Gonzalo Marroquin/Getty Images Entertainment

Introduction

The share price of ASOS (OTCPK:ASOMY) (OTCPK:ASOMF) has plummeted considerably in recent months. Due to this collapse, there are concerns about the current macroeconomic scenario, not favorable for discretionary consumption, and inflation that weighs on business margins. However, being aware that periods of economic slowdown have always been followed by years of recovery, the current uncertainty can be exploited to buy excellent businesses at discounted prices. Having a long-term perspective, I believe that the risk of obtaining a permanent loss of capital is very low in ASOS, while the potential return is incredibly high. In my opinion, the current price of the company is very low and offers an excellent risk/reward ratio. To describe the investment in ASOS, I find no better words than Mohnish Pabrai’s: “Heads, I win; Tails, I don’t lose much”.

Business Overview

ASOS plc is an online fashion retailer based in the UK. It is present in markets all over the world, and the main ones are the United Kingdom, European Union and the United States, followed by the Rest of the Word (RoW, accounted for 15.6% of revenue in FY2021). ASOS calls itself a retailer for “fashion-loving-20-somethings”. Within its platform, the company offers customers a variety of over 85,000 products in different segments such as sportswear, casual and elegant clothing and various types of accessories chosen among the proprietary brands as well as third-party brands. According to 2019 data, the share of revenues from proprietary brands stood at 40% (£3.9 billion in FY2021).

Latest Results

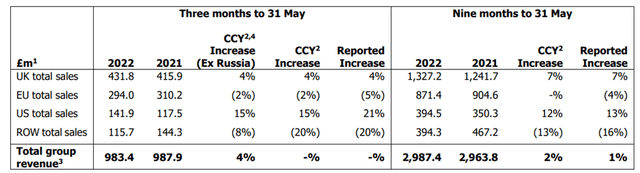

On June 16th, ASOS released the results of Q3 FY2022 which ended on May 31st. The share price fell by 30% following the results due to a lowering of the guidance for the entire year 2022 and the worsening of margins due to conditions that are affecting the entire retail sector.

Guidance for the year updated to reflect uncertain consumer purchasing behavior and the potential continuation of higher returns with revenue growth expected to be 4% to 7% and adjusted PBT now expected to be in the range of £20m to £60m.

There are some things in the quarterly that I would like to discuss deeply because I believe they are useful for getting an idea of the long-term future of ASOS, overcoming current issues such as the high cost of shipping and the slowdown in the supply chain.

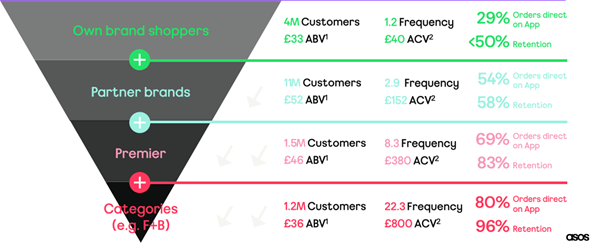

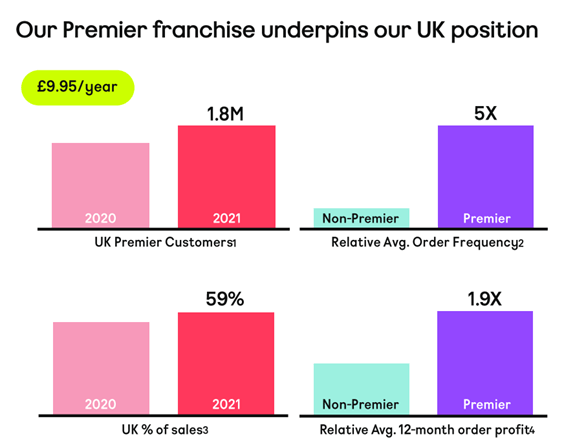

The biggest problem highlighted by management was the increase in returns due to inflationary pressures that hit people’s portfolios and this led to a worsening of margins. The points that, in my opinion, have gone unnoticed are the substantial increase in Premier users and the growth in the United States.

ASOS offers an Amazon Prime-style subscription service called “Premier Delivery,” which gives you free shipping and next-day delivery (some cities also offer same-day delivery). Customers who use this service grew by 19% compared to last year; this made me reflect – even after the increases we’ve all seen in the cost of living, 19% more people have chosen to pay for a subscription to shop on ASOS. The percentage of Premier customers is certainly small compared to the total, but it is still an important point to take into consideration because it means that the service is appreciated. Premier Delivery is also a way to retain consumers; in fact, they will tend to take advantage of the most possible of this service, thus preferring purchases on the ASOS platform over the others.

