z1b

Cathie Wood’s ARK Autonomous Technology & Robotics ETF (BATS:ARKQ) is deep in the bear market territory after losing around 50% of its value in the last twelve months amid worries over the fastest rate hike in the last four decades. However, the selloff has provided an excellent entry point for investors who believe in disruptive technologies and capital appreciation over the long term. The short-term outlook for ARKQ is less favorable, but once the market stabilizes, it is likely to start reversing losses. A global push for clean energy and increased corporate interest in technologies that reduce costs and improve supply chains are just a few reasons to be bullish about Ark’s autonomous technology & robotics ETFs.

ARK Autonomous Technology & Robotics ETF – A Risky Play in the Short Term

Cathie Wood’s ARK Autonomous Technology & Robotics ETF was hit harder than the rest of tech stocks in the last twelve months due to its exposure to interest rate-sensitive disruptive technology companies. The pain for ARKQ is likely to extend into the following months as the chances for another 75 basis point hike in November increased significantly after hotter-than-expected inflation and higher-than-expected employment data. Market volatility is likely to increase if interest rates rise from their current levels, which will put disruptive technology-focused stocks at greater risk. In an open letter to the Federal Reserve, Cathie criticized the Fed’s policy and warned that rate hikes would increase the risk of a deflationary bust.

Other billionaire fund managers, banks, and rating agencies have also expressed concerns over the rate hike policy. According to Ray Dalio, the stock market will suffer losses and the economy will enter a recession if the Fed raises rates to 4.5%. Another key name Wharton professor Jeremy Siegel said the Fed’s policy could crush the economy. Later, disruptive technology investor Elon Musk tweeted a snippet of Siegel’s interview and vindicated his stance.

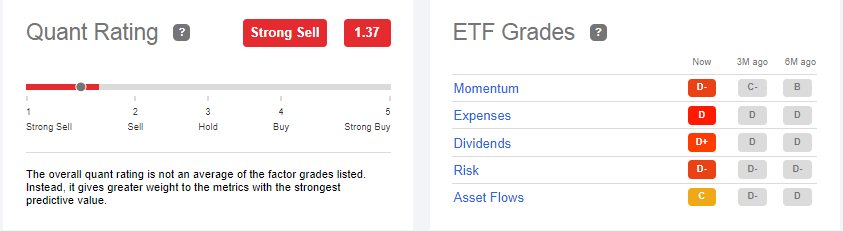

Quant Ratings (Seeking Alpha)

In addition, Seeking Alpha’s quant ratings imply that ARKQ’s price performance will not be favorable in the short term. With a quant score of 1.37, the ETF has been rated a sell. The ETF received poor grades on momentum and risk, two key factors when it comes to gauging short-term price performance. Economic uncertainty, high inflation, and the prospect of more rate hikes in the following two months of 2022 also increase the downside risk. On the positive side, the improvement in asset flow is a positive indicator, which shows dip buyers are showing interest in the ETF.

A Worthy Pick for Long-Term Investing

A wide range of disruptive technologies, including blockchain, artificial intelligence, machine learning, autonomous systems, robots, and big data, has contributed significantly to the lives of the general public and helped in enhancing corporate performance over the past few years. The pace of adoption accelerated at an enormous rate during the COVID pandemic. Consequently, a large number of companies and startups attracted record investments in the last few years with many like Tiger Cubs and Ark Invest’s founder Cathie Wood making investments in disruptive technologies as the foundation of their business.

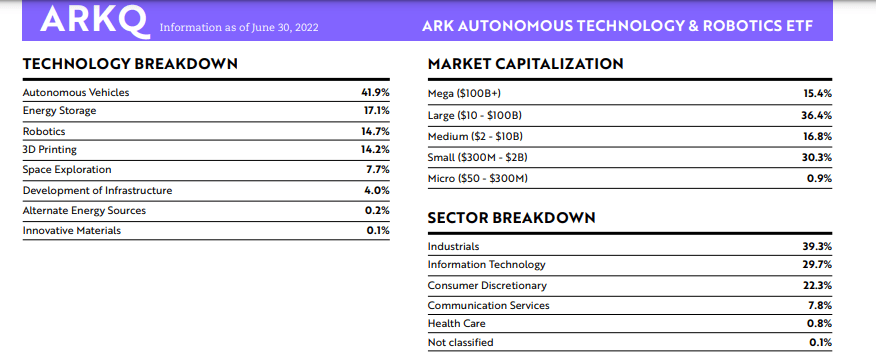

Technology Breakdown (etfs.ark-funds.com/)

