gorodenkoff/iStock via Getty Images

When it comes to the tech sector, over the past few years we have only seen two extremes. In 2020 and 2021, exuberance was the name of the game. Investors all but ignored valuation and profits, and chased after the highest-growing companies with the best brand names. The more buzz and attention they got in the media, the higher valuations went up – all without regard to valuations.

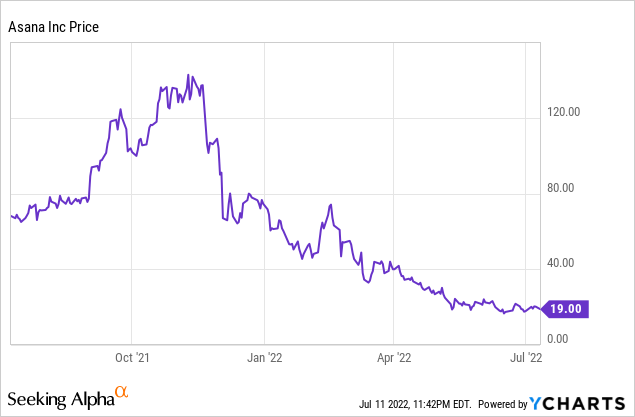

Then, that mentality slipped in 2022 and became the inverse. Again ignoring fundamentals, investors sold off high-growth tech stocks as fast as they could, overcorrecting for the valuation excesses of the past few years. And now stocks like Asana (NYSE:ASAN), trading very near all-time lows, are looking like yesterday’s trash despite the fact that business performance has held up exceptionally well.

The bullish thesis for Asana has never looked clearer

Owing to Asana’s dramatic continued declines, I’m upgrading my view on the stock to very bullish and am strongly recommending buying the latest dip here.

It almost seems like investors have forgotten how to value and appreciate the logic of the software business model. The core idea here is that all the investment comes upfront. Tons of R&D spend are required to create a great product; next, healthy investment in sales and marketing is required to get that product pushed into customer hands. But the beauty of the SaaS model is that once a customer is landed, they tend to stay – and not just stay, but eventually expand. Gross margins, which tend to be in the 70-90% range (Asana’s is among the highest in the industry) allow for tremendous economies of scale as operating expenses shrink as a percentage of revenue. And then, further down the line, a very profitable business emerges.

Asana is still a young company growing nearly 60% y/y – and yet, investors seem to be punishing the stock for its losses today rather than cheer it for its growth potential. I encourage investors to think with a long-term mindset (as a venture capitalist might) and ignore the recent pessimism on Asana.

As a refresher for investors who are newer to this name, here are the key reasons to be bullish on Asana:

- Asana’s long-term demand will be bolstered by the ongoing shift to remote and distributed teams. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025, and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana’s current user base represents only <5% of the global eligible workforce.

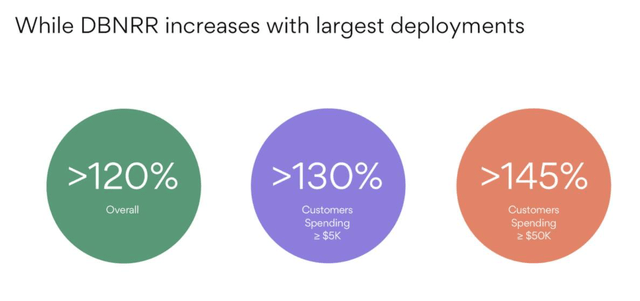

- Land and expand. Asana adopts the classic software go-to-market playbook, which is to prove its concept and value with smaller teams at first, but eventually expand to entire organizations and companies. Dollar-based net retention rates are clocking in above 140% for companies spending more than $50,000 annually on Asana, a leading indicator that Asana’s traction among larger enterprises is growing.

- Continuous innovation. The company added over 200 new product features in calendar year 2021, and in February 2022 unveiled a new workflow tool.

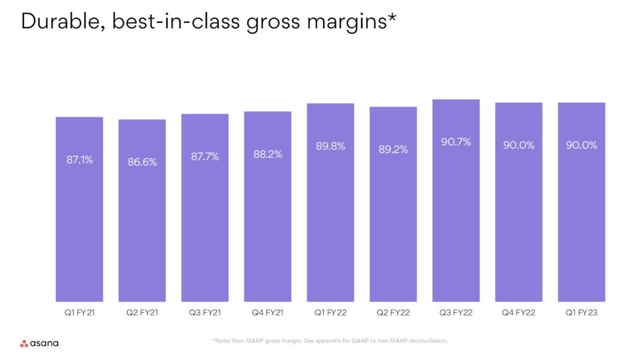

- Huge gross margin profile. Asana’s pro forma gross margins hit 90%, making it one of the highest-margin software companies in the market. While the company isn’t profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it’s larger, as nearly every dollar of incremental revenue flows through to the bottom line.

Also, Asana has never looked cheaper

Despite all of its merits, Asana’s YTD selloff has taken the stock to laughably low valuation levels. At current share prices near $19, Asana trades at a market cap of $3.61 billion. After we net off the $282.5 million of cash and $33.5 million of debt on Asana’s most recent balance sheet, the company’s resulting enterprise value is $3.36 billion.

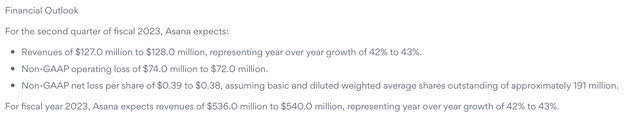

Meanwhile, for the current fiscal year Asana has guided to $536-$540 million in revenue, representing 42-43% y/y growth. We think there’s a good chance this outlook is quite conservative, given 57% y/y growth in Q1.

Asana outlook (Asana Q1 earnings release)

Nevertheless, if we take the midpoint of this revenue outlook, Asana trades at just 6.2x EV/FY23 revenue – recall there was A) once a time that Asana traded north of >20x revenue, and B) a ~6x multiple used to be a standard multiple for a company growing revenue at a 15-20% y/y pace, not nearly 60% y/y like Asana.

The bottom line here: if you can be patient in the short run, Asana has such wide leeway from a valuation perspective that barring any major fundamental slip-up, a recovery rally will be highly likely as long as overall market sentiment continues to improve.

Q1 download

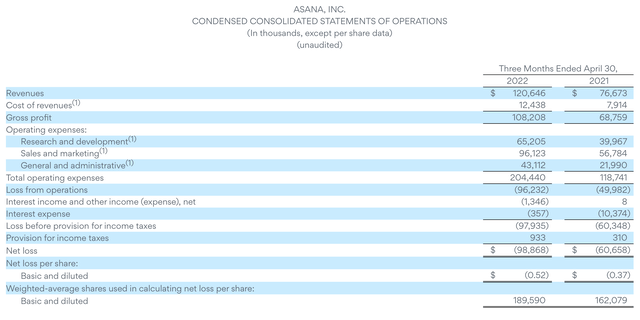

Let’s now cover Asana’s latest Q1 earnings results in greater detail. The Q1 earnings summary is shown below:

Asana Q1 results (Asana Q1 earnings release)

Asana’s revenue in the first quarter grew at a stunning 57% y/y pace to $120.6 million, beating Wall Street’s expectations of $115.1 million (+50% y/y) by a seven-point margin. We note that Asana’s revenue growth did decelerate relative to 63% y/y growth in Q4, but for the company’s ~$500 million revenue scale, a near-60% growth rate is quite impressive – and it’s also well ahead of Asana’s guidance growth range for the year.

Also important to note is that Asana’s net revenue retention rate is greater than 20%, indicating that the average customer upgrades their relationship with Asana by 20%. That figure is even larger for Asana’s larger customer segments, with customers spending >$50k per year having a much higher net retention rate of 145%. Wall Street is so glued to this metric because its expansion represents a very profitable source of growth for a software company: it costs far less to sell more to an existing customer than it is to expend sales resources landing a new customer.

Asana Q1 net retention rates (Asana Q1 earnings deck)

Here’s some additional go-to-market commentary from Anne Raimondi, the company’s COO, on the Q1 earnings call – all pointing to a very robust demand environment:

Our investments in the enterprise segment are paying off as we set new records with bigger lamps and faster expansion. We now have 390 customers spending over $100,000, and these larger deals represent our fastest-growing customer cohort, up 127%.

We’re also consistently closing strong wins in the mid-market, where I would note in particular, we are seeing an uptick in wall-to-wall deals. Across medium-sized companies and divisions of enterprise organizations, our differentiated Goals product, which seamlessly ladders individual tasks, team projects and cross-functional portfolios up to company goals with automated status reports is helping us close more strategic opportunities […]

Lastly, we have a healthy pipeline and strong engagement with our large customers. As I look across our customer base, I see 3 major trends: bigger expansions often driven by strategic cross-functional use cases, larger lands and broad cross-industry adoption.”

Asana continued to turn out strong gross margins as well. Pro forma gross margins in Q1 were 90.0%, 20bps higher than 89.8% in the year-ago Q1. We note that this indexes quite strongly against other SaaS companies, which typically land in the 70-80% pro forma gross margin range on average.

Asana gross margins (Asana Q1 earnings deck)

Investors were flustered over Asana’s pro forma operating loss margin, which was -45% in the quarter: two points worse than -43% in the year-ago Q1. This is because Asana is still spending 80%+ of its revenue on sales and marketing. I’d say, however, this is an acceptable trade-off to be making to achieve ~60% y/y revenue growth that comes at a 90%+ margin and has Asana’s huge net expansion tendencies built in. Asana has time to scale profitably; we should not judge it for its profitability when it’s still growing like a weed.

Key takeaways

My advice here: take a nibble on Asana now at current prices, ignore the short-term volatility, and wait out for a rebound. It’s unfathomable to think that Asana will continue to trade at a ~6x forward revenue multiple for its growth rate for the long run. Investors’ nightmare scenario of Asana’s losses piling up is also unrealistic because many smaller, underperforming software companies have ended up as acquisition targets.

Now, while the rest of the market is fearful is the right time to be greedy.

Be the first to comment