Capital Markets Day Presentation Capital Markets Day Presentation

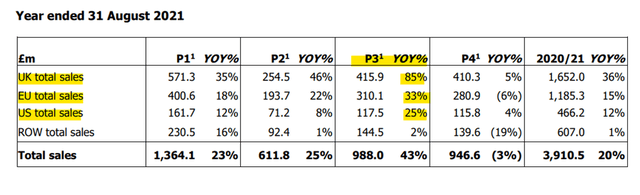

To make the results clearer, we must also take into account the enormous growth we observed in Q3 2021.

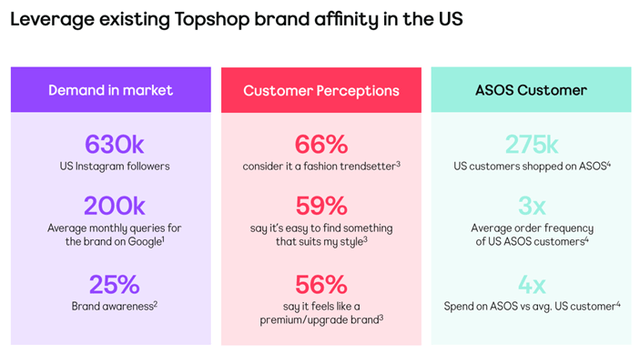

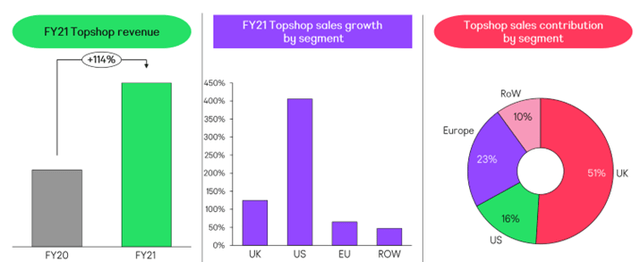

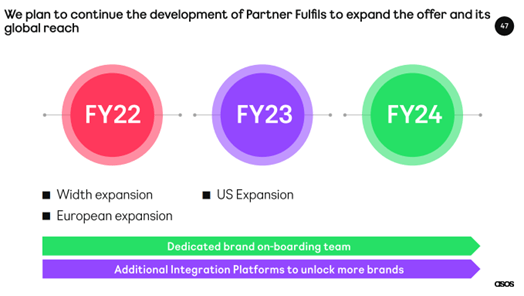

The partnership with Nordstrom for the distribution of ASOS DESIGN and Topshop products in physical stores is also paying off well. There are 11 stores where the products are present and, presently, the company is also approaching distribution in Canada. In addition to generating purchases from people who do not yet like to shop online, seeing the name of the brands could generate curiosity among consumers and bring them closer to the ASOS platform. Revenues from Topshop brands increased by 69%. The rollout of Partner Fulfils continues and the expansion outside the UK into strategic European territories is planned for the second half of 2022.

Market Outlook

ASOS operates in a highly fragmented market with an estimated TAM of $430 billion. In recent years, purchases have continued to move towards online, especially during the lockdown period. In this kind of market, it is difficult to find a company that stands out considerably from others with a particular competitive advantage. Key features for success are the ability to identify consumer preferences and be able to respond quickly to changes in these. The last two years have also shown that having a solid supply chain is essential and that the new generation of consumers also pays close attention to the sustainability of the products sold.

We must take into consideration the macroeconomic scenario in which consumption for discretionary goods will decrease and the cost of money will increase. Many fashion e-commerce companies that have opened in the last 2-3 years but are still small and growing could find difficulties ahead, and in periods of crisis, the market position of the largest and most solid companies is strengthened to the detriment of smaller players, more susceptible to economic fluctuations. Having a brand now recognized and appreciated by consumers in these periods certainly benefits the greats of the sector.

Capital Markets Day Presentation

Long-term Vision

The most obvious catalysts at the moment are the partnership with Nordstrom (JWN), geographic expansion (particularly in the US) and a new ASOS business called Partner Fulfils. However, being a little more forward-looking, other very relevant opportunities can be seen. Before continuing with the analysis, I would like to premise that this thesis and the evaluation of the business are based on the clearest catalysts mentioned above, the other opportunities that are currently more uncertain will be considered only for completeness and given their more uncertain nature they are not relevant for evaluation.

Nordstrom Partnership

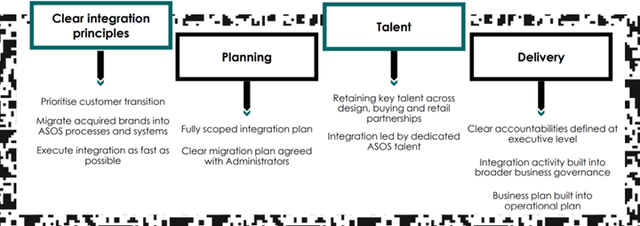

In 2021, ASOS bought Topshop Brands for £265 million in cash and additional one-off restructuring and transaction costs of c. £20 million. The revenue for FY2020 was £265 million, but the rapid integration into the ASOS platform allowed for extraordinary growth and the relaunch of the brands bought, and therefore also led to significant returns on invested capital. Nordstrom has a minority interest as per the agreement, and this has led to the distribution of other proprietary brands of ASOS (such as ASOS DESIGN) in Nordstrom’s physical and e-commerce stores as well. For the first time, consumers will also be able to buy these products in physical stores; this will help the growth of revenues and could be an excellent “advertisement” for the platform. In the last quarter, revenues from Topshop increased by 69%, demonstrating ASOS’ ability to easily and quickly integrate new brands into the platform. The user base in 2021 of over 26.4 million and the international distribution capacity can allow ASOS to relaunch struggling brands, purchased at great prices, achieving high returns on capital.

Capital Markets Day Presentation Acquisition TS TP MS HIIT Presentation

Geographic Expansion

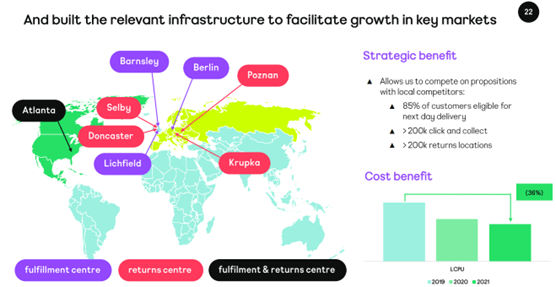

The EuroHub was opened in Berlin in 2017, and its automation was completed in 2019 at the opening of the US logistics center in Atlanta. Finally, in 2021 a new center was opened in Lichfield, and its automation is scheduled for the second half of 2023. The opening of a fifth fulfillment center is already planned. The opening and improvement of logistics centers will allow ASOS to expand even more in Europe, the United States, and the rest of the world. The increasingly widespread presence of fulfillment centers will ensure that ASOS can extend its Premier Delivery in many other countries and improve the user experience so as to differentiate itself from competitors even more.

Capital Markets Day Presentation

The chances for US expansion are clear and will be enhanced by the partnership with Nordstrom. As for the rest of the world, in the last quarter, Australia started to grow again, thanks to the improvement in distribution and the reintegration of Premier Delivery, previously blocked due to the impossibility of fulfilling fast shipping due to problems with the supply chain. ASOS’ business in Russia was halted and this significantly impacted Q3 results. Looking beyond current risks of recession and inflation, especially in Europe, I have no doubt that ASOS can continue to grow and improve its services in many more countries.

During the last year the implementation of the new inventory management system called TGR (truly global retailer) was completed. TGR will allow ASOS to be able to improve efficiency with regard to warehouses management, visibility of products available to customers in different countries and also the management of the price of the various items.

Partner Fulfils

Partner Fulfilment will allow a direct-to-consumer fulfillment by increasing the supply chain of ASOS with the inventory of its suppliers to directly fulfill customer orders. This leads to two key advantages. First is that despite no longer having a product available or having a full warehouse, the company can offer the same product using the partner’s network. The second advantage is that the company will be able to add numerous local brands (even small ones) that will be able to take advantage of the ASOS Network, while the variety of products available on the platform will increase significantly. ASOS will take a commission from these sales and, as a medium-term target, aim for a 5% of the GMV (Gross Merchandise Value) in the next 3-4 years.

