i_frontier

Earnings of Associated Banc-Corp (NYSE:ASB) will likely continue to climb this year on the back of robust loan growth. Further, the net interest income will benefit from a rising rate environment thanks to the concentration of the loan book in variable-rate loans. On the other hand, provisioning will likely remain slightly higher than normal, which will limit earnings growth. Overall, I’m expecting Associated Banc-Corp to report earnings of $2.25 per share for 2022, up 3% year-over-year. Compared to my last report on Associated Banc-Corp, I’ve revised upward the earnings estimate because I’ve tweaked up both the loan and margin estimates. For 2023, I’m expecting earnings to grow by a further 8% to $2.43 per share. The year-end target price suggests a significant upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on Associated Banc-Corp.

Net Interest Income to Benefit from the Large Balance of Variable-Rate Loans

Associated Banc-Corp’s net interest margin was up by a remarkable 29 basis points during the second quarter of 2022 thanks to the rising rate environment and net interest income’s high-rate sensitivity. The earning asset’s beta (rate sensitivity) was much higher than the deposit beta. As mentioned in the earnings presentation, the actual earning asset beta during the first half was 55%, while the deposit beta was only 13%. The high earning-asset beta is mostly attributable to the large commercial portfolio, which makes up 60% of total loans. Around 91% of commercial loans will re-price or mature within one year, as mentioned in the presentation.

Associated Banc-Corp’s deposit beta has been low so far this year despite the large balance of interest-bearing adjustable-rate deposits. These deposits, which are quick to reprice, made up 67% of total deposits. The beta was low in the last quarter because banks currently have high pricing power due to their depositors’ high liquidity. As excess liquidity will wane in the coming quarters, the pricing power will also diminish. Therefore, I’m expecting a higher deposit beta for the second half of 2022. The management is much more optimistic than me as it mentioned in the conference call that it is well positioned to control deposit beta given Associated Banc-Corp’s profile.

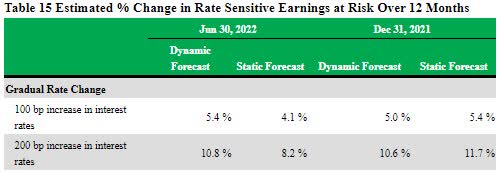

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates could boost the net interest income by 8.2% over twelve months.

2Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022 from 2.71% in the second quarter of the year. Compared to my last report on Associated Banc-Corp, I’ve revised upward my margin estimate mostly because of the second quarter’s surprisingly good performance.

Technological Investments, Strong Job Markets to Sustain Loan Growth

Associated Banc-Corp’s loan portfolio jumped by a massive 8% in the second quarter of 2022, or 32% annualized. The most remarkable part of this growth was that it was organic and broad-based across all segments.

