Sundry Photography

Thesis

ASML Holding N.V. (NASDAQ:ASML) released its Q2 earnings on July 20, which included slashed guidance due to its fast shipment delays. However, it didn’t stop the market from staging a remarkable rally from ASML’s early July oversold bottom, defying the media’s downbeat tone. Therefore, we believe the critical question investors need to ask themselves is whether the rally was a dead cat bounce (bear market rally) or a sustained bottom?

ASML has been mired in a series of troubles since the start of 2022. From the early January fire at its Berlin factory to getting caught in the broad semi-downturn, which impacted PC and mobile logic and memory chip shipments.

Then, the US government joined the fray as it lobbied its Dutch counterpart to ban ASML from selling its DUV equipment to China through SMIC (OTCQX:SMICY). Can it get any worse than this? Unfortunately, we don’t think there’s a clear answer on the table.

Notwithstanding, ASML seems to be forming a potential long-term bottom (not validated yet). While still early, it suggests that the green shoots of a bottom in ASML’s long-term chart look increasingly likely moving forward. Still, we have not been on point with our call on the EUV leader in 2022, as we turned bullish too early from our neutral stance last year. Therefore, we revisited our analytical framework and improved on the shortcomings of our valuation model and price action analysis.

So, here’s how we think ASML could likely move from here. In the near term, ASML is likely at a short-term top, given the sharp recovery. But July’s bottom could probably be its long-term lows, which is supported by our valuation analysis. Therefore, the early July bottom has likely attracted long-term dip buyers to add exposure.

Accordingly, we reiterate our Buy rating (medium-term) on ASML. But, we caution investors that our near-term view is leaning towards a Hold, given the potential topping price structure and its recent sharp rally. Therefore, investors can consider a retracement first before adding exposure.

Can The US Succeed In Curbing China’s Access To ASML’s Equipment?

We think the most critical challenge affecting sentiments in ASML now is not its Q2 update of delayed revenue recognition pushed out to 2023 due to fast shipments. Instead, the Biden Administration’s “technological terrorism” efforts are likely causing anxiety to some ASML investors.

The US government’s effort to deny China’s leading chipmakers from gaining access to more advanced chipmaking equipment was sharply retorted by Beijing. It slammed (edited):

This is yet another example of the US practice of coercive diplomacy by abusing state power and wielding technological hegemony. It is classic technological terrorism. This will only remind all countries of the risks of technology dependence on the US and prompt them to become independent and self-reliant at a faster pace. – Bloomberg

So, the question is whether the US is willing to enter into a trade war with China now, given the state of the global economy that has been hobbled by high inflation, surging energy costs, and an impending economic slowdown or recession. ASML CEO Peter Wennink warned (edited):

I think we need to realize that China is an important player in the semiconductor industry, especially not just in the matured nodes but also in mainstream semiconductors. It is a very significant supplier of the global markets. So we just have to be careful what we’re doing. The plans to restrict the shipment of deep UV lithography systems to China have been floated by politicians from time to time. The world cannot ignore the fact that China has chip manufacturing capacity that feeds the global electronics market – Nikkei Asia

As ASML investors ourselves, we are also caught in a quandary. It isn’t the first time the US has threatened to curb China’s access to advanced semi-tools (unlikely to be the last too). So, is the threat credible? We are willing to bet that it isn’t good enough.

Besides pressing concerns with its macro headwinds, adding more supply chain headaches to the world, given China’s chipmaking exposure, would likely lead to pushbacks. Also, SMIC is already capable of producing 7nm nodes with its current technology, despite not having access to EUV lithography systems. TechInsights highlighted recently (edited):

SMIC has likely advanced its production technology by two generations, defying US sanctions intended to halt the rise of China’s largest chipmaker. It is shipping Bitcoin-mining semiconductors built using 7-nanometer technology. That’s well ahead of SMIC’s established 14nm technology. Since late 2020, the US has barred the unlicensed sale to the Chinese firm of equipment that can be used to fabricate semiconductors of 10nm and beyond, infuriating Beijing. – Bloomberg

So, it’s becoming increasingly clear that the current export controls have not exacted significant damage to China’s semiconductor capabilities. Arguably, it may have slowed China’s ambitions, but not meaningful enough to untether them. Little wonder that the US wants to exact more damage.

But, The Street Is Not Buying ASML

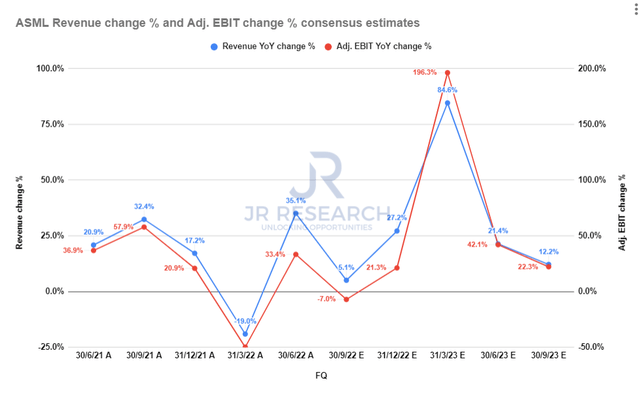

ASML revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

ASML’s marked reduced guidance of its FY22 revenue growth (from 20% to 10%) has also seen the Street revise its estimates. However, the reduction is merely a delay in revenue recognition, which should resolve by FQ1’23.

Accordingly, the revised consensus estimates suggest revenue growth of 196% in FQ1’23, with a corresponding increase in adjusted EBIT of 84.6%. So, we don’t think investors need to be unduly concerned with its revised guidance. And the market is forward-looking.

ASML’s Valuation Was Overvalued, But Well-Balanced Now

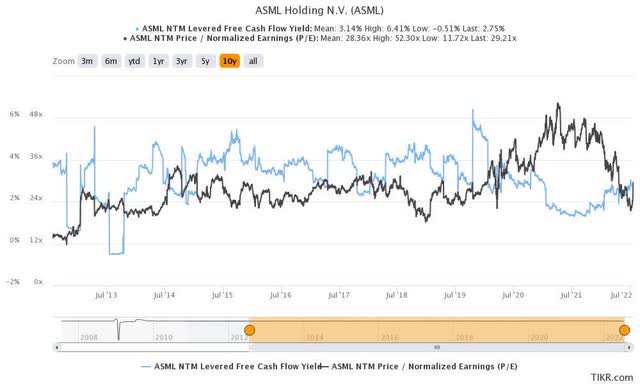

ASML NTM valuation metrics (TIKR)

We revised our valuation models and improved our analytical framework after we realized our previous DCF model wasn’t good enough to model the market’s valuation dynamics.

ASML last traded at an NTM free cash flow (FCF) yield of 2.75%, still below its 10Y mean of 3.14%. However, investors are urged to focus on its FCF profitability post-FY22, given the current supply chain and cost headwinds. ASML also suggested that it could be raising prices to cope with these challenges, protecting its gross margins.

We think it also explains why ASML was previously overvalued at its highs in 2021, given its valuation and profitability headwinds. But, we believe investors should be more confident from here.

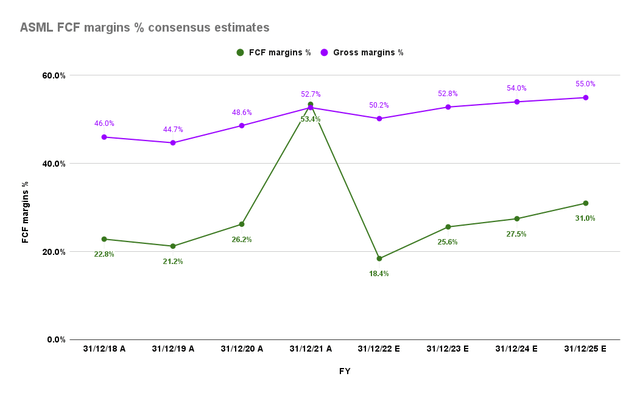

ASML adjusted gross margins % and FCF margins % consensus estimates (S&P Cap IQ)

ASML is still keeping its long-term gross margins expansion guidance, despite its near-term challenges. Therefore, the revised consensus estimates indicate consistently improved FCF margins through FY25, as seen above. Consequently, we believe it can help underpin ASML’s valuation.

| Stock |

ASML |

| Current market cap | $207.56B |

| Hurdle rate [CAGR] | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 3.5% |

| Assumed TTM FCF margin in CQ4’26 | 30% |

| Implied TTM revenue by CQ4’26 | $38.5B |

ASML reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our valuation model suggests that ASML’s valuation is well-balanced currently but not undervalued. We applied a market-perform hurdle rate of 11% but used an FCF yield of 3.5% (higher than its 10Y mean).

ASML last traded at an FY25 FCF yield of 4.91%. Therefore, we believe the market has justifiably de-rated it, given the macro headwinds and company-specific challenges. For ASML to be re-rated (requiring lower FCF yields), we posit a recovering semi-market from here.

Notwithstanding, the market rejected further selling downside at its July lows, as ASML traded at an FY25 FCF yield of close to 6.4%. Therefore, investors can consider waiting for a retracement before adding exposure to improve their chances of market outperformance.

Is ASML Stock A Buy, Sell, Or Hold?

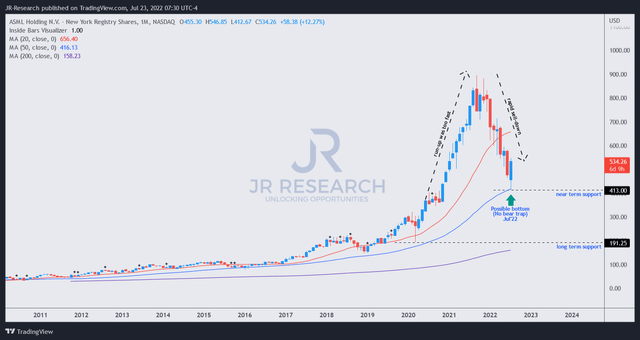

ASML price chart (monthly) (TradingView)

Our price action analysis shows that ASML has likely formed its long-term bottom, pending validation by the end of July.

However, it’s overbought in the short-term with a possible topping price structure.

Notwithstanding, we reiterate our Buy rating (medium-term) on ASML. We expect short-term volatility given its sharp recovery and overbought breadth. So, investors can consider a retracement first before adding exposure.

Be the first to comment