ktsimage

There was a long hard time when I kept far from me the remembrance of what I had thrown away when I was quite ignorant of its worth.”― Charles Dickens

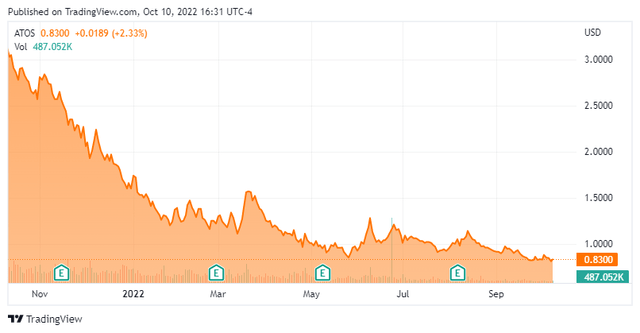

Ten months ago, we published our first article on Atossa Therapeutics (NASDAQ:ATOS) which the following conclusion around its stock.

The stock has destroyed a whole lot of shareholder value in its almost decade as a public company and still has not garnered an FDA approval. Therefore, we are passing on any investment recommendation on Atossa at this time.”

Since this is small cap name I get an occasional question around and no one else has covered this company on Seeking Alpha since my last piece on it in December of last year, we will circle back on Atossa in the analysis below.

Seeking Alpha

Company Overview:

Atossa Therapeutics, Inc. is a Seattle based clinical-stage biopharmaceutical company. The firm is focused on the discovery and development of medicines in the areas of oncology and infectious diseases. Atossa’s current focus is on breast cancer and COVID-19. The stock currently trades just south of a buck a share and sports an approximately market capitalization of $100 million.

Company Website

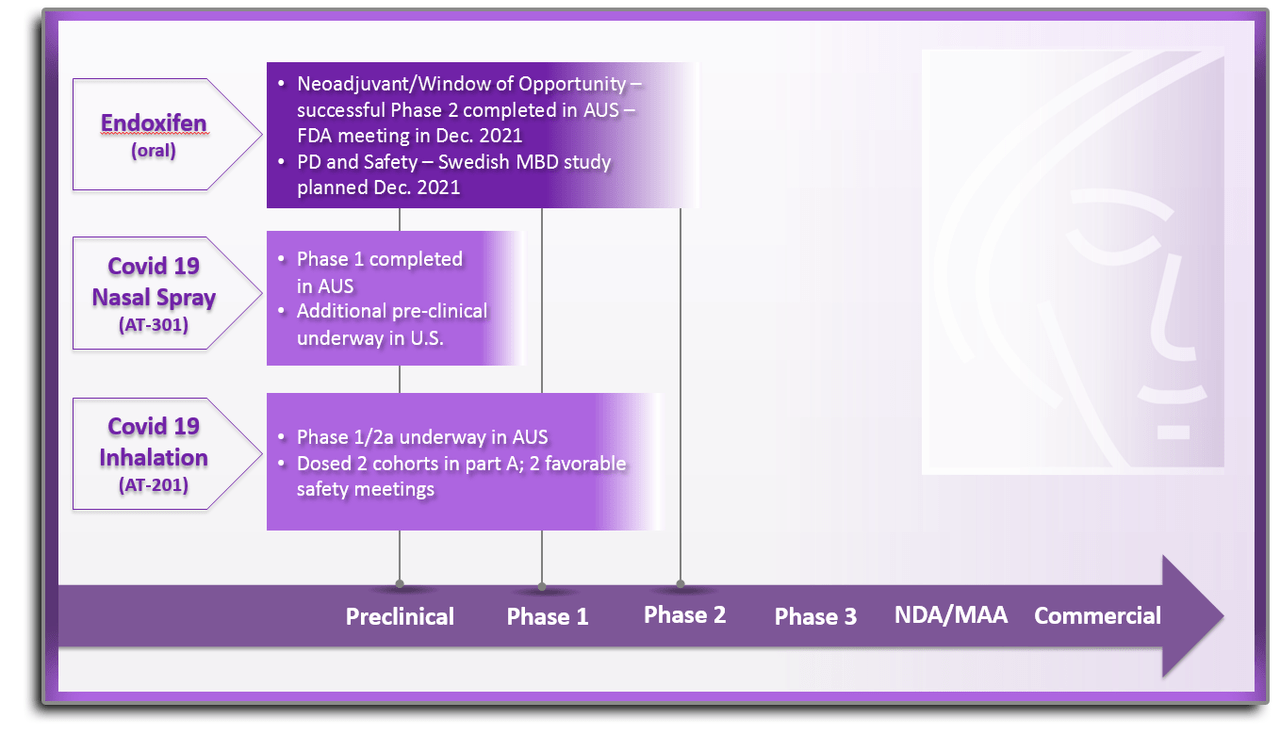

The company has shifted its efforts in recent years from being primarily focused on development a new treatment for breast cancer to also finding new compounds to treat Covid19. They kicked off the effort in spring of 2020 with a program called COVID-19 HOPE.

