Editor’s note: Seeking Alpha is proud to welcome Haketia as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Introduction: Need for Clarity After a Very Difficult Year for Assured Guaranty

Assured Guaranty Ltd. (AGO) has been a controversial stock. In this article we aim to see through the market noise by performing a fact/figures-based analysis.

2019 was an eventful and very challenging year for AGO that, in addition to the neverending PR saga, saw how its two main sources of revenue (insurance premiums and investment income) continued to fall from already very low levels. This together with the ballooning actually paid losses and the severe drop in operating cash-flow sets a question mark on AGO’s future that will put further pressure on its share price. The Coronavirus Crisis will aggravate and accelerate AGO’s problems.

S&P’S Failed Rescue Attempt

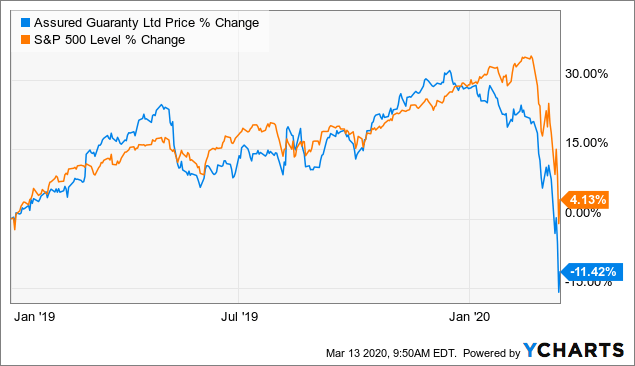

The difficulties suffered by AGO during 2019 were not reflected in AGO’s share price that went up 30% although it has now lost those gains. 2019’s price increase was fueled by AGO’s management ability to masterfully administer the news about the poor results and create high market expectations with the assistance of S&P.

Source: YCharts (AGO’s Share Price since January 2019)

Data by YCharts

Data by YCharts

Source: YCharts (% Change, AGO v S&P 500 since January 2019)

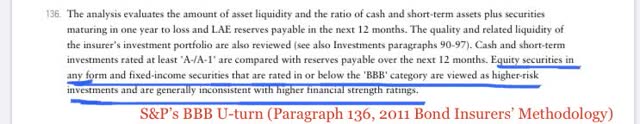

S&P relaxed the Bond Insurers’ rating methodology beyond recognisition in 2019 by dropping any meaningful investment constraints introduced after the monoline crisis including a 5% limit on BBB securities and Equities.

This allowed AGO to increase the risk profile of its investment portfolio by purchasing BM and raising the percentage of BBB securities from 5% to 8.2% (securities that are now at risk of being downgraded or even suffer defaults if the current crisis deteriorates, extending AGO’s problems into the Investment Portfolio).

Source: S&P’s 2011 Bond Insurers Methodology

Source: S&P’s 2011 Bond Insurers Methodology

Luckily for AGO, markets have short memories and S&P seemed to be more concerned about rating AGO’s international transactions. AGO’s management was thus able to create expectations of higher investment income and some unspecified asset management transformation that utterly failed to materialise.

Blue Mountain: Smoke, Mirrors and Losses

AGO’s management was very vocal when announcing the BM acquisition in August 2019 but has been vague and elusive ever since in terms of actually explaining why adding a loss-making asset manager would benefit AGO or how the additional income will actually be generated.

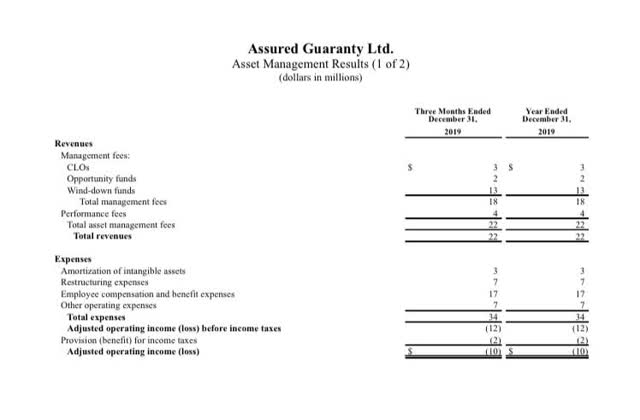

As the acquisition’s dust settles the picture is not pretty. The board’s silence is understandable looking at BM’s results with $12m operating losses in Q4 (including $7m of alleged “restructuring” costs) and only $22m of fees during Q4 ($13m from wind-down funds). Worryingly there are $10 billion of non-fee earning AUM.

