Michael Vi

Introduction

As a dividend growth investor, I seek opportunities to increase my dividend income. I purchase income-producing assets, mainly stocks in the United States. Sometimes I add to my existing positions when I believe stocks are attractive. On other occasions, I initiate new positions in companies that can help me increase my diversification and have decent valuation.

One of the most intriguing sectors right now is the technology sector. We have seen a massive decline in the Nasdaq as the sentiment shifted from growth to value. Therefore, there are some opportunities for investors in this realm. The semiconductors segment is fascinating as it includes companies that still enjoy long-term demand. ASML Holding N.V. (NASDAQ:ASML) is a leading supplier in the semiconductors industry, and I will analyze it in this article.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

SML Holding develops, produces, markets, sells, and services advanced semiconductor equipment systems consisting of lithography, metrology, and inspection-related systems for memory and logic chipmakers. The company provides extreme ultraviolet lithography systems and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various ranges of semiconductor nodes and technologies.

Fundamentals

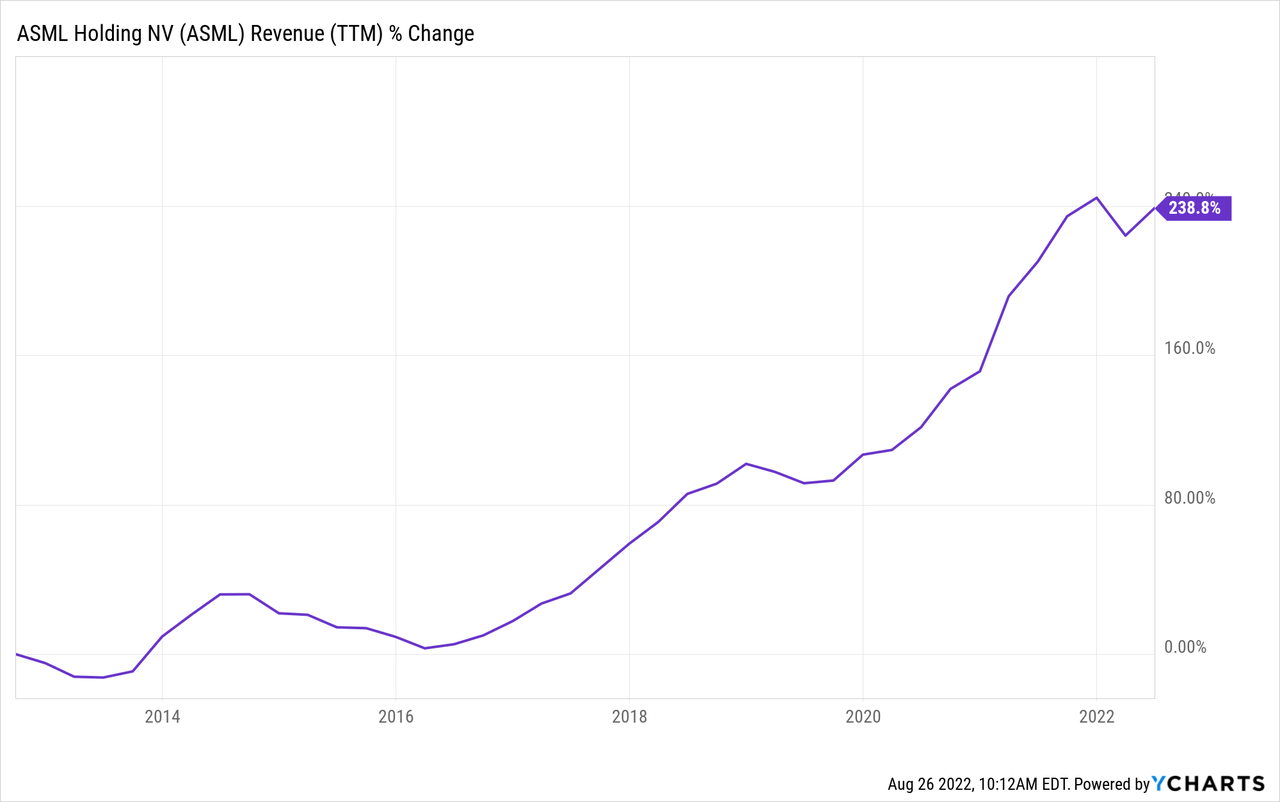

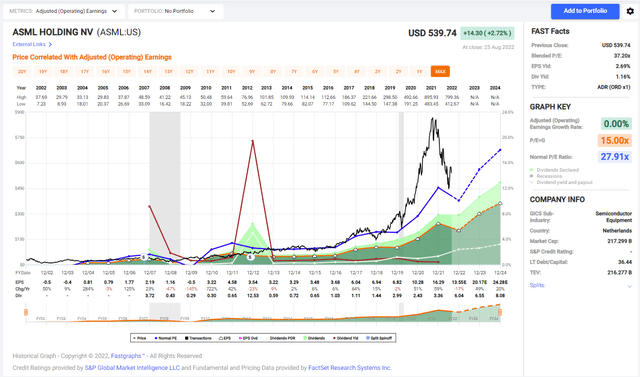

Revenues have increased significantly over the last decade. In the previous ten years, the sales more than tripled as the demand for semiconductors increased and the demand for devices needed to produce them increased. ASML’s growth is mainly organic as the company invests heavily in maintaining its leading position. In the future, analysts’ consensus, as seen on Seeking Alpha, expects ASML to keep growing EPS at an annual rate of ~11% in the medium term.

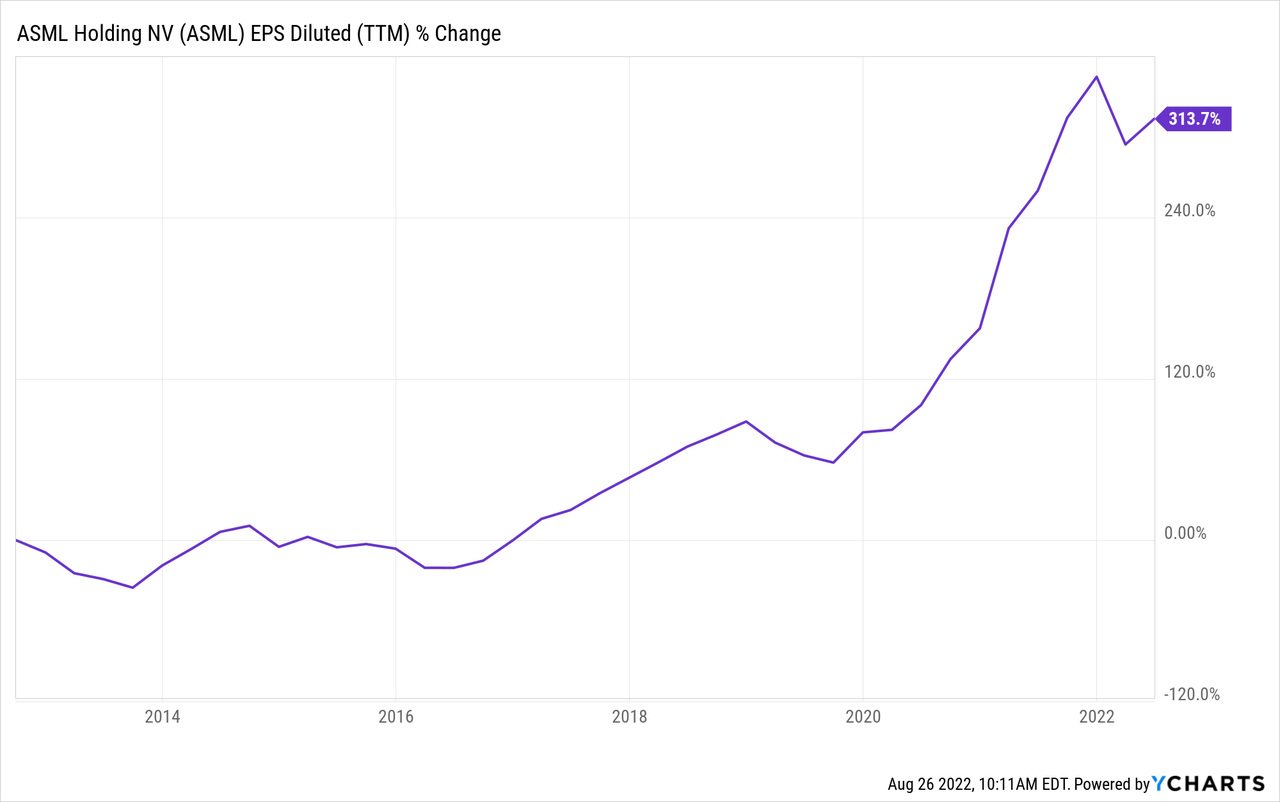

The company’s EPS (earnings per share) have increased even faster. The reasons for the EPS growing faster than sales are the company’s buyback programs and the higher margins. A larger scale, as there were more orders, allowed ASML to become leaner and more efficient with its expenses. In the future, analysts’ consensus, as seen on Seeking Alpha, expects ASML to keep growing EPS at an annual rate of ~15% in the medium term.

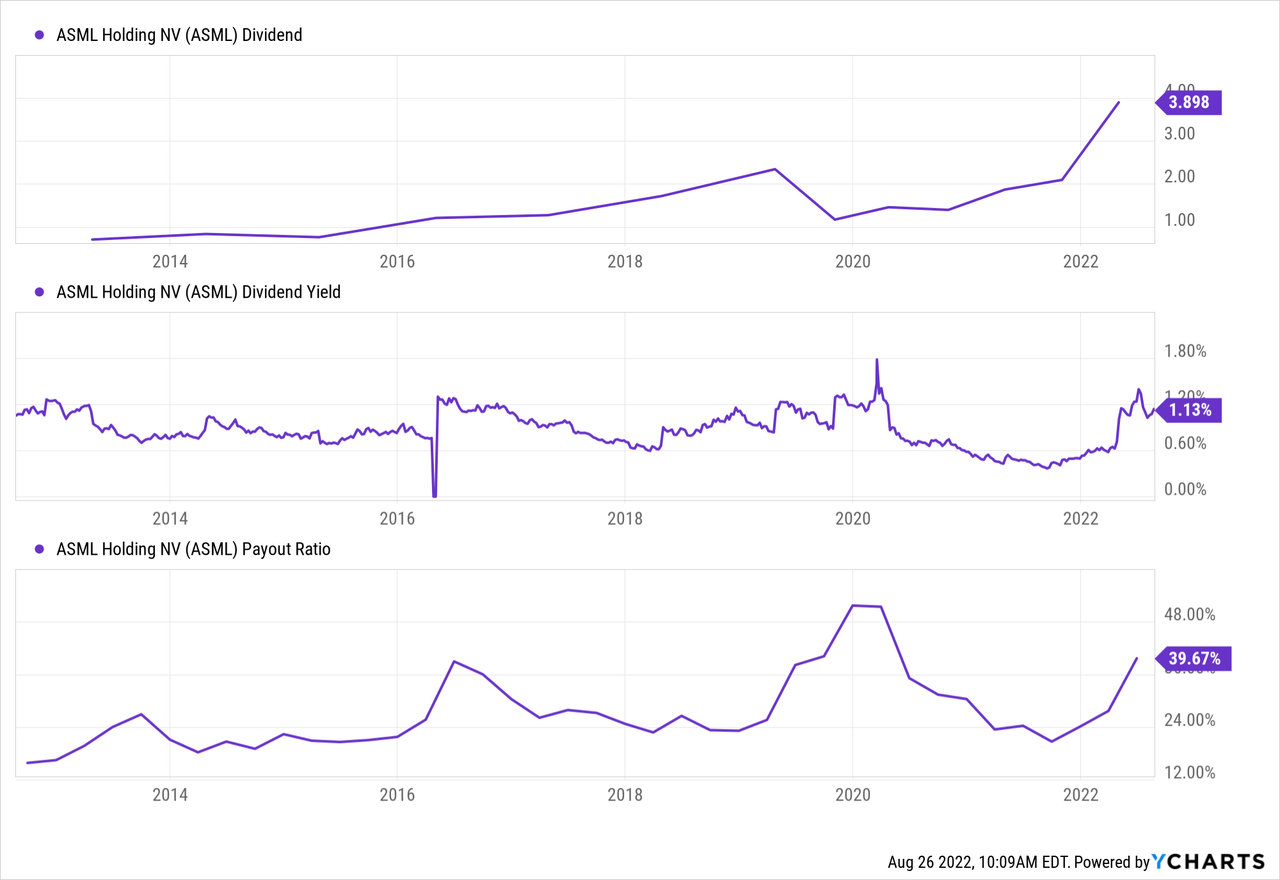

The company is a relatively new dividend payer. The company pays a 1% dividend, which seems safe and unlikely to be cut, with a payout ratio below 40%. There are several nuances regarding the dividend. The dividend increased on an annual basis for 12 years. However, there are two nuances. Only in 2022 did the company shift to a quarterly dividend, so that the graphs may look odd.

Moreover, the company pays a progressive dividend in euros. Therefore currency fluctuations may impact the USD dividend. Investors can buy the shares in Europe and diversify their dividend payments with some euros.

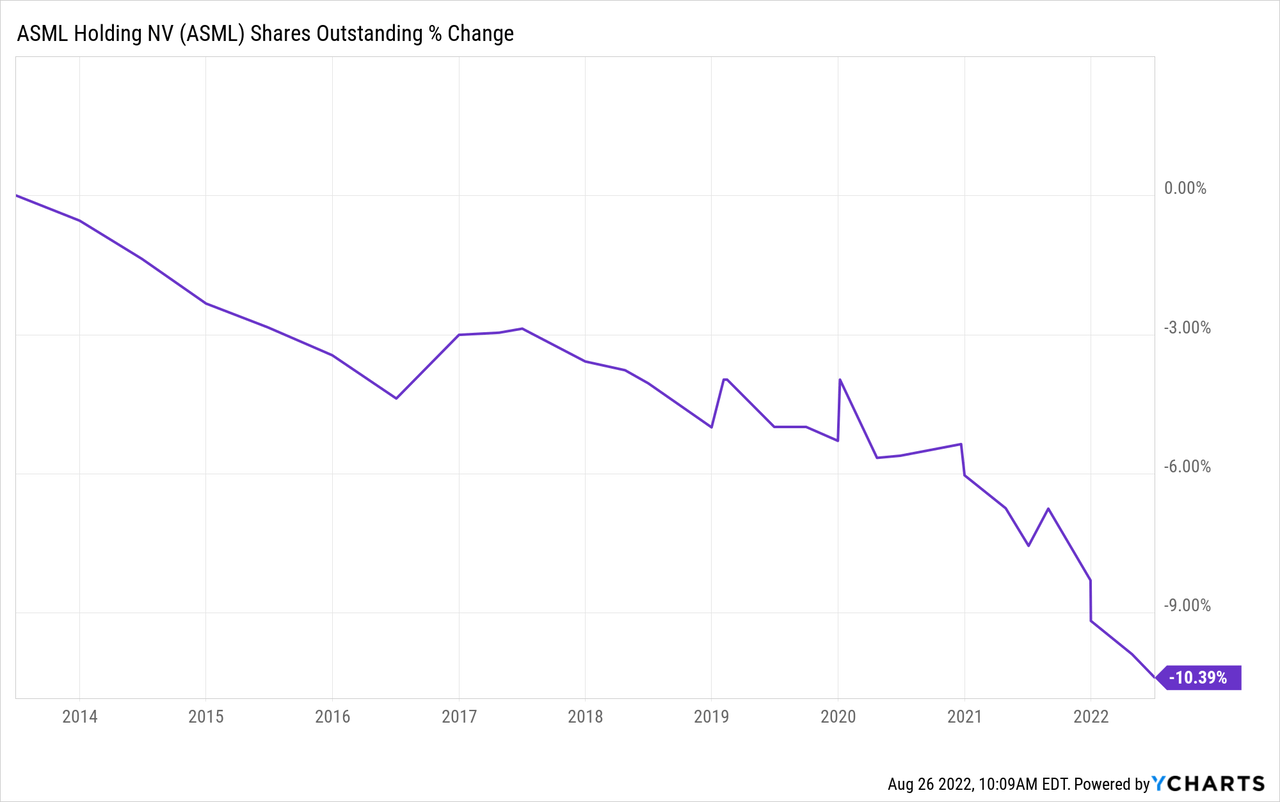

In addition to the dividend, ASML Holding also returns capital to shareholders via buybacks. Buybacks are the main form the company chooses to return money it bought back over 17B euros of stock in 2021 alone. Buybacks are incredibly efficient when the company grows as they supplement the dividend growth. ASML bought back more than 10% of its shares over the last decade. As the valuation becomes more attractive, the buyback’s effectiveness will also increase.

