gorodenkoff

Today we recommending a biotech/pharmaceutical company. Do not worry, this is not some developmental stage one, but has some degree of speculation to it, but one that we think is setting up for sizable upside. We like what we are seeing here in a little company called Assertio Holdings (NASDAQ:ASRT). This company has come a long way. The new Assertio is one that shows the promise of new operating model and an ability to quickly integrate new assets (like a recent Otrexup acquisition) into its growing platform. Because of the exciting strength of results to date from this company, we have a lot of confidence in the outlook of the business. We are excited and believe that the company could add an additional $40-$50 million of gross profit by the end of 2024. There is some momentum here, and we think there is more upside.

The play

Look, this is speculative in that it is a single digit stock, but the stock looks to head higher. I think we can pick up 10-20% gains here quickly. Here is how we want to play it now.

Entry 1: 1,000 shares $3.35-$3.40

Entry 2: 2,000 shares $3.05-$3.10

Stop loss: $2.70

Target exit: $3.80+

Discussion

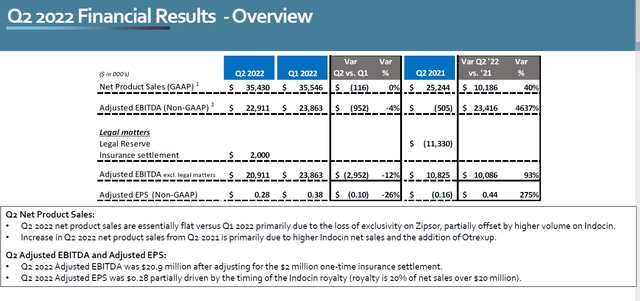

The most recent quarter sparked a rally which the stock is still enjoying. The second quarter really saw nice improvement. Net product sales of $35.4 million were $10.2 million or 40% higher than the prior year quarter. There has been an acquisition, but the increase was primarily driven by higher net pricing on Indocin, but of course the addition of Otrexup.

Indocin net sales for Q2 increased by $9.8 million over the prior year quarter, and this was also about $1.5 million over the sequential Q1 2022. Much of this was due to higher sales volume but there was a bit of a higher net realized price. Otrexup has been a winner since being bought by the company. Q2 net sales here were $2.6 million, though this was down from Q1. However, that was primarily from a supply disruption that will see volumes move to Q3. Overall, a solid Q2.

We want to be clear. Sure this is a little $3 stock. But this is not a speculative lottery ticket type biotech. This company makes money. Margins are solid. Gross profit margin in Q2 was 87% or 275 basis points higher than the prior year quarter. Winning. A lot of this was from a better product mix and improved margins on Indocin that is being sold. Of course as revenues spike, you would expect some expenses to have increased as well, but Assertio seems to have it under control.

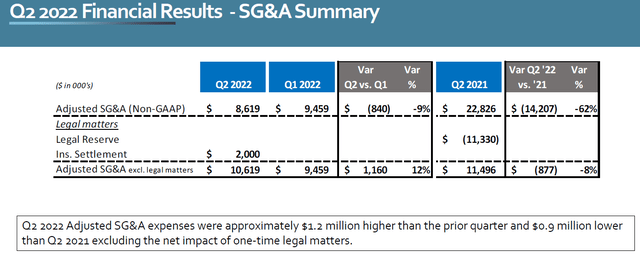

A lot of times companies like this have a major spending problem, but we are just not seeing that here. Selling, general and administrative expenses were just $8.6 million, but a lot of this was due to a $2.0 million insurance settlement benefit that was reflected here, so you could say they were $10.6 million, flat from the sequential quarter. This is not bad at all. So higher revenues, better margins, less expenses. Winning. However, we cannot get too excited as operating expenses are likely to ramp up to do some marketing spend and some sampling costs.

Overall, Q2 net income of $7.8 million was a huge turnaround from last year’s $14.2 million loss and was mostly due to higher net product sales and gross profit margins. That said, adjusted EBITDA was $22.9 million compared to a loss of $0.5 million in the prior year quarter and $23.9 million last quarter. This is great growth from last year, but slightly lower than Q1 2022 from slightly higher operating expenses. We want to point out that this EBITDA figure in Q2 continues a string of strong EBITDA figures. Further the adjusted earnings per share was $0.28 versus a loss of $0,16 in the prior year quarter. The balance sheet is also in good shape.

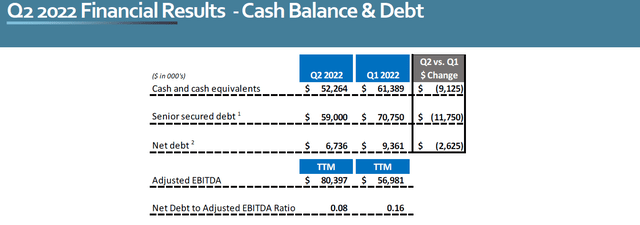

Now, one of the keys to look at in a company like this is the debt and cash on hand. There is some debt, which means some risk, and we expect operating cash flows to fluctuate as we move forward. At the end of Q2 they had senior debt of $59 million. A few months ago the company paid scheduled interest in principal of $9.3 million. The company raised some cash through equity sales to help tackle debt too, raising $7 million in the quarter. Management took that $7 million and prepaid debt. This prepayment will save the company interest $0.5 million in 2022 and $1.4 million over the debt course. Cash on hand is $52.3 million. Good stuff.

So the company is in great shape here folks. Debt-to-adjusted EBITDA was 0.08, which is a big time reduction from a ratio of 0.7 at the start of 2022. Winning. The net cash provided by operating activities was $14.4 million, which is the 5th consecutive quarter of positive operating cash flow.

Management said:

On an annual basis, we expect cash flows to be positive, but due to the timing of working capital, royalties, and interest payments, the quarterly operating cash flow will fluctuate.

Still this is a huge positive for a small company with a market cap of $165 million. Guidance was also increased.

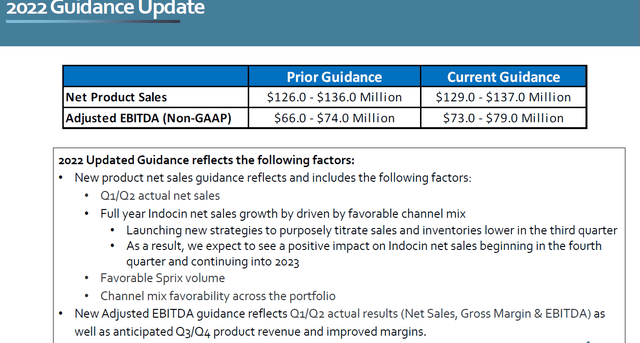

The company raised its guidance and in an impressive manner. Product net sales will be $129 to $137 million. This is a nice increase from the prior guidance (which was a hike at the time) of $126 million to $136 million. They also upped the EBITDA outlook. We want to own stocks like this. Adjusted EBITDA will be $73 to $79 million this year, much higher than the prior view of $66 million to $74 million.

Final thoughts

The stock is trading at 5.5X FWD EPS which is cheap. There is not a lot of debt. And a path to stronger revenues and earnings is quite clear. We think you can do very well here.

We think the stock moves higher, but buy a second wave if the market walks this down.

Be the first to comment