BM’s results show that the emperor had no clothes:

Source: AGO’s Financial Supplement (31 December 2019)

Source: AGO’s Financial Supplement (31 December 2019)

BM will earn a modest amount of fees going forward needing years to break-even. AGO may never recover its investment. BM’s purchase rather than transformational will be at best irrelevant for AGO although its accounts have been pompously divided into three segments.

We expect 2020 results in line with 4Q19 as the restructuring continues with approx. $80m of revenue and $120m of expenses.

Analysis of AGO’s Income

AGO’s income was low in 2019 and will deteriorate further:

1) AGO’s Revenue Sources

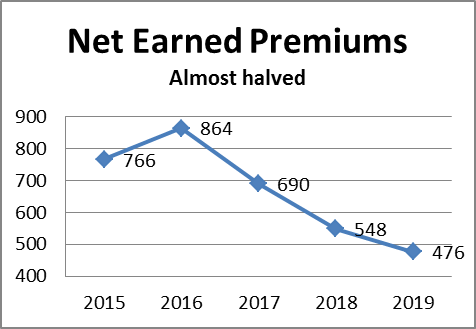

2019 saw another drop in net premiums to $476m from an already very low 2018 level ($548m). Premiums are now almost half of their 2016 levels ($864m) and falling.

Source: Own Chart

AGO has a dominant position (60%) in a dwindling duopoly. Despite all the marketing about a resurgence of the bond insurance market or an international expansion with anecdotal transactions and a sudden jump in Q4, the reality is that the actual level of new transactions is very low and likely to remain so.

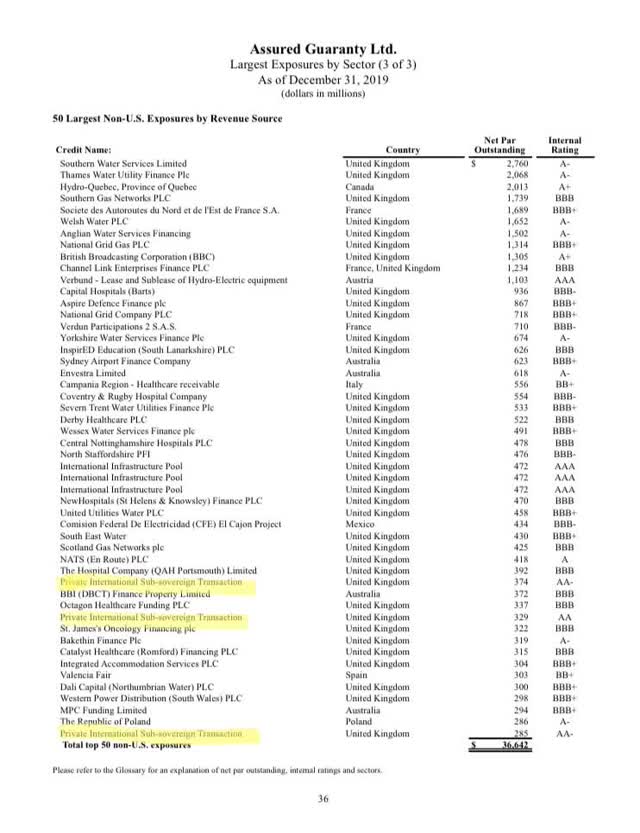

The sudden $187m jump in international PVP requires analysis as it was AGO’s only Q4 positive surprise. From the scarce information available AGO sold unspecified protection via “privately negotiated bilateral guarantees” on a $5,423m basket of UK Sub-Sovereign names for a total PVP of approx. $187m.