Valuation

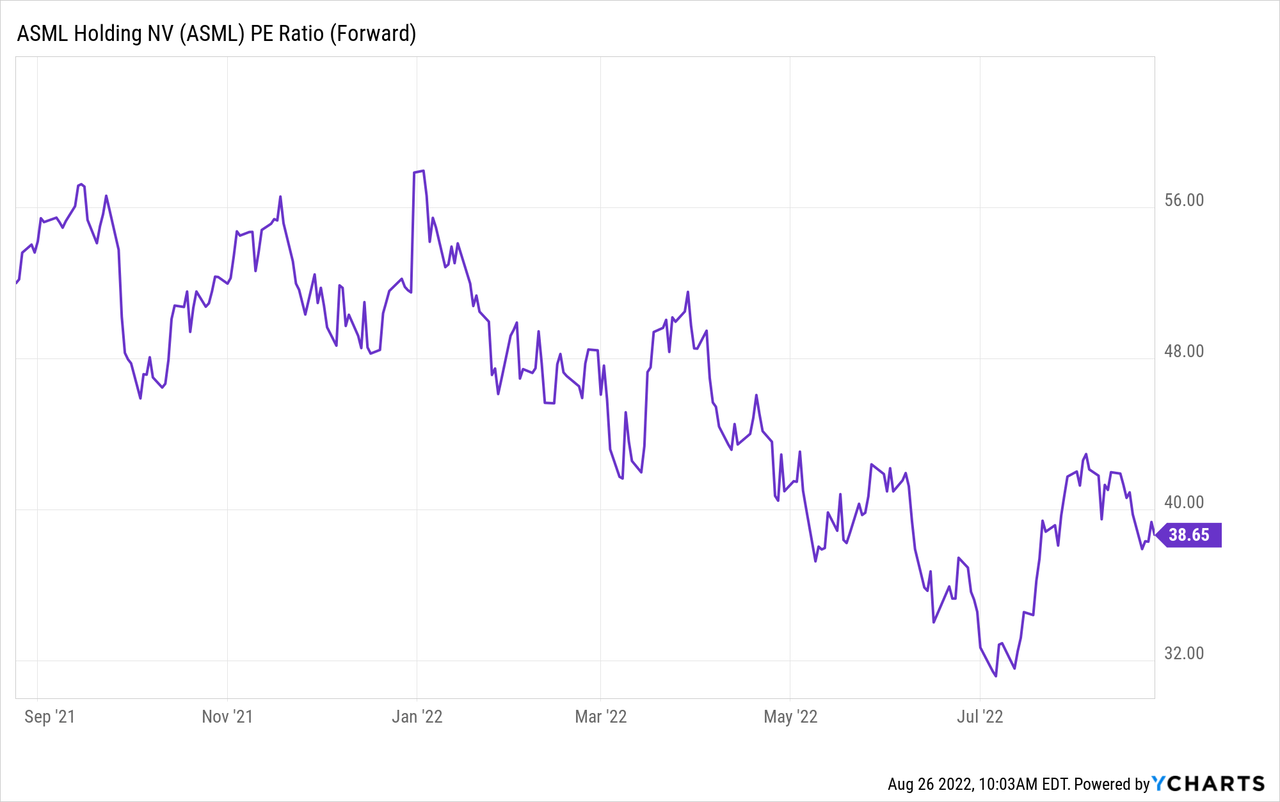

The P/E (price to earnings) ratio of ASML Holding stands at 38.7 when considering the 2022 EPS forecast. It is a high valuation, even considering the healthy 15% growth rate. Therefore, it is unsurprising that the P/E ratio, which stood at 56 at the beginning of the year, contracted. The current valuation is almost the lowest this year, but it is still an expensive stock.

The graph below emphasizes that while the stock is not as expensive as it was just several months ago, the company is still costly. The current P/E ratio is much higher than the average P/E ratio over the last two decades, which stood at around 28. ASML is never cheap, but the current valuation makes it still expensive, leaving investors with little room for error.

To conclude, while ASML has excellent fundamentals, the valuation is challenging. Even healthy double digits growth in the top and bottom line cannot justify the current valuation unless the company performs perfectly. Therefore, the current valuation leaves investors with a minimal margin of safety.

Opportunities

The long-term story remains intact for the entire semiconductor industry. There are more intelligent devices, and each device demands more semiconductors. Semiconductors have become more complex and powerful, driving the continuous demand for high-end chips and machines that can create them like the ones ASML sells. The short-term challenges won’t change the long-term megatrend.

The most significant opportunity for ASML Holding is a competitive advantage which gives it a practical monopoly. The company has a technological advantage that allows it to be the only company that sells EUV (Extreme ultraviolet lithography). As of 2022, ASML Holding is the only company that produces and sells EUV systems for chip production, mainly targeting 5 nm. It is a prominent advantage as it is the only company serving the most high-end needs.

