Lukassek/iStock via Getty Images

Looking for global exposure in your income portfolio? There are various ETFs and closed-end funds which specialize in that area.

We looked at quite a few of them, with an eye to dividend yield, discount to NAV if available, and performance. The Aberdeen Standard Global Infrastructure Income Fund (NYSE:ASGI) caught our eye.

Profile:

ASGI is a newly organized, non-diversified, closed-end management investment company, a CEF, whose objective is to seek to provide a high level of total return with an emphasis on current income. It’s a relatively new CEF, having IPOd in July 2020. A bit of bad luck with that IPO’s timing, coming during the pandemic lockdown era.

ASGI’S portfolio is managed by Aberdeen’s Global Equity Team & Real Assets Team.

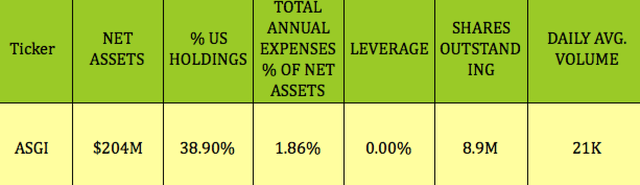

As CEF’s can run into the billions, ASGI is a small CEF, with $204M in Net Assets, and 8.9M in outstanding shares, and average daily volume of 21K. Annual expenses run at 1.86% of net assets, and there’s no leverage.

Hidden Dividend Stocks Plus

Distributions:

ASGI just announced a 10.8% increase in its monthly distribution this week:

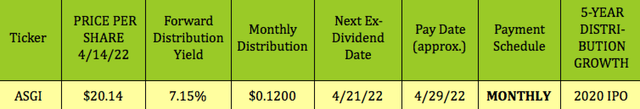

“Aberdeen Standard Global Infrastructure Income Fund announced that it has increased its monthly distribution from US $0.1083 per share to $0.12 per share, commencing with the distribution payable on April 29, 2022 to shareholders of record as of April 22, 2022 (ex-dividend date April 21, 2022).

The Fund intends to maintain the increased monthly distribution level of $0.12 per share for at least the next 12 months unless there is significant and unforeseen change in market conditions.

In approving the increase in distribution rate, the Board of Trustees considered, among other things, the Fund’s strong positive performance since inception. As of March 31, 2022 the cumulative total return since inception of the NAV of the Fund was 27.31% and the market price total return was 11.10%.” (ASGI site)

At $20.14, ASGI has a forward yield of 7.15%. It pays monthly, and goes ex-dividend next on 4/21/22, with a 4/29/22 pay date.

Hidden Dividend Stocks Plus

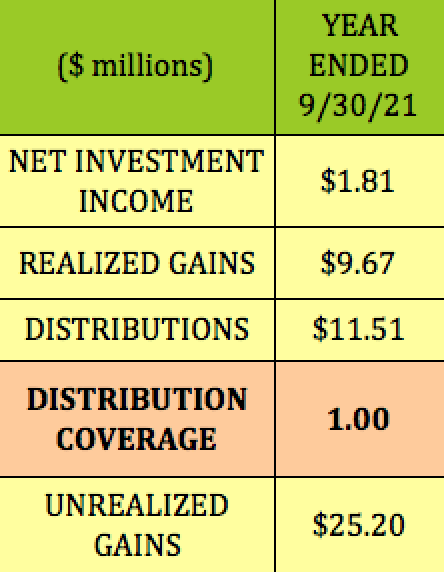

ASGI’s fiscal year ends on 9/30. It covered its distributions on a 1X factor, mainly via Realized Gains, and with ~16% NII, but it also had a big cushion, with ~$25M in Unrealized Gains:

Hidden Dividend Stocks Plus

Taxes:

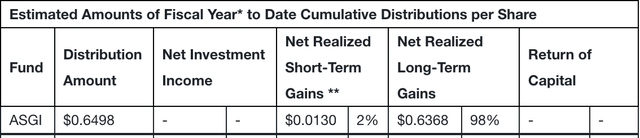

From 10/1/21 through 3/31/22, ASGI’s monthly distributions have been estimated to come from 98% in Long Term Gains and 2% in Short Term Gains, with no Return of Capital.

ASGI site

Performance:

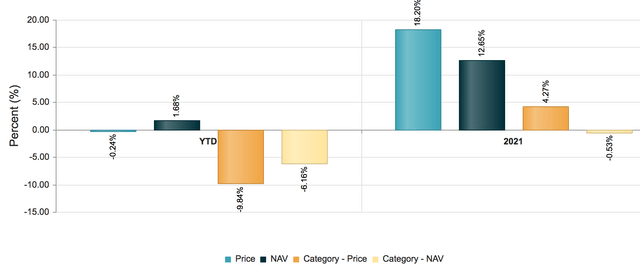

Since ASGI IPOd in mid 2020, there’s not a lot of performance history to see. However, it did outperform the Morningstar Global Equity CEF category in 2021, and has outperformed it so far in 2022, on a price and NAV basis.

CFC

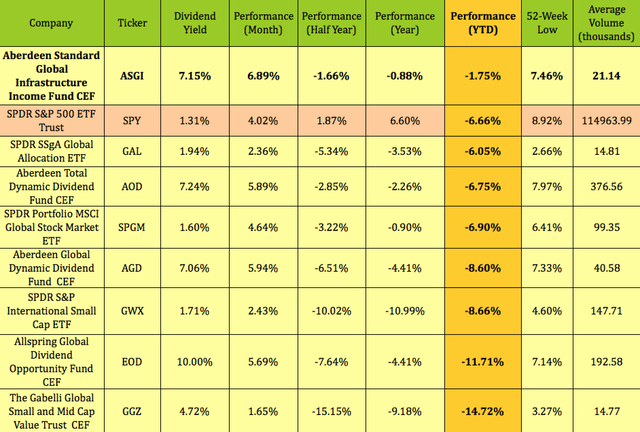

Looking at the performance of some other globally-oriented ETFs and CEFs shows ASGI with the best performance of this group over the past year, half year, month, and so far in 2022.

ASGI has lagged the S&P 500 over the past year, but has outperformed it in the past month, and so far in 2022. It’s ~7.5% above its 52-week low.

Hidden Dividend Stocks Plus

Holdings:

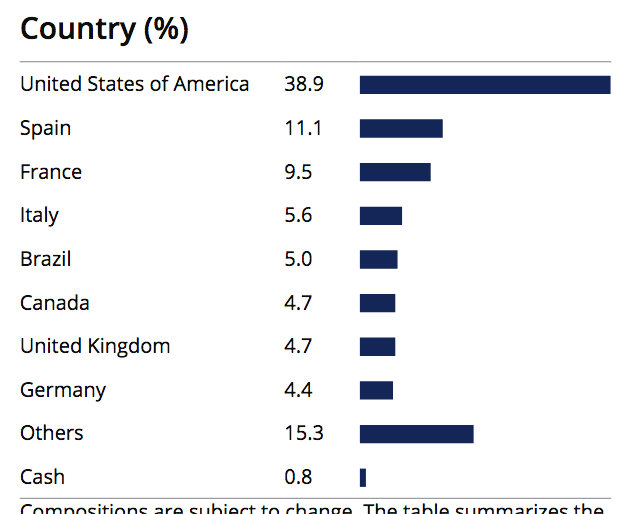

As of 2/28/22, ASGI’s biggest regional exposure was the US, at ~39%, with ~36% exposure to European countries Spain, France, Italy, the UK, and Germany:

ASGI site

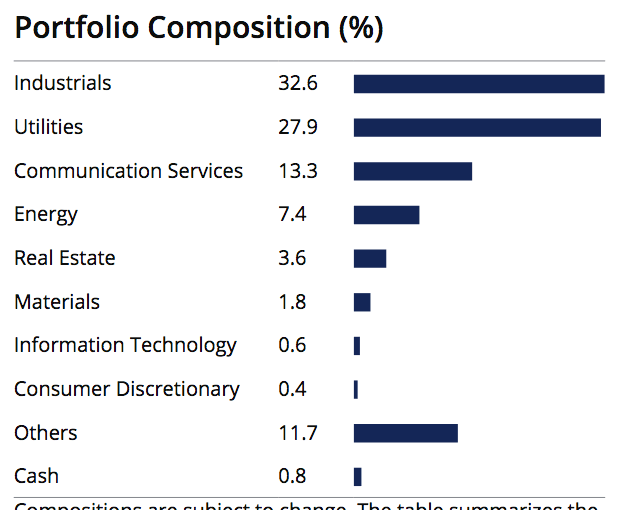

As you’d deduce from its name, ASGI’s biggest sector exposures are Industrials, Utilities, Communication Services, and Energy, forming ~81% of its portfolio:

ASGI site

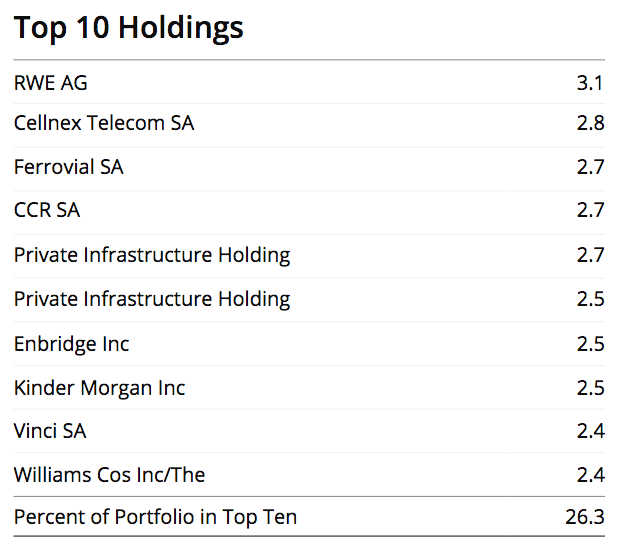

The top 10 holdings comprised 26% of ASGI’s portfolio, as of 2/28/22, with three familiar energy-related names in the mix – Enbridge (ENB), Kinder Morgan (KMI), and Williams Companies (WMB).

The top holding, RWE AG, is a Germany-based utility, with power plants in Germany, the UK and the Netherlands, and ~3,000 employees. RWE Generation produces electricity primarily from gas, hydropower and biomass.

Cellnex Telecom (OTC:CLNXF, OTCPK:CLLNY, OTC:CLNRF) is one of Europe’s leading operators of wireless telecommunications and broadcasting infrastructure with a portfolio of ~128,000 sites. It provides services in Spain, Italy, Netherlands, United Kingdom, France, Switzerland, Ireland, Poland, Portugal, Austria, Denmark and Sweden.

Ferrovial SA (OTCPK:FRRVF, OTCPK:FRRVY) is a Spanish infrastructure company with more than 63,070 employees and a global presence in six main markets. Its earnings come from toll roads, airports, construction, water, and other infrastructure-related businesses.

CCR is a Brazil-based company mainly engaged in the operation of highways, and the high capacity data transmission sector.

ASGI site

Pricing:

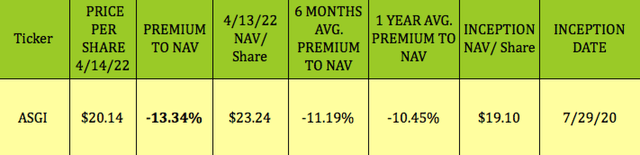

Like some of the other CEFs we’ve covered in our articles, ASGI is selling at an attractive discount to NAV.

Buying CEFs at a deeper than historic discount to NAV/Share can be a useful strategy. At its 4/14/22 afternoon price of $20.14, ASGI was selling at a -13.34% discount to its 4/13/22 NAV of $23.24. That’s deeper than its 6-month average discount of -11.19%, and its 1-year average of -10.45%.

Hidden Dividend Stocks Plus

Parting Thoughts:

With a 28% weighting in utilities, ASGI may continue riding the wave of Mr. Market’s new-found love for that sector. Although utilities are supposed to decline in periods of rising interest rates, in 2022 they’ve been one of the few bright spots in the market, rising 9% over the past three months, second only to the energy sector.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Be the first to comment