Capital Markets Day Presentation

Spawning of New Businesses

Capital Markets Day Presentation

These are currently more uncertain activities on which I will not base my assessment, but which I believe these are useful to know. Considering these opportunities, we could consider ASOS a “Spawner”. According to Mohnish Pabrai’s definition, a “spawner” is a company with the necessary DNA to incubate new businesses that have the potential to become the next massive growth engine.

Capital Markets Day Presentation Capital Markets Day Presentation Capital Markets Day Presentation

Valuation

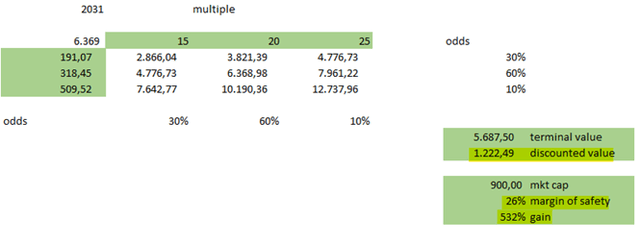

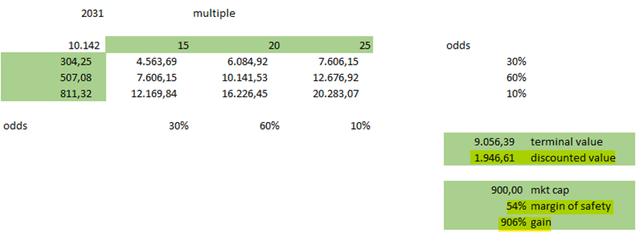

For the valuation I will use a discount rate of 15% and will consider three cases: one pessimistic, one basic, and one optimistic.

- Worst case scenario: FCF margin of 3%, P/FCF of 15;

- Base case scenario: FCF margin of 5%, P/FCF of 20; and

- Best case scenario: FCF margin of 8%, P/FCF of 25

I will also consider two revenue growth rates for the next 10 years: in one case, I will use a CAGR of 5%, and in the other of 10%. (I considered the market capitalization at the time of writing of £900 million).

In one of the latest earnings call, COO and CFO Mat Dunn provided a clear and in-depth view of the growth plan for ASOS for the next 3 to 4 years to reach the £7 billion revenue target. Considering this target, my projections seem very conservative. It is true that this target was given at a time when a recession scenario was not thought of, so the achievement could take a few more years than expected, but it still makes me think that the first case with a CAGR of 5% is truly among the worst cases we could expect, given that it would represent a revenue of £6.4 billion by 2031.

Risks

After the last conference, a big uncertainty – namely, the absence of a CEO – that weighed on the price of ASOS in the last 8 months has disappeared. It was in fact announced that the role of CEO will be held by José Antonio Ramos Calamonte:

José has made a significant impact at ASOS since he joined to lead the commercial function in January 2021, taking responsibility for driving ASOS’ product and trading strategy globally, encompassing design, sourcing, garment technology, buying and merchandising, global trading, ASOS Studios and creative. He has overseen product, category and range strategy, pricing and margin, own-label product innovation and brand partnerships, leading a team of more than 1,000 people.

While we now know who will be CEO for the next years, only time will tell if he is the right person to fill this role.

Operating in a very fragmented market, another risk is obviously competition. ASOS has in its favor the growth in demand for online shopping and a much leaner business model than giants like Zara and H&M. Even in the online world however, we find very aggressive players such as Zalando and many times people do not rely on a single platform when it comes to buying clothes; therefore, the cost of retaining a customer is sometimes very high.

The risk that is most evident at the moment is obviously the current macroeconomic situation, but it must be pointed out that this is a risk that affects the whole sector, not just ASOS. These slowdowns are part of the game and I believe ASOS is well positioned to navigate these turbulent waters.

Conclusion

I think the current price of ASOS reduces the risk a lot, as you can see from the very conservative projections: it’s like the market is pricing the end of the world. We have seen other periods of slowdown in growth in ASOS’ history, followed by periods of great performance thereafter. I don’t think it is very likely that high commodity prices and supply-chain problems will be a permanent problem. Looking more broadly at the whole market, I think even most investors don’t believe it will be permanent, because otherwise the valuations of all companies in most sectors should be revised sharply downwards. Thinking in probabilistic terms, I see ASOS as an investment with an excellent risk/reward ratio.

Be the first to comment