Atlassian’s (NASDAQ:TEAM) past six months’ price performance of 3.81% has outperformed the S&P 500’s -14.06%. This out-performance was mainly due to the combination of market turmoil and the current need for many employees to work from home. I believe that Atlassian has demonstrated a strong track record of growth. However, at $129, it is overvalued by 21% based on my base-case assumptions.

(Source: Seeking Alpha data)

(Source: Google)

Atlassian’s Q2 20 quarter outperformed expectations

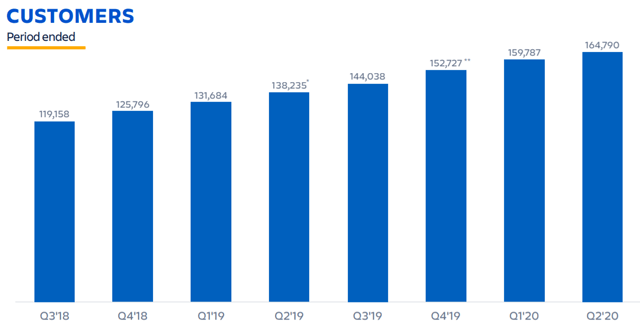

Atlassian reported an 18.8% year-on-year growth in customers, from 138,235 to 164,790. This was driven by a 10x increase in Confluence cloud customers. In total, Confluence has attained 60,000 customers. This highlights how the workforce shift towards the cloud has likely helped Atlassian gain more customers. In addition, Trello also has more than 50M users, an increase from 19M since the acquisition three years ago. According to Atlassian’s latest shareholder letter, Trello is now used by teams across 80% of the Fortune 500.

(Source: Q2 Earnings Presentation)

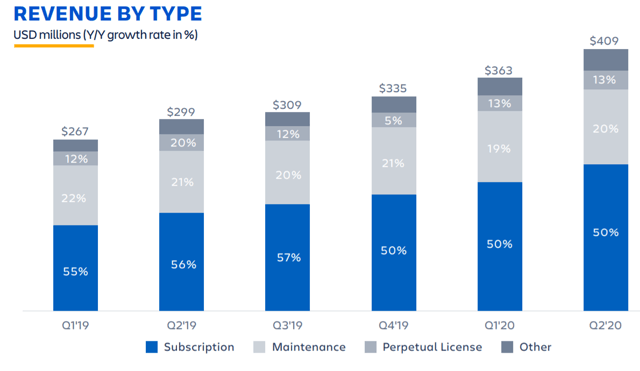

Despite the 18% customer growth, Atlassian has been able to grow revenues at 36.7% year on year from $299M to $409M. This shows that Atlassian has been able to generate more revenue from each customer, which indicates that customers find great value in its products.

(Source: Q2 Earnings Presentation)

(Source: Q2 Earnings Presentation)

At a customer base of 164K, Atlassian still has a long runway for growth. In its latest shareholder letter, the company indicated that its total addressable market reaches 100M when it includes all the technical professionals. This means that it has only penetrated 0.1% of its potential target professionals.

The phrase ‘software is eating the world’ has never been more true. Software increasingly drives how companies run their businesses and empower their teams. Development, DevOps, and IT teams continue to see expanding scope and business impact. Software developers alone represent a 23 million user TAM. That market grows to 100 million users when we include all technical professionals.

(Source: Q2 Shareholder Letter)

Atlassian’s latest balance sheet shows strength

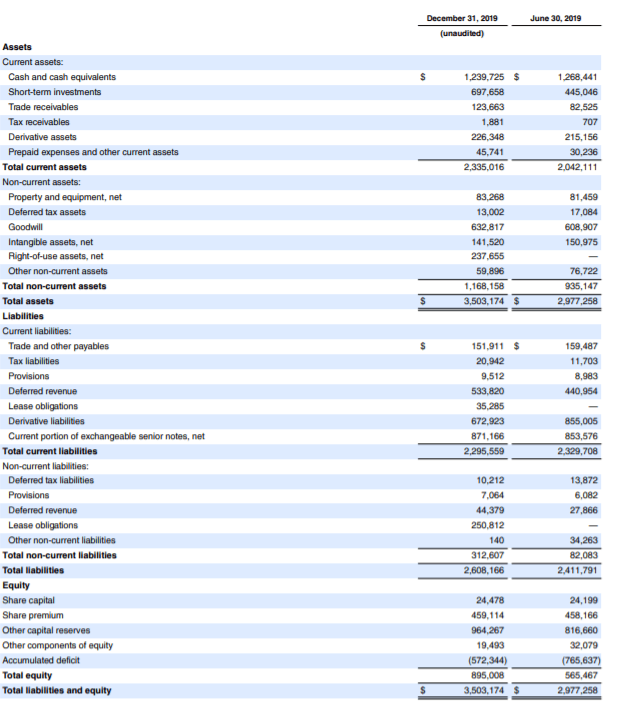

To ensure that smaller companies like Atlassian do not run into liquidity issues, one way to determine that is to monitor its cash and debt balances, as well as its cash-burn rate.

