Marko Geber

Over the last year, doubling down on highly-valued growth stocks has not been a winning strategy for the ARK Innovation ETF (NYSEARCA:ARKK), but the fund keeps making the same mistake that got the exchange traded fund into this mess.

It keeps making out-sized, counter-sentiment bets on companies simply because their stock prices have fallen. Recent fund transactions involving Unity Software Inc. (U) indicate that the ETF’s managers have not learned from their previous blunders.

The ARK Innovation ETF has excessive concentration risk, and the fund’s investment strategy is a major worry.

Huge Fund Losses But High Concentration Ratio Remains Key To The Fund’s Investment Strategy

When the fund’s philosophy of investing in innovative enterprises paid off during the pandemic, the ARK Innovation ETF was successful. However, recent fund performance implies that high-concentration strategies expose investors to unnecessary and excessive risks, potentially trapping investor capital in unsuccessful assets for years.

The fall of the growth bubble in 2021 has caused tremendous havoc in the portfolio of the ARK Innovation ETF, which is reporting disastrous fund returns.

As of June 30, 2022, the annualized 1-year NAV return is (69.18%). Over a 5-year period ending on June 30, 2022, the annualized NAV return for the ARK Innovation ETF is now a meager 8.2%.

The fund’s net asset value has risen at a somewhat faster rate, 10.82%, since its inception, but this is insufficient to justify the large concentration risk that investors in the fund are required to bear. The fund’s top ten holdings account for 59% of its assets, indicating that the fund is still overly concentrated.

1-Year NAV Return (ARK Innovation ETF)

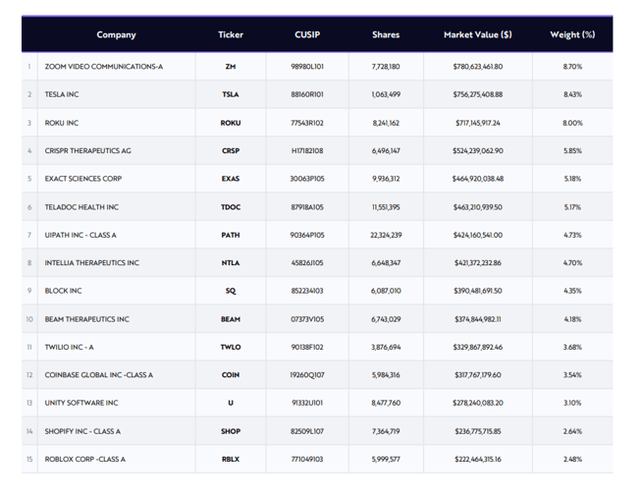

For the past year, the ARK Innovation ETF has taken a riskier strategy of doubling down on stocks after the growth bubble burst, in many cases purchasing stocks that have since lost more value. Cathy Wood increased her holdings in firms such as Zoom Video Communications (ZM), which is now the ETF’s top holding with a weighting of 8.7%, and cryptocurrency exchange Coinbase (COIN), which has a weighting of 3.5%, even after those stocks plummeted.

Top 15 Investments (ARK Innovation ETF)

Unity Software: Cathy Wood’s Latest Headache

Unity Software, which manages a game development platform, made headlines yesterday when it announced the acquisition of ironSource, a software company that helps app developers establish scalable enterprises, for $4.4 billion.

The proposed all-stock transaction (terms may be seen here) represented a significant 74% premium over the 30-day average exchange ratio, prompting concerns about whether Unity Software overpaid for the transaction. In addition, the company reduced its sales forecast from $1,350–$1,425 million to $1,300-$1,350 million.

Unity Software’s stock has lost 77% of its value so far, but it is now a 3.1% holding in the ARK Innovation ETF portfolio. Unity Software’s stock dropped 17.5% on Wednesday following the announcement of the merger with ironSource and the decreased sales guidance.

What did the ARK Innovation ETF do after Unity Software’s price plunged?

It increased its stake by 884.6K shares of Unity Software on the decrease. Other purchases were made in other funds of Ark Invest, including the ARK Next Generation Internet ETF (ARKW), which received 78.2K shares, the ARK Autonomous Technology & Robotics ETF (ARKQ), which received 62.3K shares, and the ARK Space Exploration & Innovation ETF (ARKX), which received 78.2K shares.

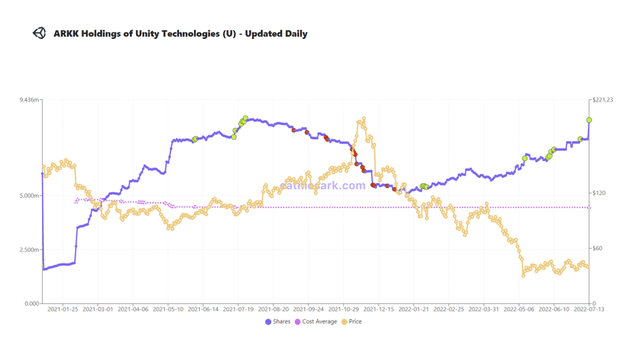

On Wednesday, Cathy Wood purchased 1.04 million shares of Unity Software across multiple ARK funds. The ARK Innovation ETF fund now owns 8.5 million shares of the game development company, which sells at an 8x sales multiple despite a 77% drop in stock value. According to Cathy’s Ark, the average cost of Unity Software in ARK Innovation ETF was $104.43 as of July 13, 2022.

Following yesterday’s steep drop, the stock price of Unity Software is hovering around $32.45, indicating that the fund is significantly under water on this particular investment. This position alone has a 69% unrealized loss.

Holdings Of Unity Technologies (Cathiesark.com)

Deal Dynamics

Unity Software agreed to an all-stock transaction, indicating that management is very confident in the acquisition’s synergistic potential.

Even though the transaction was priced at $4.4 billion, the final price may be lower because ironSource will get 0.1089 shares of Unity common stock at completion. If the stock price of Unity Software lowers, so will the effective price paid.

Because of Unity Software’s bigger market capitalization, owners of the development platform will own approximately 73.5% of the merged firm, while ironSource stockholders would own approximately 26.5%. The combined company is expected to generate $1 billion in adjusted EBITDA by 2024.

The acquisition establishes a new company with an integrated app development platform that is intended to improve the customer experience for creative monetization. The transaction is estimated to result in $300 million in annual EBITDA synergies in the third year.

Unity Software is acquiring ironSource at a time when the company’s own expansion has been limited by its inability to efficiently deliver ads. Due to monetization challenges with one of its major products, Unity Monetization, the firm decreased its 2022 sales projection by $135 million to $1,350 – $1,425 million in 1Q-22.

Unity Monetization is a technology that assists creators by inserting advertisements into their programs, allowing them to monetise their work. IronSource’s acquisition, which focuses on the creation of technology to monetise apps at scale, is intended to address this slowing growth.

Even while I have no objections to the announced deal, Unity Software is similar to many previous pandemic victors who sailed high but crashed when pandemic tailwinds receded.

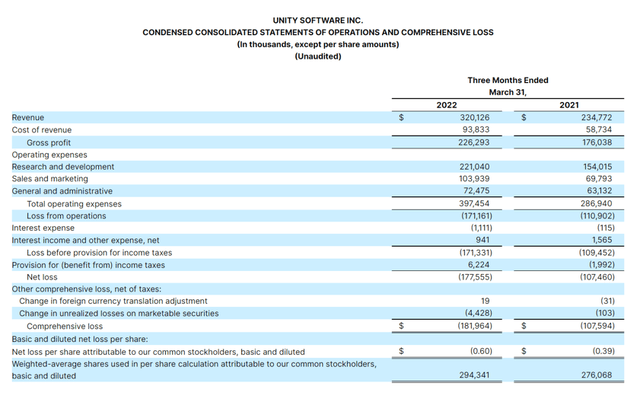

The development platform continues to prosper from app economy growth, with sales increasing 36% YoY in 1Q-22, but profits are not in sight. Unity Software lost $182 million in the first quarter on sales of $320 million, implying a loss ratio per dollar of sales of 57%. Unity Software is a profoundly unprofitable company, which is a problem for investors who are being asked to pay 8.1x revenues for the shares.

Q1-22 Revenues (ARK Innovation ETF)

My Conclusion

Doubling down on undervalued growth stocks when the market does not value them highly has not been a winning approach for the ARK Innovation ETF, and it has resulted in disastrous performance results. The fund’s 10 largest positions account for almost 60% of total investments, implying that the ARK Innovation ETF is still overly exposed to a few select stocks.

The ill-received Unity Software agreement with ironSource, Unity’s plummeting stock price, and aggressive, counter-sentiment buys across several ARK funds imply that the fund has failed to learn from its failures in the previous year and has not adjusted its diversification strategy.

For me, the ARK Innovation ETF is the ultimate value trap, and investors in the fund may find their cash trapped in ARKK for an extended length of time.

Be the first to comment