kupicoo/E+ via Getty Images

Investment Thesis

Asana (NYSE:ASAN), the work management platform, is down 80% in the past 12 months. To say that last year Asana was ”obviously” overvalued isn’t quite fair. Investing is never obvious apart from hindsight.

Today, with Asana’s share price down so significantly this means that investors’ expectations are now more realistic.

There are still a lot of issues with Asana, predominantly around the question of when exactly Asana will be reporting clean GAAP profitability.

But on balance, I do think that there’s enough here to become bullish on Asana.

What’s Happening Right Now?

The macro outlook is certainly negative. There are countless considerations that must be factored in. Least of all, the impact of inflation. However, beyond inflation, there are high energy costs and higher mortgage rates that are impacting household budgets, which in turn impacts the strength of the business environment.

And the list goes on and on. And while I recognize those headwinds and the uncertain impact that they will have on Asana, at the same time, I must be aware that these headwinds have now been known for a while.

What we don’t have clarity over is the magnitude of those impacts. That being said, it’s difficult to argue at this point that a large proportion of these headwinds are not yet priced into the market.

Simply put, this is my argument, these are now widely accepted headwinds.

Asana’s Near-Term Prospects

With the power of hindsight, I made the right call to sidestep my bullishness toward Asana this time last year.

At the time the macro environment was rapidly deteriorating, and I didn’t believe that the odds of a favorable investment were positively skewed.

Today, I believe that the odds have improved substantially. To be clear, that’s not to say that Asana cannot sell off another 30% or 40%, or even 50%, that’s all a possibility.

After all, a stock that is down 90% was once a stock that was down 80% and got cut in half.

However, my point is that the setup has started to improve. Even though the macro is going to continue to plague equities broadly, I don’t foresee another calamitous year for Asana.

The way that I see it, Asana and other high-growth companies have taken their medicine in large quantities during the past year, and a lot of risk has now been priced in.

The Bull Thesis, We’re in This Together

Asana’s CEO Dustin Moskovitz recently invested $350 million in Asana via a private placement. Back in February, I mentioned this capital infusion as a bearish consideration.

Today this capital raise has already taken place, and Asana’s shareholders have been diluted by approximately 10%.

However, one thing we can all be positively assured about, CEO Moskovitz is highly incentivized to deliver a positive upside to all shareholders.

The Bear Thesis, Profitability Profile

Moving on, Asana’s Q2 2023 moved in the wrong direction y/y.

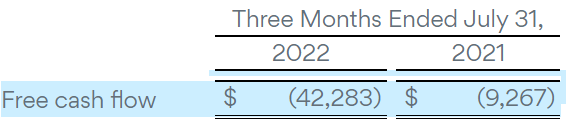

ASAN Q2 2023 results

As you can see here, Q2 2023 was negative $42 million compared with negative $9 million in the same period a year ago.

It’s one thing to have an impressive story around removing user friction on your platform, it’s quite another to have a viable business, that’s profitable.

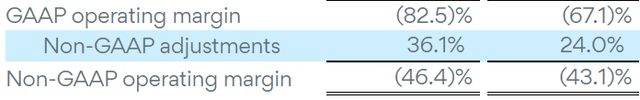

A very similar story is echoed on its non-GAAP operating margin line.

And herein lies the problem, Asana is showing that it can’t turn a clean GAAP profit! Out of every dollar of revenue, approximately 80 cents is a loss. That’s a tough hurdle to change.

Nevertheless, as I noted in my previous article, during the call, Moskovitz said that Asana will reach positive free cash flow, before the end of the calendar year 2024. Of course, the pushback is that two years is a very long time on Wall Street.

ASAN Stock Valuation — 5x Next Year’s Revenues

Asana starts its new fiscal year, fiscal 2024 in February 2023. Can Asana guide for the next twelve months to grow at 35% CAGR? Presently, that appears to be a really tough bar for Asana to guide.

However, if Asana does believe that it can sustain those growth rates that would put its stock priced at approximately 5x next year’s revenues.

If it turns out that Asana isn’t able to guide for 35% CAGR for the year ahead, and its growth rates are more muted around 30% CAGR, that would put its stock at around 6x next year’s revenues.

One way or another, Asana’s multiple has already come down a lot. Yes, there are still some questions to be answered about exactly what sort of profit margins this business sustains, but I believe altogether investors’ expectations have already moderated considerably.

The Bottom Line

My point throughout is not that Asana couldn’t further sell-off. My point is more nuanced than that. I argue that the risk-reward is now much better than it’s been for a while.

And while investors should not expect a V-shaped recovery, an environment where Asana treads water for a while is a lot better than what shareholders have had to endure in the past year.

The time when market participants thought of all investing as moonshots have now substantially dissipated. And that’s a much more constructive environment to invest in, where expectations today are more measured and realistic.

Be the first to comment