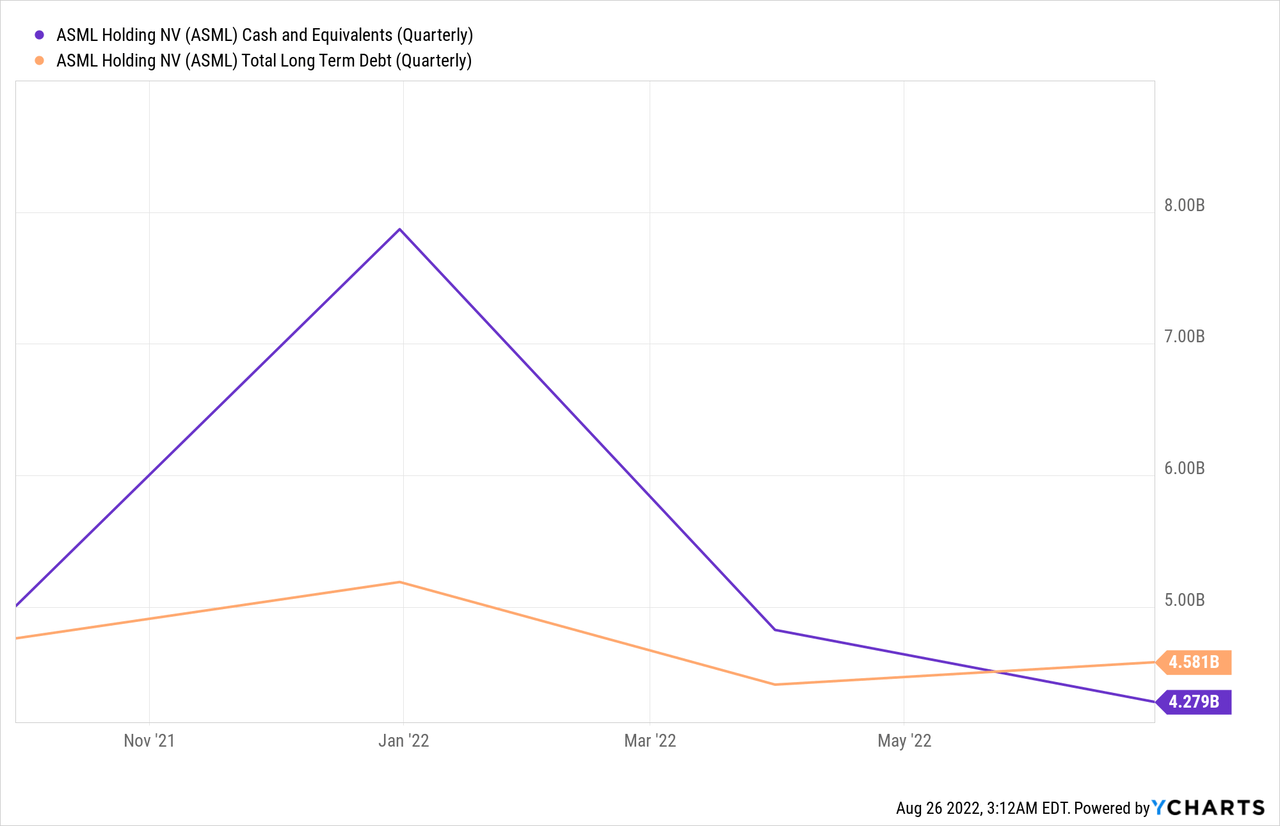

A solid balance sheet is another opportunity for the company. The company’s interest coverage is above 100. Thus the company has only a negligible risk regarding higher interest rates. Moreover, the flexibility and high cash position with a low debt level allow ASML to be very active in the M&A arena if and when needed. The lower valuation makes acquisitions more attractive in the current environment.

Risks

Lower demand in the short term that may slip into the medium term is a risk for the current valuation. According to analysts’ consensus, as seen on Seeking Alpha, analysts expect the EPS to decline 13% in 2022 and jump back 45% in 2023. That assumption relies on the recovery of the demand. We see semiconductors companies like Intel (INTC) and Nvidia (NVDA), and Micron (MU) suffer from lower demand, and if it continues, it will hurt ASML in 2023 as well.

It takes into the risk of recession. Right now, the economy is technically in recession after two consecutive quarters with negative GDP growth. However, we do not feel the recession that harshly. The job market is strong, unemployment is low, and people keep consuming. However, if the situation deteriorates, we may see harsher declines in demand. So if there is a risk of a more extended period of lower demand, there is also the risk of a more profound decrease in order during that time.

Competition is also a risk for ASML Holding. The company has a monopoly due to its leading position and tech advantage regarding unique machines. However, the company competes with peers like Lam Research (LRCX) and KLA (KLAC) on other devices. Moreover, the company may not get complacent as other companies are working on disrupting its current position.

Conclusions

ASML is a highly high-quality company. The immense growth in the top and bottom lines leads to more capital being returned to shareholders. The long-term growth opportunities will serve the company as we advance. Therefore, investors should follow this stock, which suits a diversified dividend growth portfolio.

However, the current valuation of the company is too high. It doesn’t reflect the chance that risks will materialize for a more extended time. If 2023 won’t show extreme recovery, the share price will likely decline more. Therefore, I believe the share price should be around $350-$400 in the current environment. A $500 price tag will be plausible only when we see more assurance for a recovery in 2023.

Be the first to comment