Three exposures made it into AGO’s lists as “Private International Sub-Sovereign Transaction”:

Source: AGO’s Financial Supplement (31 December 2019)

The fact that the names of the exposures cannot even be specified is very worrying. Who are these exposures and why can’t they be named?

According to the call’s statement these are mainly UK social and university housing entities, a problematic and overheated sector that has seen a lot of negative headlines recently and is extremely vulnerable to Brexit. It is important not to get confused by the word “sub-sovereign” since there is nothing sovereign about most of these exposures.

Not the kind of risk that anybody would like to take in his books just before the actual Brexit deadline of December 2020 which explains the lack of details.

For more information about the plight of these institutions and the risks of this UK market including AGO’s wraps, we highly recommend the FT series “Education in the Age of Finance“ by Thomas Hale (e.g. Higher education: is Britain’s student housing bubble set to burst? of 19 September 2019).

This transaction was aimed at boosting PVP at a time in which US Finance PVP is stagnant at around $200m. As premiums continue to fall we expect more questionable and opaque transactions.

We do not expect the decline in premiums to significantly change during the next few years as bond insurance’s market penetration will continue to be very low. Refundings dropped following the 2017 tax change and still contributed $122m during 2019 (25% of the total) but will continue to fall.

New PVP at $463m continues to be small despite AGO’s marketing efforts and the Coronavirus Crisis will put further pressure on this figure.

Net premiums should fall again during 2020 and probably be below $400m with further drops expected during the following years.

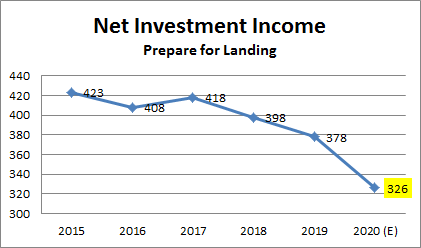

Despite the expectations created by S&P’s changes, described by AGO’s CEO (1Q19 call) as a “pretty good opportunity for us to create income”, AGO’s investment income was also very disappointing falling to $378m. As with BM, the high expectations failed to materialise.

Source: Own Chart

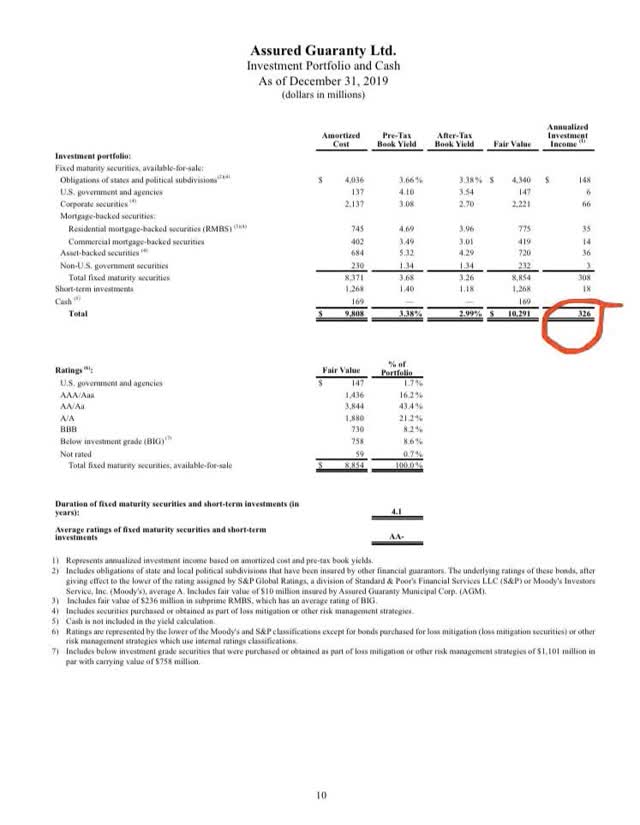

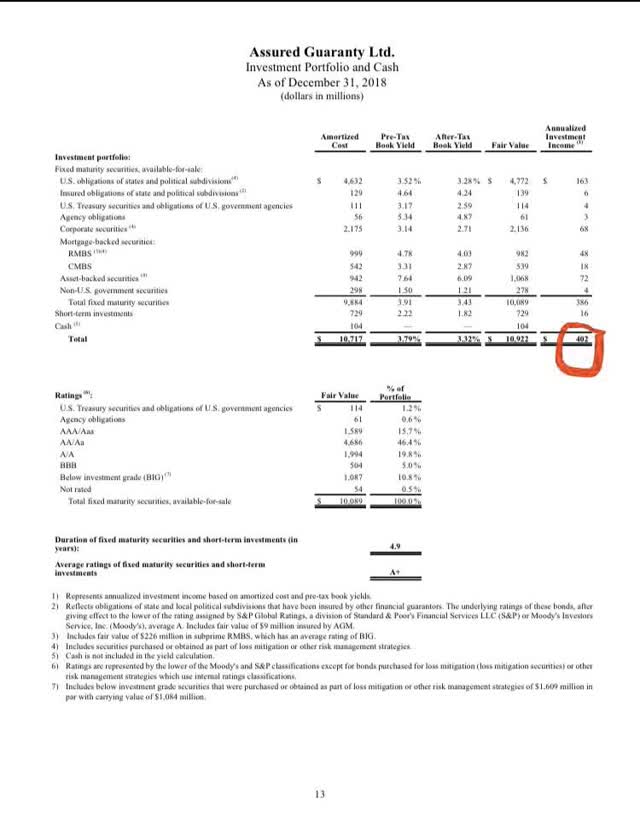

One of the reasons was the unexplained 28% fall ($1,090m to $792m) in the highly lucrative BIG securities during 2Q19. The drop will continue as the size of the Investment Portfolio has fallen to $10,291m from $10,922m and will shrink further due to the huge negative operating cash-flow.

The portfolio’s annualised income (good predictor) fell to $326m from $402m.

Source: AGO’s Financial Supplements (31 December 2018/9)

Investment Income should continue to fall in 2020 to less than $325m as the expectations created by AGO following S&P’s U-turn failed to materialise and the portfolio continues to shrink. Lower interest rates due to Coronavirus are likely to reduce it even further.

Investment Income is crucial for AGO that has benefited from a dividend/buyback limit is partially calculated based on that metric. The poor performance seems to be already affecting AGO’s buyback programme as AGO could not announce the usual $500m and the CEO was uncharacteristically unclear. AGO’s board managed to create expectations with a small yet headline grabbing $0.02 dividend increase to $0.20 per share (approximately $8m annually).

We expect that the situation will deteriorate further as AGO’s investment portfolio continues to shrink and interest rates falls due to Coronavirus will intensify this. The drop in investment income will start to have a significant detrimental effect on the buyback programme from 2021 something that will significantly lower share prices.

The importance of the other revenue items (investment gains, credit derivatives, commutations, etc) was very limited during 2018 and 2019 adding just $58m and $87m respectively. We expect that they will become almost irrelevant during 2020 with other revenue items (including BM) being in the region of $100m.

