sx70

A Tale Of Two Telcos

The last few years have been the best of times and worst of times respectively for Verizon (NYSE:VZ) and AT&T (NYSE:T). AT&T’s former management made large, ill-advised acquisitions of DirecTV in 2015 and TimeWarner in 2018. While Verizon made its own questionable media acquisition with Yahoo in 2017, it was much smaller and less of a drag on overall performance. The market certainly punished AT&T for these decisions as we see in the total return performance of the stock compared to Verizon’s. The chart below covers the period from the closure of the Time Warner merger on 6/15/2018 to the announcement of the spinoff of WarnerMedia (WBD) on 2/1/2022. AT&T delivered no return in that time frame even including dividends while Verizon returned over 30%.

Even before the media spinoff was announce however, AT&T stock has been quietly outperforming Verizon, as we see on the 2022 YTD chart.

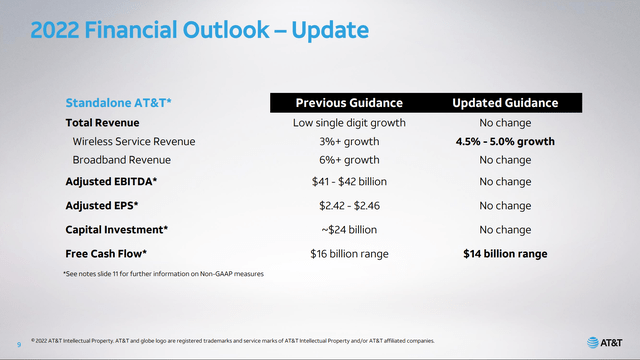

As we see at the end of the chart, both companies disappointed the market with their 2Q 2022 results, with AT&T reporting on 7/21 and Verizon reporting on 7/22. AT&T reported disappointing free cash flow due to higher capital spending and a longer collection period for receivables. Nevertheless, AT&T reported strong wireless subscriber growth and growing revenue per user. This allowed the company to maintain its earnings guidance for the full year even though the free cash flow forecast was revised down to $14 billion from $16 billion.

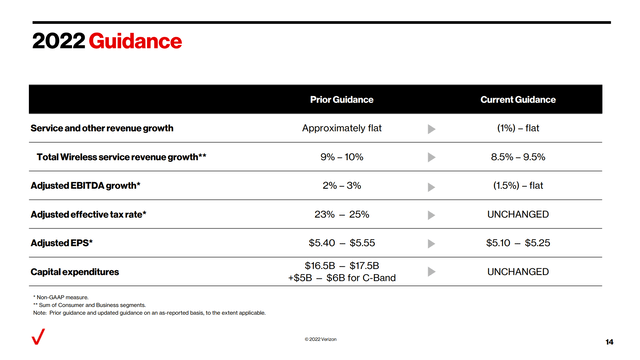

Verizon, on the other hand, had poor wireless subscriber growth and grew revenue mainly because of the acquisition of low-cost prepaid provider TracFone. Verizon cut its full year earnings guidance by over 5%. While Verizon does not provide cash flow guidance, they did cut their EBITDA forecast from growth of 2%-3% to a decline of -1.5%-0%.

Verizon 2Q 2022 Earnings Slides

Despite the cash flow shortfall in 1H, AT&T is performing better operationally and looks to continue to do so. Nevertheless, AT&T’s stock remains cheaper than Verizon’s. While this valuation gap has narrowed since 1Q results were released in April, there is still enough difference to warrant selling Verizon and buying AT&T.

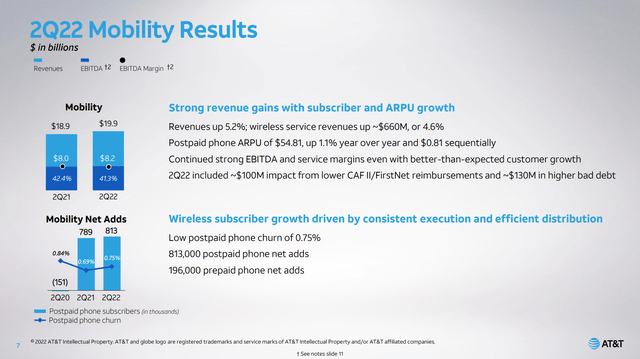

Subscriber Growth

AT&T is winning the battle for subscribers, especially in the high-paying postpaid segment. The company had another strong second quarter, adding over 1 million phone subscribers including over 800,000 postpaid. Churn rate remained low at 0.75%. With the return of international roaming, AT&T grew postpaid revenue per user (ARPU) by 1.1% over last year and 1.5% sequentially.