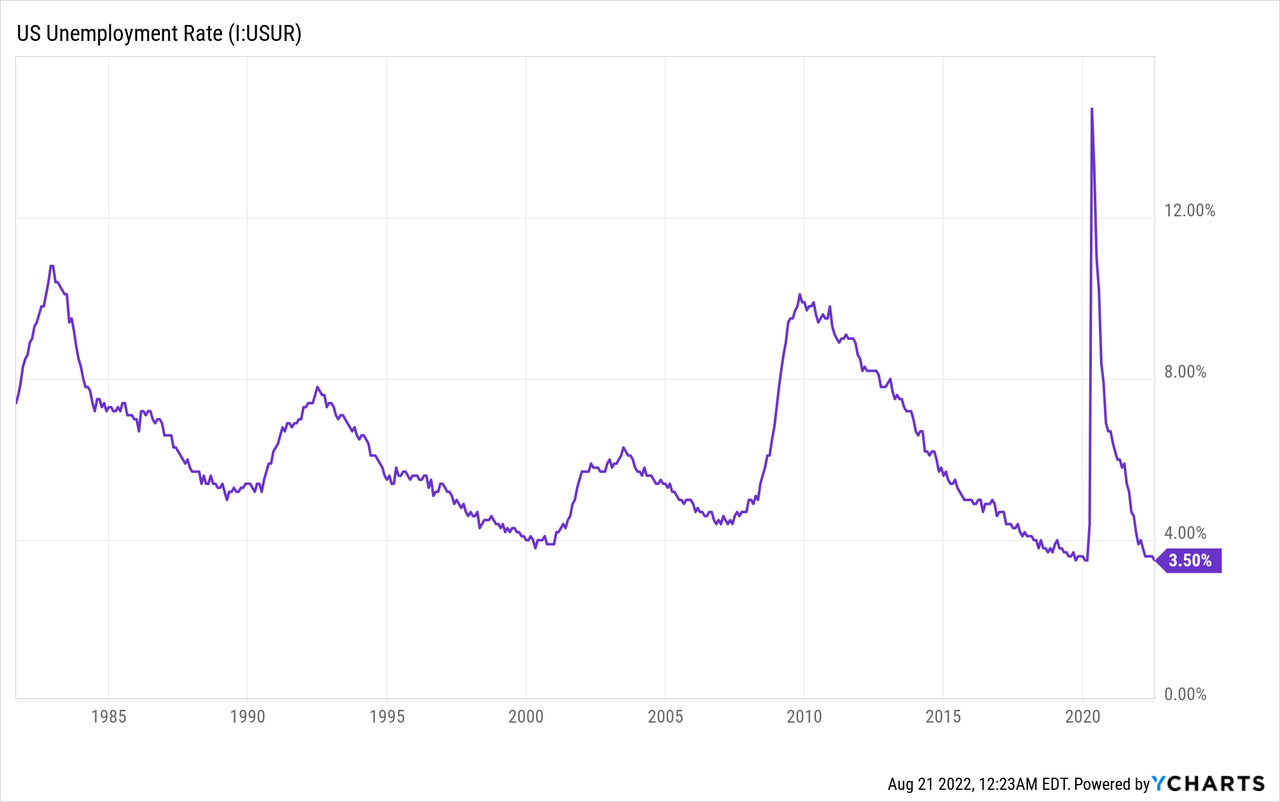

Following the second quarter’s unusually high growth, the management now expects full-year total commercial loan growth of $1.7 billion and auto finance loan growth of $1.3 billion, as mentioned in the earnings release. For 2023, the management is targeting growth of $1 billion in each of the auto finance and commercial loan segments, as mentioned in the earnings presentation. In my opinion, these targets are not too difficult to achieve given the economy is at the best level of labor employment in decades.

Further, the ongoing investments in digital platforms should also bear fruits. As mentioned in the conference call, the management expects the first of these digital updates to be rolled out to customers later this quarter.

Considering these factors, I’m expecting the loan portfolio to increase by 1.5% in each quarter (6% annualized) up till the end of 2023. This means that I’m expecting a loan growth of 12.8% for 2022. In my last report on the company, I estimated loan growth of 10.6%. I’ve revised upward my estimate because of the second quarter’s performance.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 22,702 | 22,620 | 24,068 | 23,945 | 27,006 | 28,663 | ||||

| Growth of Net Loans | 10.6% | (0.4)% | 6.4% | (0.5)% | 12.8% | 6.1% | ||||

| Other Earning Assets | 7,638 | 6,077 | 5,577 | 7,576 | 7,661 | 8,131 | ||||

| Deposits | 24,897 | 23,779 | 26,482 | 28,466 | 29,440 | 31,246 | ||||

| Borrowings and Sub-Debt | 4,527 | 4,195 | 2,435 | 2,225 | 4,341 | 4,607 | ||||

| Common equity | 3,524 | 3,665 | 3,737 | 3,832 | 3,889 | 4,133 | ||||

| Book Value Per Share ($) | 20.8 | 22.5 | 24.3 | 25.5 | 25.9 | 27.5 | ||||

| Tangible BVPS ($) | 13.4 | 14.7 | 16.7 | 17.8 | 18.2 | 19.8 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Provisioning Likely to be Slightly Higher than Normal

Associated Banc-Corp’s delinquent loans were just 0.07% of total loans at the end of June 2020, as mentioned in the presentation. In comparison, allowances were much higher at 1.20% of total loans. The coverage currently seems quite comfortable; however, inflation and the possibility of a recession may encourage the management to further boost their reserves. Further, the substantial addition of auto finance loans to the loan portfolio is likely to worsen the overall book’s credit quality. Auto finance loans are by nature a rather risky asset.