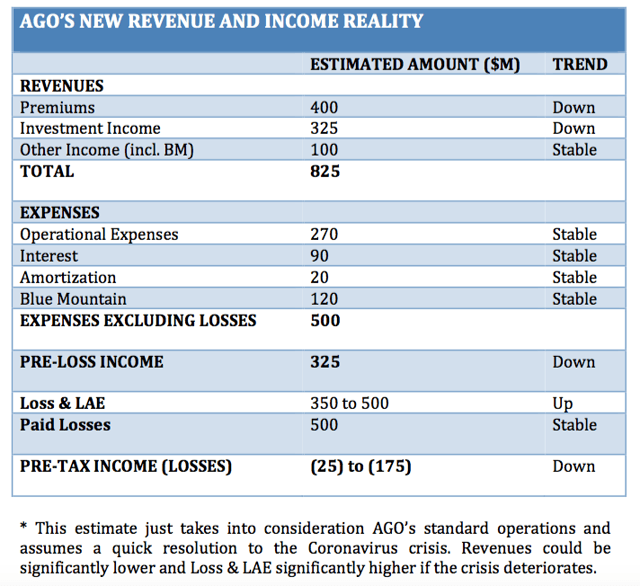

AGO’s total revenues are therefore likely to remain very low at around $825m including BM during 2020 and fall further thereafter.

2) AGO’s Expenses

- “Hard” Operational Expenses

| AGO’S ANNUAL OPERATIONAL EXPENSES ($M) | |

| Other Operating Expenses | 270 |

| BM Expenses | 120 |

| Interest | 90 |

| Amortization | 20 |

| TOTAL | 500 |

Source: Own Chart

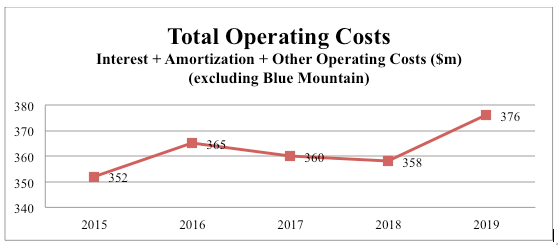

These easily measurable expenses, that contrary to the “vaporous” Loss & LAE do not allow much discretion, were stable at around $360m annually and increased to $376m (excl. BM) during 2019 probably due to some BM salaries being embedded as Corporate costs.

We expect that costs excl. BM will remain at similar levels around $380m going forward (although they could climb to $400m due to the embedded BM costs).

The separate BM expenses are likely to be slightly lower than in Q4 at $120m during 2020 as BM’s restructuring progresses.

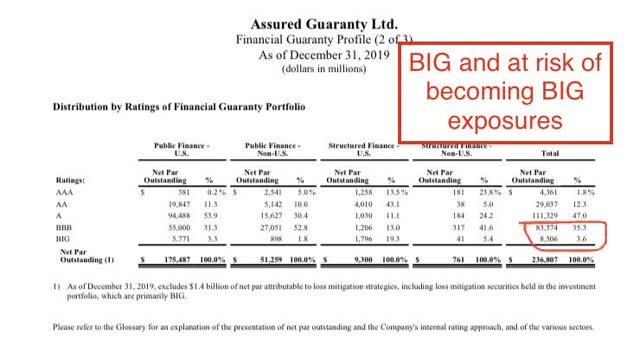

AGO is a company with premiums of around $400m annually, investment income of approx. $325m and $100m of other revenue to meet annual fixed costs of $500m, leaving just around $325m to 1) pay Dividends/Buybacks and 2) cover the Loss & LAE on its $236 billion insured portfolio (incl. $8.5 billion BIGs and $83 billion BBBs).

- Loss & LAE: Board’s Discretion and Earnings “Support”

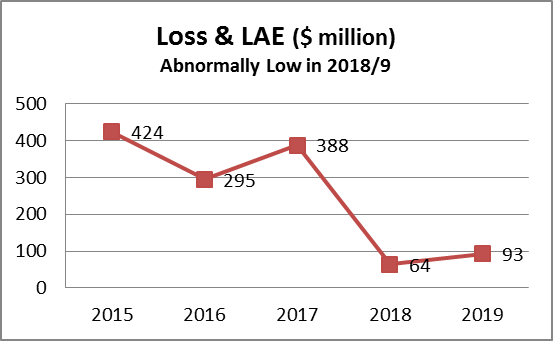

Loss & LAE remained abnormally low during 2018/9 (despite the developments in PR) and this has been crucial to avoid losses, beat earnings expectations and even deliver earnings surprises (eg 2Q19) despite the revenue squeeze.