Looking at its latest balance sheet, Atlassian has $1.2B of cash and $697M of short-term investments with no debt. Since Atlassian’s net free cash flow was $202M in the latest quarter, this provides a large cushion for Atlassian to invest in growth. It also helps the company tide through any operational difficulties in a volatile period.

(Source: Q2 Shareholder Letter)

Investment Risks

In an economic downturn, customers might cut back on non-essential services to conserve cash flow. If these businesses deem that Atlassian is not crucial to their operations, it might lead to a larger-than-expected churn rate for the company.

Atlassian also faces competition in its space that may lead to slower customer adoption on its platform. Some of these competitors include Microsoft’s (NASDAQ:MSFT) GitHub, Salesforce (NYSE:CRM), and Amazon’s AWS (NASDAQ:AMZN) Marketplace. Atlassian has to ensure that its platform continues to delight customers to gain market share and keep them from switching over to competitors.

Valuation

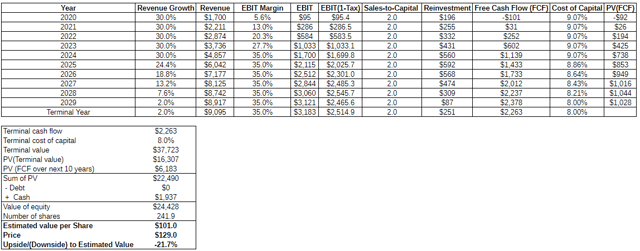

1) Revenue growth at 30% for the next five years, then dropping to 2% in perpetuity starting from the year 2025. The high growth rates in the first five years reflect Atlassian’s track record of high sales growth and its ability to penetrate its total addressable market. However, intense competition and a lack of product innovation might put a lid on high sales growth in the future as Atlassian continues to expand its offering.

2) Operating margin of 35% from 2026 onwards. Software players generally have high operating margins due to their high initial fixed costs and low incremental costs. Atlassian’s gross margins have remained above 80% since 2015. Once Atlassian scales further and profitability becomes a priority, the company should experience a high level of operating margin expansion through operating leverage. However, if Atlassian has to incur higher customer acquisition costs due to strong competition, there could be some downward pressure on its margins in the near term.

3) A sales-to-capital ratio of 2 is in line with its software peers. Developing software is not capital-intensive, so I estimate Atlassian will be able to generate $2 of sales with every $1 in incremental capital.

4) Atlassian has an initial weighted cost of capital of 9%, which drops to 8% in the terminal year. The higher cost of capital reflects the higher risk of Atlassian having negative operating income and losing money. However, once the company achieves profitability and higher free cash flows, the risk should be reduced as reflected in the lower cost of capital.

(Source: Author creation using Atlassian’s financials) (Figures are in $millions except per share data and percentages)

The value I derived for Atlassian is roughly $24.4B for the entire company. This represents a 21% downside from its current price. As with all DCFs for high-growth companies, my point estimate valuation of $101 is likely to have a large spread of possible outcomes. To overcome this shortcoming, I compare its pricing multiples against other software companies.

| Companies | Price/Sales Ratio | EV/Sales Ratio | YOY Sales Growth (%) | Operating Margin (%) |

| Atlassian | 23 | 23 | 36 | -1.6 |

| Salesforce | 7 | 7.44 | 28 | 2.9 |

|

Slack (WORK) |

17 | 22 | 57 | -87 |

|

ServiceNow (NOW) |

15.4 | 15.5 | 32 | 1.2 |

(Source: Author creation using data from Seeking Alpha)

Compared to other peers, Atlassian is expensive. Even though it has similar growth rates as ServiceNow, it is much more expensive in terms of Price/Sales and EV/sales ratio. Atlassian is more expensive than Slack, which has a stronger growth rate but worse operating margins.

Potential investors have to decide if they believe Atlassian will be able to execute better than my base-case assumptions in the long run. If investors expect competition to turn out to be weaker than expected and push up Atlassian’s future sales growth for an extended period, the recent pullback might make Atlassian a buy.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment