BeritK

When it comes to boom and bust cycles in the market, there may not be a better example recently of Ark Invest. The ETF firm led by Cathie Wood saw its assets grow tremendously throughout 2020 as easy money policies lead many high growth and unprofitable names to soar. Since the peak, however, the flagship Ark Innovation ETF (NYSEARCA:ARKK) has lost more than 76%, recently hitting a multi-year low. While investors might think the fund’s plunge has reduced the amount of risk here, I’d like to argue today that the opposite could be true when it comes to ARKK.

Cathie Wood has previously said that in times like this, Ark Invest likes to reduce its portfolio size and concentrate on its highest conviction names. That has certainly been the case with ARKK, which has gone from 44 holdings (not including the small daily cash position) at the end of October 2021 to just 31 holdings this week. Recent sales patterns indicate that at least one more name could get the boot rather soon, with a second possibly not too far behind.

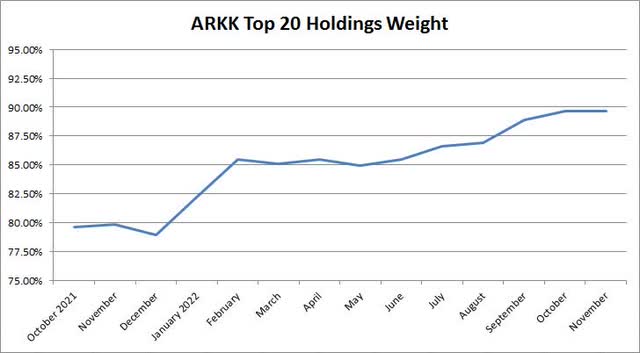

Various market experts will always disagree on what a perfect number of holdings is in any portfolio. However, simple logic tells you that a portfolio of 100 names should be a lot more diversified than a portfolio of just 10 names. With ARKK cutting down its portfolio size by nearly a third, it means that the weight composition of the fund has changed a bit. The chart below shows the collective weight of the top 20 holdings in the ETF at month’s end, except for the November 2022 data point below being Tuesday, the 15th.

ARKK Top 20 Holdings Weight (Ark Invest)

With the top 20 names being nearly 90% of the ETF now, Cathie Wood is putting a lot of her main fund in just a handful of stocks. We’ve seen many of these names blow up in the past year or two, with the fund also taking some significant losses on a number of names it has sold out of. Each major blowup now, whether it be over time or in a single day like after an earnings report, can be more important than ever, given how much reliance is being made on so few names.

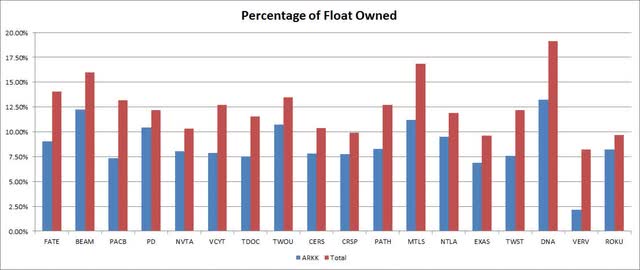

The other part of the risk situation here is how much of a stake Ark Invest has in some of these names. While there are six active ETFs as well as two index ETFs that all have different overall strategies, you’ll find many similar names across the board. There are more than a few stocks that can be found in two, three, or even more of Ark Invest’s eight funds. In fact, there are a few dozen names where Ark as a whole owns more than 5% of the outstanding shares of a particular company. If we look at float data though, and focus specifically on names that are currently in ARKK, the numbers are even more staggering.

ARK Invest Percentage Of Float Owned (Ark Invest, Yahoo! Finance)

If Cathie Wood and her team decide they need to exit, it could provide a lot of downward pressure on shares. Of the 31 stocks held by the flagship fund, 18 of them have more than 8% of their float owned by Ark Invest in total, based on Yahoo! Finance data. Additionally, 10 of these names are over 12%, with another name just below that level. When you own so much of a stock like this, it probably means the name isn’t very large. Many of these names don’t trade a ton of shares each day, so Ark Invest deciding to sell could get very tricky. Of the 18 names above, 13 of them are in a position where it would take Ark Invest more than five full trading days’ worth of volume (based on a 3-month average) to completely sell out the firm’s total holding.

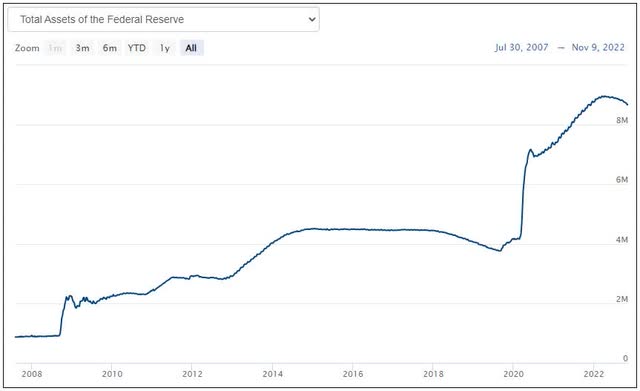

The rise in Ark Invest came mainly throughout 2020, as the Fed’s decision to greatly expand its balance sheet in response to the coronavirus sent markets much higher. High growth names that were unprofitable and heavy cash burners saw their stocks double, triple, or more. Almost as fast, however, these names have crashed back down to earth, as investors have shunned them as interest rates have risen. Some of these Ark Invest favorites have only gone public in recent years, whether it be through an IPO or SPAC.

As the chart below shows, the Fed’s balance sheet is still very close to its peak, only about $300 billion off its high, so this normalization process could take years to occur. It’s unclear how markets will react as this complex situation unfolds, even if we are about to see the end of rate hikes in the coming months. Should the US enter a recession in 2023, it could mean a lot of pain for the markets, especially if investors further shy away from these loss leaders and cash burners, which could easily send ARKK to new lows.

Fed Balance Sheet Size (Federal Reserve)

Another reason why ARKK may be getting more risky is that the investment team here seems unwilling to change its thought process. During numerous media appearances, Cathie Wood has virtually been unable to say she was wrong, and has doubled down on previous calls for inflation to drop, as well as her statement that the Fed is making a big mistake here. Instead of taking losses on names and moving on, Ark Invest has greatly increased its positions over time, losing even more money in the process.

To illustrate this point, it has been 11 months since Cathie Wood published a blog post titled: “Innovation Stocks Are Not in a Bubble: They Are in Deep Value Territory”. In this article, the argument was made that these innovation names could return 40% a year for the next five years, although that statement was later updated to say 30% to 40% per year. On the day that the post was published, ARKK closed at $97.20, so that 40% return compounded for five years would result in a price well over $500 by late 2026. With just a month to go until the first year of that timeline has finished, ARKK sits at just $37.91. To get over that 40% per year for the five-year period hurdle, the Ark Innovation ETF would need to compound more than 91.2% per year for the next roughly 4.05 years.

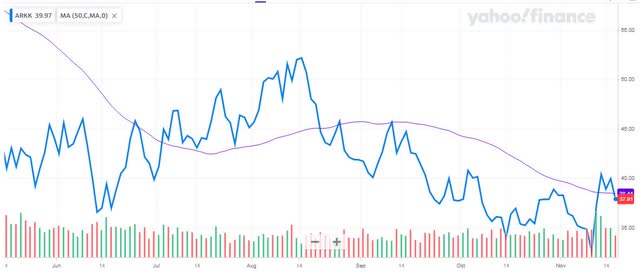

At the moment, the technical picture for ARKK isn’t very good. As the chart below shows, the ETF has made a series of lower highs and lower lows since its summer peak. The fund has spent most of the last three months below its 50-day moving average, and it fell below this key technical trend line again on Wednesday. If ARKK cannot get back above the 50-day in the coming days, the moving average line will continue lower and likely provide even more resistance in the near term.

ARKK Last 6 Months (Yahoo! Finance)

In the end, the overall risk profile of the Ark Innovation ETF may actually be increasing, despite being more than 76% off its all-time high. Cathie Wood and her team have cut the number of holdings in the flagship fund significantly this year, while continuing to focus on a select group of names that Ark Invest has large stakes in. With overall markets continuing to be very nervous about inflation, a possible recession, and the Fed’s tightening of monetary policy, there is more pressure than ever before for this small group of names to perform exceptionally well. This is especially true if Cathie Wood wants to hit her “40% return a year for 5 years” mark, as the first 11 months of that timeline is off to a very bad start.

Be the first to comment