Unfortunately for AGO this cannot stay so low in perpetuity especially as the current crisis will put further pressure on not just on PR but also on the numerous vulnerable names that populate AGO’s insured portfolio:

Source: Own Chart

The accounts show that the room for earnings surprises is getting narrow as the reserves are depleted:

| ($m) | 2019 | 2018 |

| BALANCE SHEET | ||

| Loss & LAE | 1,050 | 1,177 |

| Salvage and Subrogation Recoverable | 747 | 490 |

| ROLLFORWARD OF NET EXPECTED LOSS AND LAE TO BE PAID | ||

| Public Finance | 554 | 864 |

| Structured Finance | 183 | 319 |

Reducing Loss & LAE by releasing RMBS provided very important “support” to AGO’s board during 2019 adding $154m of net income (almost one third of AGO’s total) but this source of income has been exhausted.

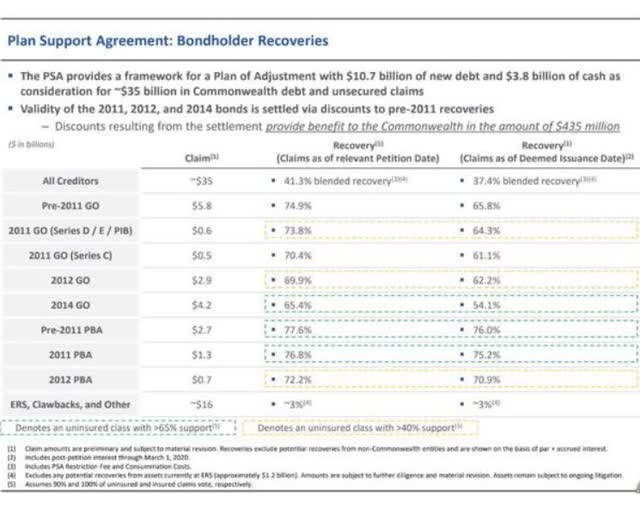

The $554m of Public Finance Loss & LAE does not seem credible by any metric if we simply observe AGO’s PR exposures and compare against either the haircuts under the most recent proposals or current bond prices.

AGO has eg $1,265m of HTA exposure that under the recent plans would suffer a 97% haircut. Assuming a generous 30% recovery this would already deplete AGO’s current reserves. Moreover PR is challenging the legality of many bonds altogether something that could have disastrous consequences.

Source: Financial Management & Oversight Board for Puerto Rico

Source: Financial Management & Oversight Board for Puerto Rico

AGO’s losses under the latest PR proposal (rejected by AGO and the other bond insurers and unlikely to go through) would dwarf the current reserves even considering any recoveries. We expect a protracted legal battle as PR’s OB seems capable of calling AGO’s bluff but it is clear is that the current reserves do not accurately represent the most likely scenarios for PR losses (let alone the rest of exposures that will deteriorate due to Coronavirus).

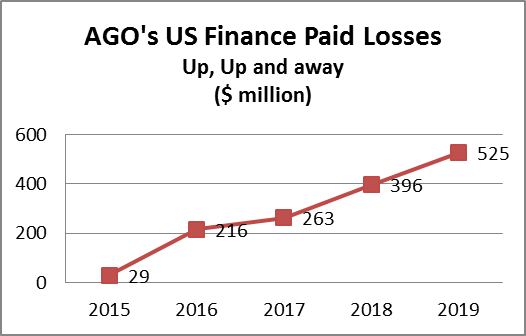

One particularly useful and not easily controllable measure of Loss & LAE is the Losses actually paid. US Public Finance losses have ballooned:

Source: Own Chart

We understand the limitations of this metric but in the absence of any other credible measure it gives a good indication of the actual state of AGO’s operations.

