izusek/E+ via Getty Images

ASAP, Inc. (NASDAQ:WTRH) is an online ordering technology platform connecting businesses like restaurants and convenience stores with consumers to streamline delivery services in approximately 1,000 cities across the U.S. The company had a moment back in 2020 at the height of the pandemic, supported by strong demand for home food delivery, although results have struggled ever since with operating and financial trends unable to gain traction.

The company recently changed its name from “Waitr Holdings” as part of a rebranding strategy to jumpstart a turnaround. Unfortunately, we believe efforts will fall short against the weight of significant financial weaknesses and intense competition in this segment. Indeed, shares are down by more than 75% in the past year, highlighting significant fundamental challenges including declining revenue and an accelerating cash burn. The stock is extremely speculative, and we view the risks here tilted to the downside.

WTRH Earnings Recap

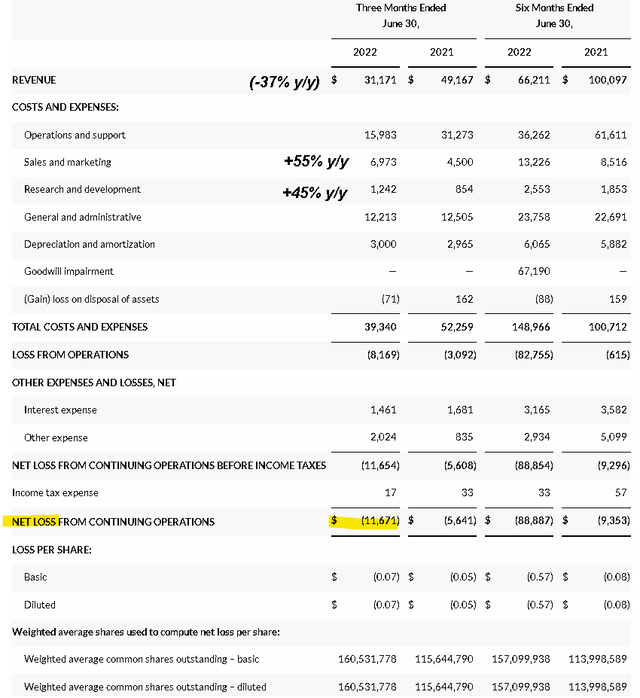

The company reported its Q2 earnings on August 8th with a non-GAAP EPS loss of -$0.06 compared to -$0.04 in Q2 2021. The company lost -$11.7 million during the quarter on $31.2 million in revenue, which fell by 37% year-over-year from $49.2 million in the period last year.

Management noted the weakness reflected what was a tough comparison period in 2021 defined by the consumer spending boost from stimulus payments along with more recent headwinds like diners pulling back on orders amid inflationary pressures. In other words, fewer people are utilizing the platform with 18,070 daily average orders during the quarter compared to 35,583 in Q2 2021.

Even with the declining top line, sales and marketing expenses jumped 55% y/y while the company also spent 45% more on research and development. The result is that the -$3.6 million in adjusted EBITDA for Q2 reversed a positive $2.5 million result in Q2 2021.

It’s also worth mentioning that the outstanding share count has climbed, with ASAP issuing stock to raise liquidity. The company ended the quarter with $28.2 million in cash against $61.8 million in long-term debt. Considering an ongoing operating cash flow bleed of -$14 million in Q2, we expect further capital issuances over the next year to support continuing operations.

In terms of corporate developments, we won’t knock ASAP for trying to stay relevant. The latest update is a collaboration with “7-Eleven” stores connecting with the platform to allow for delivery of customer online orders. ASAP is moving forward with agreements with different types of retailers covering goods like apparel, auto parts, and electronics as part of its “deliver anything” strategy. Keep in mind that the drivers work as independent contractors and are compensated as part of the order fee and through gratuities.

Separately, ASAP also partners with stadiums and large event venues to allow attendees to order concessions directly from their seats through a mobile app as another growth opportunity. An important update in July was a sponsorship deal to serve as the exclusive mobile ordering platform at “MetLife Stadium” which host “New York Giants” and “New York Jets” football games. The system is currently active at the “University of Alabama”, “Louisiana State University” and the “New Orleans Saints Superdome” with plans to expand nationally. Presumably, the segment should support some revenue boost into Q3 and Q4 as the sporting season gets underway although the contract details are unknown.

Is WTRH A Good Investment?

We’re not convinced that ASAP’s strategy to regain growth momentum will work. While headlines of partnering at NFL stadiums and even entering the New York City/New Jersey market for food delivery are positive, it’s unclear whether the economics can move the needle to support a financial rebound from the declining broader business.

The concept of ordering concessions from a mobile device with cashless payment is not necessarily new. Several other companies are offering similar solutions that are already live at major venues. Any plans for a national expansion will be highly contested.

The reality here is that the core of the business remains the restaurant food delivery platform, which is dependent on both businesses signing up, and consumers choosing to place orders through the service. Again, this is a case of ASAP being a tiny player compared to category leaders like DoorDash, Inc. (DASH) or “Grubhub” from Just Eat Takeaway (OTCPK:JTKWY) which is backed by Amazon.com, Inc. (AMZN). Even Uber Technologies, Inc. (UBER) offers food delivery services through “Uber Eats”. We can go on to include private names like “Delivery.com”, “Postmates” or “GoPuff” as a pre-IPO. A lot of companies are attempting the deliver anything model.

The largest players in each market have an advantage that extends through their relationship with local businesses while consumers are more likely to use a service that has the most options. In our view, these dynamics are the biggest challenge for ASAP to overcome making it a poor investment with an uncertain long-term outlook.

WTRH Stock Price Forecast

Without being dramatic, ASAP is a company that may very well not exist in its current form five years from now. We are bearish on the stock and suggest investors simply stay away.

That being said, there’s always room to at least consider a bullish case. The company will need to stabilize sales trends and demonstrate a path to generating positive cash flows sooner rather than later. Presumably, there are certain small cities and markets where the ASAP food delivery service operates profitability with a leading market share. Some type of restructuring to focus on the best performing areas would allow the firm-wide operation to become self-sufficient.

What’s more likely to happen, in our view, is a drawn-out deterioration of the balance sheet as the company is required to conduct further capital raises to support liquidity. We won’t be surprised if a reverse split for the stock is on the horizon and a continuation of negative equity returns.

Be the first to comment