Andrii Yalanskyi/iStock via Getty Images

Brian Dress, CFA – Director of Research and Investment Advisor

For years, investors have looked to the traditional 60/40 model (60% stock allocation and 40% bond allocation) as the standard way to orient long-term portfolios. This strategy has been very effective especially over the past decade, as we have witnessed a bull market in the stock market, while bonds performed quite well in a persistently low interest rate environment.

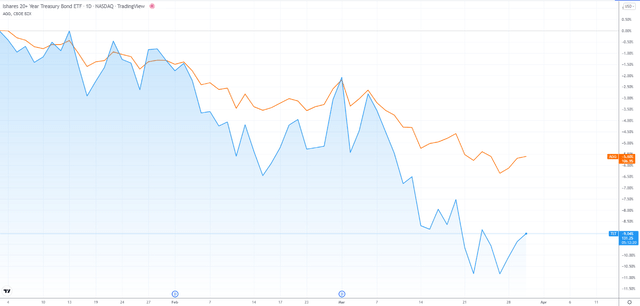

With the Federal Reserve now slated to raise rates by 2% or more in 2022, iShares 20+ Year Treasury Bond ETF (TLT) has fallen sharply by 9% since the beginning of this year. This has caused bonds across the spectrum to perform badly so far this year, with iShares Core U.S. Aggregate Bond ETF (AGG), comprised of high quality corporate bonds, down more than 5% on the year.

Investors that hold income securities in their portfolios will know that there has been significant principal depreciation for those holdings over the past few months, as interest rates begin to rise. The 10-year US Treasury rate has risen from 1.71% on March 1 to nearly 2.4% today, which shows that the bond market is responding swiftly to a changing dynamic in Fed Policy.

With an environment like this in place, it may feel to retirees and near-retirees that there is no great place to hide funds devoted to income investments. Since almost all income securities price off US Treasury rates, we have seen falling prices in Treasuries, Municipal Bonds, Corporate Bonds, and even Emerging Market debt!

Since rates have been so low for the past decade, market participants have not had the biggest risk for bond investments at top of mind over the last few years: interest rate risk. Put simply, interest rate risk is the idea that bond prices fall as rates rise. Generally, bonds with higher coupons and longer-dated maturities are most vulnerable to higher interest rates.

So what can you do to combat the sudden return of interest rate risk in the fixed income market?

Here at Left Brain, our investment team has been working hard here to find creative ways to incorporate income investments while minimizing interest rate risk. We have identified two areas: short-term high yield bonds and dividend paying stocks. We like short-term high yield bonds with yields to maturity of 5-8%, which return principal in the next 2 years or less. At maturity, investors will receive their bond principal as a lump sum payout. Our concept is that the environment for reinvestment will be better at that time than it is now, once the Federal Reserve has completed all or most of its rate hiking cycle in 2023 and beyond.

Additionally, we like certain dividend-paying stocks as an alternative to bonds because their yields are not fixed (companies can raise dividend payouts if business results improve).

In today’s article, we are enclosing our watch list of three selected short-term high yield bonds and the reasons why we like these securities. As you are probably aware, bond investing is incredibly difficult in the current rising interest rate environment. Higher rates means lower bond prices and, generally, longer dated bonds are most susceptible to rising rates. These are the types of bonds that we think can help investors preserve capital in an inflationary environment. When the bonds mature, we expect opportunities in 2023-2025 to put that capital back to work in bonds that yield more than what is currently available.

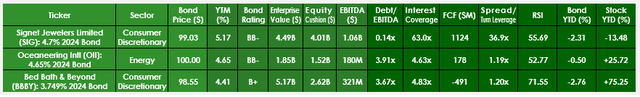

Without further adieu, here is a subset of our watch list of short-term high yield bonds (data in table is as of 3/29 market close):

Left Brain IR, FactSet, FINRA Trace Signet Website

Signet Jewelers Limited (SIG) 4.7% 2024 bond: An investment in Signet Jewelers is a play on a business with strong management that is in the aggressively managed its debt over the past few years. Signet Jewelers is the world’s largest retailer of diamond jewelry, operating in the US, Canada, and the UK under the retail banners of Zales, Kay Jewelers, Jared, and JamesAllen.com. Success for an investment in Signet bonds will depend on the company’s ability to continue generating free cash flow, which the company has used to pay off debt over the past few years. Signet is managed by CEO Virginia Drosos, who has led the company since joining in 2017. Drosos’s tenure has been marked by aggressive efforts to right size the business and set it up for success in a changing marketplace. When she entered her position, Signet had more than 3,600 total retail stores, which she has rationalized down to just over 2,800 in the most recent quarter.

Pre-Covid, the business had a very small online sales presence. In fiscal year 2019, Signet generated just under $700 million in online sales, a figure that grew to just over $1.5 billion in the most recent fiscal year (FY 2022). After Free Cash Flow (FCF) in FY 2019 of $564M and $419M in FY 2020, business has picked up significantly and Signet has delivered more than $1 billion in annual FCF each of the past two years. Signet had nearly $1 billion in debt (not including lease liabilities) at the end of fiscal year 2020. Using the company’s cash flow to pay down debt as the company cut costs, Signet’s financial team has brought the overall debt load down to below $150 million at the time of writing. Signet also has more than $1.4 billion in cash on the balance sheet. After five years of prudent management, this company is on very solid fiscal footing. Despite the cost cutting, Signet has grown its sales by 28% in fiscal year 2022 relative to the previous year.

Our view is that the 2024 bonds, which yield greater than 5% at current prices, offer a nice opportunity for capital preservation. At the same time, the bonds mature in just over two years. When Signet pays the principal back at that time, we think that opportunities will be more attractive for bond investors, as interest rates will likely be higher at that time than they are today. SIG 4.7% 2024 bonds fit will in our list of short-term high yield bonds, offering reasonable income and what we think is a high probability of repaying investors.

Oceaneering IR Website

Oceaneering International, Inc. (OII) 4.65% 2024 Bond: An investment in Oceaneering International is a play on the stabilization of the oil markets, which creates demand for oilfield services. We have followed OII for more than two years. The company offers an array of services to offshore drilling companies, including submersible vehicles, engineering, subsea installation, and much more. Demand for oilfield services, like those that OII provides, had been weak throughout 2020, as the price of oil fell precipitously in the face of the pandemic. In 2021 and into 2022, improved stability in oil prices has created a more favorable business environment for OII.

When we look at a bond, we must be comfortable both with the business trajectory underway, as well as the health of the company’s balance sheet. For seven straight quarters, OII has increased its trailing 12-month profitability on a Free Cash Flow basis. The price of oil has been steadily increasing as pandemic restrictions have abated in many parts of the world in 2021, while oil prices have spiked even more aggressively in 2022 amid geopolitical tensions. With prices moving higher oil exploration companies are beginning to commit more money to capital projects, to the direct benefit of Oceaneering. As the overall oil market stabilizes, we are gaining comfort with OII’s business case.

The financial picture is equally important for bond investments. Since 3rd quarter 2020, OII has reduced its leverage (ratio of total debt divided by EBITDA) from 6.7 times to 3.9 times, mainly through the increased profitability achieved over that period. Finally, OII carries $544 million in cash on the balance sheet, versus $880 million in total debt and $500 million available in a line of credit, so we are comfortable with the company’s liquidity position. With interest rates persistently low, high yielding bonds like the OII 4.65% 2024 bonds, associated with favorable risk-reward situations, are very difficult to identify. OII has both an improving business case and an increasingly healthy balance sheet, which gives us confidence that income investors can do well holding this particular bond.

Should the oil markets remain stable, our expectation is that demand for OII’s services will continue to improve, as oil exploration companies gain confidence and become more willing to invest in new drilling projects. Oceaneering’s 2024 bonds currently trade below “par” (price of 100), which means that buyers of the bonds can lock in more than 5.5% in annual income until the bond’s maturity in November 2024. At the time of maturity, investors are likely to receive their principal back at a time when we think interest rates will be higher and bond investment opportunities more favorable for those seeking income.

BBBY IR Website

Bed Bath & Beyond Inc. (BBBY) 3.749% 2024 bond: An investment in Bed Bath & Beyond is a play on a bond issue that is cash-covered and the involvement of an activist investor that we think may help unlock value for investors. Bed Bath & Beyond is a major American chain of retail stores that specializes in home goods. Success for BBBY will depend on efforts to rationalize store count and continue to build the company’s omnichannel business (brick and mortar + online sales). Bed Bath & Beyond is more of a play on the company’s balance sheet than it is on the success of the underlying business. The 2024 bond is the next maturity on the company’s balance sheet and is an obligation of roughly $285 million. The company currently has cash on the balance sheet in excess of $1.35 billion, so the company has plenty of wherewithal to pay back investors in the 2024 bonds.

We would additionally note that BBBY’s total debt is down more than $1 billion since 1st quarter 2020 and has been at a stable level over the past year, despite the company’s issues related to diminishing sales results. Please note that BBBY has closed roughly 1/3 of its stores in the last fiscal year, presumably shuttering some of the worst performing stores in the chain.

BBBY has struggled over the past few quarters, mainly due to supply chain disruptions that are making the company unable to maintain appropriate levels of inventory. In the most recent quarter, comparative store sales came in a -7%, which is obviously quite distressing. Activist investor Ryan Cohen (investor in Chewy and GameStop) has purchased nearly 10% of outstanding shares in the business and has secured control of three seats on the company’s board of directors. Part of the company’s portfolio is nursery store Buy Buy Baby, which has more than 100 locations in the US. This is an asset in which Cohen has expressed interest in finding a way to unlock value. Should BBBY sell the Buy Buy Baby business, it would provide an opportunity to pay down even more debt on the balance sheet.

Long term, there is some question about this business. However, we do think that the balance sheet is strong enough to hold up over the next 2 years and there is ample liquidity to pay back holders of the 2024 bonds. The involvement of an activist investor with a track record of unlocking value in past investments is yet another factor in the favor of bondholders. We like the opportunity to purchase these bonds at a discount to par and lock in roughly 4.5% annualized income, for the next 30 months.

In conclusion, we have heard from plenty of investors that identifying suitable fixed income investments is a challenge in the current rising interest rate environment. We think a novel strategy to address this concern is for investors to focus on bonds with near maturity dates. In doing so, we can minimize the impact of interest rate risk and set ourselves up to take advantage of new and more attractive bond opportunities after rates hit their peak at some time between 2023 and 2025.

Be the first to comment