Marko Geber

+100% EPS on 23.7% Sales Growth for June-quarter

Ark Restaurants (NASDAQ:ARKR) reported exceptional results, above our expectations, for Q3 ended June for FY 09/2022, with EPS jumping 100% to $1.46, versus $0.73 in the prior year. Revenues also grew substantially by 23.7% YoY as all the company’s restaurants operated without indoor dining restrictions. Event and special occasion party business was strong especially in New York and Washington DC, as both private and business activity surged. High inflation, both for food and ingredients, as well as labor, remains an issue and ongoing struggle for all enterprises in the USA, but Ark has so far been able to navigate this effectively through judicious operational decisions and menu price increases.

As can be seen in the following quarterly revenue and earnings chart, Ark is on pace for record results for this fiscal year ending shortly in September. Barring a resurgence of COVID, and/or a worse than expected recessionary slowdown in consumer spending from upscale customers in Ark’s primary markets, we would expect further growth for the upcoming new fiscal year ending 09/2023.

Raising Price Target to $30; 50% upside

With these strong results, we are increasing our price target to $30.00 [up from prior $27.00] for the stock, representing 50% upside from the current market price. Our price target is based on a 12x P/E multiple on our normal FY 9/2023 forward estimate. With the economy recovering from COVID, and pent-up demand for eating out and for travel within the USA, we now see record recovery EPS of $2.50 per share for next year’s earnings. Please note we are not factoring in any upside from possible future Meadowlands business.

Looking at the valuations, the company still looks undervalued with a current P/E of 7.8x on normal FY09/2023 estimates, a healthy balance sheet with more cash than debt, and an attractive FCF Yield of 13%. The company currently has all its restaurants operational with minimum restrictions on seating capacity. One of the big positives about this company is that it has “hidden real-estate value”, where it owns some of the land/structures where it has restaurants.

Although the market cap is on the lower side at $73 million, the stock average daily trading volume [with some fluctuations week to week] has averaged around 20,000 shares over the past year. The risk-reward scenario, especially with the likelihood of a higher dividend next year, and the optionality of Meadowlands, makes it a worthwhile investment, in our view.

Their acquisition of Blue Moon Fish Company on Dec 1, 2020 for $2.75 million has been generating strong cash flow, with EPS and FCF as we had projected being accretive.

Possible Doubling of Dividend

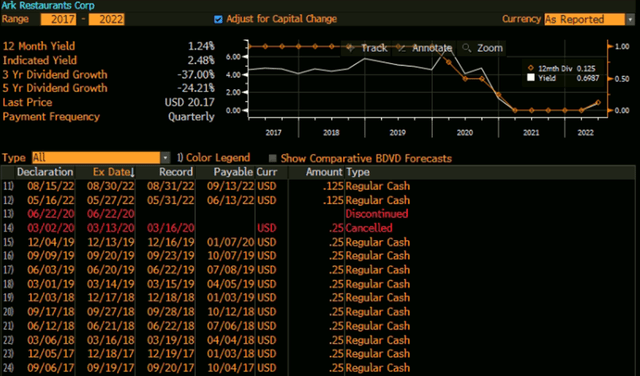

Ark Restaurants had previously discontinued the payment of cash dividends due to COVID uncertainties, but it has now in May 2022 reinstated its $0.125 per share quarterly dividend [$0.50 annualized] which is a dividend yield of 2.5%. We believe this is an indication that things are now operationally normalized for the company.

We also believe that eventually, perhaps as early as next year, the cash dividend will again reach the pre-pandemic levels of $1.00 annualized per share which would be a dividend yield of 5.1%. Management, on the most recent conference call, has indicated that a dividend hike is not imminent, and will take some time. Nonetheless, as seen in the following chart, Ark had a long history of consistency paying $1.00 in annual dividends prior to COVID.

Meadowlands Casino – A “Free Option” for Investors

As we have mentioned previously, the possible granting of licenses and the development of casino operations at the Meadowlands, New Jersey represents an enormous opportunity for Ark. Management has indicated on conference calls that they remain optimistic regarding its prospects, but it will likely take a couple years. Importantly, any upside from this is still not priced into Ark’s stock currently – it is, in our opinion, a “free option” for shareholders.

As and when all approvals are obtained and the project commences, it will be a large investment of eight or nine restaurants for the Ark Restaurants. All food and beverage operations in the casino at the Meadowlands would likely belong to Ark. Management thinks financial projections would be positive enough that the company would be able to finance it relatively easily with their balance sheet and maybe bank loans or perhaps bringing on other investors. As stated by management, the entire Meadowlands casino project may generate as much as $500 million a year in cash flow for all the numerous companies involved – how much of that accrues to Ark remains to be seen.

Potential Accretive Acquisitions

Ark Restaurants has a strong balance sheet [with slightly more cash than debt] and is always looking for potential acquisition opportunities. Generally, the company seeks deals that are 3x-4x operating cash flows, which ensures rapid accretion for Ark and a relatively quick payback period. Ark has previously been successful in acquiring, with this policy, restaurants such as Rustic, Sequoia, JB’s Blue Moon, and the 2 Oyster Houses in Alabama which are generating good cash flow for the company. The company is also preferred buyer for most of the restaurant owners because they tend to retain the same management and pay the entire acquisition price in cash up front.

Focus on Premium, Exclusive Restaurants

Ark owns and runs 20 restaurants and bars, 17 fast food franchises, and catering operations in New York City, Florida, Washington, D.C., Las Vegas, Nevada, and the Alabama Gulf Coast.

Florida continues to be a stronghold among operating eateries. And it produces a big amount of income, ranking third in terms of areas [after New York City and Las Vegas].

Ark Restaurants’ acquisition of Blue Moon Fish Company is paying off handsomely, with robust and positive cash flows and a deal that has been significantly accretive since its inception.

Hidden Real Estate Value

Ark owns the underlying land and buildings for many of its restaurants. Reported tangible [ex-goodwill] book value per share is $10.42. While we don’t have a specific real estate valuation details, but wouldn’t be surprised if the current marked-to-market value is materially higher than that on its current balance sheet. We don’t have enough information to come to a conclusion on this issue. With inflation at high levels, and huge increases in property prices and rental rates, there is in all likelihood a sharp increase in the value of Ark’s properties as well. Additionally, management has an option of doing a sale-leaseback on its properties in order to free up capital on an immediate basis, although there is no need to do this at present.

Key Downside Risks

Impact of COVID: A resurgence of COVID and restrictions on eating at restaurants would have a clear negative impact on Ark.

Impact of Inflation: According to recent studies, consumers’ tendency to reduce dining out is high on their list of discretionary spending cuts to fight inflation’s impact on their wallets.

Consumer Sentiment and a Weak Economy: This is a rising risk for the leisure industry going forward.

Conclusion – Strong Fundamentals, Cheap Valuations

Ark’s stock has done well since our initial recommendation, and we still see further 50% upside. Looking at the valuations, the company still looks undervalued with a P/E of 7.8x on FY09/2023e and a healthy balance sheet. Fundamentals have been strong, and the company is very well managed by executives who understand the restaurant industry and how to grow both organically and through acquisitions.

In addition, we believe the dividend will eventually be raised back to the $1.00 annual level, which would imply a 5.1% dividend yield. Finally, upside from the Meadowlands could be a huge “game-changer” for Ark, and it is a “free option” for investors today. Overall, the risk-reward for the stock looks very compelling to us, despite the handsome gains since our initial recommendation during the height of COVID in October 2020.

Be the first to comment