VioletaStoimenova/E+ via Getty Images

Since I first wrote about the construction company Ashtead (OTCPK:ASHTF) around three months ago, its price is up more than 21%. This has partly to do with more optimism in the stock markets in general, but also the fact that the company itself is high-performing, which made it a good buy at a discounted price. The key question is, can it continue to rise much further now?

Robust results

Its latest results are certainly encouraging. In the second quarter of its current financial year (Q2 2022, three months ending October 31, 2022), its revenue grew by 28% year-on-year (YoY) at constant currency. This brings its revenue rise to 26% for the first half of the year (H1 2022), driven by the US which is its biggest market with an 85% share in sales.

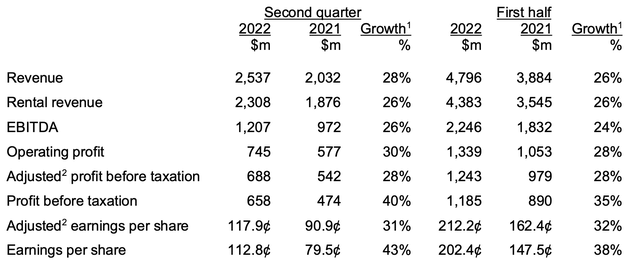

Its EBITDA margin, which had declined slightly in Q1 2022, is now back up to 47.5%. Its operating margin is also strong at 29.4%. Profits have also grown this quarter (see table below), with earnings per share up by 43% for the latest quarter. The increase in profits is notable considering increases in both its operating costs and interest expense. Its operating costs have risen by 25%, which unsurprisingly is due to high inflation. Ashtead mentions rising labour costs as well as those for transportation and fuel in this regard.

Earnings Snapshot (Source: Ashtead)

Controlled debt despite acquisitions

Interest expense has increased by 57% in the latest quarter to $87.3 million. Its interest coverage ratio though has been maintained at a very healthy 8.5x because of healthy profits. The increase in interest expense follows the increased debt because of its bolt-on acquisitions. It has added 27 such buys in the current financial year, for a sum of $609 million. It continues to stay under control with again, the continued rise in profits, though, with a net debt-to-EBITDA ratio at 1.6x, the same as it was during Q1 2022. It isn’t the lowest it has been, at 1.3x last year, but it has still been improving over the years.

Rising net income has also increased the company’s return on investment to a slightly healthier 19% from 18% last year. This is due to a particularly robust 27% number for the US, though its weakest geography, the UK, isn’t strictly speaking bad at 12% either.

Positive outlook

Looking ahead, Ashtead has raised its revenue guidance once again, after doing the same in Q1 2022. It now expects rental revenue, which comprises 90% of its total revenue, to rise by 18-21% this year now. To put this in context, it had initially expected growth of 12-14%. This is supported by a positive policy push in the US from both the Infrastructure Law, which envisages a $110 billion investment in roads, bridges and major infrastructure projects, as well as the $400 billion Inflation Reduction Act, with a focus on green infrastructure.

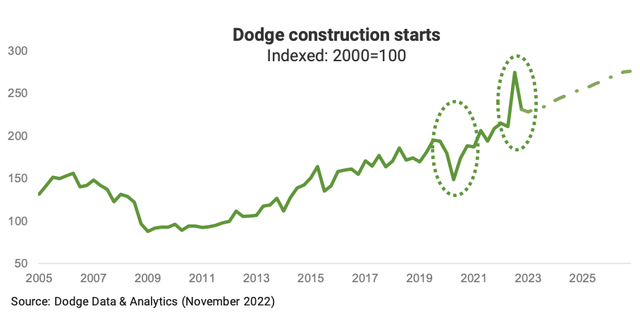

While the construction GDP in the US has been a big drag so far, forward-looking indicators like Dodge Construction Starts are also positive (see chart below), which further supports the case for continued growth for the company.

Rising valuations

However, the extent to which Ashtead’s price can rise from here depends on its valuation. Its price-to-earnings (P/E) ratio has risen to 20.4x since the last I checked, from under 17x. However, it’s still below the 23.7x for the S&P 500 Construction Materials Index, with the latest index data available for November 24, 2022. It is, however, higher than the 19.9x for the Construction & Engineering Index, and also that for the Industrials Sector as such at 17.7x. This doesn’t indicate much potential for a price rise in the short term, going by the index P/Es.

At the same time, it’s worth noting that both the company’s growth and earnings have exceeded the Industrials sector by a margin over the past five years, and continue to do so. At 14.5%, its five-year revenue growth is 37% higher than that for the sector. Its diluted EPS growth at 23.3% is higher by 26%. Further, year-to-date its price is still down by 25%.

What next?

Considering that it could continue to grow next year as well, with the policy push for construction, indicates that Ashtead’s price has scope to rise further though, despite its current valuations. This is especially so considering that next year is widely expected to be a poor one. It could just be the ADR to buy as other companies are affected. Further, with inflation expected to come off as also the rate of rise in interest rates, cost pressures could reduce. This in turn can keep its profits healthy. However, it’s possible that Ashtead’s price might show sideways trends in the near term. In the past week, it has barely budged, for instance.

But over time, it’s likely to stay rewarding. In the past five years, its price has risen by 131% and in the last decade, it has seen an even bigger rise of 876%. In fact, considering this rise in price over time, its dividend yield from the initial period of investment can add up. In the context of the UK, the Ashtead stock has the best dividend yield over a 10-year period, compared to all other FTSE 100 stocks, with a CAGR of 22.7%. This fact is easily obscured by its current dividend yield of 1.3%. I maintain a Buy on it.

Be the first to comment