NicoElNino

An Intro To Arthur J. Gallagher

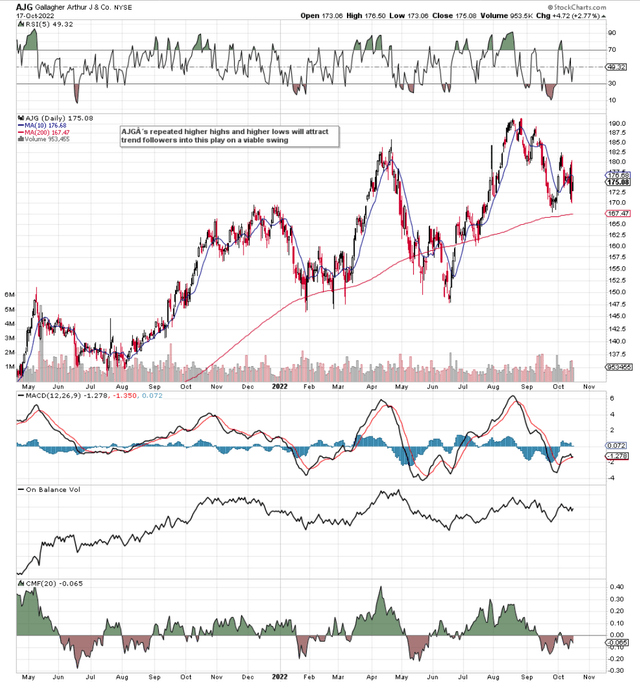

If we look at a technical chart of Arthur J. Gallagher & Co. (NYSE:AJG), we can see that the insurance company continues to make higher highs and higher lows. Furthermore, AJG is trading close to the lows of its range which may entice swing traders to put long deltas to work here on the upside on a convincing swing. From a stock trader or options trader standpoint (liquidity allowing), the play here would be to simply buy the stock or put on something like a call debit spread once we get a convincing swing above the stock’s 10-day moving average.

A call debit spread is the combination of the purchase of an in-the-money call option and the subsequent sale of an out-of-the-money call option. So for argument’s sake, with AJG currently trading for approximately $175 per share and assuming we want more extrinsic value on our sold option which means we would have theta working for us in the trade, we could buy the regular November $170/$175 call debit spread for approximately $3 per spread. This would give us a breakeven of $173 per share of AJG and a profit potential of $2 per spread. So in essence, one is basically buying 3 to make 2 and is getting rewarded (through a lower-cost basis) for putting up more risk on the trade.

Higher Highs In AJG (Stockcharts.com)

In saying the above, AJG is expected to announce its third-quarter earnings numbers on the 27th of this month. This changes our approach somewhat, especially from a risk standpoint. The reason being is that many times, the market will use something like a binary event to change the established trend of the respective stock in motion. Therefore, here are three areas both stock and option traders should tread carefully concerning size before AJG’s numbers are announced on the 27th.

AJG Stock Valuation

Although AJG can in no way be blamed for the market absolutely loving this stock (22% top-line growth in Q2) over the past six years or so, the insurance company’s valuation is far from cheap despite how earnings have been growing recently. Operating income for example has risen by close to 30% year over year and the company’s ROE currently surpasses 12%. However, AJG’s trailing book multiple now comes in at 4.18 which is light years ahead of the median of 1.21 in this sector. In earnest, the stock’s valuation was the underlying theme on the second quarter earnings call where analysts quizzed management on whether they believe a slowdown is on the cards.

Earnings Revisions

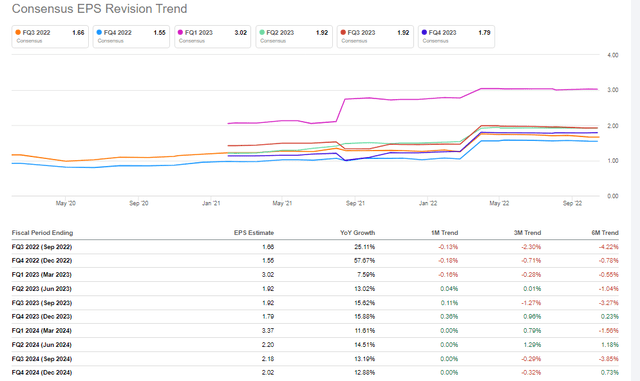

Although management does not foresee a slowdown where organic growth rates remain excellent, forward-looking earnings revisions have not been as strong as past revisions. As we can see from the numbers below, bottom-line earnings for AJG’s next three quarters continue to be revised down ever so fractionally. Now, when dealing with a company as profitable as AJG, some may believe that these very small downward revisions do not matter. We believe they do matter, however, especially given the valuation discussed earlier.

AJG Forward Looking Earnings Revisions (Seeking Alpha)

Volatility

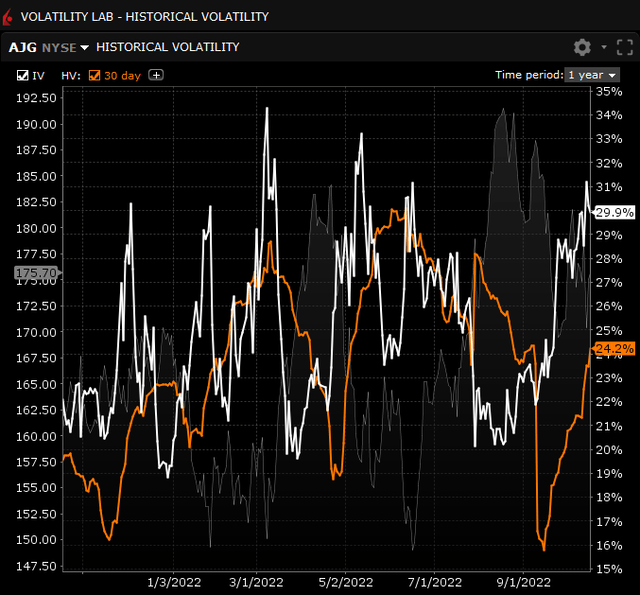

As we can see from AJG’s implied volatility chart below, IV is trading well above its 52-week range. These conditions are not really suitable for buying either call options or call debit spreads because we know from the outset that the cost of our spread(s) is going to be more expensive straight off the bat. Suffice it to say, although buying call debit spreads in a high IV environment works out fine as long as the price remains above our cost basis, we have to put more money up per spread due to the more expensive options. This again brings more risk to the table when comparing one volatility environment to the other.

AJG Implied V Historical Volatility (Interactive Brokers)

Conclusion

Although AJG looks in excellent shape from a growth, profitability, and technical standpoint, the market may use the upcoming third-quarter earnings binary event to terminate the stock’s underlying trend of higher highs & higher lows due to primarily the stock’s valuation and poorer most recent earnings revisions. We remain in risk-on mode. We look forward to continued coverage.

Be the first to comment