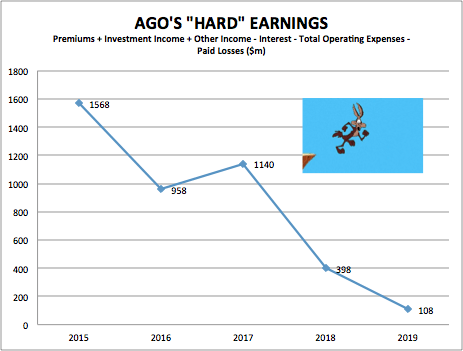

Meanwhile AGO’s “hard earnings” (replacing Loss & LAE by actually paid losses) have fallen sharply and PR’s schedule of payments shows that paid losses will remain high until an agreement for PR is reached:

Source: Own Chart

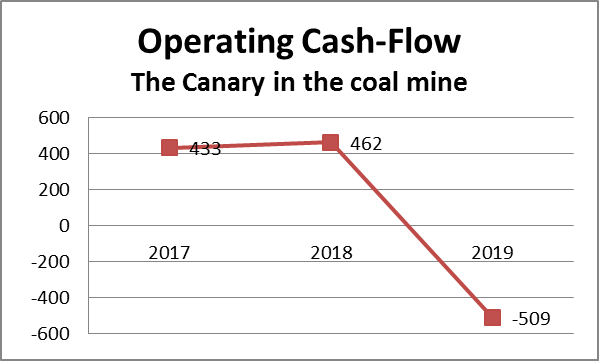

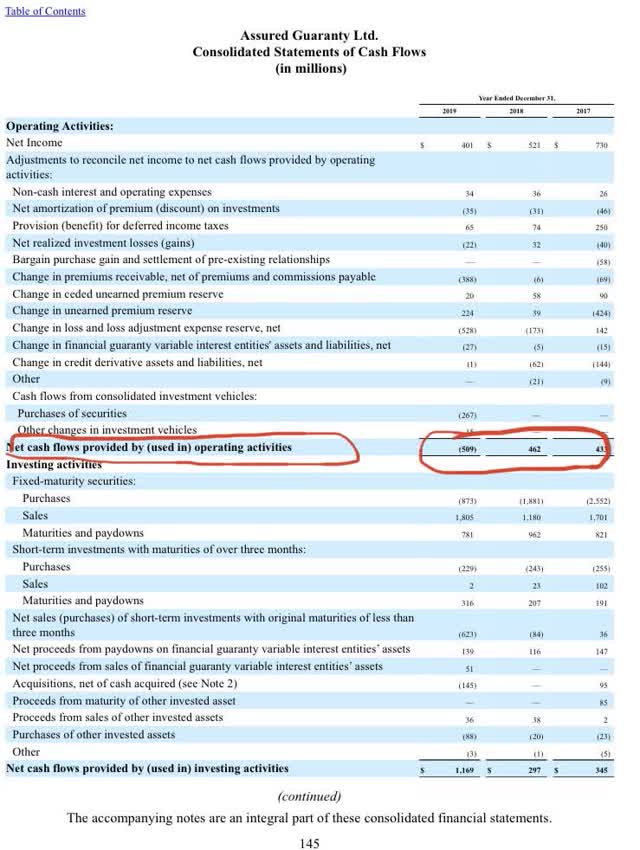

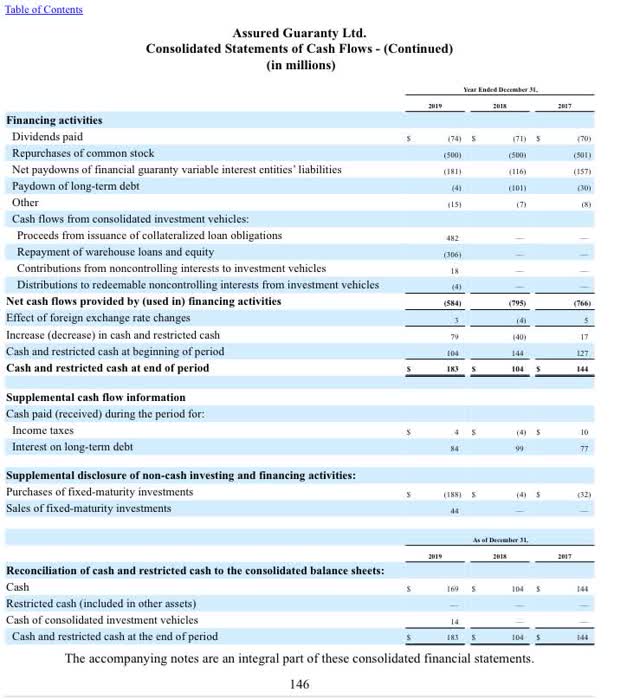

An unsustainable situation that has caused a sharp $900m fall in AGO’s Cash-Flow from Operations (from positive $400m in 2017/18 to negative $509m in 2019).

Source: Own Chart

This negative operating cash-flow had to be compensated with an increase in cash-flow from investing activities by selling Fixed-Maturity securities causing a drop in the Investment Portfolio that will reduce AGO’s Investment Income going forward thus affecting buybacks. AGO’s domino pieces continue to fall one by one slowly but relentlessly.

Source: AGO’s 2019 10-K

AGO is already de facto in loss making territory and this will remain to be the case in the near future as these losses filter into its official earnings. AGO is confident that it will recoup some of these losses once a PR deal has been reached but there is no guarantee as to whether and when any such deal will be reached or whether AGO will recover any losses (especially as PR will also be affected by the Coronavirus crisis).

This shows that despite AGO’s aggressive rhetoric it is doubtful that AGO could afford to delay a PR deal much longer as paid losses will continue to mount. PR’s OB could force a better deal just by delaying the agreement.

Loss & LAE will no longer create positive earnings surprises as the clearly insufficient Loss & LAE (especially US Finance) will have to increase to get in sync with reality thus wiping out AGO’s earnings going forward as it will exceed pre-loss earnings.

Source: AGO’s Financial Supplement (31 December 2019)

Source: AGO’s Financial Supplement (31 December 2019)

Moreover the Coronavirus crisis will put further pressure on the remaining insured portfolio, especially on the remaining $4 billion of BIG exposures excluding PR and the huge $83.5 billion of BBB exposures many of which are at risk of becoming BIG if the crisis continue.