Overall, I’m expecting the net provision expense to make up 0.011% of total loans (annualized) in the next six quarters up till the end of 2023. In comparison, the provision expense averaged 0.07% of total loans from 2017 to 2019.

Expecting Earnings to Grow by 3%

The anticipated loan growth and margin expansion will likely be the biggest drivers of earnings this year. On the other hand, slightly higher provisioning will likely limit earnings growth. Overall, I am expecting Associated Banc-Corp to report earnings of $2.25 per share for 2022, up 3% year-over-year. For 2023, I’m expecting earnings to grow by a further 8% to $2.43 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 880 | 836 | 763 | 726 | 893 | 1,021 | ||||

| Provision for loan losses | – | 16 | 174 | (88) | 12 | 32 | ||||

| Non-interest income | 356 | 381 | 514 | 332 | 300 | 304 | ||||

| Non-interest expense | 822 | 794 | 776 | 710 | 740 | 817 | ||||

| Net income – Common Sh. | 323 | 312 | 286 | 334 | 338 | 364 | ||||

| EPS – Diluted ($) | 1.90 | 1.91 | 1.86 | 2.18 | 2.25 | 2.43 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Associated Banc-Corp, I estimated earnings of $1.93 per share for 2022. I’ve revised upwards my earnings estimate because I’ve pushed up both my loan and margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Maintaining a Buy Rating

Associated Banc-Corp is offering a dividend yield of 3.7% at the current quarterly dividend rate of $0.20 per share. The earnings and dividend estimates suggest a payout ratio of 33% for 2023, which is in line with the five-year average of 35%. Therefore, I’m not expecting an increase in the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Associated Banc-Corp. The stock has traded at an average P/TB ratio of 1.36 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 13.4 | 14.7 | 16.7 | 17.8 | ||

| Average Market Price ($) | 25.6 | 21.0 | 15.0 | 21.3 | ||

| Historical P/TB | 1.91x | 1.43x | 0.90x | 1.20x | 1.36x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.2 gives a target price of $24.7 for the end of 2022. This price target implies a 13.2% upside from the August 19 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.16x | 1.26x | 1.36x | 1.46x | 1.56x |

| TBVPS – Dec 2022 ($) | 18.2 | 18.2 | 18.2 | 18.2 | 18.2 |

| Target Price ($) | 21.1 | 22.9 | 24.7 | 26.5 | 28.3 |

| Market Price ($) | 21.8 | 21.8 | 21.8 | 21.8 | 21.8 |

| Upside/(Downside) | (3.4)% | 4.9% | 13.2% | 21.6% | 29.9% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 10.6x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.9 | 1.9 | 1.9 | 2.2 | ||

| Average Market Price ($) | 25.6 | 21.0 | 15.0 | 21.3 | ||

| Historical P/E | 13.5x | 11.0x | 8.0x | 9.8x | 10.6x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.25 gives a target price of $23.8 for the end of 2022. This price target implies a 9.0% upside from the August 19 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.6x | 9.6x | 10.6x | 11.6x | 12.6x |

| EPS 2022 ($) | 2.25 | 2.25 | 2.25 | 2.25 | 2.25 |

| Target Price ($) | 19.3 | 21.5 | 23.8 | 26.0 | 28.3 |

| Market Price ($) | 21.8 | 21.8 | 21.8 | 21.8 | 21.8 |

| Upside/(Downside) | (11.6)% | (1.3)% | 9.0% | 19.3% | 29.6% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $24.2, which implies an 11.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 14.8%. Hence, I’m maintaining a buy rating on Associated Banc-Corp.

Be the first to comment