Cathie’s ARKQ is one of the ETFs that allows investors to capture trends in the fastest-growing categories in the disruptive technology space, such as autonomous transportation, robotics, 3D, manufacturing, energy storage, and space exploration. The ETF’s price popped up to around $100 a share late in 2020 and remained strong the following year before experiencing a price collapse in 2022. The price correction, however, has created an attractive entry point for long-term investors. This is because ARKQ has strong fundamentals as a majority of its portfolio is made up of companies involved in autonomous vehicles and energy storage, the two areas that are likely to see the biggest benefit of the world’s commitment to moving towards clean energy. In fact, century-old vehicle makers like Ford (F) started seeing their future in electric vehicles as governments are offering incentives to EV makers and capital markets have been flooding EV companies with cash. For example, Tesla Inc. (TSLA) is only the automaker in history to surpass $1 trillion in market value, thanks to investors’ confidence in its future fundamentals. Although its market cap fell to around $650 billion at present, it is still high than the combined value of its biggest rivals, including Volkswagen AG (OTCPK:VWAGY), Toyota Motor Corp. (TM), General Motors (GM), and Ford Motor Co.

Furthermore, ARKQ’s 50% of portfolio concentration in mega and large-cap disruptive technology companies helps in lowering the risk factor and strengthening its fundamentals. This is because these companies are well-positioned to generate year-over-year revenue and profit growth over the long term. Around 31% of its portfolio is made up of small and micro companies, while over 16% is comprised of mid-sized companies. There are 39 stocks in its portfolio, with the top holdings representing 57% of the portfolio as a whole.

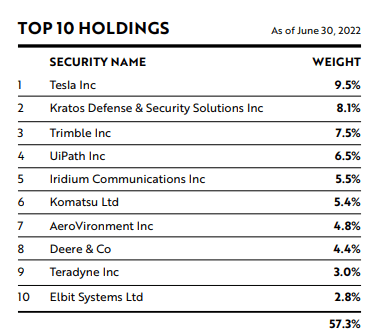

Top 10 Stock Holdings (ark-funds.com )

Tesla is the largest stock holding of ARKQ’s portfolio, accounting for 9.5% of the overall portfolio. It is a leading EV maker with significant penetration in key markets like the United States, Europe, and China. A growing belief in the future fundamentals of electric vehicles has helped boost Tesla’s share price from under $20 a share in 2019 to above $400 at the end of 2021. Increasing profitability and strong operational performance contributed to investors’ confidence in the company. When it comes to financial growth, Tesla has an impressive record. The company has earned profits every quarter since the third quarter of 2019, while its quarterly revenue has fallen just twice since 2017. In addition, Wall Street analysts expect its earnings to double by 2025 from the consensus estimate of $4.26 per share in 2022.

Besides Tesla, the majority of ARKQ’s top 10 holdings are also poised to deliver double-digit growth in the years ahead. Around 15% annual revenue and earnings growth mean both top and bottom line numbers will double in the five years, which bodes well for steady growth in share price over the long term. For instance, Kratos Defense & Security Solutions Inc. (KTOS), ARKQ’s second-largest stock holding, is well set to achieve double-digit annual revenue growth in fiscal 2022, while Wall Street estimates suggest double-digit revenue growth will continue into the future. Similarly, Trimble (TRMB) gained a strong buy rating from SA authors amid its innovative products along with a track record of generating steady growth in revenue and earnings. Moreover, Iridium Communications (IRDM), ARKQ’s fifth largest stock holding has posted record revenue and earnings in the June quarter and raised its annual revenue and earnings forecast due to robust growth trends. Besides the top 10 stocks, the rest of ARKQ’s stock holdings also include well-established names like Magna International (MGA), Lockheed Martin (LMT), Caterpillar (CAT), NVIDIA (NVDA), General Motors, and Alphabet (GOOG).

Is ARKQ in a Buying Zone?

It’s crucial to find the right entry point when it comes to buying for long-term capital appreciation. As stated earlier, ARKQ carries a high risk in the short term due to the rate hike policy and prospects for broader market volatility. In my recent article, I predicted that the NASDAQ would bottom around the 9000 level and the S&P 500 would reach 3000 by the end of this year or early in 2023. In this case, high-beta ETFs like ARKQ may extend their losses in the months to come. I believe ARKQ is already in a buying zone after losing around 50% of its value, but a perfect entry point may come by the end of this year or early in 2023 when the broader market bottoms out and starts to reverse losses.

In Conclusion

While the current bear market has wiped out trillions of dollars worth of stock market value so far in 2022, it has also opened up excellent investment opportunities in ETFs like ARKQ, which have the potential to generate robust returns over the long term. The ETF’s portfolio concentration and diversification also support the long-term investment thesis. Moreover, ARKQ also offers a small annual dividend to investors, which also helps in improving total returns over the long term.

Be the first to comment