mrgao/iStock via Getty Images

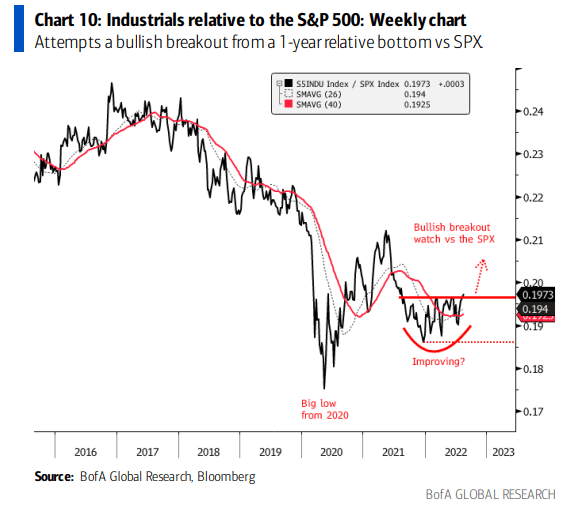

The Industrials sector (XLI) is one to watch as the second half of 2022 presses on. Bank of America Global Research notes that the sector is on the cusp of a relative breakout versus the S&P 500. This cyclical-value area is often seen as a bellwether for the economy and broader market.

Hot Sector: Industrials?

BofA Global Research

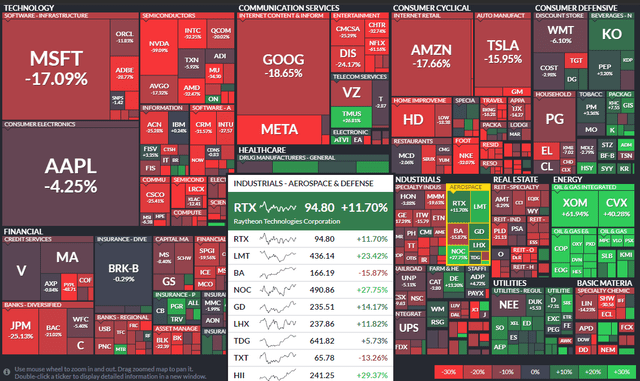

Helping to thrust Industrials higher is the Aerospace & Defense industry. Now that we are at the six-month anniversary of the unfortunate Russia/Ukraine conflict, traders must still look at price action for clues on where the markets are headed. Year-to-date, defense equities are solidly in the green. The big guys – Raytheon (RTX), Lockheed Martin (LMT), and Northrop Grumman (NOC) – are in bull markets. But one small-cap stock is not faring so well.

Hot Industry: Aerospace & Defense

According to BofA Global Research, Astra Space (NASDAQ:ASTR) is a launch service provider focused on meeting the demands of small satellite manufacturers with payloads less than 600 kg. ASTR offers access to space via low-cost rockets that are built in-house, intending to expand into satellite manufacturing and in-orbit servicing. The company now has no rockets scheduled to take flight through much of next year.

The California-based $262 million market cap Aerospace & Defense industry stock within the Industrials sector has negative earnings over the last four quarters and does not pay a dividend, according to The Wall Street Journal. Bears should take note of ASTR’s high 21.7% short float – a sudden positive news catalyst could spark a big short-covering rally.

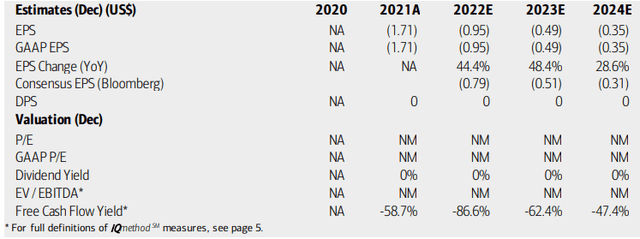

Analysts at BofA (and the Bloomberg consensus) are not sanguine on ASTR. Earnings are expected to continue in negative territory, with no signs of a dividend being announced. Moreover, free cash flow is anticipated to be steeply negative all the way through 2024. The fundamental and valuation pictures show a potentially fast burn. Not surprisingly, Astra Space missed EPS estimates badly back on August 4.

Astra Space Earnings, Valuation, Free Cash Flow Forecasts

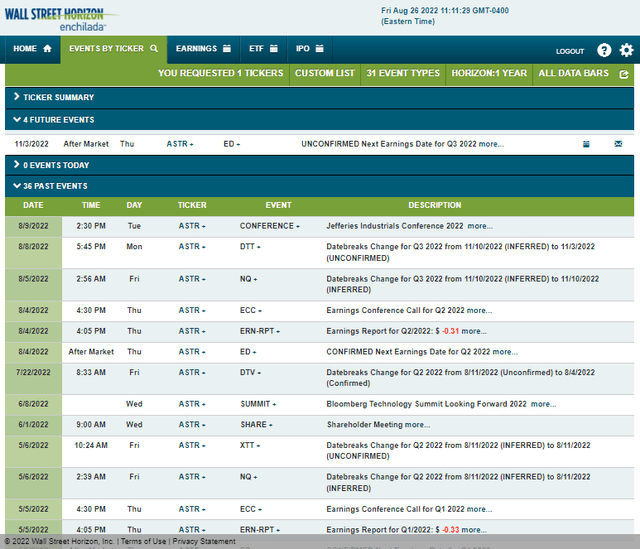

Looking ahead, Wall Street Horizon’s corporate event calendar shows no major bullish catalysts in the near future. The next earnings report is unconfirmed for Thursday, November 3, AMC.

ASTR Corporate Event Calendar

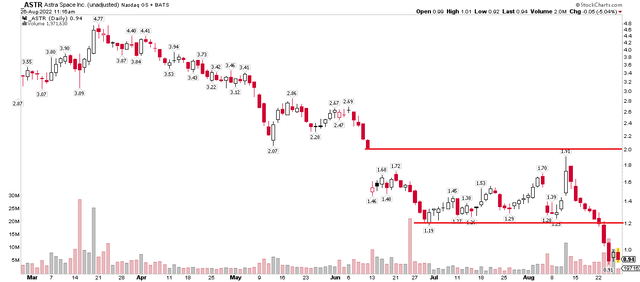

The Technical Take

Is there any hope for the bulls on the charts? It doesn’t look like it. After peaking above $22 during the crescendo of speculative meme stock mania of early 2021, shares are down 96% as equity holders have been nearly wiped out. The stock made new lows this past week, so there is no significant support down here under $1.

ASTR gapped down to $1.50 last June, then fell under $1.20. A rally to nearly fill that gap was quickly sold into. Shares were then cut in half to $0.91 on Wednesday at the low. I see more downside to come, and there’s resistance at $1.20 on any rally. This is a sell and avoid.

Astra Space Has Lots of Room to the Downside, $1.20 Resistance

The Bottom Line

ASTR looks dismal from a fundamental/valuation perspective with solidly negative earnings and its chart has gone straight down from the high early last year. Moreover, there are plenty of better-performing companies in the Aerospace & Defense industry which have done so well this year. I would go for one of the bigger players to gain exposure to the space.

Be the first to comment