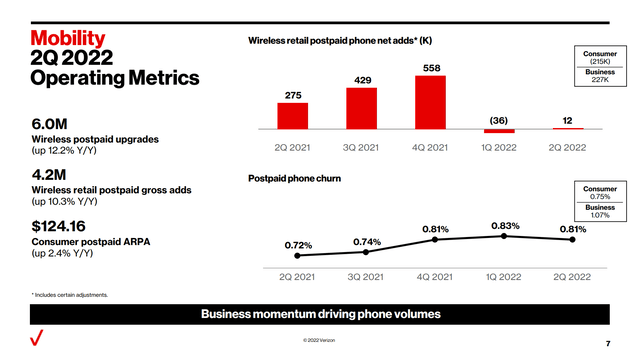

Verizon has had essentially zero net adds so far this year and is depending on adds by business customers to offset consumer losses. Churn is also higher at Verizon. Verizon’s average revenue per account (ARPA) did grow faster year-on-year but was almost flat compared to last quarter.

Verizon 2Q 2022 Earnings Slides

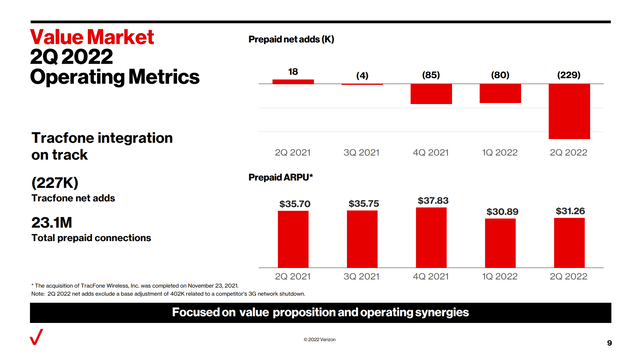

When we look at the overall mobility results including prepaid accounts, we see that Verizon grew service revenues by 8.6% which is higher than AT&T’s 5.2%, but this is driven largely by the acquisition of TracFone in 4Q 2021. These prepaid users are much less profitable with a low ARPU, and Verizon has been losing customers in this segment over the past year.

Verizon 2Q 2022 Earnings Slides

Moving on to the consumer wireline business, AT&T and Verizon are pursuing different strategies. AT&T is focusing on building out its fiber network, while Verizon is pursuing fixed wireless technology. With fixed wireless easier to install, Verizon has been showing good growth in broadband subscribers, with 268,000 net adds this quarter. AT&T has had flat to slightly negative overall broadband subscriber growth, but is doing well with its fiber rollout, gaining 316,000 net adds last quarter, offsetting losses from older technologies.

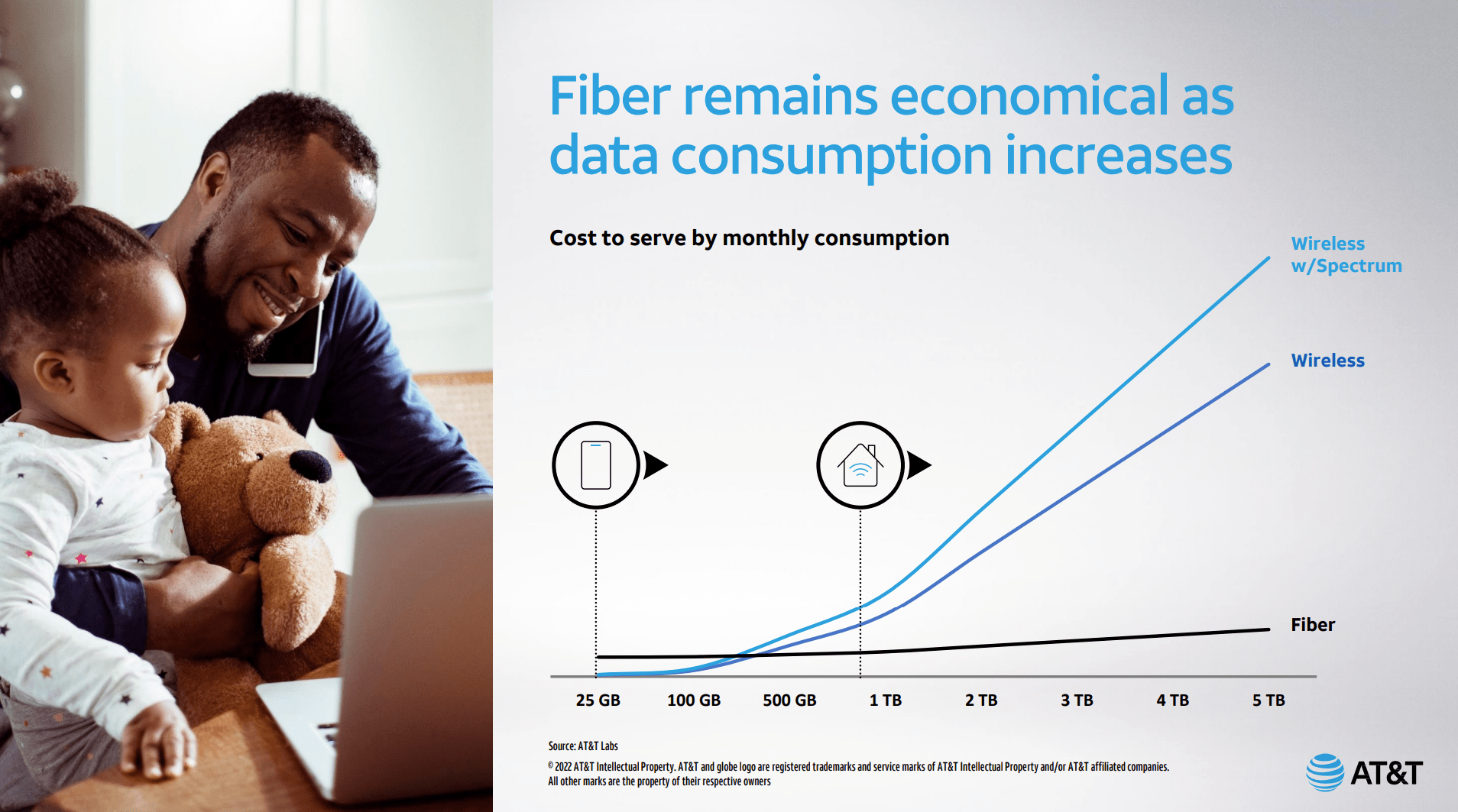

AT&T noted at its March 2022 investor day that despite the upfront investment, fiber has a lower cost to serve than fixed wireless. As data consumption rates increase, AT&T should be better positioned in the broadband market.

AT&T Investor Presentation

Finally, it is worth noting the two companies’ performance with business customers. AT&T and Verizon report this differently, with AT&T reporting business wireline as a separate segment, while Verizon includes business wireless along with business wireline as a combined Business segment. AT&T management was downbeat about business wireline performance on their earnings call which probably contributed to the negative market reaction. However, if reported on the same basis with business wireless included, AT&T and Verizon had similar performance with about $200 million less revenue compared to 2Q 2021. On a percentage basis, that means Verizon did worse since they have $7.6 billion of revenue in that segment compared to $8.6 billion for AT&T on a comparable basis.

Capital Management

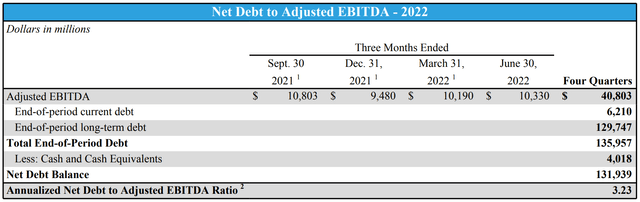

AT&T took on a lot of debt to fund its ill-advised video and media acquisitions but is in the process of deleveraging. Now that the WarnerMedia spinoff is complete, AT&T has $132 billion of net debt, compared to $168 billion a year ago. Net Debt/EBITDA is now 3.23 and is targeting reaching 2.5 by the end of 2023.

AT&T 2Q 2022 Financial and Operating Results

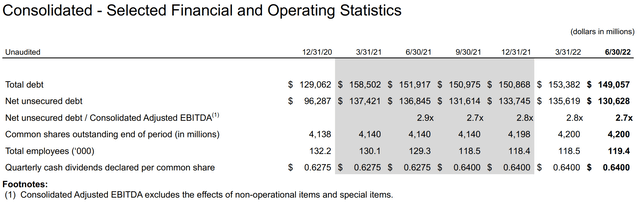

Verizon chooses to report only net unsecured debt to EBITDA, but if we adjust to include the secured debt, the ratio is more like 3.1 – better than AT&T but not by a lot.

Verizon 2Q 2022 Financial and Operating Results

The major issue for which the market appears to be punishing AT&T is free cash flow. It is important to note that AT&T defines FCF as not just operating cash flow minus capex but also adds in cash dividends from DirecTV and subtracts cash paid for vendor financing. On that basis, AT&T earned only $4.2 billion of FCF so far this year ($2.8B in 1Q and $1.4B in 2Q). This does not cover dividends paid of $5.8 billion in the first half.

This means that AT&T is forecasting $9.8 billion of FCF in the second half of the year. This implies the company expects to improve FCF by $5.8 billion in 2H. While that sounds like a heavy lift, most of it is within the company’s control. Capex and cash paid for vendor financing will be around $11 billion in 2H compared to $13 billion in 1H. The company also expects to spend $3 billion less on payments for devices in 2H due to timing issues. After these two drivers totaling $5 billion of FCF, AT&T only needs to deliver an incremental $0.8 billion to meet the new $14 billion target for the year. The company expects to do this thorough its wireless subscriber growth, partially offset by lower dividend income from DirecTV. CFO Pascal Desroches breaks this down in the earnings call:

Now before the questions on how we get to the implied $10 billion of free cash flow in the second half of the year when we generated $4 billion in the first half of the year, let me provide you with some specific items to consider.

Our outlook reflects the following expectations: $3 billion-plus lower device payment versus the first half of the year due to timing, nearly $2 billion lower capital investment versus the first half of the year as we reach our $24 billion expectations for the full year. The balance of the improvement relative to the first half of the year is due to wireless customer growth, including our recent pricing increases and lower cash interest expense. We expect these benefits to be partially offset by reduced distributions from DIRECTV and our expectations for incremental tax payments in the second half of the year. However, we do expect full year tax payments to be lower than we previously anticipated. Additionally, we expect typical free cash flow seasonality with the fourth quarter higher than the third quarter.

$9.8 billion of FCF in the second half does cover the dividend of $5.8 billion with a 59% payout ratio. If for some reason AT&T’s great wireless subscriber growth does not continue, there is still enough free cash from the more controllable drivers to cover the dividend.

Looking forward to 2023, AT&T expects to continue its high capex spending of $24 billion for one more year. Any dividend increase would depend on continued business growth and no further decline in customer credit. Therefore, a raise is not certain, but even a flat dividend would maintain AT&T’s yield lead over Verizon.

Verizon does not focus as closely as AT&T on free cash flow and does not subtract vendor financing from the number. On that basis, Verizon’s FCF in the first half was $7.2 billion, a decline of 39% from 1H 2021. This did cover the 1H dividend of $5.4 billion at a payout ratio of 75%. Verizon also has lower implied capex in 2H, having already spent $10.5 B against full year guidance of $17B. On the other hand, Verizon’s guide down in earnings implies less cash from operations in 2H. This should put both companies at similar payout ratios in the second half.

Valuation

At a share price of $18.38 at the time of writing, AT&T stock is trading at a P/E of $18.38/$2.44, or 7.5. The dividend yield is $1.11/$18.38, or 6.0%.

Using Verizon’s share price of $44.40, annual dividend of $2.56, and new EPS estimate of $5.175, Verizon has a dividend yield of 5.8% and a P/E of 8.6. AT&T is cheaper than Verizon by about 13%, on a P/E basis, closing the gap from 18% when I covered AT&T last quarter.

Before 2Q results came out, both companies had low single digit earnings growth analyst estimates for 2023 and beyond. Analysts have yet to update their out-year earnings growth forecasts for Verizon following the recent report. I would expect the negative revision to 2022 guidance combined with AT&T’s unchanged guidance to now favor AT&T.

Conclusion

Both big telcos had disappointing elements in their 2Q earnings releases. AT&T’s bad news was 1H free cash flow while Verizon’s was poor growth. AT&T has the brighter outlook, with 2H FCF improving because of timing issues but more importantly a good recent track record of delivering high-paying subscriber growth. Verizon has fallen behind in wireless subscriber growth and may begin to lose out in broadband if fiber turns out to be a better technology than fixed 5G.

Although Verizon stock enjoyed a long period of outperformance thanks to AT&T’s media missteps, the tide has already turned this year. AT&T stock has outperformed recently but has not yet fully closed the valuation gap with Verizon. There is still time to sell Verizon and buy AT&T.

Be the first to comment