The goal of this effort was to develop a therapy to improve lung function and reduce the amount of time that COVID-19 patients are on ventilators. The program uses a novel combination of two drugs that have been previously approved by the FDA for other diseases. This new compound AT-H201 mimics the function of the antibodies formed from a vaccine by blocking the ability of the virus to enter the target cells. In late April, the company announced that the Part B portion of a Phase 1/2a clinical study for AT-H201 had been completely enrolled. This four part approximate 60 patient study is being conducted in Australia. The start of Part C and D portions of this trial are subject to additional approvals from the Australian Human Research Ethics Committee.

On its second quarter earning press release the company announce a ‘shift in the development of AT-H201 to more closely align with its oncology focus by continuing the development in patients with compromised lung function due to the damaging effects of cancer treatment.’ The company plans to initiate a clinical study of patients with compromised lung function caused by radiation treatment. Next steps for this effort should be out by the end of this year.

May Company Presentation

The other product the company is developing to help fight the pandemic is AT-301. This is a nasal spray to be used in patients immediately following diagnosis of COVID-19 but who have not yet exhibited symptoms severe enough to require hospitalization. AT-301 is intended for at-home use to proactively reduce symptoms of COVID-19 and to slow the infection rate so that a person’s immune system can more effectively fight the coronavirus. While late to the game, a nasal spray would have the advantage of being easier to use and could be stored at room temperature.

May Company Presentation

The company’s breast cancer program is centered around Endoxifen. This is the most active ingredient of the FDA-approved drug tamoxifen, which has been around since 1977 and targets the prevention of recurrence of breast cancer as well as the development of new cancer. By delivering Endoxifen directly to the body, the need for liver metabolism is bypassed. In early trials, Endoxifen got to a “steady-state” in as little as seven days compared to up to four months with oral tamoxifen. Endoxifen received another patent in March of this year.

In spring of this year, Atossa announced a planned U.S. Phase 2 clinical study of Endoxifen in the neoadjuvant setting (prior to surgery) to compare Endoxifen to standard of care in premenopausal women with breast cancer. Atossa submitted an IND to the FDA around this indication in the second quarter of this year. The FDA has issued a clinical hold letter requesting additional information around this IND. Atossa planned to submit by the end of the third quarter and to initiate enrollment in the fourth quarter of this year.

Analyst Commentary & Balance Sheet:

The company gets little coverage from wall street. Two months ago, both Ascendiant and Maxim Group ($4 price target) reissued Buy ratings on the stock. That is the only analyst firm commentary I can find on this company so far in 2022. Almost 10% of the outstanding float in the stock is currently held short. There has been no insider activity in the shares in more than a year now. The company ended the second quarter of this year with approximately $131 million in cash and marketable securities on the balance sheet. This is significantly more than the current market cap for the stock. Atossa has no long term debt. Total operating expenses including R&D was a bit over $4.7 million for the second quarter.

Verdict:

It would seem Atossa Therapeutics has an investor relations problem. If the company doesn’t have an investor relations head, they dearly need to fill that position. The same complaints I had about the company at the conclusion of my first article remain firmly in place.

The company’s website doesn’t seem up to date, and there are no conference call transcripts from its quarterly earnings conference calls to peruse. It is hard to get a good feel for milestones for any of its key programs. Its company presentations are quite amateurish as well. In addition, I put very little value on the company’s Covid efforts, given how far we are into the pandemic and all the competing treatments that are already approved and established.

So despite the stock selling for significantly less than the net cash on the balance sheet, I cannot recommend ATOS for investment. The company and its shareholders seem permanently stuck in limbo. Therefore the stock continues to get an ‘incomplete’.

Maybe all one can do is hope to end up with the right regrets.”― Arthur Miller

Be the first to comment