had reached 18 million customer locations, thanks in large part to 316,000 net additions during that quarter. They are still targeting 30 million customer locations by the end of 2025.

AT&T shares are dirt cheap

While it’s great to see progress in each of these categories, none of these alone guarantee that the company would be an attractive investment. At the end of the day, investors should only buy into a firm that they think they can purchase at a discount to its true value. Based on the estimates I used in a prior article for cash flow and adjusting for the reduction in operating cash flow that the company should see now for 2022 as opposed to what was previously anticipated, I calculated that the firm is trading at a forward price to adjusted operating cash flow multiple of 3.1 and at a forward EV to EBITDA multiple of 6.5.

To put this in perspective, rival Verizon Communications (VZ) is trading at a forward price to operating cash flow multiple of 4.1 and at an EV to EBITDA multiple of 7.2. Frankly, I believe both of these companies are meaningfully undervalued. Given their quality and long-term potential, not to mention their stability, I believe that they should be trading at least double what they are at today. Having said that, even if AT&T were to see its valuation match what Verizon is exhibiting, we would see upside, based on the price to operating cash flow approach, of up to 32.3% compared to today’s pricing. Instead, using the EV to EBITDA approach, upside would still be an impressive 26.2%.

| AT&T | Verizon Communications | |

| Price / Operating Cash Flow | 3.1 | 4.1 |

| EV / EBITDA | 6.5 | 7.2 |

Takeaway

Based on all the data provided, I continue to be amazed that shares of AT&T are as cheap as they are today. In my opinion, the market’s downturn has created the kind of buying opportunity that most investors can only dream of. Although the company is not the largest position in my portfolio, I do still add to it as the stock drops. Naturally, this means that I have a ‘strong buy’ rating on the enterprise right now. And unless something changes materially for the worse, I cannot imagine that picture changing anytime soon.

Be the first to comment