Even if we do not underestimate AGO’s accounting skills, we believe that it is likely that AGO will have to start announcing losses as early as in 2020.

Source: Own Chart

Effect on AGO’s Share Price & Our Recommendation

We believe that the domino effect created by higher paid losses, lower revenues, lower or even negative income and lower buybacks will inevitably have a significant detrimental effect on AGO’s share price thus creating an excellent short opportunity even from current levels.

Our expectation prior to Coronavirus was already that the downward spiral would eventually end up with AGO having to be put into run-off. Our price target for AGO has been and continues to be close to zero in the medium-term.

AGO’s share price has fallen almost 20% since we originally submitted our article, whilst this logically reduces the room for further short term drops the current crisis reinforces our main thesis by showing that AGO is ill equipped and extremely vulnerable to any deterioration in the credit markets.

The current crisis is neither central nor necessary for our thesis but it will have the effect of shortening AGO’s “distance to default/run-off” as it will cause a deterioration the insured portfolio potentially with further defaults and this deterioration may also affect the now riskier investment portfolio that is highly correlated to the insured portfolio.

The main risks for this thesis are:

1) market volatility that will ensue as the crisis progresses leading to indiscriminate price moves based solely on the evolution of Coronavirus; and

2) a scenario with a quick resolution of the Coronavirus crisis (which we do wish at a personal level but is far from certain) followed by a miraculously favorable PR resolution (unlikely) with very high recoveries that would allow AGO’s management to keep Loss & LAE artificially low for one more year thus temporarily decelerating the downward spiral and helping to maintain an artificially inflated share price for a few quarters.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in AGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment