Spencer Platt/Getty Images News

Artisan Partners Asset Management Inc. (NYSE:APAM) has shown an ability to grow at a unique profitable rate over the last five years. In an industry that is increasingly under pressure, thanks to the success of passive investment vehicles; the asset manager has demonstrated strong investment returns across its strategies, and due to that, successfully grown its assets under management. Although that success has not translated into stock market success, the fundamentals of the business are very good. Artisan Partners is a worthy long-term investment.

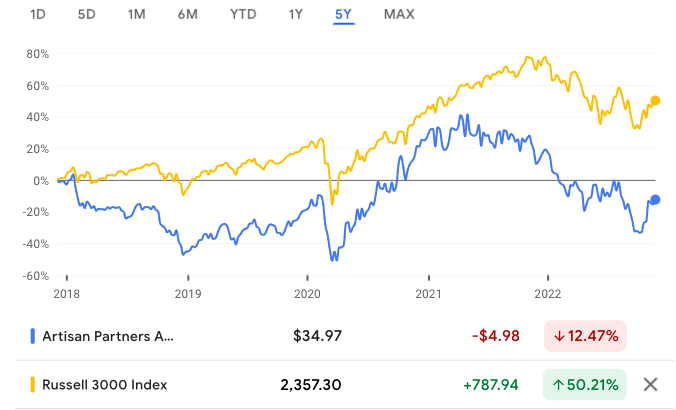

In the last five years, Artisan Partners has significantly trailed the market, with the share price declining 12.47%, while the Russell 3000 gained 50.21%.

Source: Google Finance

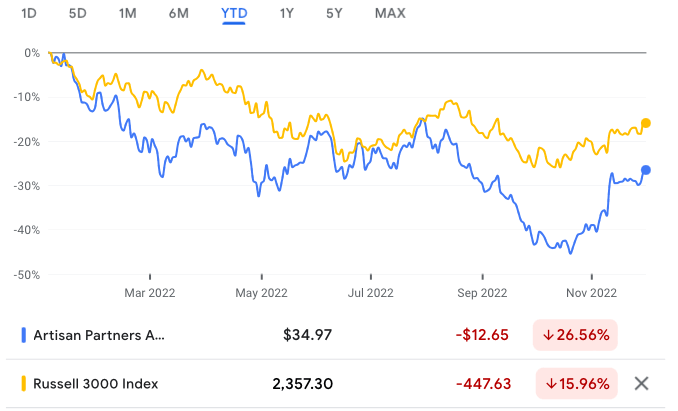

In the year-to-date, the asset managers’ fortunes have fared even worse, with the share price falling 26.56%, compared to a decline of 15.96% for the Russell 3000.

Source: Google Finance

The company’s stock market troubles are odd given the strong growth and rising profitability that the company has displayed over that time.

Artisan Partners Is Uniquely Profitable

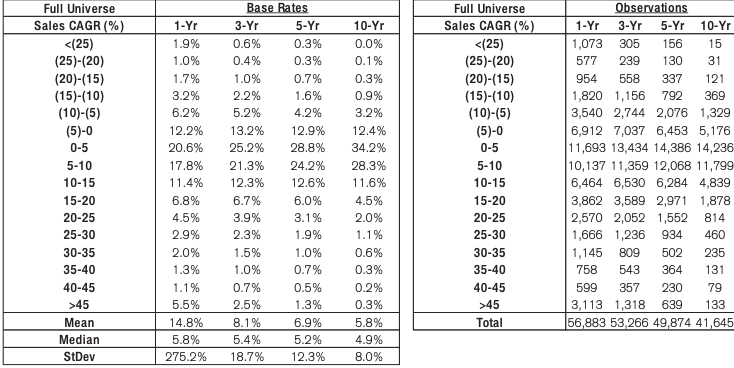

Revenue has grown from $795.6 million in 2017, to $1.23 billion in 2021, at a 5-year compound annual growth rate (CAGR) of 8.82%. According to Credit Suisse’s (CS) The Base Rate Book, 24.2% of firms between 1950 and 2015 achieved a similar rate of growth. In the first nine months of the year, revenue was $767.3 million, a drop from the $912.2 million the firm earned in the same period in 2021.

Source: Credit Suisse

Gross profitability in 2017 was 0.46, rising to 0.53 in 2021. This is well above the 0.33 threshold that Robert Novy-Marx’ research shows marks an attractive stock.

Operating income grew from $286.4 million in 2017, to $540.5 million in 2021, at a 5-year operating income CAGR of 13.54%. Operating income margin rose from nearly 36% in 2017, to over 44% in 2021. In the first nine months of the year, operating income margin declined to just over 35.7%.

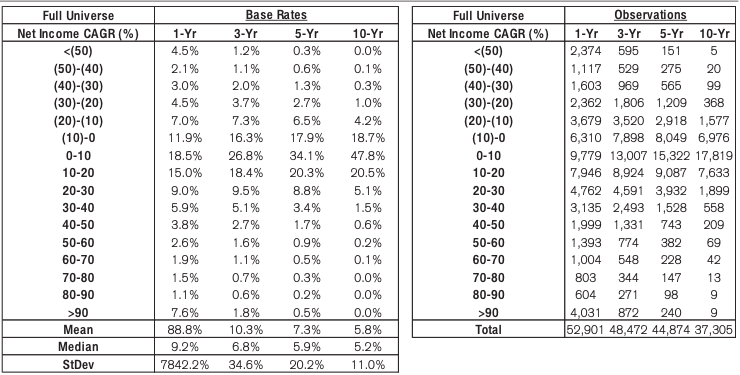

Net income rose from $49.6 million in 2017, to $336.5 million in 2021, for a 5-year earnings CAGR of 46.67%. According to The Base Rate Book, that gives us a base rate of 1.7%, underlining the exceptional nature of the company’s profitability. In the first nine months of the year, the asset manager earned $153.9 million, compared to $$251.9 million in the same period in the year prior.

Source: Credit Suisse

Free cash flow (FCF) has risen from $220.12 million in 2017, to $392.58 million in 2021, at a 5-year FCF CAGR of 12.27%. In the first nine months of the year, the company generated FCF of $290 million, compared to $399 million for the same period in 2021.

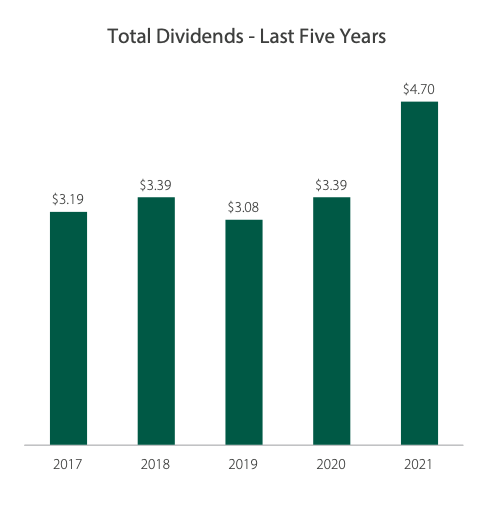

The company’s growing ability to generate cash has allowed management to increase dividends from $3.19 per share in 2017, to $4.7 per share in 2021.

Source: Artisan Partners Business Update and Third Quarter 2022 Earnings Presentation

There tends to be an inverse relationship between asset growth and future returns, a phenomenon known as the asset growth effect, so it is important to pay attention to what’s happening with the asset base. The company has grown assets from $837.16 million in 2017, to $1.2 billion in 2021, at a 5-year total assets CAGR of 7.61%

Returns on invested capital (ROIC) has declined from 45.6% in 2017, to 35.5%. In the trailing twelve months, ROIC further declined to 23.2%.

Business Model

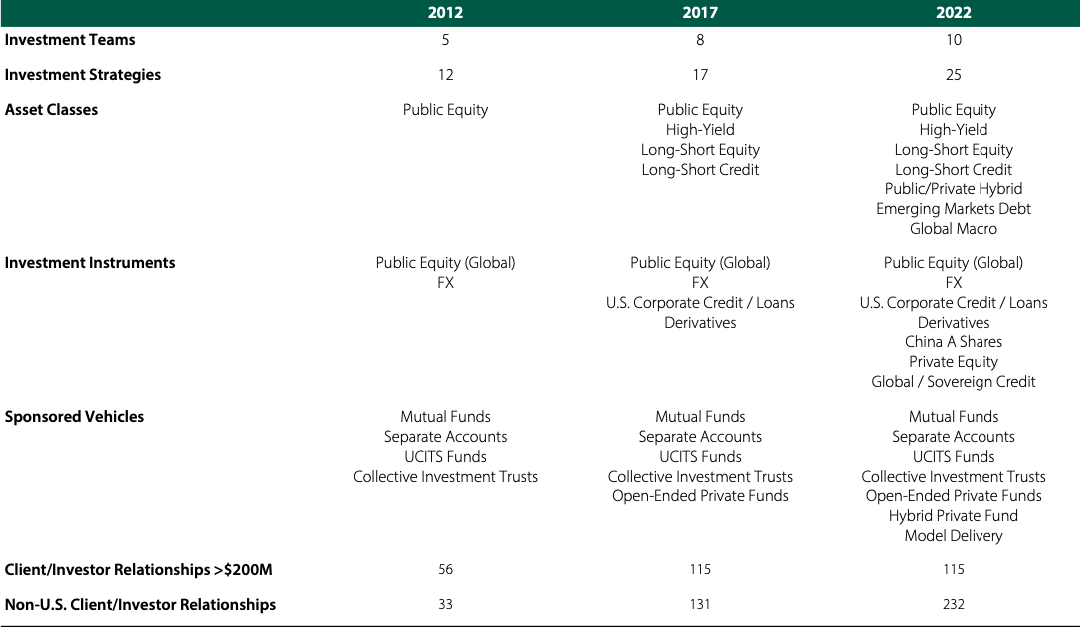

Artisan Partners manages investments through pooled investment funds and separate accounts. The company serves as investment advisor to Artisan Funds, Artisan Global Funds, and Artisan Private Funds. In the Q3 earnings call, Eric Colson, the company’s CEO, described Artisan Partners philosophy as defined by “thoughtful growth”, which he defined as growth that is “careful, incremental and disciplined”. As part of that approach the company has invested in three key areas for the future: differentiated credit, private investing, and China.

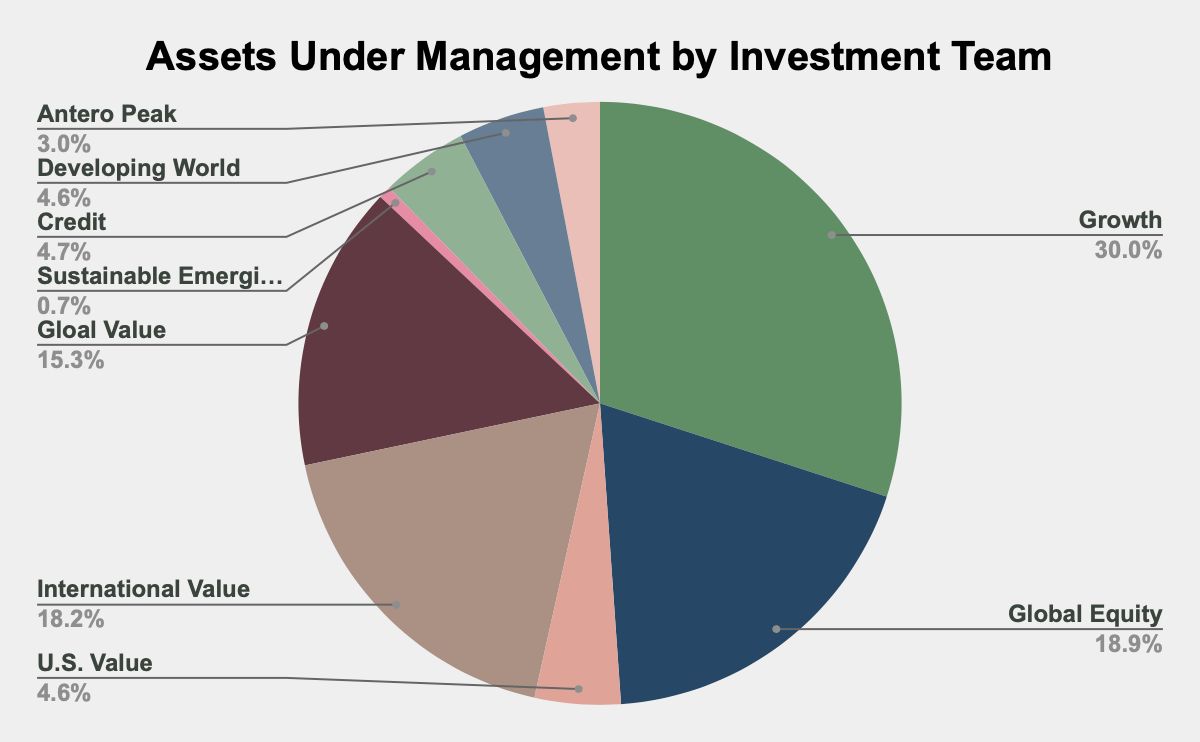

The company has grown its assets under management (AUM) from $115.5 billion in 2017, to $174.8 billion in 2021, at a 5-year AUM CAGR of 8.64%. As of Sept. 3 2022, AUM stood at $120.6 billion, compared to $173.6 billion for the same period last year. The AUM is invested across 25 strategies, managed by 10 investment teams: growth, global equity, U.S. value, international value, global value, sustainable emerging markets, credit, developing world, Antero Peak and the recently created EMsights Capital team.

Source: Artisan Partners Business Update and Third Quarter 2022 Earnings Presentation

In 2021, the three largest teams in terms of AUM were the Growth Team, which was responsible for 30% of AUM; followed by the Global Equity Team at 18.9%; and the International Value Team at 18.2%.

Source: 2021 Form 10-K and Author’s Calculations

Of the strategies the investment teams employ, just one, the Value Equity Strategy used by the U.S. Value Team has underperformed its benchmark, with the Value Equity Strategy returning 7.89% per year compared to 8.77% for the Russell 1000 Value Index, although it did beat the Russell 1000 Value Index, which gained 6.84% per year.

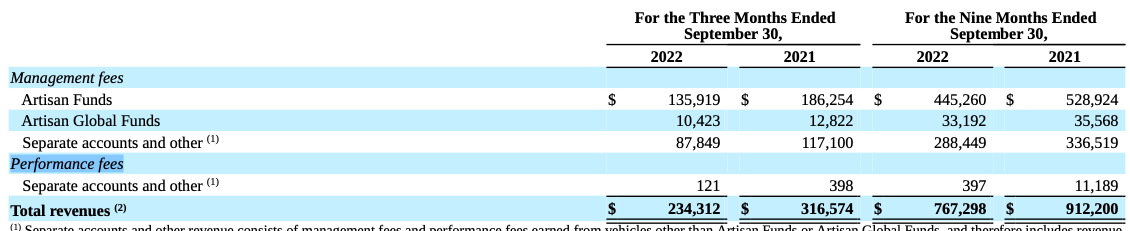

Management fees are the most important part of revenue, by far, eclipsing performance fees. This is not unique to Artisan Partners and is a feature of asset managers. In the first nine months of the year, management fees were responsible for 98.77% of revenues.

Source: Artisan Partners Q3 2022 Form 10-Q

So, given the nature of the company’s revenues, the higher the average daily AUM, the higher the management fees that the company is able to earn. In the first nine months of the year, weighted average management fees were 0.7% of AUM. The balance of revenue is in the form of performance fees or incentive allocations from Artisan Private Funds, based on the performance of those funds.

The weighted average management fee has declined over the years. In the last three years, the average declined from 0.716% in 2019, to 0.707% in 2021. The reason for this is that the rise of passive investing instruments has provided investors with low-cost investment options that generally beat active managers. Faced with low-cost and superior strategies, there has been pressure on management fees to decline toward those of passive vehicles. Given the superiority of passive strategies in general, that pressure is likely to force management fees below those of passive vehicles.

Added to this, the barriers to entry in the market are very, very low, and the supply of asset managers has exploded. Competition is for losers, and competition has stripped away the pricing power of asset managers, further adding to the downward pressure on management fees.

In order to succeed, asset managers have to grow their AUM at a faster rate than management fees are declining. AUM growth is where the money is at. So long as AUM inflows exceed AUM outflows at the required rate, an asset manager can grow revenue and profits. That is what has made 2022 such a terrible year for the company, with the value of AUM sharply declining due to the performance of their positions.

Importantly, Artisan Partners can grow AUM without having to grow incremental capital by any meaningful amount. As Colson said in the Q3 2022 earnings call, “attracting new talent and retaining and stimulating existing talent” are critical to the company. Not only is this critical, it is largely what accounts for the company’s incremental capital. Between 2017 and 2021, total compensation and benefits grew from $402.9 million to $563 million, at a 5-year compensation and benefits CAGR of 6.92%.

Artisan Partners has a diversified client base, in terms of investment strategy, client type, distribution channel, and geographic region. The company’s focus is on sophisticated investors and asset allocators such as institutions and intermediaries with institution-like centralized decision-making processes and long-term horizons. In 2021, 64% of the company’s clients were sourced through its institutional channel. In that time, 32% of the company’s clients were sourced through its intermediary channel. Among those intermediaries are financial advisers and broker-dealer advisors, who could bring more assets Artisan Partners way, over time, assuming that the strategies’ long-term future performance matches that of the past. This is a potential engine for growth.

Valuation

Artisan Partners has a price-earnings multiple of 10.12, compared to the S&P 500, which has a PE multiple of 21.01, giving an attractive relative valuation. In addition, with $283.88 million in FCF in the TTM period, the company has an FCF yield (FCF/enterprise value) of 11.3%. This is far in excess of the 1.5% FCF yield of the 2,000 largest firms in the United States, as measured by New Constructs. This suggests that the future stock market performance of the company will be very strong, given how cheap its FCF are going for.

Conclusion

Artisan Partners operates a very simple to understand business. Despite incredible competition, the asset manager has been able to grow its AUM, thanks to the success of its investment strategies. That ability to grow AUM is vital if the firm is to continue to grow revenue and profits. There are no indications that that is changing. Given that, over the years, Artisan Partners have shown unique profitability, the company’s current difficulties should be seen as an opportunity to buy a very good company at a very attractive price.

Be the first to comment